Global Coffee And Tea Shop Market

Market Size in USD Billion

CAGR :

%

USD

237.28 Billion

USD

461.46 Billion

2024

2032

USD

237.28 Billion

USD

461.46 Billion

2024

2032

| 2025 –2032 | |

| USD 237.28 Billion | |

| USD 461.46 Billion | |

|

|

|

|

Coffee and Tea Shop Market Size

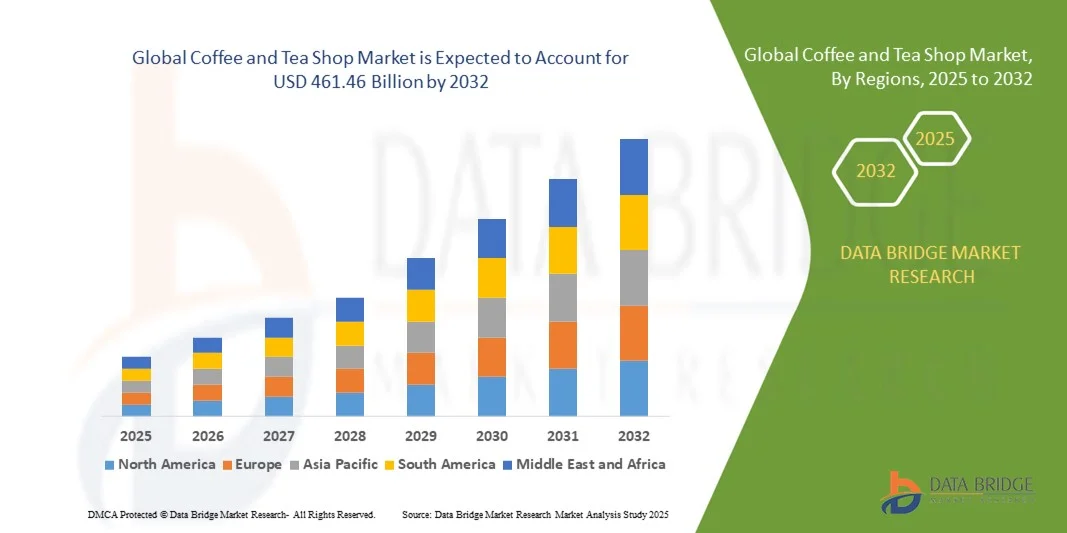

- The global coffee and tea shop market size was valued at USD 237.28 billion in 2024 and is expected to reach USD 461.46 billion by 2032, at a CAGR of 8.67% during the forecast period

- The market growth is largely fueled by the increasing consumer preference for specialty coffee and tea experiences, combined with the rising café culture in urban and semi-urban areas. The proliferation of branded café chains and independent coffee shops offering premium beverages, bakery items, and comfortable ambiances is driving footfall and enhancing market revenue

- Furthermore, the growing demand for convenience-oriented services such as takeaway, delivery, and mobile ordering, along with the expansion of international and regional café chains, is establishing coffee and tea shops as preferred social and lifestyle destinations. These converging factors are accelerating the expansion of café outlets and boosting overall industry growth

Coffee and Tea Shop Market Analysis

- Coffee and tea shops, providing specialty beverages, snacks, and social spaces, are increasingly becoming essential lifestyle and social hubs in both urban and semi-urban settings due to their premium product offerings, ambiance, and service quality

- The escalating demand for coffee and tea shops is primarily fueled by urbanization, rising disposable incomes, changing consumer lifestyles, and the growing inclination toward experiential dining and beverage consumption, encouraging both local and international brands to expand their presence in key markets

- Europe dominated the coffee and tea shop market in 2024, due to high urbanization, rising disposable incomes, and a strong café culture

- Asia-Pacific is expected to be the fastest growing region in the coffee and tea shop market during the forecast period due to urbanization, rising disposable incomes, and increasing café culture in countries such as China, Japan, and India

- Café bakery segment dominated the market with a market share of 39% in 2024, due to its strong appeal among a wide demographic seeking both high-quality beverages and fresh bakery products. Consumers often prefer Café Bakeries for their combination of premium coffee and pastries, providing a complete café experience under one roof. The market sees sustained demand for this segment due to its ability to attract repeat customers through menu variety, cozy ambiance, and seasonal promotions. Café Bakeries also benefit from their integration with loyalty programs and social media marketing, enhancing brand visibility and customer retention. The presence of established chains and franchised outlets further consolidates their market dominance, making them a preferred choice for urban and suburban areas

Report Scope and Coffee and Tea Shop Market Segmentation

|

Attributes |

Coffee and Tea Shop Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coffee and Tea Shop Market Trends

Rise of Specialty and Premium Coffee Experiences

- The coffee and tea shop market is rapidly evolving with a marked increase in consumer preference for specialty and premium coffee experiences. Buyers, especially younger demographics, are seeking higher-quality, ethically sourced, and uniquely roasted coffee beans offered through curated café environments that emphasize craftsmanship and provenance

- For instance, brands such as Starbucks Reserve and Blue Tokai Coffee Roasters are expanding specialty coffee offerings, emphasizing single-origin beans, artisanal brewing methods, and immersive cafe experiences. These initiatives cater to consumers valuing authenticity, traceability, and a premium drinking atmosphere beyond conventional coffee shop options

- The rising inclination toward health-conscious consumption is also driving demand for premium tea varieties, including specialty green, white, and herbal teas known for their wellness properties. Tea shops are investing in educating consumers about origin, brewing techniques, and flavor profiles to enhance the experiential aspect

- In addition, the trend toward sustainability and transparency in sourcing aligns with growing consumer ethics. Coffee and tea shops increasingly showcase certifications such as Fair Trade, Rainforest Alliance, and organic labels, which strengthen brand trust and appeal to socially responsible buyers

- Innovations in beverage customization, including cold brew variants, plant-based milk options, and eco-friendly packaging, further elevate the premium experience while catering to diverse lifestyle preferences. Digital engagement via apps and loyalty programs is also reshaping consumer interactions within specialty coffee and tea markets

- This sustained momentum toward premiumization, ethical sourcing, and experiential consumption is projected to remain a defining factor shaping the coffee and tea shop market globally. As coffee and tea culture matures, consumer expectations for quality and authenticity will encourage ongoing diversification and innovation in the sector

Coffee and Tea Shop Market Dynamics

Driver

Increasing Urbanization and Disposable Incomes

- The rapid urbanization trend and rising disposable incomes in emerging and developed markets are key drivers accelerating growth in the coffee and tea shop sector. Urban consumers with higher spending power show increased willingness to invest in experiential dining and premium beverage options

- For instance, the expansion of multinational café chains such as Costa Coffee and Tim Hortons in urban centers of Asia, Africa, and Latin America has tapped into previously underserved populations seeking refined coffee and tea drinking experiences. These outlets contribute significantly to market penetration and consumer maturation

- The growth in café culture is closely linked to evolving lifestyles, increased office-based work, and socializing trends within urban environments. Consumers increasingly treat coffee and tea shop visits as social and cultural activities, boosting footfall and frequency of visits

- In addition, rising disposable incomes drive demand for premiumization, pushing consumers to explore artisan coffees, exotic teas, and specialty brewing methods. This economic uplift is complemented by lifestyle aspirations that prioritize quality and convenience in beverage consumption

- The expanding middle class and youthful demographics in urban locations are instrumental in creating a robust demand base for new café formats incorporating innovation, sustainability, and digital convenience. This convergence fosters steady market expansion and diversification across regions

Restraint/Challenge

Intensifying Competition Among Café Chains and Independent Outlets

- The coffee and tea shop market faces heightened competition due to the proliferation of both large multinational chains and independent specialty cafés. The increasing number of outlets creates market saturation, making customer acquisition and retention more challenging for operators

- For instance, key players such as Starbucks and Dunkin’ are engaged in aggressive expansions and local collaborations, intensifying rivalry with boutique cafés such as Stumptown Coffee Roasters and Intelligentsia Coffee that emphasize artisanal offerings and niche experiences. This competitive environment requires strong brand differentiation and marketing investments

- Market fragmentation can lead to price wars and diminishing margin potential, especially among smaller independent players lacking scale advantages. Balancing competitive pricing with high-quality product delivery and operational costs is an ongoing challenge

- In addition, evolving consumer preferences demand continuous innovation and service enhancement, pressuring outlets to regularly upgrade their menus, ambiance, and customer engagement tools. Failure to keep pace with changing tastes and digital trends may result in loss of market share

- Sustaining profitability amid rising rent costs, labor shortages, and supply chain disruptions further complicates competition. Strategic alliances, diversification of offerings, and localization strategies will be essential for market participants aiming to thrive in this dynamic sector

Coffee and Tea Shop Market Scope

The market is segmented on the basis of design, distribution channel, and service type.

- By Design

On the basis of design, the Coffee and Tea Shop market is segmented into Café Bakery, Student Café, Co-Working Café, Parisian Café, Sidewalk Café, Grab-and-go Café, and Corporate Café. The Café Bakery segment dominated the market with the largest market revenue share of 39% in 2024, driven by its strong appeal among a wide demographic seeking both high-quality beverages and fresh bakery products. Consumers often prefer Café Bakeries for their combination of premium coffee and pastries, providing a complete café experience under one roof. The market sees sustained demand for this segment due to its ability to attract repeat customers through menu variety, cozy ambiance, and seasonal promotions. Café Bakeries also benefit from their integration with loyalty programs and social media marketing, enhancing brand visibility and customer retention. The presence of established chains and franchised outlets further consolidates their market dominance, making them a preferred choice for urban and suburban areas.

The Student Café segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing number of college and university students seeking affordable and convenient coffee options. Student Cafés often provide flexible seating arrangements, study-friendly environments, and budget-conscious menus, making them highly attractive to the younger demographic. Their growth is further supported by collaborations with educational institutions, Wi-Fi availability, and extended opening hours catering to student schedules. The segment’s popularity is also enhanced by social media engagement and student-oriented promotions, driving frequent visits and brand loyalty.

- By Distribution Channel

On the basis of distribution channel, the Coffee and Tea Shop market is segmented into Supermarkets/Hypermarkets, Convenience Stores, E-commerce, and Other channels. The Supermarkets/Hypermarkets segment dominated the market with the largest revenue share in 2024, driven by the convenience of one-stop shopping for both beverages and packaged coffee products. Consumers often prefer these channels for easy access to a wide variety of branded coffee and tea options along with bakery accompaniments. Supermarkets and hypermarkets also benefit from promotional campaigns, loyalty programs, and in-store displays that enhance product visibility and encourage bulk purchases. The established presence of international and regional brands in this channel further strengthens its dominance.

The E-commerce segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing online shopping habits and the demand for doorstep delivery of specialty coffee and tea products. Online channels provide convenience, subscription options, and a broader selection of gourmet and niche products that may not be available offline. E-commerce platforms also offer personalized recommendations, customer reviews, and targeted discounts, enhancing the shopping experience. The increasing penetration of smartphones and digital payment systems further accelerates this segment’s growth.

- By Service Type

On the basis of service type, the Coffee and Tea Shop market is segmented into Dine-in and Takeaway/Delivery. The Dine-in segment dominated the market with the largest revenue share in 2024, driven by the experiential appeal of enjoying coffee and tea in a comfortable and social environment. Consumers often prioritize Dine-in cafés for their ambiance, seating arrangements, and ability to host social gatherings or informal meetings. This segment benefits from value-added services such as live music, barista interactions, and themed décor, which enhance customer engagement and brand loyalty. The market also sees demand from urban professionals and leisure customers seeking a relaxing environment away from home or work.

The Takeaway/Delivery segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising preference for convenience and on-the-go consumption. Online ordering apps and food delivery platforms have accelerated the adoption of takeaway and delivery services, enabling cafés to reach a wider customer base. The segment is further supported by subscription-based coffee delivery, pre-ordering, and contactless payment options, meeting the evolving needs of busy urban consumers. Promotions, discounts, and loyalty programs specifically tailored for delivery customers also drive frequent purchases and enhance revenue growth.

Coffee and Tea Shop Market Regional Analysis

- Europe dominated the coffee and tea shop market with the largest revenue share in 2024, driven by high urbanization, rising disposable incomes, and a strong café culture

- Consumers in the region highly value premium coffee experiences, artisanal beverages, and specialty bakery offerings, making café chains and independent coffee shops popular destinations

- The widespread adoption is further supported by increasing tourism, strong social media engagement, and a growing preference for lifestyle-driven cafés, establishing Europe as a key market for both local and international brands

U.K. Coffee and Tea Shop Market Insight

The U.K. coffee and tea shop market captured the largest revenue share in Europe in 2024, fueled by the popularity of specialty coffee and café chains. Consumers are increasingly seeking premium beverages, cozy ambiances, and convenience-focused services such as takeaway and delivery. The growing trend of artisanal coffee, loyalty programs, and digital ordering platforms further propels the market. Moreover, the U.K.’s vibrant café culture and high disposable income levels contribute significantly to market expansion.

Germany Coffee and Tea Shop Market Insight

The Germany coffee and tea shop market is expected to grow at a substantial CAGR during the forecast period, driven by the increasing preference for high-quality coffee, bakery items, and sustainable sourcing. German consumers favor cafés that combine modern design with social and work-friendly environments. The market is further supported by robust retail infrastructure, the presence of established café chains, and rising awareness of specialty coffee experiences.

France Coffee and Tea Shop Market Insight

The France coffee and tea shop market is witnessing steady growth due to the strong cultural emphasis on café experiences and gourmet beverages. French consumers value traditional Parisian cafés alongside modern concepts offering artisanal coffee and snacks. Urbanization, tourism, and lifestyle-driven consumption patterns are supporting growth in both independent and chain-operated outlets. The integration of dine-in, takeaway, and delivery services is further expanding market reach.

North America Coffee and Tea Shop Market Insight

The North America coffee and tea shop market is poised to grow steadily, driven by the demand for premium coffee, café chains, and specialty beverages. The U.S. leads the market with a strong preference for convenience, digital ordering, and branded café experiences. Consumers increasingly seek café environments that cater to socializing, remote work, and quick service, driving innovation in service offerings and store layouts.

Asia-Pacific Coffee and Tea Shop Market Insight

The Asia-Pacific coffee and tea shop market is expected to grow at the fastest CAGR during 2025–2032, driven by urbanization, rising disposable incomes, and increasing café culture in countries such as China, Japan, and India. The expansion of international café chains, coupled with local specialty cafés, is boosting market penetration. Rapid adoption of takeaway and delivery services, alongside growing demand for premium coffee and innovative beverages, further fuels growth in the region.

China Coffee and Tea Shop Market Insight

The China coffee and tea shop market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising urban lifestyles, expanding middle-class consumer base, and increasing interest in premium and specialty coffee. The growth of e-commerce and mobile ordering platforms, coupled with the entry of international and local café chains, is driving widespread adoption.

Japan Coffee and Tea Shop Market Insight

The Japan coffee and tea shop market is gaining momentum due to a high preference for specialty coffee, themed cafés, and convenience-focused formats. Japanese consumers value unique café experiences, seasonal menus, and modern store designs. The integration of technology for ordering, payments, and delivery, along with increasing disposable income, is supporting the market’s steady growth.

Coffee and Tea Shop Market Share

The coffee and tea shop industry is primarily led by well-established companies, including:

- Adelie Foods Limited (U.K.)

- Costa Coffee (U.K.)

- Starbucks (U.S.)

- Alpro (Belgium)

- PRET (U.K.)

- Caffè Nero (U.K.)

- Compass Group PLC (U.K.)

- McDonald’s (U.S.)

- Nespresso (Switzerland)

- Greggs (U.K.)

- SOLO (U.K.)

- Huhtamaki (Finland)

- Tchibo (Germany)

- Mondelez International, Inc. (U.S.)

- Café Coffee Day (India)

Latest Developments in Global Coffee and Tea Shop Market

- In April 2025, the Indonesian coffee brand Kopi Kenangan (Kenangan Coffee) entered India with an investment of approximately ₹40 crore and plans to open 50 stores over the next three years. The entry of a well-established Southeast Asian brand reflects increasing investor interest in India’s growing café market. It also highlights the rising demand among Indian consumers for diverse global coffee concepts and innovative beverage options. Kopi Kenangan’s expansion is expected to bring international quality standards, menu innovation, and brand differentiation, which may encourage local cafés to upgrade their offerings to remain competitive

- In February 2025, The Coffee Bean & Tea Leaf expanded its presence in India with the launch of a new flagship café in Janakpuri, Delhi. This move strengthens the brand’s footprint in the premium café segment, targeting urban consumers who seek high-quality specialty coffee and tea experiences. The launch enhances brand visibility and also intensifies competition among both international and local café chains. By entering a prime location in the capital, the company is positioning itself to attract repeat visits and loyalty among discerning consumers, supporting the growth of the premium café market in India

- In February 2025, the Vietnamese 24-hour café chain Three O’Clock entered India via a master-franchise agreement with plans to launch 100 outlets across India and neighboring countries. This strategic entry underscores India’s importance as a regional hub for café expansion. The concept of round-the-clock café services is expected to appeal to urban professionals, night-shift workers, and students seeking flexible coffee and snack options. By introducing a unique service model, Three O’Clock is likely to influence competitive dynamics and encourage innovation in operational hours and service offerings within the Indian café industry

- In July 2024, the Delhi-based Super Coffee announced plans to open 100 stores over the next three years to capture demand from the Gen Z demographic. This expansion leverages the younger generation’s affinity for trend-driven, digitally integrated café experiences, including social media engagement, mobile ordering, and loyalty programs. By scaling rapidly in urban markets, Super Coffee aims to strengthen brand awareness and accessibility, while catering to consumers who prioritize affordability, convenience, and contemporary café environments. This move signals the rising importance of youth-oriented strategies in shaping café market growth

- In July 2024, Keurig Dr Pepper announced the acquisition of JDE Peet’s, creating a new global coffee entity with combined annual net sales of around $16 billion. This significant consolidation is expected to reshape the competitive landscape in the global hot beverage sector, providing the company with expanded product portfolios, enhanced distribution networks, and broader geographic reach. The acquisition accelerates access to international markets, increases operational efficiencies, and enables the combined entity to introduce diverse coffee and tea offerings, which may influence consumer preferences and drive innovation across both retail and café channels worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coffee And Tea Shop Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coffee And Tea Shop Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coffee And Tea Shop Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.