Global Coffee Drinks Market

Market Size in USD Billion

CAGR :

%

USD

48.62 Billion

USD

87.16 Billion

2025

2033

USD

48.62 Billion

USD

87.16 Billion

2025

2033

| 2026 –2033 | |

| USD 48.62 Billion | |

| USD 87.16 Billion | |

|

|

|

|

What is the Global Coffee Drinks Market Size and Growth Rate?

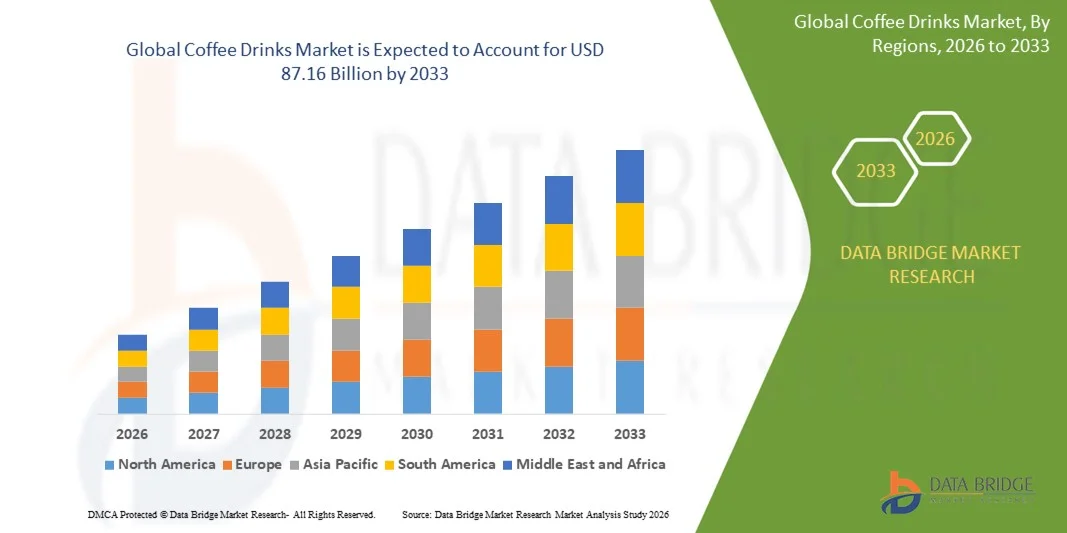

- The global coffee drinks market size was valued at USD 48.62 billion in 2025 and is expected to reach USD 87.16 billion by 2033, at a CAGR of 7.57% during the forecast period

- Increasing demand of the coffee among the consumers, rising levels of disposable income of the people, rising prevalence of innovative packaging, and escalating demand for ready-to-drink coffee, gourmet, and specialty coffee beverages, changing consumer consumption patterns, rapid urbanization, and expanding demand for premium coffee beverages owing to increase in awareness of coffee beans and their related origin

- Expansion of modern retail outlets stocking a large variety of coffee brands and changing consumer preferences for instant coffee beverages premix are some of the major as well as vital factors which will likely to augment the growth of the coffee drinks market

What are the Major Takeaways of Coffee Drinks Market?

- Development of new products to enhance the portfolio along with intense research and development activities and prevalence of improved distribution channel which will further contribute by generating massive opportunities that will lead to the growth of the coffee drinks market

- Limited foodservice sales of ready-to-drink coffee which will likely to act as market restraint factor for the growth of the coffee drinks

- Asia-Pacific dominated the coffee drinks market with the largest revenue share of 49.5% in 2025, driven by rapid urbanization, increasing disposable income, and a strong café culture across emerging economies such as China, Japan, India, and South Korea

- North America is projected to witness the fastest growth rate of 9.7% during 2026–2033, driven by the strong presence of global coffee brands, high demand for functional and RTD beverages, and growing consumer preference for sustainable and plant-based coffee options

- The Ready-to-Drink (RTD) segment dominated the market with the largest revenue share of 44.8% in 2025, driven by the rising consumer demand for convenient, on-the-go beverages that offer both taste and functionality

Report Scope and Coffee Drinks Market Segmentation

|

Attributes |

Coffee Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Coffee Drinks Market?

Rising Demand for Ready-to-Drink (RTD) and Functional Coffee Beverages

- The coffee drinks market is experiencing a major shift toward ready-to-drink (RTD) and functional beverages, fueled by changing consumer lifestyles, urbanization, and the growing preference for convenient caffeine options. Manufacturers are focusing on innovative formulations that combine taste, health benefits, and portability

- For instance, Starbucks Corporation and Nestlé S.A. expanded their RTD coffee portfolios with plant-based and protein-infused variants to attract health-conscious consumers seeking energy and wellness benefits in a single beverage

- Rising health awareness and demand for clean-label, low-sugar, and dairy-free alternatives are driving the adoption of cold brews, nitro coffees, and functional blends enriched with adaptogens, collagen, and probiotics

- The surge in on-the-go consumption, especially among millennials and working professionals, has accelerated product innovation in sustainable packaging and extended shelf-life solutions

- Growing investments in premiumization, including specialty coffee sourcing, ethical production, and transparent supply chains, are reshaping the competitive landscape

- As consumers increasingly associate coffee with lifestyle, wellness, and sustainability, the expansion of RTD and functional coffee lines is expected to remain the dominant trend shaping global market growth

What are the Key Drivers of Coffee Drinks Market?

- Growing demand for convenience beverages is driving the popularity of RTD and packaged coffee options across retail stores, cafes, and e-commerce channels worldwide

- For instance, in 2025, The Coca-Cola Company expanded its Costa Coffee RTD range in Asia and Europe, capitalizing on strong regional demand for portable, cold coffee beverages

- Health and wellness trends are influencing product innovation, with brands introducing low-calorie, organic, and fortified drinks that cater to fitness-oriented and vegan consumers

- Rising disposable income and urban café culture, particularly in Asia-Pacific and Latin America, are boosting the consumption of premium coffee drinks

- Digital marketing and direct-to-consumer (D2C) strategies are enhancing brand reach and consumer engagement, especially among Gen Z and millennial demographics

- As innovation in flavors, packaging, and sustainable sourcing accelerates, the coffee drinks market is expected to witness steady growth and diversification across global regions

Which Factor is Challenging the Growth of the Coffee Drinks Market?

- Fluctuating coffee bean prices due to climate change and supply chain disruptions remain a critical challenge for manufacturers, impacting production costs and pricing stability

- For instance, droughts in Brazil and rising export costs in Vietnam during 2024–2025 caused a global spike in arabica and robusta bean prices, affecting profitability across coffee producers

- High competition among local and international brands increases pricing pressure, making product differentiation and brand loyalty difficult to sustain

- Stringent regulations on sugar content and packaging waste in regions such as the U.S. and Europe are compelling companies to reformulate products and adopt sustainable packaging solutions

- Changing consumer preferences toward alternative beverages such as energy drinks, matcha, and plant-based elixirs pose substitution threats

- To overcome these challenges, key players are focusing on supply chain resilience, sustainable sourcing, and product diversification, ensuring long-term market stability and profitability

How is the Coffee Drinks Market Segmented?

The market is segmented on the basis of coffee type, beans type, and distribution channel.

- By Coffee Type

On the basis of coffee type, the coffee drinks market is segmented into Instant, Filter, Bean to Cup, and Ready-to-Drink (RTD). The Ready-to-Drink (RTD) segment dominated the market with the largest revenue share of 44.8% in 2025, driven by the rising consumer demand for convenient, on-the-go beverages that offer both taste and functionality. The growing popularity of cold brews, nitro coffees, and functional blends with added health benefits has further boosted segment growth. RTD products are widely preferred across retail stores, cafes, and vending channels due to their portability and extended shelf life.

The Bean to Cup segment is expected to register the fastest CAGR from 2026 to 2033, supported by the growing trend of café-style experiences at home and workplaces. Technological advancements in automatic coffee machines and increased availability of premium coffee beans are further enhancing adoption in residential and commercial spaces.

- By Beans Type

On the basis of beans type, the coffee drinks market is segmented into Robusta, Arabica, and Others. The Arabica segment dominated the market with the largest revenue share of 57.6% in 2025, owing to its smooth flavor profile, lower caffeine content, and strong consumer preference for premium-quality beverages. Major manufacturers prioritize Arabica beans due to their suitability for specialty, gourmet, and cold-brew coffee formulations.

The Robusta segment is anticipated to record the fastest CAGR from 2026 to 2033, driven by increasing use in instant and RTD coffee products for its bold flavor and cost efficiency. Its higher caffeine concentration appeals to energy drink consumers and developing markets seeking affordable, strong-tasting options. The shift toward blended formulations combining Arabica and Robusta beans also enhances flavor diversity and cost optimization for large-scale producers.

- By Distribution Channel

On the basis of distribution channel, the coffee drinks market is segmented into Hypermarkets/Supermarkets, Convenience Stores, Specialty Coffee Shops, Online Retail, and Others. The Hypermarkets/Supermarkets segment dominated the market with the largest revenue share of 41.2% in 2025, supported by the wide availability of multiple coffee brands, discount offers, and the growing preference for one-stop shopping experiences. In-store promotions and brand visibility further strengthen sales in this segment.

The Online Retail segment is projected to exhibit the fastest CAGR from 2026 to 2033, fueled by the surge in e-commerce adoption, direct-to-consumer (D2C) brand launches, and digital marketing campaigns targeting younger consumers. The convenience of doorstep delivery, subscription-based models, and access to premium and niche coffee brands online are driving robust growth in this channel globally.

Which Region Holds the Largest Share of the Coffee Drinks Market?

- Asia-Pacific dominated the Coffee Drinks market with the largest revenue share of 49.5% in 2025, driven by rapid urbanization, increasing disposable income, and a strong café culture across emerging economies such as China, Japan, India, and South Korea. The region’s expanding middle-class population, rising preference for premium and ready-to-drink coffee beverages, and growth of international coffee chains are key growth drivers

- Local and global brands are investing heavily in product innovation, sustainable packaging, and distribution expansion to cater to the region’s diverse consumer preferences

- Furthermore, the surge in e-commerce platforms, digital marketing initiatives, and the growing influence of Western coffee culture are strengthening Asia-Pacific’s dominance in the global Coffee Drinks landscape

China Coffee Drinks Market Insight

China is the largest contributor in Asia-Pacific, supported by the rapid expansion of urban coffee culture, rising demand for premium and RTD coffee, and increasing popularity of café chains such as Starbucks, Luckin Coffee, and Costa. The shift toward convenience-driven consumption and online coffee subscriptions is reshaping consumer behavior. Domestic brands are focusing on local flavors, sustainable sourcing, and cold brew innovations, enhancing China’s leadership in the regional market.

India Coffee Drinks Market Insight

India is witnessing robust growth in the Coffee Drinks market due to rising café culture, increasing disposable income, and growing popularity of ready-to-drink and instant coffee among millennials and young professionals. Government initiatives promoting domestic coffee production in regions such as Karnataka and Kerala are strengthening the supply chain. The expansion of premium café brands, D2C models, and online retail channels is fueling further growth in the country’s coffee sector.

North America Coffee Drinks Market Insight

North America is projected to witness the fastest growth rate of 9.7% during 2026–2033, driven by the strong presence of global coffee brands, high demand for functional and RTD beverages, and growing consumer preference for sustainable and plant-based coffee options. The region’s advanced retail infrastructure and continuous product innovation in cold brew, nitro coffee, and low-sugar variants are key factors accelerating market growth.

U.S. Coffee Drinks Market Insight

The U.S. leads the North American Coffee Drinks market, driven by increasing consumption of premium and specialty coffee, expanding café culture, and rising demand for on-the-go beverages. The growing popularity of plant-based creamers, low-calorie formulations, and sustainable packaging is reshaping product portfolios. Major players such as Starbucks, The Coca-Cola Company, and Nestlé are focusing on RTD coffee innovation to meet evolving consumer preferences.

Canada Coffee Drinks Market Insight

Canada contributes steadily to the regional market, supported by increasing demand for premium, organic, and fair-trade coffee products. The rising popularity of cold brews, specialty cafés, and RTD coffee formats is boosting consumption. Domestic manufacturers are investing in eco-friendly packaging and online retail strategies to reach a wider audience, while consumers’ preference for ethically sourced coffee continues to drive growth.

Europe Coffee Drinks Market Insight

Europe is witnessing stable growth, driven by strong consumer preference for artisanal, organic, and sustainably sourced coffee beverages. Countries such as Germany, France, and the U.K. are at the forefront of premium coffee innovation, with rising popularity of RTD formats and barista-style drinks. Stringent EU sustainability regulations and growing café culture are supporting the region’s expanding market presence.

Germany Coffee Drinks Market Insight

Germany leads Europe’s Coffee Drinks market, propelled by high demand for organic and specialty coffee products. Consumers are increasingly adopting RTD and low-sugar coffee beverages, supported by the growing number of artisanal roasters and premium café chains. Sustainable sourcing and recyclable packaging initiatives are further strengthening Germany’s market position within Europe.

U.K. Coffee Drinks Market Insight

The U.K. market is expanding steadily, driven by rising consumer inclination toward premium coffee, RTD beverages, and sustainability-focused brands. The growing influence of international café chains and post-pandemic shifts toward home-based coffee consumption are fueling market growth. Product innovations in dairy-free and functional coffee beverages continue to attract health-conscious consumers, bolstering the U.K.’s share in the European market.

Which are the Top Companies in Coffee Drinks Market?

The coffee drinks industry is primarily led by well-established companies, including:

- The Coca-Cola Company (U.S.)

- Nestlé (Switzerland)

- Starbucks Coffee Company (U.S.)

- illycaffè S.p.A. (Italy)

- Unilever (U.K./Netherlands)

- UCC Ueshima Coffee Co., Ltd. (Japan)

- Coffee Roasting Company Schreyögg srl (Italy)

- LUIGI LAVAZZA SPA (Italy)

- Dunkin' (U.S.)

- The Kraft Heinz Company (U.S.)

- The J.M. Smucker Company (U.S.)

- Tata Consumer Products (India)

- Eight O’Clock Coffee Company (U.S.)

- AMT Coffee (U.K.)

- Keurig Green Mountain, Inc. (U.S.)

- Tchibo Coffee International Ltd (Germany)

- Cameron’s Specialty Coffee (U.S.)

- Equal Exchange Coop (U.S.)

- Costa (U.K.)

- Harney & Sons Fine Teas (U.S.)

What are the Recent Developments in Global Coffee Drinks Market?

- In April 2025, Starbucks Coffee Company announced plans to hire more baristas and scale back automation deployment following lower-than-expected financial results and a 1% global sales decline. This initiative, led by CEO Brian Niccol, was designed to rebuild customer trust and strengthen brand loyalty in its largest market, the U.S. This strategic move is expected to enhance in-store experiences and revitalize Starbucks’ overall growth momentum

- In April 2025, Nestlé expanded its Nescafé Ready-to-Drink cold coffee range to India, the MENA region, and Brazil, aiming to attract younger, fast-paced consumers. The expansion was driven by the rising popularity of cold coffee, which continues to deliver double-digit growth among Gen Z and Millennial audiences. This move reinforces Nestlé’s commitment to catering to evolving consumer preferences and strengthening its global RTD coffee portfolio

- In March 2025, UCC Ueshima Coffee Co. in Japan began mass production of coffee roasted using green hydrogen technology, with an investment of approximately 1 billion yen. This innovation was introduced to lower CO₂ emissions and enhance the flavor profile of premium coffee. The company initially targeted upscale segments such as hotels and airlines, positioning itself as a pioneer in sustainable coffee production

- In November 2024, Nestlé introduced a new Nescafé Classic soluble coffee range in Central and Eastern Europe, featuring innovative caramel and hazelnut flavors. The product was developed to dissolve seamlessly in both hot and cold water, appealing to the growing demand among younger consumers for cold and flavored coffee options. This launch underlines Nestlé’s focus on product innovation and regional market diversification

- In October 2024, Starbucks Coffee Company expanded its global coffee sustainability efforts by establishing two new coffee innovation farms in Guatemala and Costa Rica, with additional investments planned for Africa and Asia. The initiative aims to boost crop productivity, improve farmer profitability, and address the effects of climate change on Arabica coffee cultivation. This expansion highlights Starbucks’ long-term vision for sustainable coffee farming worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coffee Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coffee Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coffee Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.