Global Coffee Extracts Market

Market Size in USD Billion

CAGR :

%

USD

1.86 Billion

USD

2.59 Billion

2024

2032

USD

1.86 Billion

USD

2.59 Billion

2024

2032

| 2025 –2032 | |

| USD 1.86 Billion | |

| USD 2.59 Billion | |

|

|

|

|

Coffee Extracts Market Size

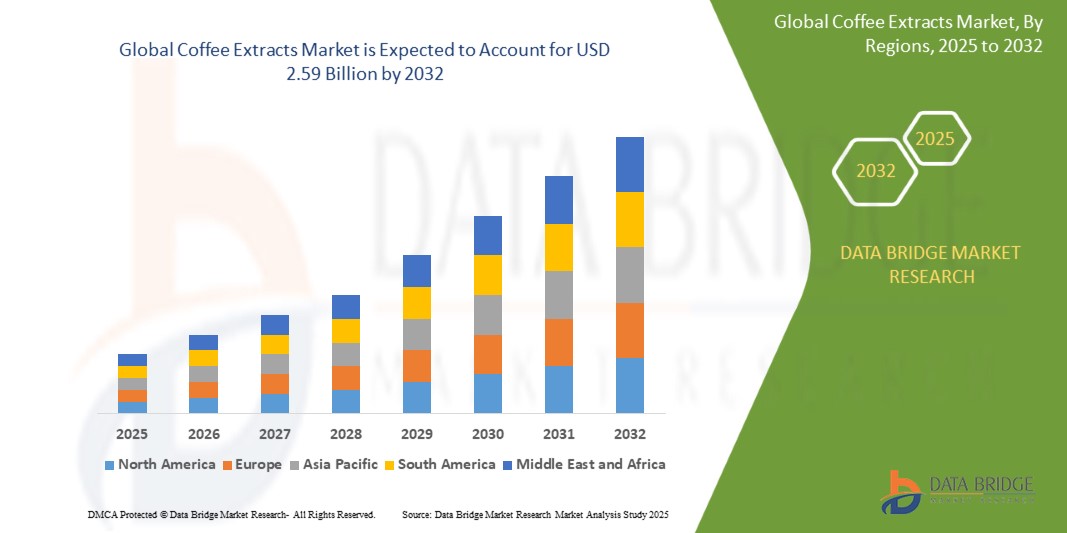

- The global coffee extracts market size was valued at USD 1.86 billion in 2024 and is expected to reach USD 2.59 billion by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fueled by the increasing global consumption of coffee and coffee-based beverages, along with rising demand for convenience, consistency, and premium flavors in both foodservice and retail applications

- Furthermore, the growing trend of functional and wellness-oriented products, including nutraceuticals and dietary supplements, is driving the adoption of coffee extracts across food, beverage, and pharmaceutical industries. These converging factors are accelerating the uptake of coffee extracts, thereby significantly boosting the industry's growth

Coffee Extracts Market Analysis

- Coffee extracts are concentrated forms of coffee derived from roasted or unroasted coffee beans, available in liquid, dried, or capsule formats. They are widely used to enhance flavor and aroma in beverages, desserts, baked goods, and savory dishes, while also serving functional and health-focused applications

- The escalating demand for coffee extracts is primarily fueled by the expanding café culture, rising preference for ready-to-drink and specialty coffee beverages, and growing consumer awareness of high-quality, organic, and sustainable products. In addition, the integration of coffee extracts into innovative food and beverage formulations is further supporting market growth

- North America dominated the coffee extracts market in 2024, due to the high consumption of coffee-based beverages, desserts, and bakery products, as well as the region’s preference for premium and specialty coffee offerings

- Asia-Pacific is expected to be the fastest growing region in the coffee extracts market during the forecast period due to rising urbanization, growing disposable incomes, and increasing coffee consumption in countries such as China, Japan, and India

- Conventional segment dominated the market with a market share of 65.7% in 2024, due to large-scale production, widespread availability, and cost-effectiveness. Conventional coffee extracts are preferred by manufacturers for consistent quality, flavor uniformity, and ease of mass production, which makes them suitable for the growing ready-to-drink and processed food markets. The segment also benefits from established supply chains and global trade networks, ensuring reliable sourcing and distribution

Report Scope and Coffee Extracts Market Segmentation

|

Attributes |

Coffee Extracts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coffee Extracts Market Trends

Expanding Food and Beverage Industry

- The steady growth of the global food and beverage sector is driving the adoption of coffee extracts as manufacturers seek versatile ingredients for applications ranging from ready-to-drink beverages to bakery products and dairy alternatives. Coffee extracts provide flavor and aroma and also functional benefits including antioxidant properties for diverse formulations

- For instance, Kerry Group has expanded its coffee extracts offerings for integration in RTD beverages and plant-based products, enabling beverage companies to innovate with new flavor profiles and clean-label claims

- The rise in specialty coffee trends is spurring demand for premium extracts, including cold brew concentrates and single-origin options tailored for use in artisanal drinks and gourmet products

- Growth in health-conscious consumer segments is prompting interest in extracts with enhanced functional attributes, such as decaffeinated extracts or those with added nutritional fortification for use in health beverages and functional foods

- In addition, e-commerce and direct-to-consumer distribution models are expanding market reach, allowing small brands and startups to launch coffee extract-infused products rapidly and cost-effectively

- Diversification in product formats such as sprays, powders, freeze-dried concentrates, and liquid extracts is increasing usage across food processing, baking, and confectionery sectors seeking consistent coffee taste and aroma

- Advancements in extraction technologies—such as supercritical CO2 and cold brew processes—enable richer, more stable extracts for formulating products with extended shelf life and superior sensory attributes

Coffee Extracts Market Dynamics

Driver

Growing Demand for Convenience Food

- Expanding demand for convenience food and beverage products is a major driver for coffee extracts adoption, as food manufacturers and quick service outlets seek consistent, easy-to-use flavor boosters that deliver quality and speed in mass production

- For instance, Nestlé uses coffee extracts for its Nescafé instant beverage lines and RTD coffee products, catering to urban consumers seeking quick and premium drinks without lengthy preparation

- Growth in on-the-go consumption and foodservice chains reinforces the market for coffee extracts, utilized in desserts, ice creams, flavored syrups, and energy drinks to meet changing habits and preferences

- Expansion in meal-kit and catering businesses is also driving demand for versatile ingredients, with extracts fulfilling needs for consistent, scalable, and recognizable coffee flavor in hot and cold dishes

- The rise of vegan and plant-based diets accelerates extract usage in formulating non-dairy coffee beverages and alternative dessert profiles, appealing to a wider consumer base

Restraint/Challenge

Dependency on Coffee Supply Chain

- The market faces strong restraint from dependency on the global coffee supply chain, which is subject to volatility in production, logistics, and pricing due to climate, trade policies, and crop disease

- For instance, major manufacturers such as JDE Peet’s have faced supply disruptions resulting from adverse weather and crop failures in key coffee-producing nations such as Brazil and Vietnam, impacting the availability and pricing of extracts for downstream industries

- Fluctuations in green coffee bean prices can lead to unpredictable cost structures for food and beverage manufacturers, posing challenges in maintaining profit margins and product consistency

- In addition, complexity in supply chain logistics and ethical sourcing requirements—including fair trade and sustainability certifications—add layers of cost and compliance for extract producers

- Political and economic instability in producing regions further threatens continuity, prompting companies to diversify sourcing or invest in traceable supply chain solutions

Coffee Extracts Market Scope

The market is segmented on the basis of end use, nature, product, and formulation.

• By End Use

On the basis of end use, the coffee extracts market is segmented into food industry, desserts, baking goods, savory dishes, beverage industry, pharmaceutical industry, and others. The beverage industry segment dominated the largest market revenue share in 2024, driven by the increasing consumer preference for specialty coffee drinks, ready-to-drink beverages, and premium coffee-based beverages. Coffee extracts in beverages provide consistent flavor, aroma, and convenience, making them highly favored by both commercial producers and at-home users. The segment’s growth is also fueled by the rising café culture, global coffee consumption trends, and innovations in cold brew, iced coffee, and flavored coffee drinks, which extensively use coffee extracts for standardization and enhanced taste profiles.

The desserts segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the rising use of coffee extracts in confectionery, ice creams, and bakery products. The versatility of coffee extracts allows for easy incorporation into various dessert recipes without compromising flavor intensity. Increased consumer demand for gourmet desserts and premium bakery items in cafes and restaurants further accelerates the adoption of coffee extracts. Moreover, manufacturers are leveraging coffee extracts to create unique flavors and limited-edition dessert offerings, catering to evolving taste preferences and experiential consumption trends.

• By Nature

On the basis of nature, the coffee extracts market is segmented into conventional and organic. The conventional segment held the largest market revenue share of 65.7% in 2024, driven by large-scale production, widespread availability, and cost-effectiveness. Conventional coffee extracts are preferred by manufacturers for consistent quality, flavor uniformity, and ease of mass production, which makes them suitable for the growing ready-to-drink and processed food markets. The segment also benefits from established supply chains and global trade networks, ensuring reliable sourcing and distribution.

The organic segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing consumer awareness regarding health, sustainability, and chemical-free products. Organic coffee extracts are gaining popularity among health-conscious consumers, premium beverage producers, and specialty dessert manufacturers. Rising demand for clean-label products and certifications in food and beverage sectors further encourages manufacturers to adopt organic coffee extracts. The segment also benefits from trends in wellness-focused beverages, functional foods, and eco-friendly production practices.

• By Product

On the basis of product, the coffee extracts market is segmented into liquid concentrates, dried form, and capsules or tablets. The liquid concentrates segment dominated the largest market revenue share in 2024, owing to its high solubility, ease of use in beverages and culinary applications, and ability to maintain consistent flavor and aroma. Liquid coffee extracts are particularly preferred in large-scale beverage production, bakeries, and ready-to-drink formulations, offering manufacturers streamlined processing and formulation flexibility. Their convenience in mixing, storage, and transport also drives widespread adoption across commercial and foodservice sectors.

The dried form segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its longer shelf life, ease of incorporation in instant coffee products, bakery ingredients, and confectionery items. Dried coffee extracts allow for precise dosage, reduced packaging requirements, and minimal degradation of flavor during storage, which appeals to both industrial and home-use applications. Increasing demand for instant coffee products, powdered beverages, and convenience-focused solutions significantly contributes to the growth of this segment globally.

• By Formulation

On the basis of formulation, the coffee extracts market is segmented into roasted and unroasted. The roasted segment dominated the largest market revenue share in 2024, driven by its rich flavor, strong aroma, and widespread acceptance among consumers. Roasted coffee extracts are extensively used in beverages, desserts, and bakery applications, offering a characteristic taste profile that aligns with global coffee consumption trends. Manufacturers favor roasted extracts for their ability to deliver consistent flavor intensity and aromatic quality in a variety of end-use applications.

The unroasted segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing interest in specialty and green coffee products, health-focused formulations, and functional beverages. Unroasted coffee extracts retain higher levels of antioxidants, chlorogenic acids, and bioactive compounds, attracting health-conscious consumers and nutraceutical product developers. The segment also benefits from increasing adoption in innovative beverage formulations, cold brew preparations, and wellness-focused coffee products, supporting its rapid market expansion.

Coffee Extracts Market Regional Analysis

- North America dominated the coffee extracts market with the largest revenue share in 2024, driven by the high consumption of coffee-based beverages, desserts, and bakery products, as well as the region’s preference for premium and specialty coffee offerings

- Consumers in the region highly value the consistent flavor, convenience, and quality offered by coffee extracts, making them a preferred ingredient in commercial and home-use applications

- This widespread adoption is further supported by high disposable incomes, a well-established café culture, and growing demand for ready-to-drink and gourmet coffee products, establishing coffee extracts as a critical component in the food and beverage industry

U.S. Coffee Extracts Market Insight

The U.S. coffee extracts market captured the largest revenue share in 2024 within North America, fueled by the growing popularity of specialty coffee drinks, cold brew beverages, and ready-to-drink formulations. Consumers are increasingly prioritizing high-quality, consistent coffee flavors in both home and commercial applications. The expansion of cafés, bakeries, and dessert outlets, combined with rising demand for functional and innovative coffee-based products, is further propelling market growth. In addition, the integration of coffee extracts into food, beverage, and pharmaceutical applications is supporting diversification in product offerings. Technological advancements in extraction processes and increased availability of organic and premium options continue to drive adoption among U.S. consumers.

Europe Coffee Extracts Market Insight

The Europe coffee extracts market is projected to expand at a substantial CAGR throughout the forecast period, driven by the strong coffee culture, growing café chains, and rising consumption of gourmet coffee beverages. The demand for high-quality coffee extracts in desserts, bakery goods, and beverages is fostering adoption across both commercial and residential applications. European consumers are also drawn to premium, sustainable, and organic coffee extract offerings, reflecting the region’s focus on health and environmental considerations. Innovation in specialty drinks, cold coffee preparations, and dessert applications further supports market growth. Countries such as Germany, France, and Italy are witnessing significant incorporation of coffee extracts in both traditional and modern culinary practices.

U.K. Coffee Extracts Market Insight

The U.K. coffee extracts market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing preference for home-brewing, ready-to-drink coffee beverages, and café-based specialty drinks. Consumers are showing heightened interest in convenience, consistent flavor, and unique coffee experiences, which encourages the adoption of coffee extracts in food, desserts, and beverages. The U.K.’s strong retail, e-commerce, and café infrastructure continues to facilitate market growth, while rising interest in organic and sustainably sourced products further supports expansion. The market also benefits from product innovation in flavored extracts and ready-to-use formulations, catering to both domestic and commercial end users.

Germany Coffee Extracts Market Insight

The Germany coffee extracts market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong coffee culture, high consumption rates, and preference for premium quality ingredients. Increasing awareness of health, sustainability, and organic products, along with growing demand for specialty coffee drinks and functional food applications, promotes the adoption of coffee extracts. Germany’s advanced food and beverage industry infrastructure supports innovative product development, while the incorporation of coffee extracts into bakery, dessert, and beverage applications is becoming increasingly prevalent. In addition, manufacturers are focusing on high-quality and eco-conscious formulations to meet consumer expectations.

Asia-Pacific Coffee Extracts Market Insight

The Asia-Pacific coffee extracts market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising urbanization, growing disposable incomes, and increasing coffee consumption in countries such as China, Japan, and India. The region’s emerging café culture, expanding food and beverage industry, and rising popularity of ready-to-drink coffee products are key factors driving demand. Furthermore, as APAC becomes a production hub for coffee extracts, affordability and accessibility are improving, enabling wider market penetration. Government initiatives promoting modern food processing and lifestyle changes are also contributing to rapid market growth in the region.

Japan Coffee Extracts Market Insight

The Japan coffee extracts market is gaining momentum due to the country’s high coffee consumption, café culture, and demand for premium and functional coffee beverages. Consumers are seeking consistent flavor, aroma, and quality in both home-use and commercial applications. The integration of coffee extracts in desserts, bakery items, and specialty drinks, combined with an aging population seeking convenient solutions, is supporting steady growth. In addition, Japanese consumers favor innovative and health-conscious coffee products, encouraging manufacturers to develop specialty and functional extracts tailored to local preferences.

China Coffee Extracts Market Insight

The China coffee extracts market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, an expanding middle class, and rising coffee consumption. The growing café culture, increasing availability of ready-to-drink coffee products, and strong domestic production of coffee extracts are key drivers of market growth. The push towards premium and specialty coffee beverages, along with rising awareness of quality, flavor consistency, and organic options, is further propelling the market. Moreover, strong support from domestic manufacturers and advancements in extraction technology are helping China maintain a dominant position in the Asia-Pacific coffee extracts market.

Coffee Extracts Market Share

The coffee extracts industry is primarily led by well-established companies, including:

- McCormick (U.S.)

- Savory Spice (U.S.)

- J. R. Watkins (U.S.)

- Sports Research (U.S.)

- Lumen (U.S.)

- Nestlé S.A. (Switzerland)

- Starbucks Corporation (U.S.)

- Kraft Heinz Company (U.S.)

- Luigi Lavazza S.p.A. (Italy)

- E. & J. Gallo Winery (U.S.)

- Kerry Group (Ireland)

- Massimo Zanetti Beverage Group (Italy)

- Finlays (U.K.)

- PureSvetol (France)

- NatureWise (U.S.)

Latest Developments in Global Coffee Extracts Market

- In May 2025, Finlays, a leading global supplier of premium coffee, tea, botanicals, and extract solutions, announced the next evolution of its extracts business, Finlays Solutions. This new division positions Finlays as an end-to-end beverage innovation partner, offering foodservice operators, retail brands, and ingredient houses expert guidance and comprehensive support to better serve a fast-moving, flavour-forward world. The launch introduces a revitalized visual identity, purpose pillars, and a new website, aiming to blend tradition with innovation to develop market-changing products. This move is expected to strengthen Finlays’ presence in the coffee extracts market and drive adoption among commercial and retail players

- In September 2024, Bayer launched its Age Factor ecosystem, a comprehensive platform combining a scientifically formulated dietary supplement, a wellness companion app, and a saliva-based biological age test powered by Chronomics. This initiative marks Bayer's entry into the healthy-aging space, offering consumers new tools to support their healthy-aging journey. The ecosystem represents a significant step in personalized health, integrating dietary supplements with digital health tools to provide a holistic approach to aging, and highlighting the growing intersection of coffee extracts with functional and wellness-oriented products

- In March 2023, NatureWise introduced an organic coffee extract for nutraceuticals, focusing on organic, non-GMO, clinically tested green coffee bean supplements. This product leverages strong direct-to-consumer (DTC) and online retail channels to reach health-conscious consumers seeking natural weight management solutions. The launch reflects the increasing trend of integrating coffee extracts into dietary supplements, catering to the demand for functional and wellness-focused products in the nutraceutical segment

- In June 2023, McCormick & Company, a global leader in flavor solutions, acquired FONA International, a U.S.-based flavor company. This acquisition enhances McCormick's capabilities in the beverage sector, including coffee extracts, by expanding its portfolio of flavor solutions. The move underscores the growing demand for innovative flavor profiles in beverages and positions McCormick to capture a larger share of the coffee extracts and beverage ingredients market

- In February 2023, Allegro Coffee Company, a subsidiary of Whole Foods Market, collaborated with small-scale organic coffee farmers in Ethiopia to launch a new single-origin organic coffee blend. This partnership emphasizes sustainability and direct trade, offering consumers a product that supports ethical sourcing and promotes environmental responsibility. The initiative highlights the increasing consumer preference for transparency, traceability, and sustainable practices in the coffee extracts and broader coffee markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coffee Extracts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coffee Extracts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coffee Extracts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.