Global Coherent Optical Equipment Market

Market Size in USD Billion

CAGR :

%

USD

58.79 Billion

USD

119.05 Billion

2024

2032

USD

58.79 Billion

USD

119.05 Billion

2024

2032

| 2025 –2032 | |

| USD 58.79 Billion | |

| USD 119.05 Billion | |

|

|

|

|

Coherent Optical Equipment Market Analysis

The coherent optical equipment market has seen significant growth due to advancements in technology and methods, particularly in telecommunications and data center applications. The latest method gaining traction is the use of digital signal processing (DSP) in coherent optics, which allows for higher modulation formats, improving the bandwidth efficiency and transmission distance of optical signals. This innovation is paired with advanced photonic integrated circuits (PICs), which are helping reduce size and power consumption while enhancing performance.

Moreover, the integration of machine learning (ML) and artificial intelligence (AI) in network optimization plays a critical role in maximizing the performance of coherent optical systems. These technologies enable predictive maintenance, real-time monitoring, and adaptive modulation, contributing to overall system reliability.

The growth of cloud computing, the expanding demand for high-bandwidth services, and the rollout of 5G are all driving the coherent optical equipment market. The demand for faster and more efficient data transmission is pushing investments into next-gen coherent optical technologies, with major telecom companies leveraging these solutions for long-distance fiber-optic communications. As these technologies mature, the market is expected to continue growing.

Coherent Optical Equipment Market Size

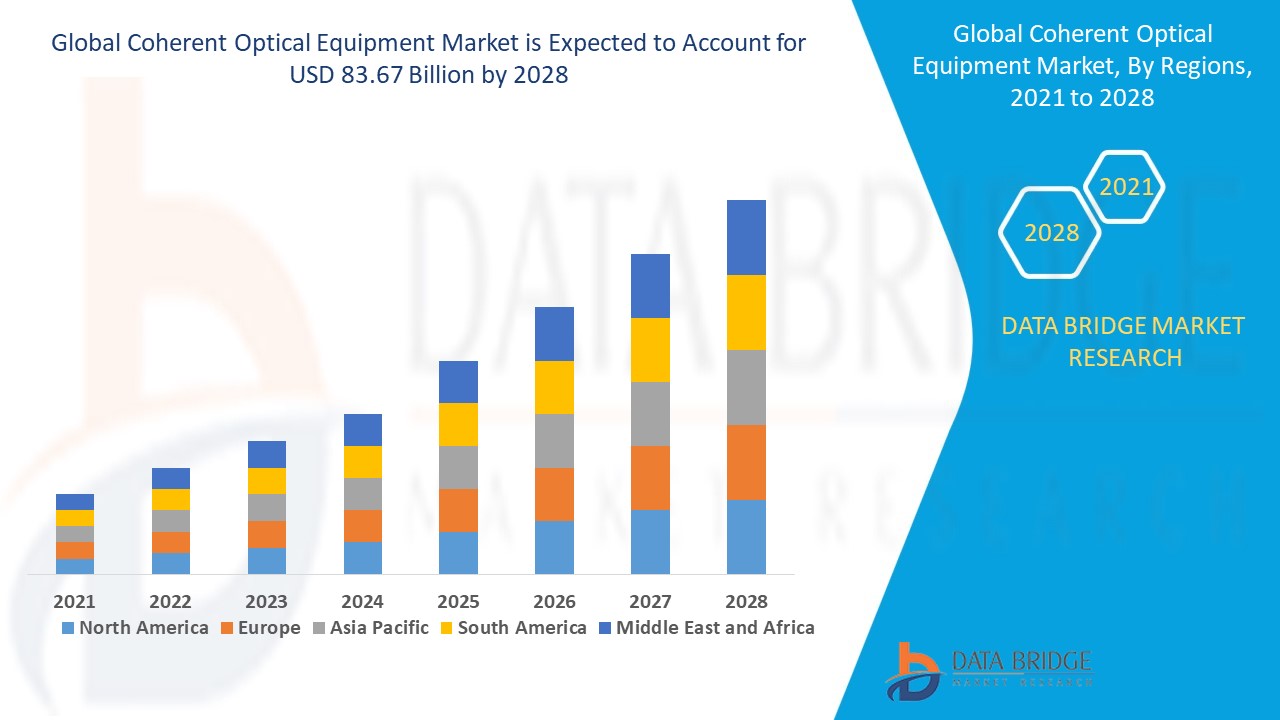

The global coherent optical equipment market size was valued at USD 58.79 billion in 2024 and is projected to reach USD 119.05 billion by 2032, with a CAGR of 9.22% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Coherent Optical Equipment Market Trends

“Growing Demand for High-Speed Internet and Data Transmission”

One key trend driving the growth of the coherent optical equipment market is the increasing demand for high-speed internet and data transmission. The surge in data consumption, fueled by cloud computing, 5G networks, and video streaming services, is pushing telecommunications providers to upgrade their infrastructure. Coherent optical technologies, such as advanced modulation formats and digital signal processing, enable faster and more efficient transmission over long distances. For instance, companies such as Huawei and Nokia have been investing in coherent optical systems to support 5G rollouts, which require high bandwidth. This trend is expected to continue as the world moves toward more connected and data-heavy environments.

Report Scope and Coherent Optical Equipment Market Segmentation

|

Attributes |

Coherent Optical Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Ciena Corporation (U.S.), Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (U.S.), Nokia (Finland), Infinera Corporation (U.S.), FUJITSU OPTICAL COMPONENTS LIMITED (Japan), Ribbon Communications Operating Company, Inc. (U.S.), ZTE Corporation (China), ADVA Optical Networking (Germany), Telefonaktiebolaget LM Ericsson (Sweden), NEC Corporation (Japan), Carl Zeiss Meditec AG (Germany), and Zygo Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Coherent Optical Equipment Market Definition

Coherent optical equipment refers to devices used in optical communication systems that rely on coherent light sources, such as lasers, to transmit data. These systems use the phase, amplitude, and frequency of light to encode and decode information, enabling higher data transmission rates and longer distances compared to traditional optical systems. Coherent optical equipment includes components such as modulators, detectors, and receivers, which are key in enabling advanced technologies such as coherent wavelength division multiplexing (CWDM) and coherent optical transmission networks. These systems are vital in applications such as high-capacity fiber-optic communication, data centers, and long-haul telecommunications.

Coherent Optical Equipment Market Dynamics

Drivers

- Growing Cloud Computing

The rapid growth of cloud computing has significantly increased the demand for high-capacity optical networks to support the massive data storage and processing needs of cloud data centers. Coherent optical systems, which provide high bandwidth and long-distance transmission with reduced power consumption, are crucial for managing this influx of data. For instance, Amazon Web Services (AWS) and Microsoft Azure rely on coherent optical networks to ensure seamless, fast, and scalable connectivity between their global data centers. As more businesses migrate to the cloud and expand their digital infrastructure, the demand for coherent optical equipment continues to rise, driving market growth.

- Expansion of 5G Networks

The expansion of 5G networks is a key driver for the coherent optical equipment market. 5G’s promise of faster data speeds and lower latency necessitates advanced optical transmission systems that can handle the significantly higher bandwidth required. Coherent optical technology, which enables efficient transmission over long distances with minimal loss, plays a crucial role in supporting 5G backhaul networks. For instance, companies such as Huawei and Ciena have been instrumental in deploying coherent optical equipment to support the global 5G rollout, ensuring that network operators can deliver high-speed, reliable connections. As 5G networks expand, the demand for coherent optical solutions to meet these needs continues to rise, driving market growth.

Opportunities

- Advancements in Optical Technology

Continued innovations in coherent optical technology, particularly in modulation formats and digital signal processing (DSP), are significantly enhancing the performance of optical systems. These advancements allow for higher data transmission rates, improved signal quality over long distances, and more efficient power consumption. For instance, technologies such as 400G and 800G coherent optical modules are being adopted in next-generation data centers to meet the growing demand for bandwidth. These innovations also enable telecom companies to upgrade their networks to 5G, allowing for faster, more reliable connections. As a result, the increased capability and efficiency of coherent optical systems are opening up new opportunities across industries such as telecommunications, cloud computing, and data centers.

- Support for IoT Expansion

The rapid growth of the Internet of Things (IoT) is generating massive volumes of data, requiring advanced and efficient data transmission systems. Coherent optical systems offer a solution by enabling high-capacity and low-latency networks, essential for handling the large amounts of data produced by interconnected devices. For instance, in smart cities, where millions of sensors and devices generate real-time data, coherent optical equipment ensures seamless communication between devices and cloud servers. This rising demand for robust data infrastructure creates significant opportunities for the coherent optical equipment market, as industries and governments seek to implement scalable, high-speed transmission systems to support IoT ecosystems effectively.

Restraints/Challenges

- High Implementation Costs

High implementation costs are a significant restraint for the coherent optical equipment market. Coherent optical technology demands advanced infrastructure and specialized components, which result in substantial initial investments. In addition, ongoing maintenance costs further add to the financial burden. These expenses make it challenging for organizations, particularly in cost-sensitive regions, to adopt and implement coherent optical systems. As a result, the high cost of entry can delay or prevent the widespread deployment of these technologies, limiting market growth. This financial barrier particularly affects small and medium-sized enterprises (SMEs), hindering the potential for market expansion in regions with lower budgets or in industries focused on cost-cutting measures.

- Limited Availability of Skilled Labor

The limited availability of skilled labor is a significant challenge in the coherent optical equipment market. The demand for professionals with expertise in advanced optical technologies, system integration, and maintenance far exceeds the available supply. This skills gap creates difficulties for businesses looking to adopt and operate these complex systems. The shortage of qualified technicians and engineers hampers the efficient deployment and ongoing maintenance of coherent optical systems. As a result, organizations may face delays in implementation and higher operational costs, which further constrains market growth. The lack of skilled labor impedes the widespread adoption of these technologies, limiting the potential of the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Coherent Optical Equipment Market Scope

The market is segmented on the basis of technology, equipment, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- 100G

- 200G

- 400G+

- 400G ZR

Equipment

- Wavelength-Division Multiplexer

- Modules/Chips

- Test and Measurement Equipment

- Optical Amplifiers

- Optical Switches

- Others

- Optical Fiber

- Optical Splitters

- Fiber Optic Circulators

- Optical Transceivers

Application

- Networking

- Fiber-to-the-Building/Premises (FTTB/P) Optical Network

- Fiber-to-the-Home (FTTH) Optical Network

- Data Center

- OEMs

End User

- Service Provider

- Internet Service Provider

- Telecom Service Provider

- Public Sector

- Industries

- Aviation

- Energy

- Railways

Component

- Laser

- DSP

- Transmitter

- Receiver

- Modulator

Coherent Optical Equipment Market Regional Analysis

The market is analyzed and market size insights and trends are provided by technology, equipment, application and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the coherent optical equipment market due to its large base of existing users and high internet usage. The region benefits from significant investments in infrastructure and advanced technology adoption, which drive the demand for high-speed data transmission, supporting growth in the coherent optical equipment sector.

Asia-Pacific is expected to expand at a significant growth rate in the coherent optical equipment market over the forecast period, driven by increased investments in research and development. These investments are focused on introducing advanced technologies and innovations, enabling the region to lead in the adoption of cutting-edge optical equipment solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Coherent Optical Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Coherent Optical Equipment Market Leaders Operating in the Market Are:

- Ciena Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Cisco Systems, Inc. (U.S.)

- Nokia (Finland)

- Infinera Corporation (U.S.)

- FUJITSU OPTICAL COMPONENTS LIMITED (Japan)

- Ribbon Communications Operating Company, Inc. (U.S.)

- ZTE Corporation (China)

- ADVA Optical Networking (Germany)

- Telefonaktiebolaget LM Ericsson (Sweden)

- NEC Corporation (Japan)

- Carl Zeiss Meditec AG (Germany)

- Zygo Corporation (U.S.)

Latest Developments in Coherent Optical Equipment Market

- In October 2023, ZTE Corporation, a leading provider of information and communication technology solutions, unveiled the ZXA10 C600E, a Tbit-level deterministic all-optical access platform, at the Network X exhibition in Paris, France. This platform aims to drive innovation in Fiber to the X (FTTx) services, enhancing the growth of global optical fiber technology

- In February 2023, Nokia introduced the PSE-6s, a sixth-generation super-coherent photonic service engine that lowers network power consumption by 60%. This product features a unique chip-to-chip interface, enabling deployment in pairs for the industry's first 2.4Tb/s coherent transport solution, promising a significant improvement in optical network efficiency

- In June 2023, ADVA Optical Networking received a major order from a European telecommunications service provider for its XGS-PON coherent optical transport portfolio. The order includes the FSP 3000 XGS-PON transponders and the A1000 coherent optical network manager, enhancing the provider's capabilities to meet growing demand for high-speed, reliable broadband services

- In June 2023, Nokia completed the acquisition of Adtran, a provider of optical networking solutions. This strategic acquisition strengthens Nokia's position in the global coherent optical equipment market, expanding its portfolio and allowing the company to offer a broader range of solutions for optical networks, further enhancing its competitive edge

- In March 2021, Cisco finalized its acquisition of Acacia Communications, a Massachusetts-based firm specializing in high-speed optical interconnect technologies. This acquisition enables Cisco to enhance its offerings in data center, metro, regional, long-haul, and submarine networks, providing an expanded portfolio of optical solutions to address the increasing demand for high-bandwidth connectivity

- In August 2020, Windstream and Ciena announced a partnership where Windstream will utilize Ciena’s photonic, coherent optical, and intelligent software platforms to develop its National Converged Optical Network. This network will help meet the rising bandwidth demands driven by remote work, cloud computing, video streaming, and other bandwidth-intensive applications in the digital era

- In May 2020, Nokia introduced its WaveFabric Elements optical range, designed for the growing demands of 5G and cloud environments. The portfolio includes photonic chips, devices, and subsystems, such as the Photonic Service Engine V, a fifth-generation coherent digital signal processor, enabling efficient, high-capacity optical networks to support next-gen technologies such as 5G

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coherent Optical Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coherent Optical Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coherent Optical Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.