Global Coil Coatings Market

Market Size in USD Billion

CAGR :

%

USD

3.24 Billion

USD

4.93 Billion

2024

2032

USD

3.24 Billion

USD

4.93 Billion

2024

2032

| 2025 –2032 | |

| USD 3.24 Billion | |

| USD 4.93 Billion | |

|

|

|

|

Coil Coatings Market Size

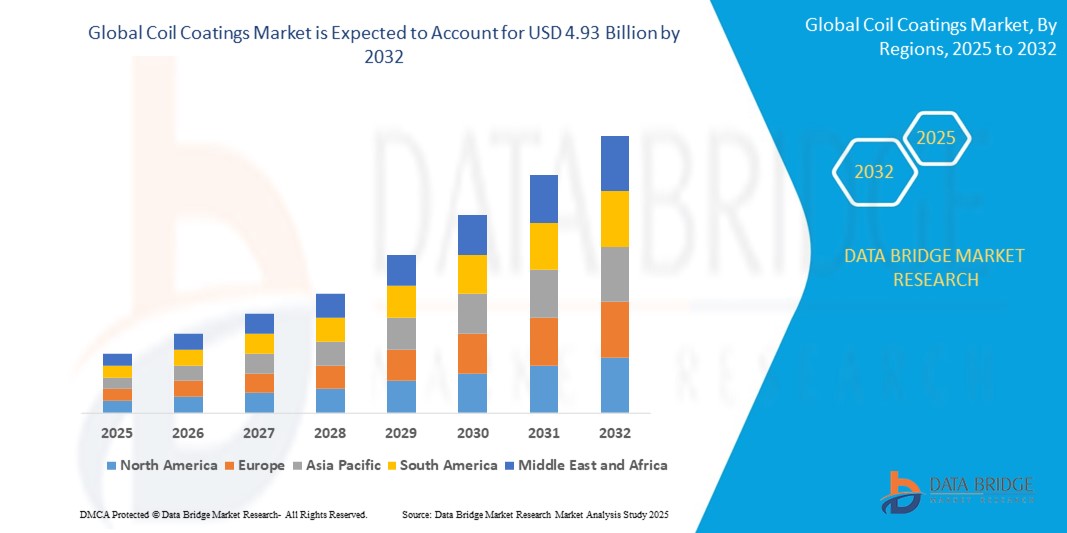

- The global coil coatings market size was valued at USD 3.24 billion in 2024 and is expected to reach USD 4.93 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is primarily driven by increasing demand for durable, corrosion-resistant, and aesthetically appealing coatings in the building and construction sector, coupled with rising adoption in automotive and industrial applications

- Growing awareness of energy-efficient coatings and the need for sustainable, eco-friendly solutions are further propelling demand across OEM and aftermarket channels

Coil Coatings Market Analysis

- The coil coatings market is experiencing robust growth due to the rising need for high-performance coatings that enhance durability, weather resistance, and visual appeal in various applications

- The building and construction sector dominates the market, driven by rapid urbanization, infrastructure development, and the increasing use of pre-coated steel and aluminium in roofing, cladding, and facades

- Asia-Pacific dominates the revenue growth of the coil coatings market, with a revenue share of 38.5% in 2024, driven by the booming construction industry, automotive OEMs, and industrial manufacturing in countries such as China, India, and Japan

- North America is projected to be the fastest-growing region during the forecast period, fuelled by advancements in coating technologies, increasing demand for energy-efficient building materials, and growing automotive production

- The polyester coil coatings segment holds the largest market share of 42% in 2024, owing to its cost-effectiveness, versatility, and excellent corrosion resistance. The adoption of fluoropolymer coatings is also rising due to their superior durability and UV resistance

Report Scope and Coil Coatings Market Segmentation

|

Attributes |

Coil Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Coil Coatings Market Trends

“Growing Adoption of Polyester and Fluoropolymer Coil Coatings”

- Polyester coil coatings are gaining traction due to their cost-effectiveness, durability, and versatility, making them a preferred choice for building and construction applications

- Fluoropolymer coil coatings are increasingly popular for their superior weather resistance, UV protection, and long-lasting aesthetic appeal, particularly in high-end architectural projects

- These coatings are favored in regions with extreme weather conditions, such as the Asia Pacific, for their ability to withstand harsh climates while maintaining color and gloss

- Luxury and commercial building projects are increasingly specifying fluoropolymer coatings for premium finishes and extended lifespan

- For instance, companies such as Nippon Paint offer advanced fluoropolymer coil coating solutions for architectural cladding in skyscrapers and commercial complexes

- OEMs in the automotive and appliance sectors are integrating polyester and siliconized polyester coatings to enhance product durability and corrosion resistance

Coil Coatings Market Dynamics

Driver

“Increasing Demand for Durable and Sustainable Coating Solutions”

- Rising awareness of environmental concerns and the need for sustainable construction materials are driving demand for coil coatings with high durability and eco-friendly properties

- Polyester and polyurethane coil coatings offer excellent corrosion resistance and weatherability, reducing maintenance costs and extending the lifespan of coated materials such as steel and aluminum

- The growth of the building and construction sector, particularly in the Asia Pacific, is fueling demand for coil coatings to protect structures and enhance aesthetic appeal

- Coil coatings contribute to energy efficiency by reflecting solar heat, reducing cooling costs in buildings, especially in hot climates such as India and Southeast Asia

- The rise of electric vehicles (EVs) and advanced manufacturing in the automotive sector is increasing the use of coil coatings for lightweight aluminum components, improving fuel efficiency and battery performance

- Automakers and appliance manufacturers are partnering with coating providers to integrate factory-applied coil coatings. For instance, Tata Steel collaborates with coil coating suppliers to provide pre-coated steel for automotive and construction applications

Restraint/Challenge

“Stringent Environmental Regulations on VOC Emissions”

- Regulatory restrictions on volatile organic compound (VOC) emissions in coil coating production and application are limiting market growth and increasing compliance costs for manufacturers

- Different regions, such as North America and Europe, enforce strict environmental standards, complicating formulation and production processes for global manufacturers

- High-VOC coatings are being phased out due to their environmental impact, pushing manufacturers to invest in low-VOC or water-based alternatives, which can be costlier

- For instance, the European Union’s REACH regulations and the U.S. EPA standards require low-VOC coatings, restricting the use of traditional solvent-based coil coatings

- These regulations may discourage smaller manufacturers from entering the market and limit the availability of certain high-performance coatings, potentially impacting market expansion

Coil Coatings Market Scope

The market is segmented on the basis of resin type, application, and end-use industry.

- By Resin Type

On the basis of resin type, the coil coatings market is segmented into polyester coil coatings, fluoropolymer coil coatings, siliconized polyester coil coatings, plastisol coil coatings, polyvinylidene fluorides (PVDF), polyurethane, and other resin coil coatings. The Polyester Coil Coatings segment held the largest market revenue share of 37.28% in 2024, driven by its cost-effectiveness, versatility, and excellent resistance to weathering and corrosion.

The polyvinylidene fluorides (PVDF) segment is expected to witness the fastest CAGR of around 5.8% from 2025 to 2032, fueled by its superior resistance to chemicals, UV radiation, and extreme temperatures. PVDF coatings are increasingly utilized in high-end architectural applications and the automotive sector, particularly for electric vehicle (EV) components, due to their long-term durability and eco-friendly variants that align with stringent environmental regulations.

- By Application

On the basis of application the coil coatings market is segmented into steel and aluminum applications. The steel segment held the largest market revenue share of 52% in 2024, driven by its widespread use in construction for roofing, wall panels, and structural components. Steel’s inherent strength, combined with coil coatings, ensures longevity and protection against corrosion, making it a staple in infrastructure projects.

The aluminum segment is anticipated to register the fastest CAGR from 2025 to 2032, propelled by its growing adoption in lightweight automotive components and modern architectural designs. Aluminum’s corrosion resistance and recyclability, enhanced by coil coatings, make it increasingly popular in industries prioritizing sustainability and weight reduction, such as automotive OEMs and green building initiatives.

By End-Use Industry

On the basis of end-use industry, the coil coatings market is segmented into building and construction, industrial and domestic appliances, consumer durable goods, furniture, HVAC, automotive, and others. The building and construction segment held the largest revenue share of approximately 52% in 2023, driven by rapid urbanization, infrastructure development, and the demand for durable, aesthetically appealing coated metal sheets for roofing, cladding, and facades. The increasing adoption of energy-efficient building codes further boosts the demand for coil coatings in this sector.

The automotive segment is expected to exhibit the fastest CAGR from 2025 to 2032, driven by the rising production of passenger vehicles and electric vehicles (EVs), particularly in the Asia Pacific region, which dominates the revenue growth of the automotive original equipment manufacturer (OEM) market.

Coil Coatings Market Regional Analysis

- Asia-Pacific dominates the revenue growth of the coil coatings market, with a revenue share of 38.5% in 2024, driven by the booming construction industry, automotive OEMs, and industrial manufacturing in countries such as China, India, and Japan

- North America is projected to be the fastest-growing region during the forecast period, fuelled by advancements in coating technologies, increasing demand for energy-efficient building materials, and growing automotive production

U.S. Coil Coatings Market Insight

The U.S. coil coatings market is anticipated to grow at a significant CAGR from 2024 to 2030. This growth is driven by the increasing demand for coil coatings in the construction industry, including residential, commercial, and industrial sectors. The rising requirement for warehouses due to the rapidly expanding e-commerce industry is expected to further boost the demand for coated steel products.

Europe Coil Coatings Market Insight

The European coil coatings market is also showing a promising outlook, with an expected value of USD 1.5 billion in 2024, projected to increase to USD 2.25 billion by 2035. The demand in Europe is largely buoyed by a strong emphasis on eco-friendly coating solutions and stringent environmental regulations. The region's mature automotive industry and ongoing renovation and maintenance activities in the building and construction sector are major drivers for the adoption of coil coatings.

U.K. Coil Coatings Market Insight

The U.K. coil coatings market is expected to grow at a noteworthy CAGR from 2024 to 2030. This growth is primarily fueled by rising investments in both public and private construction activities. The increasing adoption of digital construction methods is also anticipated to be a major driver, subsequently augmenting the demand for coil coatings across various applications in the country.

Germany Coil Coatings Market Insight

The German coil coatings market held the largest share of the European market in 2023. This is influenced by a well-developed infrastructure and a strong focus on innovation and sustainability within the industrial sector. Despite fluctuations in crude steel production, the demand for coil coatings remains robust, especially in residential and commercial buildings, aligning with the country's preference for high-quality, durable, and environmentally conscious solutions.

Asia-Pacific Coil Coatings Market Insight

The Asia-Pacific coil coatings market is poised to grow at the fastest CAGR and is expected to maintain its dominance throughout the forecast period, projected to reach over USD 2.5 billion by the end of 2032. This rapid growth is attributed to extensive industrialization and urbanization, particularly in emerging economies such as China, India, and Southeast Asian nations. The region's robust construction sector, coupled with the expansion of the automotive industry driven by both domestic consumption and export demand, is fueling the demand for coil coatings.

Japan Coil Coatings Market Insight

The Japan coil coatings market is gaining momentum due to the country’s high-tech manufacturing base, stringent quality standards, and increasing demand for high-performance and aesthetically appealing coatings in both construction and automotive sectors. The emphasis on innovative coating technologies and the adoption of eco-friendly solutions are further driving market growth.

China Coil Coatings Market Insight

The China coil coatings market held the largest share in Asia-Pacific in 2023, and it continues to be a dominant force. The relaxation of COVID-19 measures and significant ongoing infrastructure projects, particularly in railway construction, have positively influenced investor confidence and accelerated market growth. As a major manufacturing hub and with rapid urbanization, China's demand for coil coatings in construction, automotive, and appliance sectors remains exceptionally high.

Coil Coatings Market Share

The coil coatings industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- Henkel Adhesives Technologies India Private Limited (India)

- Kansai Nerolac Paints Limited (India)

- PPG Industries, Inc. (U.S.)

- Beckers Group (Germany)

- The Sherwin-Williams Company (U.S.)

- Eastman Chemical Company (U.S.)

- NOROO Coil Coatings Co. Ltd. (China)

- HUEHOCO (Germany)

- Jotun (Norway)

- BASF (Germany)

- NIPSEA Group (Singapore)

Latest Developments in Global Coil Coatings Market

- In October 2024, AkzoNobel introduced CeramiShield, an advanced coil coating designed for enhanced durability and corrosion resistance in architectural and industrial applications. This innovative coating offers superior weatherability and UV protection, addressing the growing demand for sustainable, long-lasting building materials. CeramiShield strengthens AkzoNobel’s position in the global coil coatings market, particularly in regions with extreme climates, by delivering high-performance solutions for metal substrates

- In September 2024, PPG Industries completed the acquisition of Tikkurila’s coil coatings division, expanding its portfolio and strengthening its presence in the European market. This strategic move enhances PPG’s ability to offer a broader range of high-performance coatings for pre-coated metals, leveraging Tikkurila’s established expertise and customer base. The acquisition supports PPG’s growth strategy in the architectural and industrial sectors, boosting its competitive edge

- In February 2024, KANSAI HELIOS signed a share purchase agreement with GREBE Holding in Weilburg, Germany, to acquire its entire industrial coatings business, WEILBURGER Coatings. This acquisition strengthens KANSAI HELIOS' presence in the global coatings market, expanding its portfolio across multiple industrial segments. WEILBURGER Coatings, known for its expertise in non-stick, high-temperature, and railway coatings, operates in Germany, Italy, France, Turkey, the USA, Brazil, India, and China. The deal aligns with KANSAI HELIOS' strategy to enhance innovation and market reach

- In January 2024, Beckers and ArcelorMittal announced a partnership to develop radiation curing technology for pre-painted steels in the coil coating industry. This collaboration focuses on electron-beam (EB) curing, replacing traditional solvent-based paints with solvent-free coatings to enhance sustainability. The technology aims to reduce CO2 and VOC emissions, lower energy consumption, and improve productivity while maintaining high-performance standards. The initiative builds on Beckers’ 18 years of research and ArcelorMittal’s expertise in steel manufacturing

- In April 2022, BlueScope Steel Limited completed a $500 million acquisition of Cornerstone Building Brands Inc.'s Coil Coatings business, marking a major expansion in the commercial and industrial construction sectors. This acquisition adds the second-largest metal painter in the US to BlueScope’s portfolio, with an annual capacity of approximately 900,000 tons across seven facilities. The deal enhances BlueScope’s ability to provide high-quality coil coatings for metal buildings and roofing, reinforcing its market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Coil Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Coil Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Coil Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.