Global Coin Collection Market

Market Size in USD Billion

CAGR :

%

USD

12.38 Billion

USD

26.15 Billion

2024

2032

USD

12.38 Billion

USD

26.15 Billion

2024

2032

| 2025 –2032 | |

| USD 12.38 Billion | |

| USD 26.15 Billion | |

|

|

|

|

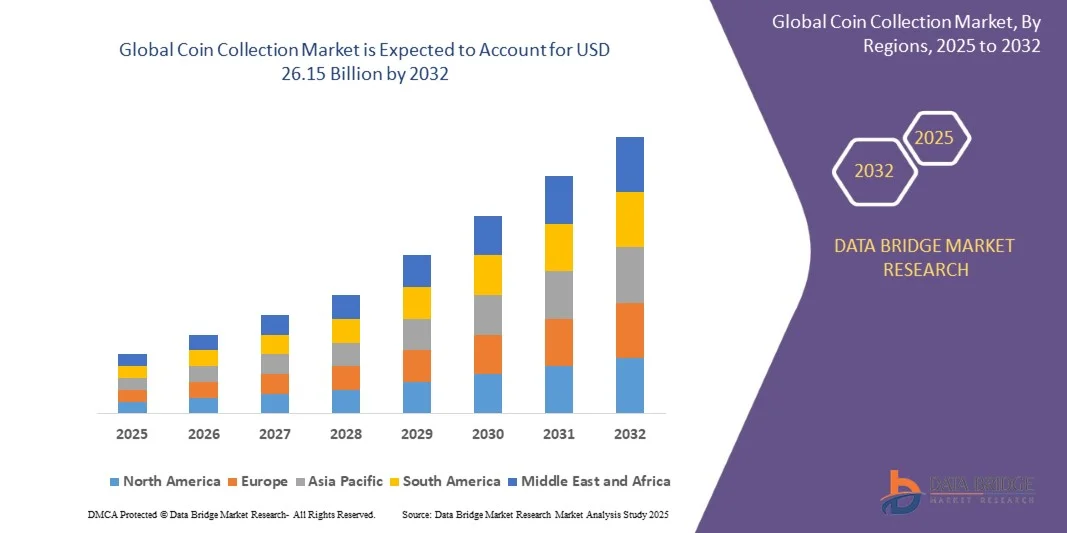

What is the Global Coin Collection Market Size and Growth Rate?

- The global coin collection market size was valued at USD 12.38 billion in 2024 and is expected to reach USD 26.15 billion by 2032, at a CAGR of 9.80% during the forecast period

- Market growth is primarily driven by the increasing interest in numismatics, fueled by rising disposable incomes, growing awareness of coins as collectible assets, and expanding access to online trading platforms

- In addition, the investment appeal of rare and precious metal coins, coupled with the cultural and historical significance attached to collections, continues to enhance market expansion across both developed and emerging economies

What are the Major Takeaways of Coin Collection Market?

- Coin collections, encompassing circulation, bullion, and commemorative coins, are increasingly recognized as a blend of hobby and investment, offering both sentimental and financial value to collectors

- The growing popularity of online auction platforms, specialized marketplaces, and digital cataloging tools is significantly simplifying access and participation for hobbyists, investors, and professional numismatists

- Rising demand is further supported by global interest in heritage preservation, limited-edition releases, and alternative investments, establishing coin collection as a resilient and steadily expanding niche market

- North America dominated the coin collection market with the largest revenue share of 42.3% in 2024, supported by a strong base of collectors, high disposable incomes, and the cultural value placed on numismatics

- The Asia-Pacific (APAC) market is expected to grow at the fastest CAGR of 6.32% from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and a growing middle class with interest in both collectibles and bullion investments

- The collection type segment dominated the market with the largest revenue share of 46.7% in 2024, driven by rising interest among hobbyists and numismatists in limited-edition and historically significant coins

Report Scope and Coin Collection Market Segmentation

|

Attributes |

Coin Collection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Coin Collection Market?

“Rising Popularity of Digital and Themed Collections”

- A significant trend shaping the global coin collection market is the growing shift toward digitally cataloged collections and the rising demand for themed coins such as historical events, cultural icons, and limited-edition releases. This trend reflects collectors’ increasing desire for uniqueness, personalization, and easy access to global markets

- For instance, The Royal Mint (U.K.) has launched a series of themed commemorative coins featuring British monarchs and major historical milestones, which have gained global popularity among both investors and hobbyists

- Digital platforms now allow collectors to authenticate, trade, and showcase coins virtually, reducing geographical limitations and creating a thriving secondary marketplace. Mobile applications also enhance the collecting experience with features such as digital cataloging and price tracking

- The integration of blockchain and NFTs in coin authentication and ownership transfer is another aspect redefining modern collecting habits

- This trend is creating a new ecosystem where traditional collectors and younger, tech-savvy investors converge, thereby broadening the overall collector base and fueling long-term market expansion

What are the Key Drivers of Coin Collection Market?

- The increasing investment appeal of coins as tangible assets during periods of economic uncertainty is a strong driver of market growth. Precious metal coins such as gold and silver bullions are especially popular due to their intrinsic value and long-term wealth preservation benefits

- For instance, in March 2024, APMEX (U.S.) reported a surge in global demand for gold bullion coins as investors sought safe-haven assets amid inflation concerns

- Rising consumer interest in historical and limited-edition coins is also contributing significantly. These coins hold both collectible and emotional value, making them popular among hobbyists and completists

- The growing digital transformation of the market through online platforms, auctions, and authentication technologies is widening global accessibility for both casual and professional collectors

- Furthermore, government mints worldwide are increasingly issuing themed and commemorative coins to celebrate cultural events, which boosts demand across numismatists, hobbyists, and investors. This convergence of investment, hobby, and technology is establishing coin collection as a resilient global market

Which Factor is Challenging the Growth of the Coin Collection Market?

- One of the key challenges restraining the growth of the coin collection market is the prevalence of counterfeit and fraudulent coins, which undermines collector confidence and market integrity. Advanced counterfeit techniques make it difficult for inexperienced collectors to distinguish genuine pieces from fakes

- For instance, in 2023, reports of counterfeit rare coins circulating in global online marketplaces raised concerns among major industry bodies, pushing calls for stricter regulation and authentication practices

- In addition, the high cost of rare and precious metal coins often creates a barrier for new entrants and budget-conscious collectors. While lower-priced options exist, premium collections remain inaccessible to a large consumer base

- Another major challenge is the fragmentation of the secondary market, where valuation inconsistencies and lack of standardized pricing often discourage participation

- Addressing these challenges will require wider adoption of authentication technologies (such as blockchain-based certification), transparent pricing mechanisms, and collector education programs. Tackling counterfeits and affordability issues will be crucial for ensuring sustainable growth in the coin collection industry

How is the Coin Collection Market Segmented?

The market is segmented on the basis of coin type, metal type, coin age, themes, end user, and service channel.

• By Coin Type

The Coin Collection market is segmented into circulation type, collection type, and bullions. The collection type segment dominated the market with the largest revenue share of 46.7% in 2024, driven by rising interest among hobbyists and numismatists in limited-edition and historically significant coins. Collectors value these coins for their rarity, cultural importance, and potential long-term appreciation, making them highly sought-after in auctions and private trades.

On the other hand, the bullions segment is anticipated to witness the fastest growth rate of 20.4% from 2025 to 2032, fueled by increasing investor interest in gold, silver, and platinum coins as a secure store of value during economic uncertainties. The demand for bullion coins such as the American Eagle, Canadian Maple Leaf, and South African Krugerrand continues to expand globally. This trend indicates a dual market dynamic—collectors driving cultural demand and investors propelling financial demand.

• By Metal Type

Based on metal type, the Coin Collection market is segmented into gold, silver, copper, platinum, and others. The gold segment dominated the market with a revenue share of 41.5% in 2024, owing to gold’s universal recognition as a valuable asset and its strong dual appeal among both collectors and investors. Gold coins are often viewed as safe-haven assets, driving consistent demand during market fluctuations. Silver, on the other hand, is gaining significant traction due to its affordability and accessibility for new collectors and small-scale investors.

The silver segment is projected to witness the fastest CAGR of 21.1% from 2025 to 2032, as mints and private players increasingly release silver commemorative editions that appeal to hobbyists. Platinum coins, though niche, are also growing in relevance due to their rarity. Overall, gold remains the dominant choice, while silver is emerging as the growth engine of the market.

• By Coin Age

The market is segmented into pre-1800’s, 1800’s, 1900’s, and modern coins. The 1900’s segment held the largest market revenue share of 39.2% in 2024, driven by strong demand for coins tied to significant global events, wars, and historic transitions in currency systems. Collectors value these coins for their relatively higher availability compared to pre-1800’s, while still holding strong historical importance. Modern coins are seeing rising popularity due to commemorative issues, limited mintages, and accessibility for entry-level collectors.

The modern coin segment is projected to register the fastest CAGR of 22.5% from 2025 to 2032, driven by government mints and private organizations issuing special editions to attract new generations of collectors. Meanwhile, pre-1800’s coins remain rare and high-value but are limited by availability. This dynamic shows how historical significance drives dominance, while modern creativity fuels rapid growth.

• By Themes

The Coin Collection market is segmented into series/year collection, type collection, composition collection, date collection, error collection, country collection, and others. The country collection segment dominated the market with the largest revenue share of 35.6% in 2024, fueled by collectors’ fascination with assembling sets from diverse geographies, highlighting cultural and political significance. National mints often release themed coin sets that appeal to patriotic collectors and global enthusiasts asuch as.

On the other hand, the error collection segment is projected to be the fastest-growing at a CAGR of 20.9% from 2025 to 2032, as rare minting mistakes significantly increase the rarity and value of coins in secondary markets. Series/year collections also remain popular among hobbyists looking for continuity and completeness. Overall, while geographical diversity anchors dominance, error coins are becoming the prized gems that push market growth.

• By End-user

The market is segmented into numismatists, hobbyists, investors, and completists. The investor segment dominated the market with a 44.8% revenue share in 2024, reflecting the increasing use of precious metal coins such as gold and silver as investment-grade assets and hedges against inflation. Institutional and retail investors are increasingly viewing coin collections as collectibles and as portfolio diversification tools.

Meanwhile, the hobbyist segment is forecasted to witness the fastest CAGR of 21.6% from 2025 to 2032, fueled by rising awareness of numismatics as a leisure activity, especially among younger generations exploring affordable modern coins. Numismatists continue to drive high-value demand through rare acquisitions and auctions, while completists focus on building full thematic sets. This dual presence of investors seeking value appreciation and hobbyists seeking leisure indicates balanced demand across user categories.

• By Service Channel

The Coin Collection market is segmented into online and offline channels. The offline segment held the largest revenue share of 53.2% in 2024, driven by the strong role of auctions, coin expos, and physical coin shops in authenticating, appraising, and trading rare coins. Collectors and investors often prefer physical inspection and expert valuation before making purchases of high-value items.

However, the online segment is expected to record the fastest CAGR of 23.4% from 2025 to 2032, fueled by the rise of e-commerce platforms, dedicated coin-trading websites, and blockchain-based authenticity solutions. Online platforms are democratizing access to coins, enabling hobbyists and small investors to purchase with greater convenience. The rise of digital marketplaces and virtual auctions is transforming the landscape, making the market more accessible to global participants. This indicates a gradual but strong digital shift in the sector.

Which Region Holds the Largest Share of the Coin Collection Market?

- North America dominated the coin collection market with the largest revenue share of 42.3% in 2024, supported by a strong base of collectors, high disposable incomes, and the cultural value placed on numismatics. The region benefits from established auction houses, active coin clubs, and the presence of prominent mints that continuously release special editions and commemoratives

- The demand is reinforced by investment-driven purchases of bullion coins, particularly gold and silver, as a hedge against economic uncertainty

- The U.S. leads regional growth, with hobbyists, investors, and completists contributing significantly to the thriving marketplace through both offline auctions and digital platforms

U.S. Coin Collection Market Insight

The U.S. market captured 82% of North America’s revenue share in 2024, fueled by a strong culture of coin collecting, high-value auctions, and the dominance of bullion investments. The presence of institutions such as the U.S. Mint, along with global recognition of American Eagle bullion coins, ensures continuous demand. Growing interest among younger generations in modern commemorative issues and digital trading platforms also drives growth, while rare coin auctions remain a high-value driver.

Europe Coin Collection Market Insight

The Europe market is projected to expand at a notable CAGR during 2025–2032, driven by rising collector communities, historical richness of European currencies, and strong bullion demand. Collectors in Europe value centuries-old coins and unique themes linked to monarchies, wars, and cultural milestones. Auctions in Switzerland, Germany, and the U.K. play a central role, with both individual collectors and investors contributing to demand.

U.K. Coin Collection Market Insight

The U.K. market is expected to grow at a significant CAGR, driven by collectors’ interest in royal commemorative issues and bullion coins from The Royal Mint. Concerns around wealth preservation, coupled with strong online distribution channels, boost adoption. The Royal Mint’s limited-edition releases and global recognition of British sovereign coins continue to strengthen demand among investors and hobbyists asuch as.

Germany Coin Collection Market Insight

The Germany market is anticipated to expand considerably, fueled by the country’s rich numismatic tradition and emphasis on historical and thematic collections. Germany’s role as a central hub for coin fairs and auctions, such as the World Money Fair in Berlin, contributes to strong collector interest. The country also shows rising demand for eco-conscious minting techniques, reflecting its cultural alignment with sustainability.

Which Region is the Fastest Growing in the Coin Collection Market?

The Asia-Pacific (APAC) market is expected to grow at the fastest CAGR of 6.32% from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and a growing middle class with interest in both collectibles and bullion investments. Government-backed initiatives for digitalization and financial diversification are further fueling the adoption of coin collections. The region also benefits from being a key hub for affordable minting and distribution.

Japan Coin Collection Market Insight

The Japan market is witnessing strong growth due to the nation’s appreciation for cultural and historical preservation, coupled with its tech-savvy population. Limited-edition commemorative coins issued for global events, such as the Olympics, are highly valued. Furthermore, Japan’s aging population is driving steady demand for collectibles as both heritage assets and long-term investments.

China Coin Collection Market Insight

The China market accounted for the largest APAC share in 2024, supported by its massive collector base, rapid economic growth, and the popularity of commemorative issues from the People’s Bank of China. Demand is strong across bullion, themed coins, and circulation-based collections. Government-backed initiatives, such as the promotion of cultural heritage through coin releases, and the country’s large manufacturing base, make China a key global hub for coin collection demand and supply.

Which are the Top Companies in Coin Collection Market?

The Coin Collection industry is primarily led by well-established companies, including:

- APMEX (American Precious Metals Exchange) (U.S.)

- A-Mark Precious Metals (U.S.)

- Asset Marketing Services (AMS) (U.S.)

- Stack’s Bowers Gallery (U.S.)

- Stonex Bullion (Germany)

- BullionByPost (U.K.)

- Bold Precious Metal (U.S.)

- Baird & Co. (U.K.)

- The Royal Mint Limited (U.K.)

- Austin Rare Coins (U.S.)

What are the Recent Developments in Coin Collection Market?

- In June 2025, the Royal Canadian Mint officially launched a new commemorative USD2 circulation coin celebrating Inuit Nunangat, which represents the cultures and traditions of Canada’s northern homeland. A total of three million coins were produced, including two million in color, marking a significant addition to Canada’s commemorative coinage. This initiative highlights the Mint’s dedication to honoring Indigenous heritage and broadening national cultural awareness

- In June 2025, the Royal Australian Mint unveiled a new USD2 commemorative coin to honor the 30th anniversary of the Torres Strait Islander flag’s official recognition. The illustration, designed by Indigenous artist Lavinia Ketchell, drew inspiration from cultural symbols of the flag and was revealed ahead of its pre-sale in June 2025. This launch underlines the Mint’s role in celebrating cultural identity and national milestones through numismatic artistry

- In June 2025, the U.S. Mint announced the upcoming pre-sale of the 250th Anniversary United States Army American Eagle One Ounce Silver Proof Coin, minted in West Point with 99.9% silver. The pre-sale was scheduled for June 13, 2025, with a limited mintage of 100,000 coins and a household order cap of three. This release emphasizes the Mint’s commitment to commemorating military heritage while offering collectors a limited-edition investment opportunity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.