Global Cold Chain Monitoring Components Market

Market Size in USD Billion

CAGR :

%

USD

8.36 Billion

USD

26.86 Billion

2024

2032

USD

8.36 Billion

USD

26.86 Billion

2024

2032

| 2025 –2032 | |

| USD 8.36 Billion | |

| USD 26.86 Billion | |

|

|

|

|

Global Cold Chain Monitoring Components Market Size

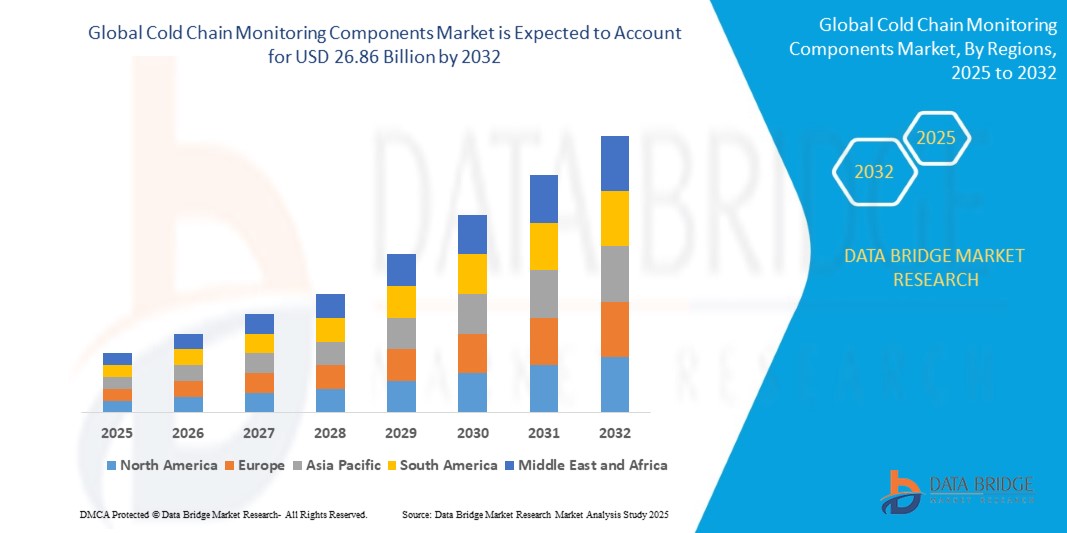

- The Global Cold Chain Monitoring Components Market Size was valued at USD 8.36 Billion in 2024 and is expected to reach USD 26.86 Billion by 2032, at a CAGR of 18.1% during the forecast period

- The growth of the Global Cold Chain Monitoring Components Market is fueled by the escalating demand for temperature-sensitive products, increasingly stringent regulatory compliance, and rapid advancements in IoT, AI, and cloud-based monitoring technologies.

Global Cold Chain Monitoring Components Market Analysis

The Global Cold Chain Monitoring Components Market is experiencing robust growth as industries across pharmaceuticals, food and beverage, chemicals, and healthcare sectors increasingly prioritize product integrity, compliance, and supply chain transparency. The rising demand for temperature-sensitive goods, including vaccines, biologics, frozen foods, and specialty chemicals, has made cold chain monitoring components an essential part of modern logistics and storage systems.

A primary driver of market growth is the advancement in sensor technology, IoT integration, wireless communication, and cloud-based analytics platforms. Innovations in real-time temperature monitoring, humidity tracking, and geolocation have enabled end-to-end visibility, proactive alerts, and corrective actions during the transportation and storage of perishable products. These improvements have not only increased operational efficiency but also minimized wastage and ensured adherence to international quality standards.

The increasing focus on regulatory compliance, particularly with frameworks like FDA, WHO, and EU Good Distribution Practices (GDP), is further accelerating the adoption of monitoring solutions. Cold chain monitoring components help companies meet stringent audit requirements, reduce spoilage risks, and maintain product safety, especially in pharmaceutical and biotech sectors. In the food and beverage industry, rising consumer expectations for quality and traceability are driving the need for smarter cold chain management systems.

Retailers, logistics providers, and third-party cold storage operators are also investing in advanced monitoring infrastructure to optimize inventory turnover, reduce energy consumption, and gain competitive advantage. The integration of AI and predictive analytics is enabling organizations to forecast potential disruptions, optimize routing, and enhance inventory control in cold chain logistics.

Despite strong momentum, the market faces several challenges. These include high implementation and maintenance costs, complexity in integrating with legacy systems, data privacy concerns, and a shortage of skilled technical personnel. In emerging markets, limited digital infrastructure and inconsistent power supply remain additional obstacles that hamper widespread adoption.

Nevertheless, the outlook remains optimistic. Government initiatives to improve food safety and vaccine distribution, combined with growing e-commerce penetration and urbanization, are creating new opportunities for cold chain monitoring components. As technology becomes more accessible and awareness grows among stakeholders, the market is expected to witness sustained expansion in the years ahead.

Report Scope and Global Cold Chain Monitoring Components Market Segmentation

|

Attributes |

Global Cold Chain Monitoring Components Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Cold Chain Monitoring Components Market Trends

“Innovation and Integration: Enhancing Cold Chain Transparency and Product Integrity Through Smart Monitoring Technologies”

- A key and accelerating trend in the Global Cold Chain Monitoring Components Market is the integration of smart technologies such as IoT, artificial intelligence (AI), and machine learning (ML) to enable real-time condition tracking, predictive analytics, and automated alerts. These advancements are transforming how cold chains are monitored and managed across pharmaceutical, food, and logistics sectors.

- Companies are increasingly deploying wireless sensors, RFID tags, and cloud-connected data loggers to monitor temperature, humidity, and location throughout the supply chain. This trend supports the growing need for compliance, traceability, and product safety especially for high-value or perishable goods.

- The adoption of cloud-based platforms and mobile applications is rising, allowing stakeholders to access live data, generate compliance reports, and respond to temperature excursions remotely. These technologies are enabling more agile, responsive, and resilient cold chain operations.

- The convergence of environmental sustainability and digital innovation is driving interest in energy-efficient monitoring systems and smart packaging solutions that reduce waste, minimize carbon footprint, and support eco-friendly supply chain practices. This is particularly relevant in sectors such as food export, healthcare, and retail distribution.

Global Cold Chain Monitoring Components Market Dynamics

Driver

“Rising Demand for Supply Chain Visibility, Product Integrity, and Regulatory Compliance”

- The growing need for real-time visibility into temperature-sensitive logistics is driving adoption of Cold Chain Monitoring Components across the pharmaceutical, food & beverage, and chemical industries. These systems ensure product integrity, reduce spoilage, and improve end-to-end traceability.

- Regulatory mandates such as FDA guidelines, EU Good Distribution Practices (GDP), and WHO standards require continuous temperature monitoring and documentation throughout the cold chain, pushing enterprises to implement advanced monitoring solutions.

- The global distribution of high-value biopharmaceuticals, vaccines, and cell/gene therapies has intensified the demand for precision-controlled environments supported by intelligent sensors, data loggers, and analytics-driven platforms.

- Consumer demand for quality assurance, sustainability, and accountability is rising, prompting brands to adopt cold chain monitoring systems to maintain freshness and build trust in perishable product categories.

- Technological advancements in wireless connectivity, cloud platforms, and IoT-based sensors are making cold chain monitoring more scalable, accessible, and efficient—fostering higher adoption across industries and geographies.

Restraint/Challenge

“High Implementation Costs, Infrastructure Barriers, and Limited Interoperability”

- The high initial investment required for sophisticated cold chain monitoring systems including hardware sensors, cloud infrastructure, software licensing, and training poses a challenge for SMEs and organizations in cost-sensitive markets.

- Infrastructural limitations in emerging economies, such as unreliable power supply, poor internet connectivity, and limited access to refrigerated transport, restrict the deployment and effectiveness of monitoring technologies.

- Many cold chain systems lack interoperability, making it difficult to integrate with existing logistics management platforms or ERP systems, leading to data silos and inefficiencies.

- The lack of standardized global protocols and fragmented regulatory requirements across countries create complexity for multinational operators attempting to streamline their monitoring processes.

- Data privacy concerns and cybersecurity risks especially with cloud-connected, IoT-based monitoring solutions also act as deterrents for full-scale implementation in critical sectors like healthcare and defense.

Global Cold Chain Monitoring Components Market Scope

The market is segmented on the basis of Component, Logistics/Service Type, Application.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Logistics/Service Type |

|

|

By Application |

|

- By Component

The Global Cold Chain Monitoring Components Market, when segmented by component, comprises hardware and software, each playing a critical role in ensuring temperature-controlled logistics. The hardware segment includes sensors, data loggers, real-time monitoring devices, and RFID devices that enable the physical capture and relay of environmental data across storage and transportation phases. Sensors are crucial for tracking variables such as temperature, humidity, and vibration, while data loggers offer time-stamped records that ensure compliance and auditing. Real-time monitoring devices provide continuous visibility, supporting proactive responses to any deviations, and RFID devices enhance tracking accuracy and automation within the supply chain. On the other hand, the software segment is divided into on-premise and cloud-based solutions. On-premise software offers localized control, often preferred by organizations with strict data policies, while cloud-based platforms provide scalability, remote accessibility, and integration with IoT devices—making them increasingly popular for global, multi-point cold chain networks. Both segments work in tandem to offer complete end-to-end monitoring, analytics, alerts, and reporting functionalities, supporting regulatory compliance, quality assurance, and operational efficiency.

- By Logistics/Service Type

The Global Cold Chain Monitoring Components Market, when analyzed by logistics or service type, is segmented into storage and transportation, both of which are essential in maintaining the integrity of temperature-sensitive goods throughout the supply chain. The storage segment encompasses monitoring solutions implemented in warehouses, distribution centers, and cold rooms, where precise environmental control is required to preserve product quality over extended periods. Sensors and data loggers are extensively used to monitor temperature, humidity, and air flow in these static environments, ensuring compliance with stringent regulatory standards. The transportation segment, on the other hand, focuses on monitoring during the dynamic movement of goods via road, rail, sea, or air. Real-time tracking devices, GPS-enabled sensors, and RFID systems play a critical role in providing continuous visibility into the condition of perishable goods in transit. This segment is especially vital for high-value products such as pharmaceuticals, biologics, fresh produce, and seafood, where even slight deviations in temperature can lead to spoilage or loss. Together, both segments ensure the uninterrupted cold chain from origin to destination, supporting safety, compliance, and operational efficiency across global supply networks.

- By Application

The Global Cold Chain Monitoring Components Market, segmented by application, includes pharmaceuticals and healthcare, food and beverages, and chemicals, each with distinct temperature sensitivity and compliance requirements. In the pharmaceuticals and healthcare sector, cold chain monitoring is critical for maintaining the efficacy and safety of vaccines, biologics, insulin, and other temperature-sensitive drugs. Real-time monitoring and data logging ensure strict adherence to regulatory standards like WHO GDP, FDA, and EMA guidelines. The food and beverages segment relies heavily on cold chain solutions to preserve freshness, prevent spoilage, and extend shelf life for products such as dairy, meat, seafood, frozen foods, and ready-to-eat meals. Continuous temperature control during storage and transportation is essential to prevent contamination and ensure food safety. In the chemicals segment, cold chain monitoring is used to manage the transport and storage of temperature-sensitive industrial chemicals, specialty reagents, and volatile compounds that can degrade or become hazardous if exposed to temperature fluctuations. These applications demand highly reliable, tamper-proof monitoring systems to ensure product integrity and regulatory compliance across the supply chain.

Global Cold Chain Monitoring Components Market Regional Analysis

- In North America, the cold chain monitoring components market is driven by strong regulatory frameworks, a well-established pharmaceutical sector, and high demand for perishable foods. The region is witnessing widespread adoption of real-time monitoring devices, cloud-based software, and IoT-enabled sensors to ensure product safety and regulatory compliance, particularly for temperature-sensitive drugs and biologics.

- Europe is a mature market where stringent regulations around food safety, pharmaceutical transportation, and environmental sustainability are key growth drivers. Countries like Germany, the UK, France, and the Netherlands are investing in advanced cold chain infrastructure, with increasing deployment of RFID tracking, data loggers, and analytics platforms to enhance visibility and traceability throughout the logistics chain.

- The Asia Pacific region is experiencing rapid market growth, fueled by expanding pharmaceutical production, increasing exports of seafood and fresh produce, and the rise of e-commerce grocery platforms. Countries like China, India, Japan, and South Korea are investing in cold chain modernization, leveraging cost-effective monitoring solutions and mobile-based technologies to bridge infrastructure gaps and support large-scale vaccine distribution programs.

- In Latin America, the market is emerging, with key developments focused on improving food export quality and ensuring safe pharmaceutical transportation. Countries such as Brazil, Mexico, and Argentina are adopting cold chain monitoring solutions gradually, as logistics players seek to minimize spoilage and comply with global trade standards. Limited infrastructure and cost sensitivity remain challenges, prompting demand for affordable, scalable technologies.

- The Middle East and Africa region presents growing potential due to the rising demand for imported perishable goods, healthcare expansion, and government-led food security initiatives. The UAE, Saudi Arabia, and South Africa are among the leading adopters, investing in temperature-controlled storage and real-time tracking systems to ensure product integrity across long transit routes and extreme climates.

North America Cold Chain Monitoring Components Market Insight

The North America Cold Chain Monitoring Components Market continues to dominate globally due to the region’s advanced logistics infrastructure, strict regulatory standards, and high demand from pharmaceutical, healthcare, and food sectors. The United States leads the regional market, driven by FDA regulations and the critical need for temperature-sensitive supply chain integrity, particularly for vaccines, biologics, and perishable food items. The growing adoption of IoT-enabled sensors, RFID devices, and real-time monitoring technologies is enabling enhanced visibility, traceability, and compliance across cold storage and transportation networks. Cloud-based monitoring platforms are gaining popularity for their scalability and data-driven insights, supporting predictive maintenance and proactive risk management. Additionally, the rapid growth of e-commerce and home delivery services is increasing the demand for real-time cold chain monitoring solutions. The region’s focus on sustainability and energy-efficient cold chain systems further supports innovation and long-term market expansion.

Europe Cold Chain Monitoring Components Market Insight

The Europe Cold Chain Monitoring Components Market is mature and technologically advanced, driven by a strong regulatory environment, a well-established pharmaceutical sector, and high consumer expectations for food quality and safety. Countries like Germany, France, the UK, and the Netherlands are leading the charge, integrating real-time temperature sensors, RFID tracking, and analytics platforms into both storage and transportation segments. The region's stringent standards around Good Distribution Practices (GDP), food safety, and environmental impact have accelerated adoption of smart logistics solutions. Additionally, Europe's push toward sustainability is fueling investments in cold-chain systems designed to reduce waste, optimize energy usage, and extend shelf life. The growing expansion of e-grocery and online meal services is further increasing demand for reliable, traceable monitoring solutions. Collectively, these factors position Europe as a key innovation hub in the cold chain market, emphasizing compliance, consumer trust, and operational efficiency.

Asia Pacific Cold Chain Monitoring Components Market Insight

The Asia Pacific Cold Chain Monitoring Components Market is witnessing the fastest regional growth, driven by rapid industrialization, expanding pharmaceutical production, and surging demand for food safety and traceability. Major countries such as China, India, Japan, and South Korea are investing heavily in modern cold chain infrastructure to support growing vaccine distribution, fresh produce export, and e-commerce-driven grocery delivery. Cost-effective manufacturing and widespread adoption of IoT-enabled sensors, RFID devices, and mobile-based monitoring systems are helping bridge infrastructure gaps. In emerging Southeast Asian nations, pilot deployments in healthcare and perishables logistics are gaining momentum thanks to government-backed food safety regulations and rural healthcare initiatives. Additionally, investment in cold storage for seafood, dairy, and meat is rising to meet both domestic consumption and international export requirements. Overall, Asia Pacific offers significant growth potential as digital monitoring technologies become more affordable, accessible, and essential for compliance and quality control in expanding cold chain networks.

Latin America Cold Chain Monitoring Components Market Insight

The Latin America Cold Chain Monitoring Components Market is advancing steadily, driven by improving healthcare infrastructure, growing food export demand, and evolving regulatory frameworks. In countries like Brazil, Mexico, and Argentina, stakeholders in pharmaceuticals and food sectors are investing in temperature-monitoring devices, data loggers, and analytics platforms to ensure product quality during storage and transportation. Regulatory pressures for food safety and vaccine handling, as well as the expansion of cold storage facilities for perishable goods, are establishing the need for robust monitoring systems. Despite challenges such as underdeveloped logistics networks and cost sensitivity, the trend towards modernization supported by public–private partnerships and international trade agreements is accelerating adoption. Additionally, the rise of e-commerce and grocery delivery services is creating new opportunities for real-time tracking in last-mile logistics. As cold chain components become more affordable and scalable, more organizations are recognizing their value in reducing spoilage, ensuring compliance, and enhancing consumer confidence, positioning Latin America for sustained growth in this market.

Middle East and Africa Cold Chain Monitoring Components Market Insight

The Middle East and Africa Cold Chain Monitoring Components Market is witnessing accelerated growth driven by expanding pharmaceutical distribution, increased food import activity, and rising demand for supply chain transparency. Countries such as the UAE, Saudi Arabia, and South Africa are spearheading cold chain infrastructure development with investments in refrigerated storage, real-time monitoring systems, and smart logistics platforms. The healthcare sector, in particular, is a major growth driver, as governments prioritize the safe distribution of temperature-sensitive vaccines, biologics, and other pharmaceuticals. The region’s growing reliance on imported perishable food products also fuels demand for real-time sensors, data loggers, and cloud-based cold chain monitoring tools to maintain product integrity throughout the journey. Additionally, regulatory reforms and national food safety strategies are encouraging greater adoption of traceability and monitoring solutions in both food and healthcare supply chains. However, challenges persist, including high equipment and installation costs, inconsistent electricity supply in rural areas, and limited digital infrastructure in several African nations. Despite these constraints, the market holds strong potential as technology providers expand partnerships and local governments roll out digitization initiatives to modernize the cold chain ecosystem.

Global Cold Chain Monitoring Components Market Share

The Global Cold Chain Monitoring Components industry is primarily led by well-established companies, including:

- Sensitech Inc.

- Emerson Electric Co.

- Carrier Global Corporation

- Testo SE & Co. KGaA

- ORBCOMM Inc.

- Berlinger & Co. AG

- Monnit Corporation

- Elpro-Buchs AG

- Rotronic AG

- Dickson Inc.

- Controlant

- NXP Semiconductors N.V.

- Honeywell International Inc.

- Zebra Technologies Corporation

- Haier Biomedical

Latest Developments in Global Cold Chain Monitoring Components Market

- In May 2025, researchers explored how predictive analytics can streamline cross-border logistics within the cold chain, highlighting the growing sophistication of software components.

- In May 2025, the "Cold Chain Logistics Market Outlook to 2029" report indicated that the APAC region leads the market, fueled by strong economic growth, urbanization, and demand for perishable goods, driving the need for robust monitoring components.

- In April 2025, Tower Cold Chain announced a live tracking feature to support its advanced passive temperature-controlled containers, utilizing systems created by ELPRO to provide clients with near real-time visibility into their shipments.

- In January 2025, a "Cold Chain Tracking and Monitoring Market Report" forecasted that the installed base of active remote tracking systems for refrigerated cargo carrying units would reach 4.5 million units by 2028, reflecting widespread adoption of real-time hardware components.

- In January 2025, JimiIoT introduced the LL303 tracker, an IoT-enabled cold chain management solution offering solar-powered operation, GNSS-based location tracking, and real-time temperature monitoring, showcasing innovation in compact, energy-efficient hardware.

- In December 2024, the World Health Organization (WHO) released updated guidelines for manufacturers of temperature monitoring devices under its PQS system, aiming to ensure performance, quality, and safety for cold chain equipment components.

- In November 2024, Gather AI implemented system intelligence for automated inventory counting in cold storage and freezer inventory at a fresh food warehouse, utilizing drones with computer vision to automate monitoring in controlled temperature zones.

- In September 2024, ELPRO launched elproPREDICT, an advanced real-time predictive analytics solution, integrating data from its real-time monitoring devices to provide actionable insights for proactive risk mitigation in cold chain logistics.

- In September 2024, United Parcel Service Inc. (UPS) acquired Frigo-Trans, a German logistics company, signaling increased investment and consolidation in cold chain capabilities that will drive demand for advanced monitoring solutions.

- In February 2024, Sensitech launched the TempTale GEO X, a GxP-compliant IoT solution designed to monitor temperature-sensitive pharmaceuticals during global transportation, highlighting advancements in specialized monitoring hardware.

- In August 2023, Emergent Cold Latin America acquired the cold storage business of Frigorifico Modelo in Montevideo, Uruguay, with plans for immediate expansion, signifying continued investment in infrastructure that requires robust monitoring components.

- In May 2023, Tridentify introduced an advanced real-time cold chain monitoring system, aiming to transform how companies oversee operations by offering a comprehensive real-time view of product stability and shelf life, particularly for pharmaceuticals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cold Chain Monitoring Components Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cold Chain Monitoring Components Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cold Chain Monitoring Components Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.