Global Cold Insulation Market

Market Size in USD Billion

CAGR :

%

USD

6.81 Billion

USD

13.37 Billion

2024

2032

USD

6.81 Billion

USD

13.37 Billion

2024

2032

| 2025 –2032 | |

| USD 6.81 Billion | |

| USD 13.37 Billion | |

|

|

|

|

Cold Insulation Market Size

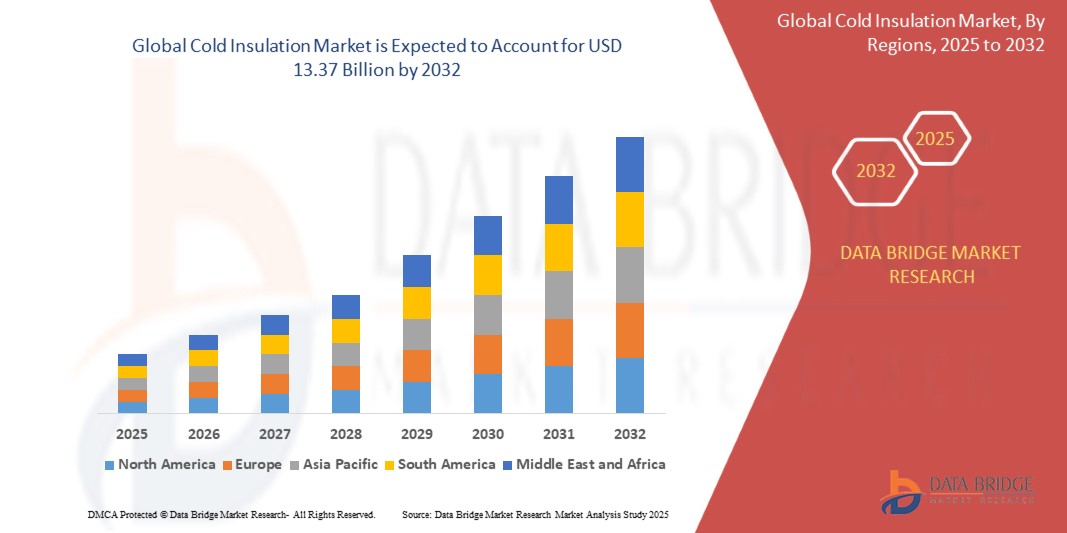

- The global cold insulation market size was valued at USD 6.81 billion in 2024 and is expected to reach USD 13.37 billion by 2032, at a CAGR of 8.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient systems across industries such as oil and gas, chemicals, refrigeration, and HVAC

- Rising environmental concerns and stringent government regulations to reduce greenhouse gas emissions are further driving the adoption of cold insulation materials in both industrial and commercial applications

Cold Insulation Market Analysis

- The cold insulation market is witnessing strong momentum due to the growing need for thermal insulation to prevent heat gain and improve energy efficiency in low-temperature operations

- The expanding industrial infrastructure in developing regions, along with increased investments in LNG terminals, cold storage facilities, and cryogenic transportation, is contributing to significant demand for advanced insulation solutions

- Asia-Pacific dominated the cold insulation market with the largest revenue share of 38.26% in 2024, driven by rapid industrialization, expansion of the oil and gas sector, and increasing demand for energy-efficient insulation systems across emerging economies

- Europe region is expected to witness the highest growth rate in the global cold insulation market, driven by stringent regulatory frameworks on emissions and energy consumption, growing demand for sustainable building practices, and a strong focus on innovation in insulation technology

- The polyurethane foam segment dominated the market with the largest revenue share in 2024, driven by its excellent thermal resistance, moisture barrier properties, and widespread use across cold storage and refrigeration applications. It is extensively utilized in industries due to its durability and compatibility with varied temperature ranges. Its cost-effectiveness and availability in multiple forms such as spray and rigid panels have further solidified its adoption across commercial and industrial settings

Report Scope and Cold Insulation Market Segmentation

|

Attributes |

Cold Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for LNG Infrastructure Development • Growing Adoption of Eco-Friendly Insulation Materials |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cold Insulation Market Trends

“Growing Focus on Energy-Efficient Cold Storage Systems”

- Energy efficiency is becoming a key consideration in cold storage design, driving the adoption of insulation solutions that minimize heat gain and reduce energy consumption

- Sectors such as food processing and pharmaceuticals increasingly rely on temperature-controlled environments, where high-performance cold insulation ensures compliance and product integrity

- Rising electricity costs are encouraging businesses to invest in long-term insulation upgrades to cut down on operational expenses

- Government mandates and environmental regulations are pushing industries to meet new energy benchmarks through better thermal insulation

- The expansion of organized retail and e-commerce in developing countries is creating significant demand for energy-efficient cold chains

- For instance, In India, cold storage companies are adopting advanced insulation to meet energy-saving mandates under the National Mission on Food Processing

Cold Insulation Market Dynamics

Driver

“Expanding Liquefied Natural Gas (LNG) Industry”

- The global LNG industry is expanding rapidly, requiring cryogenic storage and transport systems insulated to extremely low temperatures

- LNG infrastructure such as terminals, pipelines, and marine vessels depends on high-performance insulation to maintain safety and efficiency

- Increasing demand for clean energy sources is fueling investments in LNG projects, especially in Asia-Pacific and the Middle East

- Key insulation materials such as polyurethane foam and polystyrene are in high demand due to their low thermal conductivity and moisture resistance

- Strategic partnerships and government-backed LNG expansions are boosting demand for cold insulation in both upstream and downstream operations

- For instance, Qatar’s North Field Expansion Project is set to significantly increase LNG output, leading to higher demand for cryogenic insulation materials

Restraint/Challenge

“High Installation and Maintenance Costs”

- Cold insulation systems, especially for industrial and cryogenic use, require specialized materials and skilled labor, leading to high upfront installation costs

- Ongoing maintenance, including inspections and repairs, adds to the operational cost burden for companies using cold insulation

- Budget constraints, particularly for small and medium enterprises, often delay or limit the adoption of high-performance insulation systems

- Retrofitting older infrastructure with modern insulation can be cost-intensive and disrupt regular operations

- Developing regions may struggle to afford or justify the investment, slowing the market’s overall penetration in price-sensitive areas

- For instance, In Southeast Asia, many small-scale cold storage businesses delay insulation upgrades due to financial limitations and lack of access to technical expertise

Cold Insulation Market Scope

The market is segmented on the basis of type, end use, and application.

• By Type

On the basis of type, the cold insulation market is segmented into polyisocyanurate, polyurethane foam, nitrile rubber, phenolic foam, ceramic fiber, and polystyrene foam. The polyurethane foam segment dominated the market with the largest revenue share in 2024, driven by its excellent thermal resistance, moisture barrier properties, and widespread use across cold storage and refrigeration applications. It is extensively utilized in industries due to its durability and compatibility with varied temperature ranges. Its cost-effectiveness and availability in multiple forms such as spray and rigid panels have further solidified its adoption across commercial and industrial settings.

The polyisocyanurate segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by its superior thermal performance and fire resistance. This type is gaining traction in applications where energy efficiency and safety are critical, particularly in cold pipelines and LNG infrastructure. Its compatibility with green building standards and low environmental impact also contribute to rising demand in modern construction and retrofitting projects.

• By End Use

On the basis of end use, the market is segmented into commercial and industrial. The industrial segment held the largest market share in 2024, primarily due to high demand across oil and gas, petrochemical, and chemical sectors. These industries rely heavily on cold insulation to maintain process integrity and ensure energy efficiency in extreme temperature environments.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising adoption in food retail, cold storage logistics, and data centers. The need for thermal insulation in commercial HVAC systems and refrigeration units is boosting the segment’s expansion, particularly in urban areas with growing infrastructure investments.

• By Application

On the basis of application, the cold insulation market is segmented into HVAC, chemicals, oil and gas, refrigeration, and others. The refrigeration segment dominated the market in 2024, backed by the rapid growth of cold chain logistics and temperature-sensitive goods such as food and pharmaceuticals. Insulation plays a vital role in maintaining low temperatures during storage and transportation, reducing energy losses and improving operational efficiency.

The oil and gas segment is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding LNG projects and increasing investments in cryogenic infrastructure. The segment’s need for reliable, high-performance insulation materials to handle extremely low temperatures is a critical driver of demand in this application.

Cold Insulation Market Regional Analysis

- Asia-Pacific dominated the cold insulation market with the largest revenue share of 38.26% in 2024, driven by rapid industrialization, expansion of the oil and gas sector, and increasing demand for energy-efficient insulation systems across emerging economies

- Countries in the region, such as China, India, and South Korea, are investing significantly in infrastructure and chemical processing facilities that require cold insulation to prevent energy losses and maintain low-temperature operations

- The market growth is also supported by rising awareness regarding greenhouse gas reduction and government mandates to improve thermal efficiency in industrial and commercial settings

China Cold Insulation Market Insight

The China cold insulation market accounted for the highest revenue share in Asia-Pacific in 2024, driven by a robust manufacturing base, increasing LNG infrastructure development, and stringent energy-efficiency norms. The rising deployment of HVAC systems in residential and commercial buildings, coupled with strong investment in petrochemical and refrigeration sectors, continues to fuel market expansion. The availability of cost-effective insulation materials and presence of key manufacturers further bolster China’s leading position in the region.

Japan Cold Insulation Market Insight

The Japan cold insulation market is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in energy-efficient technologies and increasing demand from the chemical and refrigeration industries. Japan's strong emphasis on environmental sustainability and energy conservation is encouraging the adoption of cold insulation in both new infrastructure and retrofitting projects. The country’s well-established electronics and pharmaceutical sectors require precise temperature control, further supporting the demand for reliable cold insulation systems. In addition, Japan’s expanding LNG infrastructure and focus on reducing carbon emissions contribute significantly to market expansion.

North America Cold Insulation Market Insight

The North America cold insulation market is expected to witness the fastest growth rate from 2025 to 2032, driven by a mature refrigeration industry, strong presence of oil and gas infrastructure, and growing demand for sustainable cold chain logistics. The region emphasizes energy efficiency and emission control, prompting industries to upgrade their insulation systems. In addition, the surge in frozen food consumption and vaccine storage facilities has led to increased cold storage infrastructure, further stimulating market growth.

U.S. Cold Insulation Market Insight

The U.S. cold insulation market is expected to witness the fastest growth rate from 2025 to 2032, propelled by technological advancements in insulation materials, high adoption of LNG storage systems, and strict regulatory frameworks promoting energy conservation. The growing need to retrofit older buildings with efficient insulation, along with rising demand in the food processing and chemicals industries, has accelerated the market’s expansion. Major players in the U.S. are also investing in R&D to develop lightweight and eco-friendly insulation solutions.

Europe Cold Insulation Market Insight

The Europe cold insulation market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong environmental regulations, rapid urbanization, and a growing push toward decarbonization. Government initiatives to reduce carbon emissions and enhance energy performance across industrial processes are spurring the adoption of advanced cold insulation solutions. Countries such as Germany, France, and Italy are focusing on LNG imports and energy storage systems, creating ample opportunities in the market.

Germany Cold Insulation Market Insight

The Germany cold insulation market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's commitment to industrial sustainability and energy transition. The need for efficient temperature management in chemical production, pharmaceuticals, and refrigeration logistics has driven demand for high-performance cold insulation materials. In addition, Germany’s extensive district cooling networks and focus on green building practices are reinforcing the adoption of advanced insulation technologies across various sectors.

U.K. Cold Insulation Market Insight

The U.K. cold insulation market is expected to witness the fastest growth rate from 2025 to 2032, supported by government initiatives focused on reducing energy consumption and enhancing industrial efficiency. The increasing demand for temperature-sensitive goods such as pharmaceuticals and frozen food products is boosting the development of cold storage and logistics infrastructure. Furthermore, the U.K.'s transition toward cleaner energy sources, including LNG and hydrogen, is generating new opportunities for cold insulation applications in storage and distribution facilities.

Cold Insulation Market Share

The Cold Insulation industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Owens Corning (U.S.)

- ROCKWOOL A/S (Denmark)

- SAINT-GOBAIN (France)

- Huntsman International LLC (U.S.)

- Armacell (Luxembourg)

- Dow (U.S.)

- Morgan Advanced Materials (U.K.)

- Evonik Industries AG (Germany)

- Knauf Insulation (U.S.)

- Kingspan Group (Ireland)

- Recticel (Belgium)

- Aspen Aerogels, Inc. (U.S.)

- Johns Manville (U.S.)

- Beijing New Building Material (Group) Co., Ltd. (Japan)

- Atlas Roofing Corporation (U.S.)

Latest Developments in Global Cold Insulation Market

- In July 2022, Dow and the Al-Hejailan Group signed a Memorandum of Understanding (MoU) to create a joint venture for building and operating a methyl diethanolamine (MDEA) plant in Saudi Arabia’s PlasChem Park. This collaboration aims to meet increasing demand for natural gas purification across Saudi Arabia and the broader Middle East, enhancing local production capabilities while aligning with regional energy requirements

- In 2022, Tiger India Private Limited expanded its product portfolio in India by launching four vacuum-insulated bottle models. These bottles maintain the coolness of carbonated drinks for extended periods, tapping into the growing demand for portable, temperature-retaining drinkware in the Indian market

- In November 2021, Frank and Oak, a Canadian sustainable clothing company, launched its Alpine parka as part of its men’s fall/winter collection. Made from organic and recycled materials, including PrimaLoft insulation, the parka is designed for functionality and warmth. It features a recycled sherpa-lined hood, ribbed storm cuffs, and breathable fabric, providing warmth in temperatures as low as -25°C while maintaining environmental responsibility

- In October 2021, Eco Depot Inc.’s subsidiary, Bronya Canada Group, received the required R-Value certification for its Bronya Climate Shield Façade product range. This insulation rating reflects the product's ability to enhance energy efficiency by preventing heat transfer, boosting climate control. The R 20-Value rating will aid the brand in expanding its presence in the cold insulation market by promoting energy savings and reducing carbon emissions

- In 2021, Wynnchurch Capital, L.P., acquired Insulation Corporation of America, a manufacturer of polystyrene foam products used in packaging, building insulation, and cold chain applications. The acquisition strengthens Wynnchurch’s platform by expanding its reach into new markets, enhancing capabilities in the cold insulation market, and offering energy-efficient solutions to meet growing demands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cold Insulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cold Insulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cold Insulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.