Global Cold Sore Treatment For Hsv 1 Virus Market

Market Size in USD Million

CAGR :

%

USD

988.49 Million

USD

1,648.27 Million

2024

2032

USD

988.49 Million

USD

1,648.27 Million

2024

2032

| 2025 –2032 | |

| USD 988.49 Million | |

| USD 1,648.27 Million | |

|

|

|

|

Cold Sore Treatment (for HSV 1 Virus) Market Size

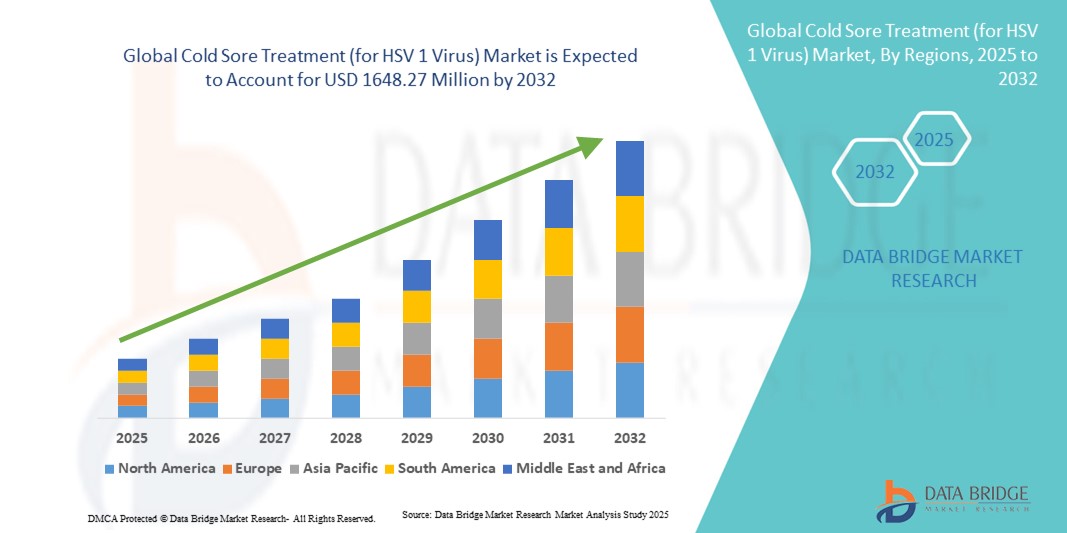

- The global cold sore treatment (for HSV 1 virus) market size was valued at USD 988.49 million in 2024 and is expected to reach USD 1648.27 million by 2032, at a CAGR of 6.6% during the forecast period

- The market growth is largely fueled by the rising prevalence of HSV-1 infections globally, coupled with increasing awareness among consumers regarding early treatment and preventive care

- Furthermore, growing adoption of over-the-counter (OTC) and prescription antiviral therapies, combined with innovations in topical creams, cold sore patches, and combination formulations, is driving market expansion. These converging factors are accelerating the uptake of cold sore treatments, thereby significantly boosting the industry's growth

Cold Sore Treatment (for HSV 1 Virus) Market Analysis

- Cold sore treatments include topical antivirals, oral medications, combination therapies, and cold sore patches designed to reduce lesion duration, prevent recurrence, and alleviate symptoms. These treatments are available in both OTC and prescription formats, catering to a wide range of patient needs across home healthcare and clinical settings

- The escalating demand for cold sore treatments is primarily fueled by increasing health awareness, higher disposable incomes, expanding healthcare infrastructure, and a growing preference for convenient, fast-acting, and effective therapeutic solutions for recurrent herpes labialis

- North America dominated the cold sore treatment (for HSV 1 virus) market with a share of 32.85% due to high prevalence of HSV-1 infections and increasing awareness of early intervention and effective treatment options

- Asia-Pacific is expected to be the fastest growing region in the cold sore treatment (for HSV 1 virus) market during the forecast period due to urbanization, increasing disposable incomes, and growing awareness of HSV-1 management in countries such as China, Japan, and India

- Herpes simplex type 1 virus segment dominated the market with a market share of 60.5% due to its high prevalence as the primary cause of oral cold sores and frequent recurrence. Strong awareness of early treatment, availability of effective topical and oral therapies, and adult consumers prioritizing quick relief and prevention support its market dominance. Widespread access to both OTC and prescription products further reinforces adoption

Report Scope and Cold Sore Treatment (for HSV 1 Virus) Market Segmentation

|

Attributes |

Cold Sore Treatment (for HSV 1 Virus) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cold Sore Treatment (for HSV 1 Virus) Market Trends

Growing Prevalence of Cold Sore Infection

- The global cold sore treatment market is expanding due to the increasing prevalence of HSV-1 infections. Millions of people worldwide are affected, driving consistent demand for over-the-counter (OTC) antiviral creams, ointments, and oral treatment solutions

- For instance, GlaxoSmithKline’s Zovirax remains a leading brand in the cold sore segment, offering topical antiviral cream that provides symptom relief and quicker healing. The brand continues to strengthen its position through wide retail visibility and accessibility

- Growing focus on OTC treatments is supporting market growth. Consumers prefer fast-acting topical options available in pharmacies and supermarkets, making affordability and convenience key factors shaping treatment adoption in both developed and emerging regions

- In addition, natural remedy trends are influencing product diversification. Companies are formulating herbal cold sore treatments with plant-based extracts such as lemon balm and tea tree oil, targeting wellness-focused consumers seeking alternative treatment approaches

- E-commerce and digital pharmacies are reinforcing accessibility. Online platforms are boosting product reach, enabling consumers to discreetly purchase cold sore treatment products and compare multiple brands, fueling higher competition in this therapeutic category

- Pharmaceutical research in novel drug delivery systems is advancing treatment efficacy. Liposomal formulations, patches, and nanoparticle-based delivery methods improve absorption and extend antiviral effectiveness, strengthening the clinical potential of future cold sore treatment formulations

Cold Sore Treatment (for HSV 1 Virus) Market Dynamics

Driver

Growing Awareness about Cold Sore Symptoms and Treatment Options

- Rising awareness through public health campaigns is reinforcing demand for cold sore treatment. Education about early symptom recognition is driving proactive purchases, as consumers seek faster recovery and reduced virus transmission risks within households

- For instance, Pfizer has marketed awareness campaigns about cold sore management alongside its product portfolio. This dual strategy focuses on both symptom education and treatment accessibility, strengthening brand image while actively promoting public responsibility

- Increasing consumer knowledge about HSV-1 transmission pathways encourages proactive adoption of treatment. Awareness that earlier intervention leads to shorter outbreak cycles is making consumers turn to topical antivirals and oral formulations more readily

- In addition, celebrity endorsements and health influencer promotions are reducing stigma surrounding cold sore discussions. This visibility supports greater acceptance and willingness among consumers to purchase treatment options during recurrent outbreaks

- Supportive digital platforms such as mobile health apps and telemedicine services are reinforcing consumer awareness. By providing direct consultations and faster treatment options, these services further improve adoption rates across multiple regional markets

Restraint/Challenge

Increasing Complexity of Vaccine Development

- The absence of an effective HSV-1 vaccine remains a major challenge for permanent cold sore solutions. Developing vaccines against herpes viruses is extremely complex due to their ability to remain dormant and evade immune responses

- For instance, Genocea Biosciences terminated its promising HSV vaccine research due to clinical limitations and inconsistent immune responses. Such setbacks demonstrate the scientific challenges involved in developing reliable prophylactic solutions for HSV-1 infections

- High failure rates in clinical trial phases make vaccine development costly and uncertain. Continuous trial delays discourage investment, limiting breakthroughs in long-term preventive therapies for cold sore and herpes simplex virus management globally

- In addition, viral mutation complexity increases difficulty in developing broad-spectrum vaccines. This complication demands high levels of funding and advanced technology, which remain unavailable to many mid-sized biotech firms pursuing HSV-1 therapies

- While supportive OTC and prescription drugs remain reliable, reliance on symptomatic treatment constrains permanent solutions. The lack of vaccines prolongs consumer dependence on temporary remedies, maintaining a cycle of recurring demand but not eradication

Cold Sore Treatment (for HSV 1 Virus) Market Scope

The market is segmented on the basis of treatment type, route of administration, mode of purchase, strain type, drug type, population type, gender, end user, and distribution channel.

- By Treatment Type

On the basis of treatment type, the cold sore treatment market is segmented into medications, applied products, cold sore patches, and others (non-medicated products). The medications segment dominated the largest market revenue share in 2024, driven by its proven clinical efficacy in suppressing viral replication and speeding up lesion healing. Antiviral medications, including acyclovir, valacyclovir, and famciclovir, are widely recommended by healthcare professionals for both initial and recurrent outbreaks. Patients favor medications for their consistent results, ease of use, and ability to reduce pain, itching, and swelling associated with cold sores. The strong adoption of medications is further supported by their compatibility with both adult and pediatric populations, as well as widespread availability through prescription and OTC channels. The established trust in pharmaceutical brands and ongoing awareness campaigns emphasizing early intervention strengthen this segment’s dominance.

The cold sore patches segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer preference for discreet and convenient treatment options. These patches offer protection from external irritants, reduce the risk of virus spread, and provide moisturizing benefits that enhance comfort and healing. Innovations in hydrocolloid, transparent, and medicated patch technologies are further driving adoption, particularly among young professionals and frequent travelers. Patches are also favored for their aesthetic advantages, allowing users to continue daily activities without visible lesions interfering. The growth is accelerated by a rising trend of at-home self-care and preventive treatment approaches, as consumers increasingly prioritize convenience alongside therapeutic efficacy.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, topical, and others. The topical segment dominated the largest market revenue share in 2024, as it allows direct application to affected areas, providing fast relief from pain, itching, and discomfort. Topical antivirals and soothing creams are easy to use and minimize systemic exposure, making them suitable for first-time or mild outbreaks. Formulations often include moisturizers, cooling agents, and protective barriers that enhance the overall healing experience. Consumer preference for self-managed care, combined with the wide availability of OTC topical products, contributes to its strong market position. Topical administration is particularly popular among adults and geriatrics seeking immediate, localized symptom management.

The oral segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its systemic efficacy for severe or recurrent cold sore cases. Oral antiviral drugs penetrate the bloodstream, offering faster viral suppression and reducing the likelihood of outbreaks. This route is preferred for patients with frequent episodes or lesions that are difficult to manage topically. Increased physician prescriptions, insurance coverage for oral antivirals, and heightened awareness of preventive treatment benefits are fueling adoption. Oral administration is particularly gaining traction in professional and adult populations, where convenience and effectiveness are critical for managing recurring cold sores.

- By Mode of Purchase

On the basis of mode of purchase, the market is segmented into over-the-counter (OTC) and prescription drugs. The OTC segment dominated the largest market revenue share in 2024, due to the convenience of easy access and rising trends in self-medication. Consumers often prefer OTC creams, gels, and patches for immediate symptom relief without consulting a physician. Marketing campaigns, strong retail presence, and educational initiatives highlighting OTC options enhance consumer confidence and adoption. OTC products also allow individuals to proactively manage outbreaks, contributing to their continued dominance. The segment benefits from widespread availability in pharmacies, supermarkets, and e-commerce platforms, catering to diverse demographics.

The prescription drug segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for potent antiviral therapies in severe or recurrent cases. Prescription medications offer higher efficacy, longer-lasting protection, and reduced viral shedding, which are particularly important for adults and immunocompromised individuals. Growing awareness about proper medical guidance, coupled with improved access to healthcare providers, supports the adoption of prescription treatments. Increasing patient preference for clinically supervised management ensures rapid segment growth. In addition, healthcare programs promoting antiviral prescriptions for recurrent cold sores are accelerating adoption across both developed and emerging markets.

- By Strain Type

On the basis of strain type, the market is segmented into herpes simplex type 1 virus (HSV-1) and herpes simplex type 2 virus (HSV-2). The HSV-1 segment dominated the largest market revenue share of 60.5% in 2024, driven by its high prevalence as the primary cause of oral cold sores and frequent recurrence. Strong awareness of early treatment, availability of effective topical and oral therapies, and adult consumers prioritizing quick relief and prevention support its market dominance. Widespread access to both OTC and prescription products further reinforces adoption.

The HSV-2 segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing oral-genital transmission awareness and the rising prevalence of HSV-2 infections. Improved diagnostics and screening programs allow early identification, encouraging timely treatment. Pharmaceutical innovation targeting HSV-2 specifically, coupled with heightened patient education, drives adoption. The segment is further supported by preventive counseling and patient initiatives promoting antiviral therapy. Rising global prevalence and growing public understanding of HSV-2 transmission risks accelerate segment growth.

- By Drug Type

On the basis of drug type, the market is segmented into generic and branded drugs. The branded segment dominated the largest market revenue share in 2024, owing to strong consumer trust, extensive marketing, and consistent clinical performance. Branded drugs are perceived as more reliable, with rigorous quality control, established efficacy, and supportive professional endorsements. Consumers often prefer branded options due to familiarity, proven therapeutic outcomes, and long-standing brand reputation. Healthcare providers also recommend branded antivirals to ensure patient compliance and minimize complications. The segment benefits from global pharmaceutical company support, strategic partnerships, and targeted awareness campaigns that reinforce its dominance.

The generic segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by cost-conscious consumers and increasing healthcare affordability initiatives. Generic antivirals offer similar efficacy to branded counterparts at lower prices, making them attractive in both developed and emerging markets. Rising healthcare expenditures and government promotion of generics further accelerate adoption. Expanding manufacturing capabilities, coupled with regulatory approvals facilitating generic entry, support rapid market penetration. Increasing patient confidence in generics and wider availability across pharmacies and e-commerce platforms further drive segment growth.

- By Population Type

On the basis of population type, the market is segmented into adults, pediatrics, and geriatrics. The adults segment dominated the largest market revenue share in 2024, due to high prevalence of HSV-1 infections and lifestyle factors such as stress, sun exposure, and immunity fluctuations. Adults are proactive in seeking treatment for social, cosmetic, and comfort reasons, driving strong adoption of both OTC and prescription products. Awareness campaigns, easy availability of topical creams and oral antivirals, and workplace-related needs further contribute to dominance. The segment encompasses a wide age range, ensuring consistent demand across young and middle-aged adults. Pharmaceutical R&D also prioritizes adult-focused formulations to enhance compliance and therapeutic efficacy.

The pediatrics segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing parental awareness regarding early management of cold sores. Pediatric-friendly formulations, including flavored topicals and safe patches, facilitate adoption. Healthcare providers emphasize prevention and safe treatment, which encourages early intervention. Rising incidence of HSV-1 among children, combined with educational initiatives for caregivers, supports rapid growth. Availability of gentle, non-irritating formulations suitable for delicate skin enhances segment acceptance. In addition, growing e-commerce penetration makes pediatric products easily accessible to parents globally.

- By Gender

On the basis of gender, the market is segmented into female and male. The female segment dominated the largest market revenue share in 2024, due to higher treatment-seeking behavior and proactive health management practices. Women tend to prioritize early intervention for visible cold sores and are more likely to purchase OTC and branded products. Marketing campaigns and awareness programs often target female consumers, emphasizing aesthetics, comfort, and social confidence. Healthcare providers also report higher consultation rates among females, further boosting adoption. Availability of products tailored to female preferences, such as discreet patches and moisturizing topicals, reinforces the segment’s dominance.

The male segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness campaigns, evolving self-care trends, and lifestyle-related triggers such as stress and sun exposure. Men are becoming more proactive in seeking treatment for both symptomatic relief and preventive management. Growth is further supported by new product formats, convenient administration options, and online accessibility. Rising acceptance of OTC and topical treatments among men, coupled with targeted marketing efforts, accelerates adoption. Educational initiatives emphasizing male susceptibility to HSV-1 outbreaks also contribute to segment growth.

- By End User

On the basis of end user, the market is segmented into home healthcare, hospitals, specialty clinics, and others. The home healthcare segment dominated the largest market revenue share in 2024, driven by the convenience and privacy of self-administered treatments. Consumers prefer managing cold sores at home using topical creams, gels, and patches to reduce discomfort without visiting healthcare facilities. OTC availability, online resources, and instructional guides further support home-based treatment. Adults and geriatrics form the primary user base due to ease of use and accessibility. Growth is also supported by increasing trust in self-care products and digital health platforms offering guidance on cold sore management.

The specialty clinics segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising visits to dermatologists and infectious disease specialists for severe or recurrent cold sores. Clinics offer access to prescription antivirals, advanced patch therapies, and professional counseling. Patients seek targeted treatment, early intervention, and follow-up care, boosting adoption. Expansion of specialized healthcare services and increasing awareness about clinical management of HSV-1 infections accelerate growth. Rising healthcare expenditure and insurance coverage for clinic-based care further support this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and others. The retail sales segment dominated the largest market revenue share in 2024, due to the widespread availability of cold sore treatments in pharmacies, supermarkets, and e-commerce platforms. Retail channels provide convenience, brand variety, and immediate access to consumers. OTC creams, gels, and patches are highly accessible through retail channels, making them a preferred choice for adults managing recurrent outbreaks. Awareness campaigns and promotional activities further strengthen retail penetration.

The direct tenders segment is expected to witness the fastest growth rate from 2025 to 2032, driven by bulk procurement by hospitals, specialty clinics, and institutional buyers. Government and private tenders for antiviral medications, along with institutional contracts, ensure consistent demand. Strategic collaborations between manufacturers and healthcare providers, coupled with regulatory support, accelerate segment adoption. The channel is particularly attractive for large-scale distribution of prescription antivirals and branded treatments. Rising institutional awareness of HSV-1 prevalence and treatment efficacy further propels growth.

Cold Sore Treatment (for HSV 1 Virus) Market Regional Analysis

- North America dominated the cold sore treatment (for HSV 1 virus) market with the largest revenue share of 32.85% in 2024, driven by high prevalence of HSV-1 infections and increasing awareness of early intervention and effective treatment options

- Consumers in the region prefer convenient, clinically validated OTC and prescription treatments, including topical creams, oral antivirals, and cold sore patches

- The widespread adoption is supported by strong healthcare infrastructure, high disposable incomes, and growing consumer focus on preventive healthcare, establishing North America as a leading market for cold sore therapies

U.S. Cold Sore Treatment (for HSV-1 Virus) Market Insight

The U.S. market captured the largest revenue share of around 80% within North America in 2024, fueled by rising HSV-1 incidence and increased consumer focus on self-care and preventive treatments. Extensive availability of OTC and prescription medications, along with physician recommendations for early antiviral therapy, drives adoption. Consumers are seeking reliable, fast-acting, and easy-to-use treatments. The expansion of e-commerce and retail pharmacy networks further supports market growth.

Europe Cold Sore Treatment (for HSV-1 Virus) Market Insight

Europe Cold Sore Treatment (for HSV-1 Virus) Market is projected to expand at a substantial CAGR during the forecast period, driven by high HSV-1 prevalence, growing healthcare awareness, and adoption of both OTC and prescription therapies. Urbanization and rising healthcare expenditure encourage adoption across home, clinical, and hospital settings. Consumers are drawn to effective, easy-to-use, and preventive treatment options. Growth spans adult, pediatric, and geriatric populations, with products incorporated into both home care and clinical treatment plans.

U.K. Cold Sore Treatment (for HSV-1 Virus) Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness regarding HSV-1 management and early intervention. Concerns over frequent outbreaks and social discomfort are encouraging both consumers and healthcare providers to adopt OTC and prescription antiviral products. The U.K.’s advanced healthcare infrastructure and robust retail and online pharmacy network continue to stimulate market growth. Rising acceptance of cold sore patches and topical formulations for home-based care further supports expansion.

Germany Cold Sore Treatment (for HSV-1 Virus) Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of HSV-1 prevalence, clinical treatment options, and preventive measures. Germany’s strong healthcare system, patient education programs, and widespread availability of OTC and prescription antivirals support market growth. Consumers prefer innovative, safe, and effective products, particularly topical creams and cold sore patches. Adoption is rising in home healthcare and clinical settings, driven by an emphasis on timely treatment and improved outcomes.

Asia-Pacific Cold Sore Treatment (for HSV-1 Virus) Market Insight

Asia-Pacific Cold Sore Treatment (for HSV-1 Virus) Market is poised to grow at the fastest CAGR during 2025–2032, driven by urbanization, increasing disposable incomes, and growing awareness of HSV-1 management in countries such as China, Japan, and India. Expanding healthcare infrastructure and rising penetration of OTC and prescription antivirals are driving adoption. Government initiatives promoting preventive healthcare and self-care products further support growth.

Japan Cold Sore Treatment (for HSV-1 Virus) Market Insight

The Japan market is gaining momentum due to high health awareness, urbanization, and demand for convenient home-based therapies. The population emphasizes early treatment and preventive care, with rising preference for topical creams and cold sore patches. Integration of health monitoring and mobile apps encourages timely intervention. Japan’s aging population is likely to spur demand for safe and easy-to-use antiviral solutions across residential and clinical sectors.

China Cold Sore Treatment (for HSV-1 Virus) Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to high HSV-1 prevalence, rising healthcare awareness, and urban population growth. Increasing middle-class adoption of OTC and prescription antivirals drives growth. Government health campaigns promoting early intervention and availability of affordable treatments support adoption. Strong domestic manufacturers and expanding e-commerce and retail channels are key factors propelling the market in China.

Cold Sore Treatment (for HSV 1 Virus) Market Share

The cold sore treatment (for HSV 1 virus) industry is primarily led by well-established companies, including:

- Fresenius SE & Co. KGaA (Germany)

- Zydus Pharmaceuticals, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novartis AG (Switzerland)

- Sun Pharmaceutical Industries Ltd. (India)

- Quantum Health (U.S.)

- GSK plc. (U.K.)

- Haleon Group of Companies (U.K.)

- Church & Dwight Co., Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Viatris Inc. (U.S.)

- Carma Labs Inc. (U.S.)

- URGO MEDICAL (France)

- Apotex Inc. (Canada)

- Amneal Pharmaceuticals LLC (U.S.)

- Blistex Inc. (U.S.)

- FOCUS CONSUMER HEALTHCARE (U.S.)

- Hetero Healthcare Limited (India)

- Amparo Medical Technologies (U.S.)

- Devirex AG (Switzerland)

Latest Developments in Global Cold Sore Treatment (for HSV 1 Virus) Market

- In July 2021, Devirex launched Lipivir, a lip gel designed to prevent cold sores. Initially available in pharmacies, drugstores, beauty spas, and online platforms across Switzerland and Austria, this product marked a significant transition from laboratory development to market distribution. The introduction of Lipivir provided consumers with a preventive option, expanding the range of available treatments and potentially reducing the frequency of outbreaks

- In January 2021, Mylan launched a new formulation of Acyclovir in combination with a corticosteroid, aimed at reducing inflammation associated with cold sores. This combination therapy provided a dual-action approach, addressing both the viral infection and the inflammatory response, potentially leading to faster healing times and improved patient outcomes

- In November 2020, Amneal Pharmaceuticals received FDA approval for its Abbreviated New Drug Application (ANDA) for Acyclovir Cream, 5%, a generic version of Zovirax. This approval allowed Amneal to offer a cost-effective alternative for the treatment of recurrent herpes labialis in immunocompetent adults and adolescents. The entry of this generic product into the market increased accessibility to effective treatments, potentially leading to a rise in market penetration and competition

- In August 2020, GSK completed the acquisition of Affinivax, Inc., a clinical-stage biopharmaceutical company. While Affinivax specializes in developing next-generation pneumococcal vaccines, this acquisition reflects GSK's commitment to expanding its portfolio in infectious disease management. The strategic move could lead to enhanced research and development capabilities, indirectly benefiting the cold sore treatment market through potential innovations in antiviral therapies

- In June 2020, Pfizer announced the development of a new topical antiviral agent targeting HSV-1. Early-stage clinical trials showed promising results in reducing lesion duration and viral shedding. If successful, this new treatment could offer an alternative for patients seeking effective and convenient options, thereby influencing market dynamics and consumer preferences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.