Global Cold Storage Warehouses Market

Market Size in USD Billion

CAGR :

%

USD

163.82 Billion

USD

420.94 Billion

2025

2033

USD

163.82 Billion

USD

420.94 Billion

2025

2033

| 2026 –2033 | |

| USD 163.82 Billion | |

| USD 420.94 Billion | |

|

|

|

|

Storage Warehouses Market Size

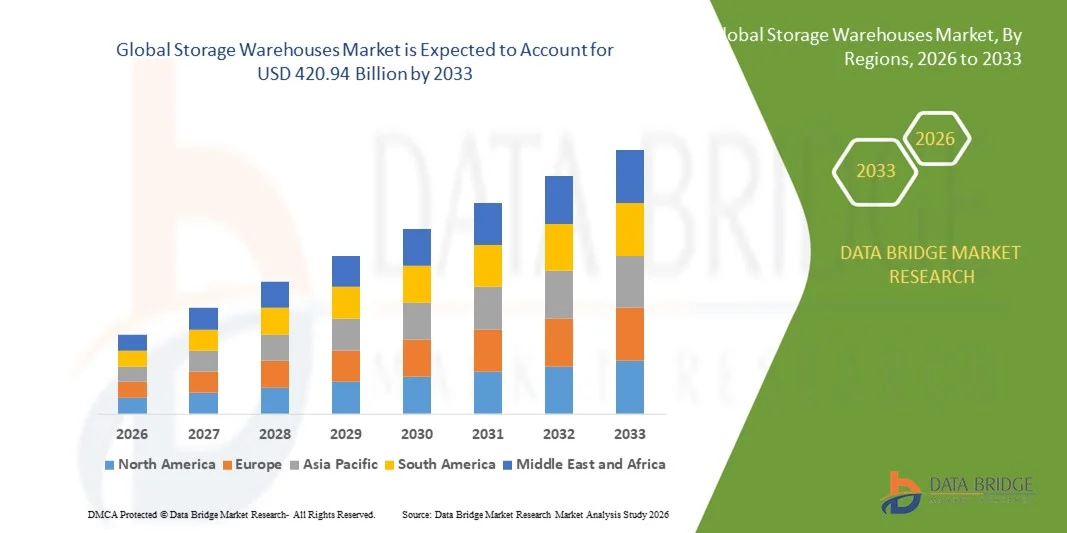

- The global storage warehouses market size was valued at USD 163.82 billion in 2025 and is expected to reach USD 420.94 billion by 2033, at a CAGR of 12.52% during the forecast period

- The market growth is largely fuelled by the rapid expansion of e-commerce, increasing demand for organized logistics, and rising need for efficient inventory management solutions

- Growing adoption of automated storage and retrieval systems (AS/RS) and smart warehouse technologies is enhancing operational efficiency and reducing labor costs, supporting market growth

Storage Warehouses Market Analysis

- The market is witnessing a shift toward technology-driven solutions, including warehouse management systems (WMS), robotics, and IoT integration, to optimize storage, improve accuracy, and enhance real-time tracking of inventory

- Increasing investment by logistics service providers and retailers in modern warehousing infrastructure is promoting market growth, while trends such as omni-channel retailing and same-day delivery are driving the demand for strategically located warehouses

- North America dominated the storage warehouses market with the largest revenue share in 2025, driven by rapid growth in e-commerce, increased demand for cold chain logistics, and advanced supply chain infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global storage warehouses market, driven by expanding manufacturing hubs, growing retail and food processing industries, and government initiatives supporting logistics and cold chain infrastructure development

- The private and semi-private segment held the largest market revenue share in 2025, driven by the growing preference of companies to control inventory, reduce lead times, and maintain operational flexibility. Private warehouses also allow for tailored automation and security systems, making them a favored choice for e-commerce, retail, and industrial operators

Report Scope and Storage Warehouses Market Segmentation

|

Attributes |

Storage Warehouses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Storage Warehouses Market Trends

Rise of Automated And Smart Warehousing Solutions

- The growing adoption of automated and smart storage warehouses is transforming the logistics and supply chain landscape by enabling real-time inventory management and operational efficiency. Advanced warehouse management systems (WMS), robotics, and IoT-enabled equipment allow operators to optimize storage space, reduce errors, and improve order fulfillment speed, resulting in enhanced productivity and reduced operational costs. These technologies also support predictive analytics for inventory demand, enabling better resource allocation and minimizing waste

- Increasing demand for cold storage, temperature-controlled, and high-value goods storage is accelerating the deployment of specialized warehouses. These facilities are particularly beneficial for perishable goods, pharmaceuticals, and e-commerce products, ensuring product quality, compliance, and timely delivery. Moreover, automated temperature monitoring and climate control systems reduce spoilage risks and maintain product integrity across the supply chain

- The integration of smart technologies with storage infrastructure enables predictive maintenance, energy optimization, and real-time monitoring. Operators benefit from lower downtime, improved safety, and scalable solutions that can accommodate fluctuating demand patterns across different sectors. In addition, IoT sensors and AI-driven analytics help forecast equipment failures and optimize energy consumption, reducing operational costs further

- For instance, in 2023, several logistics providers in North America reported significant improvements in operational efficiency and reduced stock losses after implementing automated storage retrieval systems (ASRS) and IoT-based monitoring in their warehouses. These systems enabled faster processing of inbound and outbound shipments, enhanced inventory visibility, and improved labor utilization

- While smart and automated warehouses are enhancing operational efficiency and scalability, their effectiveness depends on technology adoption, workforce training, and investment in infrastructure. Companies must focus on customized and cost-effective solutions to fully capitalize on market growth. Successful implementation also relies on seamless integration with existing supply chain systems and ongoing maintenance support to sustain performance improvements

Storage Warehouses Market Dynamics

Driver

Rising Demand For E-Commerce And Efficient Supply Chain Solutions

- The exponential growth of e-commerce and omnichannel retailing is driving the demand for modern storage warehouses. Faster delivery expectations, seasonal demand spikes, and high SKU variety are pushing companies to invest in automated and strategically located facilities. Retailers are leveraging smart warehouses to meet same-day delivery commitments while maintaining accurate inventory levels

- Businesses are increasingly prioritizing warehouse efficiency to reduce logistics costs and improve customer satisfaction. Advanced solutions, such as real-time inventory tracking, robotics, and AI-enabled warehouse management systems, are enabling faster and more accurate order processing. These technologies also help optimize labor deployment and reduce human error, increasing overall operational reliability

- The rise in cold chain and temperature-sensitive product demand is also fueling the market. Food, pharmaceutical, and healthcare sectors require specialized storage solutions, prompting investments in climate-controlled and automated warehouse infrastructure. Furthermore, compliance with regulatory standards for storage and transportation is pushing companies to adopt technologically advanced monitoring systems

- For instance, in 2022, several major retailers in Europe integrated robotics and AI-based WMS in their regional warehouses, resulting in faster order fulfillment and reduced labor dependency. The adoption of automated sorting, picking, and packaging systems allowed these warehouses to process larger volumes with minimal delays and fewer errors

- While e-commerce growth and technological adoption are propelling market expansion, companies must continually upgrade infrastructure, adopt innovative solutions, and ensure workforce readiness to maintain operational efficiency. Organizations are increasingly focusing on scalable, modular warehouse designs that can quickly adapt to changing market demands and seasonal fluctuations

Restraint/Challenge

High Capital Investment And Operational Complexity

- The high initial cost of establishing advanced automated or climate-controlled warehouses, including robotics, sensors, and warehouse management systems, limits adoption among small and medium-sized operators. Capital-intensive projects often require long-term ROI planning and may be prohibitive for businesses with limited access to financing

- In remote locations, lack of skilled personnel and technical expertise can affect the optimal use of automated warehouse systems. Workforce training and maintenance capabilities are critical for sustained efficiency and minimal downtime. Without sufficient expertise, companies risk underutilization of advanced technologies and increased operational errors

- Supply chain constraints, including availability of specialized equipment, software integration, and maintenance support, can hinder timely implementation and operational performance. Delays in procurement, component shortages, or software incompatibilities may disrupt warehouse operations and reduce the benefits of automation investments

- For instance, in 2023, several warehouse projects in Southeast Asia experienced delays due to equipment shortages and integration issues, affecting inventory management and delivery schedules. These setbacks highlighted the need for robust supply chain planning and contingency measures when deploying new technologies

- While technology and automation enhance warehouse operations, addressing cost, complexity, and skill gaps remains essential for long-term growth and wider adoption of storage warehouse solutions globally. Continuous training programs, investment in modular technologies, and strategic partnerships with equipment suppliers are crucial to overcoming these challenges and ensuring sustained market expansion

Storage Warehouses Market Scope

The market is segmented on the basis of warehouse type, construction type, temperature type, and end use.

- By Warehouse Type

On the basis of warehouse type, the storage warehouses market is segmented into private and semi-private, and public. The private and semi-private segment held the largest market revenue share in 2025, driven by the growing preference of companies to control inventory, reduce lead times, and maintain operational flexibility. Private warehouses also allow for tailored automation and security systems, making them a favored choice for e-commerce, retail, and industrial operators.

The public warehouse segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for shared and flexible storage solutions. Public warehouses are particularly attractive for small and medium-sized enterprises seeking cost-efficient storage, access to advanced infrastructure, and scalability without heavy capital investment.

- By Construction Type

On the basis of construction type, the market is segmented into bulk storage, production stores, and port warehouses. The bulk storage segment held the largest market revenue share in 2025, fueled by high demand for storing large volumes of goods, commodities, and raw materials efficiently. Bulk warehouses are designed for optimal space utilization, mechanized handling, and faster loading/unloading operations.

The port warehouse segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing global trade and logistics activities. These warehouses provide strategic storage near ports, reducing transit times, facilitating customs clearance, and enabling faster distribution of imported and exported goods.

- By Temperature Type

On the basis of temperature type, the market is segmented into chilled and frozen warehouses. The chilled segment held the largest market revenue share in 2025, owing to high demand for perishable products, fruits, vegetables, and dairy that require controlled low-temperature storage. Chilled warehouses also help maintain quality and extend the shelf life of sensitive goods.

The frozen warehouse segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising consumption of frozen foods, seafood, and meat products. Frozen warehouses offer advanced temperature management, ensuring product safety and compliance with stringent food safety standards.

- By End Use

On the basis of end use, the market is segmented into food, fruits and vegetables, dairy products, fish, meat and seafood, processed foods, textiles, and pharmaceuticals. The food segment held the largest market revenue share in 2025, driven by growing global demand for packaged, fresh, and processed foods requiring efficient storage solutions.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing pharmaceutical production, stringent storage regulations, and the need for temperature-controlled environments to maintain drug efficacy. Pharmaceutical warehouses often integrate advanced monitoring and automation systems to ensure compliance and reduce losses.

Storage Warehouses Market Regional Analysis

- North America dominated the storage warehouses market with the largest revenue share in 2025, driven by rapid growth in e-commerce, increased demand for cold chain logistics, and advanced supply chain infrastructure

- Businesses in the region highly value automated and smart warehouse solutions that enable real-time inventory management, operational efficiency, and faster order fulfillment

- This widespread adoption is further supported by robust logistics networks, high technological integration, and a growing preference for scalable storage solutions, establishing North America as a leader in modern warehousing

U.S. Storage Warehouses Market Insight

The U.S. storage warehouses market captured the largest revenue share in 2025 within North America, fueled by the expansion of e-commerce, omnichannel retailing, and demand for temperature-controlled storage. Companies are increasingly investing in automation, robotics, and warehouse management systems (WMS) to optimize operations, reduce labor costs, and improve delivery speed. Moreover, integration of IoT-enabled monitoring and predictive analytics is driving efficiency and reliability across warehouse operations.

Europe Storage Warehouses Market Insight

The Europe storage warehouses market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the need for modernized supply chains and specialized storage solutions such as cold chain facilities. Urbanization, growing retail demand, and government initiatives supporting logistics modernization are fostering warehouse automation. European operators are increasingly adopting robotics, AI, and advanced WMS to improve accuracy, reduce human errors, and enhance overall warehouse efficiency.

U.K. Storage Warehouses Market Insight

The U.K. storage warehouses market is expected to witness significant growth from 2026 to 2033, driven by the rise of e-commerce, rapid urban logistics expansion, and demand for temperature-sensitive storage. Companies are investing in automated retrieval systems, smart shelving, and climate-controlled storage to meet consumer expectations for faster delivery and higher product safety. The U.K.’s robust digital infrastructure and logistics network further support the adoption of advanced warehouse solutions.

Germany Storage Warehouses Market Insight

The Germany storage warehouses market is expected to witness substantial growth from 2026 to 2033, fueled by the country’s strong industrial base, technological advancement, and focus on supply chain optimization. Adoption of smart warehouses, automated inventory systems, and IoT-enabled monitoring is increasing, particularly in automotive, pharmaceutical, and food sectors. Germany’s emphasis on efficiency, sustainability, and innovation is promoting advanced warehousing practices to meet rising operational demands.

Asia-Pacific Storage Warehouses Market Insight

The Asia-Pacific storage warehouses market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing e-commerce penetration, urbanization, and rising demand for cold chain logistics in countries such as China, India, and Japan. The region’s expanding industrial and retail sectors are fueling investments in automated warehouses, smart inventory management, and temperature-controlled storage solutions. Moreover, as APAC emerges as a manufacturing and logistics hub, the affordability and accessibility of modern storage warehouses are increasing across the region.

Japan Storage Warehouses Market Insight

The Japan storage warehouses market is expected to witness robust growth from 2026 to 2033, supported by rapid urbanization, high e-commerce adoption, and a demand for efficient logistics solutions. Japanese operators are focusing on automation, robotics, and IoT-enabled systems to optimize warehouse capacity, reduce operational costs, and improve order accuracy. In addition, specialized storage for perishable goods and pharmaceuticals is driving investment in advanced temperature-controlled warehouse infrastructure.

China Storage Warehouses Market Insight

The China storage warehouses market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s booming e-commerce sector, rapid industrialization, and strong logistics infrastructure. Investments in automated warehouses, cold storage, and smart warehouse management systems are accelerating to support large-scale distribution. The push for supply chain modernization, along with affordable and scalable storage solutions, is enabling China to lead the APAC region in advanced warehousing capabilities.

Storage Warehouses Market Share

The -Storage Warehouses industry is primarily led by well-established companies, including:

Here’s the list of companies with their copyright and headquarters countries in the format you requested:

- LINEAGE LOGISTICS HOLDING, LLC (U.S.)

- AmeriCold Logistics LLC (U.S.)

- Barloworld Limited (South Africa)

- VersaCold Logistics Services (Canada)

- Agro Merchants Group (U.S.)

- Burris Logistics (U.S.)

- Wabash National Corporation (U.S.)

- A B Oxford Cold Storage Co. Pty Ltd (Australia)

- Coldman (U.S.)

- A.N. Deringer, Inc. (U.S.)

- Stellar (U.S.)

- United States Cold Storage (U.S.)

- DHL International GmbH (Germany)

- XPO Logistics, Inc. (U.S.)

- Crystal Logistic Cool Chain Ltd (U.K.)

- Kloosterboer (Netherlands)

- Tippmann Group / Interstate Warehousing (U.S.)

- GEODIS (France)

- NFI Industries (U.S.)

- Penske (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cold Storage Warehouses Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cold Storage Warehouses Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cold Storage Warehouses Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.