Global Collaboration Display Market

Market Size in USD Million

CAGR :

%

USD

910.00 Million

USD

1,593.01 Million

2024

2032

USD

910.00 Million

USD

1,593.01 Million

2024

2032

| 2025 –2032 | |

| USD 910.00 Million | |

| USD 1,593.01 Million | |

|

|

|

|

Collaboration Display Market Size

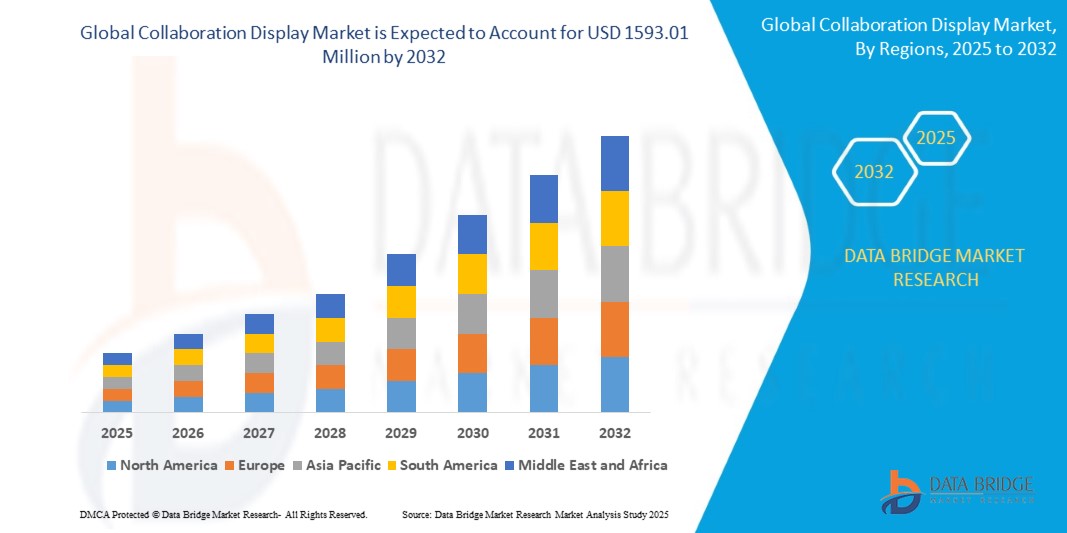

- The global collaboration display market size was valued at USD 910 million in 2024 and is expected to reach USD 1593.01 million by 2032, at a CAGR of 7.25% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital workplace solutions, hybrid work models, and interactive learning environments, leading to higher demand for collaboration displays across corporate, educational, and government sectors

- Furthermore, rising need for seamless communication, real-time collaboration, and integrated software solutions is driving organizations to invest in advanced displays that support video conferencing, cloud connectivity, and interactive content sharing. These factors are accelerating the uptake of collaboration display solutions, thereby significantly boosting the market’s expansion

Collaboration Display Market Analysis

- Collaboration displays are interactive devices that enable real-time communication, content sharing, and digital whiteboarding across offices, classrooms, and conference rooms. They integrate hardware and software solutions to support video conferencing, cloud collaboration, and multi-user engagement

- The escalating demand for collaboration displays is primarily fueled by the shift toward hybrid work and learning, increased digitalization of workplaces and educational institutions, and growing emphasis on productivity, engagement, and efficient team collaboration

- North America dominated the collaboration display market with a share of 34.5% in 2024, due to rapid adoption of digital workplace solutions and hybrid work models

- Asia-Pacific is expected to be the fastest growing region in the collaboration display market during the forecast period due to urbanization, rising digitalization in workplaces and classrooms, and increasing adoption of hybrid learning and remote collaboration solutions

- Hardware segment dominated the market with a market share of 63% in 2024, due to the growing adoption of interactive displays, touch panels, and integrated audio-visual components in modern workspaces. Organizations increasingly prefer hardware solutions that provide reliability, intuitive user experience, and compatibility with multiple conferencing platforms. Hardware-led displays also offer robust build quality and advanced features such as digital whiteboarding, multi-touch capabilities, and wireless screen sharing, making them the preferred choice for large enterprises and educational institutions. The segment benefits from technological innovations and rising corporate investments in upgrading meeting room infrastructure

Report Scope and Collaboration Display Market Segmentation

|

Attributes |

Collaboration Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Collaboration Display Market Trends

Increasing Adoption of Hybrid Work and Learning Solutions

- The collaboration display market is expanding rapidly as organizations increasingly adopt hybrid work and learning models that demand seamless digital engagement and real-time interactive communication across dispersed teams and classrooms. This shift drives investment in advanced display technologies integrated with cloud services and video conferencing capabilities

- For instance, Microsoft Surface Hub and Cisco Webex Boards have become critical tools for enterprises and educational institutions implementing hybrid environments. These products enable dynamic collaboration through touch interaction, multi-user access, and AI-enhanced meeting features, bolstering productivity and inclusivity

- Emerging features such as AI-powered automated content recognition, gesture control, and voice commands are improving user experience and operational efficiency. Vendors prioritize intuitive interfaces and integration with popular platforms including Zoom, Google Meet, and Microsoft Teams to enhance accessibility

- The growing emphasis on interactive digital whiteboards supports creativity and ideation, transforming traditional meeting formats. Educational sectors adopt these technologies for remote learning interactivity, while corporate environments benefit from improved decision-making processes anchored on visual collaboration

- Cloud-based collaboration tools are becoming standard, allowing real-time file sharing, multi-location conferences, and asynchronous teamwork, expanding the utility of collaboration displays. These cloud integrations enable seamless scalability, data security, and ease of deployment across organizational levels

- Enhanced hardware designs focusing on large-format, 4K resolution, and low-latency touch responsiveness cater to demands for realistic and engaging collaborative environments. Users experience improved visual clarity and responsiveness critical for complex workflows and immersive presentations

Collaboration Display Market Dynamics

Driver

Demand for Interactive, Cloud-Enabled Collaboration Tools

- There is accelerating demand for cloud-enabled interactive collaboration tools that facilitate seamless communication among remote and on-site participants. These solutions connect teams globally, enabling simultaneous brainstorming, content annotation, and document sharing through centralized interfaces

- For instance, Google Jamboard integrates real-time cloud-based whiteboarding with Google's productivity suite, driving adoption in education and enterprise markets. Such solutions highlight the critical need for scalable cloud ecosystems strengthening collaboration reliability and ease of access

- Enterprises seek enhanced interactivity to boost engagement during meetings, favoring displays with responsive touchscreens, multi-user capability, and software interoperability. These tools help overcome the limitations of traditional conference rooms by digitizing workflow and maximizing productivity

- Cloud adoption trends support increased remote workforce reliance and hybrid operational models. Organizations prioritize collaboration displays equipped with secure cloud storage, seamless video conferencing, and multi-platform compatibility to optimize distributed teamwork

- Continuous software innovations incorporating AI-powered meeting insights and automated transcription provide value-added features that enhance collaboration effectiveness. These advances reduce manual efforts, improve post-meeting follow-ups, and facilitate knowledge retention across teams

Restraint/Challenge

High Cost and Integration Complexity

- The high cost of advanced collaboration display systems creates a barrier for small and medium-sized enterprises to invest, slowing overall market penetration despite growing demand. Initial capital expenditures often include hardware, software licenses, and integration services

- For instance, cost concerns have limited adoption rates among startups and educational institutions with budget constraints, highlighting affordability as a key restraining factor. Integration complexity with legacy IT infrastructure further complicates deployment and ongoing maintenance requirements

- Seamless interoperability between collaboration displays and existing enterprise tools is necessary yet challenging, often requiring customized systems integration. Complex IT environments and diverse platform preferences lead to higher implementation costs and extended timelines

- Frequent technology updates and rapid innovation cycles increase the risk of equipment obsolescence, deterring potential buyers from committing long-term investments. Organizations worry about sunk costs and compatibility issues with emerging collaboration software and protocols

- Security concerns related to cloud data sharing and meeting content privacy act as additional challenges. Enterprises require robust encryption and compliance assurances, raising demands on vendors to deliver secure, certified collaboration solutions

Collaboration Display Market Scope

The market is segmented on the basis of offering, screen size, resolution, end user, and application.

• By Offering

On the basis of offering, the collaboration display market is segmented into hardware and software & services. The hardware segment dominated the largest market revenue share of 63% in 2024, driven by the growing adoption of interactive displays, touch panels, and integrated audio-visual components in modern workspaces. Organizations increasingly prefer hardware solutions that provide reliability, intuitive user experience, and compatibility with multiple conferencing platforms. Hardware-led displays also offer robust build quality and advanced features such as digital whiteboarding, multi-touch capabilities, and wireless screen sharing, making them the preferred choice for large enterprises and educational institutions. The segment benefits from technological innovations and rising corporate investments in upgrading meeting room infrastructure.

The software & services segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of cloud-based collaboration platforms and AI-powered software tools. The growing demand for seamless integration with video conferencing solutions, analytics, device management, and security features is driving software adoption. Software solutions enable remote management, real-time collaboration, and enhanced productivity, particularly for distributed teams. In addition, subscription-based software models provide scalable solutions for organizations of all sizes, accelerating market growth.

• By Screen Size

On the basis of screen size, the market is segmented into up to 65 inches and above 65 inches. The up to 65 inches segment held the largest market revenue share in 2024, owing to its flexibility, affordability, and suitability for small to medium-sized meeting rooms. These displays are widely preferred in corporate offices, classrooms, and huddle rooms due to their compact footprint, ease of installation, and cost-effective nature. Users also value the high-resolution clarity, responsive touch functionality, and integration with standard conferencing tools, which makes them a versatile choice across diverse work environments.

The above 65 inches segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing demand for immersive collaboration experiences in large meeting rooms, auditoriums, and training centers. Larger screens enhance visibility for multiple participants, support multi-window content sharing, and offer superior interactive experiences. The rising adoption of ultra-large displays for presentations, digital whiteboarding, and hybrid collaboration is accelerating market expansion in this segment.

• By Resolution

On the basis of resolution, the collaboration display market is segmented into 1080p and 4K/UHD. The 1080p segment dominated the market in 2024, owing to its cost efficiency, widespread compatibility, and sufficient image quality for small and medium meeting environments. Users appreciate 1080p displays for delivering clear visuals, smooth video playback, and integration with existing video conferencing systems without requiring high bandwidth. The segment benefits from a balance of affordability and performance, making it the default choice for many organizations upgrading their collaboration setups.

The 4K/UHD segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for ultra-high-definition visuals and enhanced clarity in large-scale meetings, classrooms, and creative workspaces. 4K/UHD displays facilitate detailed content viewing, seamless video conferencing, and improved participant engagement. Technological advancements in display panels and graphics processing, combined with decreasing costs of UHD panels, are accelerating adoption across enterprises and educational institutions.

• By End User

On the basis of end user, the collaboration display market is segmented into corporate office, government organizations, educational institutes, and others. The corporate office segment dominated the largest revenue share in 2024, fueled by growing adoption of digital collaboration tools, interactive displays, and hybrid meeting setups in modern workplaces. Organizations prioritize collaboration displays to boost productivity, enable seamless remote communication, and facilitate efficient teamwork. The segment also benefits from rising investments in smart office infrastructure, advanced video conferencing technologies, and employee-centric work environments.

The educational institutes segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing demand for digital learning solutions, interactive classrooms, and hybrid teaching models. The integration of collaboration displays in educational environments enhances student engagement, supports remote learning, and enables interactive teaching methods. Government initiatives to modernize educational infrastructure further accelerate adoption, making it a high-growth segment.

• By Application

On the basis of application, the collaboration display market is segmented into large meeting rooms, huddle rooms, classrooms, open layouts, offices, and others. The large meeting rooms segment dominated the largest market revenue share in 2024, owing to the need for advanced displays capable of supporting multi-participant video conferencing, high-quality presentations, and collaborative workflows. Enterprises and institutions prefer large meeting room displays for clear visibility, interactive content sharing, and seamless integration with conferencing platforms. The segment also benefits from corporate expansion, global collaboration initiatives, and increasing adoption of hybrid work environments.

The huddle rooms segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for small, flexible meeting spaces that support quick team discussions and remote collaboration. Huddle room displays are valued for their compact size, plug-and-play connectivity, and cost-effectiveness. Organizations increasingly use these spaces to boost productivity, enable agile collaboration, and reduce reliance on larger conference rooms, which is accelerating market growth in this application segment.

Collaboration Display Market Regional Analysis

- North America dominated the collaboration display market with the largest revenue share of 34.5% in 2024, driven by rapid adoption of digital workplace solutions and hybrid work models

- Organizations and educational institutions in the region are increasingly investing in interactive displays to enhance productivity, collaboration, and remote engagement

- This widespread adoption is further supported by high technological awareness, strong IT infrastructure, and robust corporate and government spending on advanced meeting solutions, establishing collaboration displays as a preferred tool for both professional and academic environments

U.S. Collaboration Display Market Insight

The U.S. collaboration display market captured the largest revenue share in 2024 within North America, fueled by the expansion of hybrid work setups and digital classrooms. Enterprises are prioritizing high-quality, interactive displays to facilitate seamless team collaboration, video conferencing, and remote presentations. The growing emphasis on employee productivity, coupled with demand for cloud-integrated and software-enabled displays, is driving market growth. In addition, adoption of AI-powered collaboration tools and integration with platforms such as Microsoft Teams, Zoom, and Google Workspace is accelerating market expansion.

Europe Collaboration Display Market Insight

The Europe collaboration display market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing adoption of hybrid work solutions, digital classrooms, and corporate investments in smart office infrastructure. The growing need for efficient team collaboration and remote engagement across Germany, France, and the Nordics is fostering market demand. European organizations value the convenience, energy efficiency, and productivity enhancements offered by collaboration displays, particularly in corporate offices, universities, and government institutions.

U.K. Collaboration Display Market Insight

The U.K. collaboration display market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising trend of hybrid work, digital learning, and the desire for seamless communication solutions. Businesses and educational institutions are increasingly implementing interactive displays for remote collaboration, training, and presentations. The U.K.’s strong IT infrastructure, digital adoption culture, and expanding e-learning ecosystem continue to stimulate market growth.

Germany Collaboration Display Market Insight

The Germany collaboration display market is expected to expand at a considerable CAGR during the forecast period, driven by corporate digital transformation initiatives, adoption of smart office technologies, and demand for interactive educational solutions. Germany’s emphasis on innovation, high-quality infrastructure, and integration of collaboration displays with other IoT and AV technologies supports market growth. Organizations are also focusing on eco-friendly and energy-efficient solutions, increasing the adoption of advanced displays in both commercial and academic settings.

Asia-Pacific Collaboration Display Market Insight

The Asia-Pacific collaboration display market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by urbanization, rising digitalization in workplaces and classrooms, and increasing adoption of hybrid learning and remote collaboration solutions. Countries such as China, Japan, and India are witnessing strong demand for interactive displays in corporate offices, educational institutions, and government organizations. The region’s growing technology adoption, supportive government initiatives, and the presence of cost-competitive display manufacturers are accelerating market expansion.

Japan Collaboration Display Market Insight

The Japan collaboration display market is gaining momentum due to the country’s technology-driven work culture, emphasis on productivity, and demand for advanced learning solutions. Adoption is driven by interactive displays that integrate with video conferencing, cloud services, and AI-powered collaboration tools. Japan’s aging population is also encouraging the deployment of user-friendly, accessible displays in workplaces, educational institutions, and public sector facilities.

China Collaboration Display Market Insight

The China collaboration display market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, digital transformation in enterprises and schools, and a growing middle-class workforce adopting advanced office technologies. The push for smart campuses, corporate digitalization, and cost-effective, high-quality collaboration displays has fueled widespread adoption. Strong domestic manufacturers and government initiatives promoting smart infrastructure further accelerate market growth.

Collaboration Display Market Share

The collaboration display industry is primarily led by well-established companies, including:

- NEC Display Solutions (Japan)

- BenQ (Taiwan)

- Avocor (U.K.)

- Zoom (U.S.)

- Google (U.S.)

- Microsoft (U.S.)

- Lenovo (China)

- Mitsubishi Electric Power Products (Japan)

- Dell (U.S.)

- HP (U.S.)

- Epson America (U.S.)

- Poly (U.S.)

- Cisco (U.S.)

- Samsung (South Korea)

- Sharp Electronics Corporation (Japan)

Latest Developments in Global Collaboration Display Market

- In February 2021, Smart Technologies launched the SMART Learning Suite Software, a teacher-driven enhancement tool designed to support hybrid teaching environments. This software provides educators with a comprehensive library of ready-made activities and lessons, enabling interactive and seamless learning experiences. Its introduction strengthens Smart Technologies’ position in the education segment of the collaboration display market by addressing the growing demand for digital and hybrid classroom solutions, enhancing engagement, and streamlining lesson delivery for teachers

- In December 2020, Sharp Imaging and Information Company of America (SIICA), a division of Sharp Electronics Corporation (SEC), introduced the Sharp 4T-B70CT1U AQUOS BOARD interactive display for classrooms and meeting rooms. This new display integrates advanced interactive capabilities, improving engagement and collaboration in educational and corporate settings. The launch reinforces Sharp’s competitiveness in the collaboration display market by expanding its portfolio of interactive solutions and meeting the increasing need for high-quality, user-friendly displays in hybrid learning and professional environments

- In December 2020, Cisco acquired Dashbase, a move aimed at enhancing its cloud-based data analytics and event log capabilities. By incorporating Dashbase’s technology, Cisco can offer customers more robust insights and upgrade its collaboration products with advanced features. This acquisition strengthens Cisco’s position in the collaboration display market by integrating analytics-driven intelligence, supporting enterprise decision-making, and enhancing the value of its existing collaboration solutions

- In November 2020, NEC and Sharp formed a joint venture, creating Sharp NEC Display Solutions (SNDS), with NEC transferring 66% of its NDS shares to Sharp while retaining 34%. This strategic partnership combines NEC’s and Sharp’s technological expertise and product portfolios, allowing SNDS to deliver enhanced interactive displays for corporate and educational sectors. The venture significantly strengthens market presence, innovation capabilities, and competitive advantage in the global collaboration display space

- In September 2020, ViewSonic collaborated with Microsoft to integrate its ViewBoard IFP70 series with Microsoft Windows Collaboration Display certification. This certification ensures seamless compatibility with Microsoft Teams and other collaboration tools, enhancing communication in office and hybrid work environments. The partnership bolsters ViewSonic’s position in the collaboration display market by providing next-generation solutions for enterprises returning to office spaces and seeking reliable, certified interactive technology

- In May 2020, Microsoft launched the Surface Hub 2S, an all-in-one digital whiteboard designed for meetings, presentations, and team collaboration. Equipped with the Surface Hub 2 Camera and Pen, it offers an integrated interactive experience for both corporate and educational settings. The introduction of Surface Hub 2S strengthens Microsoft’s footprint in the collaboration display market by addressing the increasing demand for versatile, technology-enabled workspaces and driving adoption of interactive digital solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Collaboration Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Collaboration Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Collaboration Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.