Global Colony Stimulating Factors Market

Market Size in USD Billion

CAGR :

%

USD

9.46 Billion

USD

21.33 Billion

2024

2032

USD

9.46 Billion

USD

21.33 Billion

2024

2032

| 2025 –2032 | |

| USD 9.46 Billion | |

| USD 21.33 Billion | |

|

|

|

|

Colony Stimulating Factors Market Size

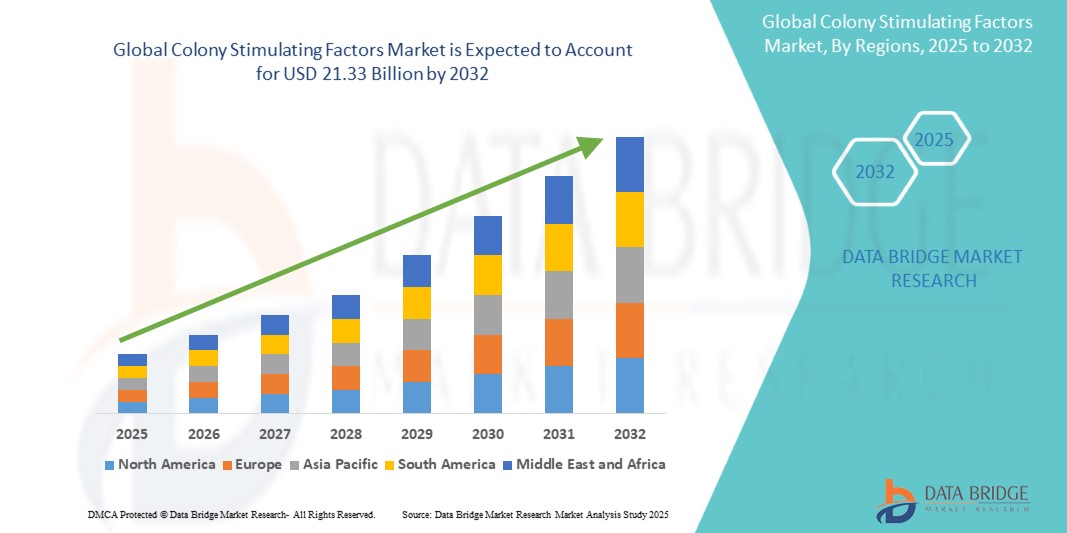

- The global colony stimulating factors market size was valued at USD 9.46 billion in 2024 and is expected to reach USD 21.33 billion by 2032, at a CAGR of 10.70% during the forecast period

- The market growth is largely fueled by the growing prevalence of hematological disorders, cancer treatments, and supportive therapies, driving the increasing demand for Colony Stimulating Factors (CSFs) in both clinical and hospital settings

- Furthermore, rising awareness among healthcare professionals and patients regarding the benefits of CSFs in stimulating bone marrow production, reducing infection risks, and improving patient outcomes is accelerating the adoption of colony stimulating factors solutions, thereby significantly boosting the industry's growth

Colony Stimulating Factors Market Analysis

- Colony Stimulating Factors (CSFs) are glycoproteins that stimulate the production of blood cells and are increasingly vital components in the treatment of neutropenia, chemotherapy-induced neutropenia, and other hematologic conditions in both clinical and hospital settings due to their enhanced efficacy, targeted action, and integration with advanced therapeutic protocols

- The escalating demand for CSFs is primarily fueled by the rising prevalence of cancer and blood disorders, advancements in biotechnology, and a growing preference for targeted therapies that minimize side effects

- North America dominated the colony stimulating factors market with the largest revenue share of 23% in 2024, characterized by early adoption of advanced treatment protocols, high healthcare expenditure, and a strong presence of key industry players. The U.S. experienced substantial growth in CSFs usage, particularly in oncology and hematology departments, driven by innovations from both established pharmaceutical companies and biotech startups focusing on biosimilars and novel formulations

- Asia-Pacific is expected to be the fastest-growing region in the colony stimulating factors market during the forecast period due to increasing urbanization, rising disposable incomes, and expanding access to healthcare services, particularly in countries like China and India

- The Granulocyte–Colony-Stimulating Factor (G-CSF) segment dominated the colony stimulating factors market with a market revenue share of 80% in 2024, driven by its extensive use in managing chemotherapy-induced neutropenia and other hematologic conditions

Report Scope and Colony Stimulating Factors Market Segmentation

|

Attributes |

Colony Stimulating Factors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Colony Stimulating Factors Market Trends

Rising Adoption and Advancements in Colony Stimulating Factors

- A significant and accelerating trend in the global colony stimulating factors market is the growing adoption of innovative therapies and advanced biologics aimed at improving patient outcomes in oncology, hematology, and immune-compromised conditions. These therapies are increasingly being used to manage chemotherapy-induced neutropenia, bone marrow suppression, and other critical complications, enhancing patient recovery and quality of life

- For instance, novel formulations of filgrastim, pegfilgrastim, and biosimilar CSFs are gaining traction across hospitals, specialty clinics, and homecare settings due to their proven efficacy and improved dosing convenience. The availability of long-acting CSFs and self-administration options is helping patients adhere better to prescribed treatment regimens while reducing hospital visits and healthcare costs

- Technological advancements in recombinant DNA technology and biosimilars have enabled the development of more effective, safer, and cost-efficient CSFs, expanding their accessibility across emerging and developed markets. Ongoing clinical trials and research are focused on optimizing dosage, reducing adverse effects, and targeting specific patient populations for better therapeutic outcomes

- The integration of CSFs into standardized oncology and hematology treatment protocols facilitates more predictable patient management, improves immune recovery rates, and reduces the risk of infection-related complications. Hospitals and specialty clinics are increasingly incorporating CSFs into treatment pathways to ensure efficient patient care

- This trend toward more targeted, effective, and patient-friendly CSF therapies is reshaping treatment strategies in supportive care. Consequently, pharmaceutical companies are investing heavily in R&D for novel CSF formulations, biosimilars, and combination therapies to strengthen their portfolios and expand market reach

- The demand for CSFs is growing rapidly across both developed and emerging markets, driven by the rising incidence of cancer, increasing prevalence of hematological disorders, and expanding adoption of chemotherapy and bone marrow transplantation procedures

Colony Stimulating Factors Market Dynamics

Driver

Growing Need Due to Rising Incidence of Hematological Disorders and Cancer Treatments

- The increasing prevalence of cancer, chemotherapy-induced neutropenia, and other hematological disorders is a significant driver for the heightened demand for Colony Stimulating Factors. CSFs play a critical role in stimulating white blood cell production, reducing infection risks, and improving patient recovery during and after treatment

- For instance, in April 2024, major pharmaceutical companies such as Amgen and Sandoz announced advancements in biosimilar CSF therapies, aiming to enhance efficacy, reduce treatment costs, and improve patient adherence. Such strategic developments are expected to propel Colony Stimulating Factors market growth during the forecast period

- As awareness of chemotherapy side effects and immune suppression grows among healthcare providers and patients, CSFs offer essential clinical benefits, including faster immune recovery, reduced hospitalization duration, and lower risk of treatment delays. This makes them a critical component of supportive care in oncology and hematology

- Furthermore, increasing adoption of outpatient care and home-based treatment programs is driving demand for patient-friendly CSF formulations, such as long-acting and self-administered options, which allow patients to maintain therapy continuity with minimal hospital visits

- The expanding global healthcare infrastructure, rising government and private investments in cancer care, and growing patient preference for accessible and effective treatment solutions are key factors propelling the adoption of CSFs across hospitals, specialty clinics, and homecare settings

Restraint/Challenge

High Costs of Advanced Therapies and Access Limitations in Emerging Markets

- The colony stimulating factors market faces challenges due to the relatively high cost of advanced CSF therapies, which can limit adoption, especially in price-sensitive regions. Branded and long-acting formulations, while clinically effective, are expensive for many patients and healthcare systems, creating barriers for widespread use

- Although biosimilar CSFs have improved affordability, premium options with enhanced efficacy or convenience—such as self-administered or pegylated formulations—remain out of reach for certain populations

- In addition, access to these therapies can be restricted in emerging markets due to limited healthcare infrastructure, distribution challenges, and logistical complexities associated with handling temperature-sensitive biologics

- These constraints may delay treatment delivery and reduce patient adherence, impacting overall clinical outcomes

- Overcoming these hurdles requires strategic measures such as scaling up biosimilar production, expanding insurance coverage, implementing patient assistance programs, and strengthening distribution networks

- By addressing cost and accessibility barriers, pharmaceutical companies and healthcare providers can support broader adoption of CSFs and ensure that more patients benefit from these essential supportive care therapies

Colony Stimulating Factors Market Scope

The market is segmented on the basis of type, drug, application, dosage, route of administration, end-users, and distribution channel.

• By Type

On the basis of type, the colony stimulating factors market is segmented into Macrophage–Colony-Stimulating Factor (M-CSF), Multiple-Colony-Stimulating Factor or Interleukin 3 (IL-3), Granulocyte-Macrophage–Colony-Stimulating Factor (GM-CSF), and Granulocyte–Colony-Stimulating Factor (G-CSF). The Granulocyte–Colony-Stimulating Factor (G-CSF) segment dominated the largest market revenue share of 80% in 2024, driven by its extensive use in managing chemotherapy-induced neutropenia and other hematologic conditions. G-CSF stimulates the bone marrow to produce neutrophils, enhancing immune response and reducing infection risks. Its long-established clinical safety, wide adoption across hospitals, and availability in both branded and biosimilar forms make it highly accessible and cost-effective.

The Granulocyte-Macrophage–Colony-Stimulating Factor (GM-CSF) segment is anticipated to witness the fastest growth rate of 10.4% CAGR from 2025 to 2032. This surge is largely fueled by its expanding applications across immunotherapy, regenerative medicine, and bone marrow recovery. The increasing prevalence of immune-related disorders, coupled with ongoing clinical trials and research, is driving interest in GM-CSF as a versatile therapeutic agent. In addition, rising healthcare investments, particularly in advanced biologics and personalized medicine, are broadening its scope and accelerating adoption in both hospital and outpatient settings.

• By Drug

On the basis of drug, the colony stimulating factors market is segmented into Pegfilgrastim, Tbo-filgrastim, Sargramostim, and Filgrastim. Filgrastim dominated the largest market revenue share of 45% in 2024, driven by its proven effectiveness in preventing infections in chemotherapy patients and stimulating neutrophil production. Its widespread availability, cost-effectiveness, and long-standing clinical adoption, coupled with strong familiarity among healthcare professionals, contribute to its leading market position and extensive use in hospital and outpatient settings.

Pegfilgrastim is expected to witness the fastest CAGR of 8.5% from 2025 to 2032, owing to its long-acting formulation that reduces dosing frequency and improves patient compliance. Its ability to maintain therapeutic levels for extended periods, along with ease of administration in outpatient and homecare settings, enhances convenience for patients and caregivers while supporting consistent and effective treatment outcomes. In addition, ongoing clinical research and the development of biosimilar versions are expected to further expand its accessibility and adoption across global markets.

• By Application

On the basis of application, the colony stimulating factors market is segmented into aplastic anemia, bone marrow transplantation, neutropenia, neutropenia associated with chemotherapy, neutropenia associated with radiation, and peripheral progenitor cell transplantation. The neutropenia associated with chemotherapy segment dominated the market with a revenue share of 60% in 2024, driven by the high prevalence of cancer worldwide and the critical need to reduce infection risks in patients undergoing chemotherapy. Chemotherapy-induced neutropenia can lead to serious complications, including treatment delays, increased hospitalization, and elevated mortality risk. CSFs, particularly G-CSF, are essential in stimulating the bone marrow to produce neutrophils, which strengthen the immune system and help patients maintain their treatment schedules.

The bone marrow transplantation segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, fueled by advancements in stem cell therapies and the increasing incidence of hematologic disorders requiring bone marrow transplants. CSFs play a vital role in promoting hematopoietic recovery, enhancing engraftment success, and reducing post-transplant complications. The rising adoption of personalized medicine, improved transplant techniques, and ongoing research into new therapeutic indications are contributing to the segment’s rapid growth.

• By Dosage

On the basis of dosage, the colony stimulating factors market is segmented into tablets, capsules, injections, and others. The Injection segment dominated the market with a share of 75% in 2024, driven by its rapid onset of action, precise dosing control, and well-established clinical efficacy. Injectable CSFs, including both subcutaneous and intravenous forms, are highly preferred in hospital and clinical settings, particularly for patients undergoing intensive treatments such as chemotherapy or bone marrow transplantation. This format ensures consistent bioavailability, allowing healthcare professionals to adjust doses accurately based on patient response and condition severity. In addition, injectable CSFs provide faster therapeutic effects, making them critical in managing acute neutropenia and other complications.

Tablets are anticipated to witness the fastest CAGR of 7.2% from 2025 to 2032, driven by the increasing demand for convenient, oral medication options that allow for easy self-administration in both homecare and outpatient settings. Tablets offer precise dosing, portability, and enhanced patient compliance, reducing the need for frequent clinical visits. Their ease of storage and transport, combined with widespread acceptance among patients, further supports their growing preference in modern therapeutic regimens, making them a key segment in the drug delivery landscape.

• By Route of Administration

On the basis of route of administration, the colony stimulating factors market is segmented into intravenous, subcutaneous, oral, and others. The subcutaneous route dominated the market with a share of 70% in 2024, driven by its ease of administration, minimal discomfort, and suitability for self-injection in both homecare and outpatient settings. This route allows for slow, sustained absorption of CSFs, maintaining effective therapeutic levels over extended periods while reducing systemic side effects. It is particularly beneficial for patients requiring repeated doses during long-term treatments, such as chemotherapy or post-bone marrow transplantation recovery. Subcutaneous administration also enhances patient compliance by allowing self-administration, reducing the frequency of hospital visits, and providing flexibility for outpatient care.

The Intravenous route is expected to witness the fastest CAGR of 5.9% from 2025 to 2032, fueled by the need for immediate therapeutic effects in hospitalized patients, especially in critical care situations like severe neutropenia or acute infections. Intravenous administration ensures rapid bioavailability, precise dose control, and optimal efficacy, making it the preferred choice in emergency and intensive care units. Its widespread use in advanced hospitals and specialty centers continues to support growth, particularly in scenarios where timely intervention can prevent life-threatening complications.

• By End-Users

On the basis of end-users, the colony stimulating factors market is segmented into hospitals, specialty clinics, homecare, and others. Hospitals dominated the market with the largest share of 50% in 2024, primarily due to high patient volumes, access to specialized medical staff, and infrastructure for complex treatments like chemotherapy, bone marrow transplantation, and severe neutropenia management. Hospitals offer continuous monitoring, ensuring immediate intervention for adverse reactions and maximizing therapeutic outcomes. Moreover, the centralized management of CSF therapies in hospitals ensures accurate dosing, timely administration, and adherence to clinical protocols, which is critical for patient safety.

Homecare is expected to witness the fastest CAGR of 8.5% from 2025 to 2032, driven by advancements in user-friendly, self-administered CSF formulations and devices. Patients increasingly prefer home-based treatment for convenience, comfort, and reduced healthcare costs. The availability of remote monitoring tools, telemedicine support, and patient education programs further ensures safe and effective therapy administration in homecare settings, supporting strong growth in this segment.

• By Distribution Channel

On the basis of distribution channel, the colony stimulating factors market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. Hospital pharmacies dominated the market with a share of 60% in 2024, due to centralized dispensing of CSF therapies that ensures timely access for patients requiring urgent or ongoing treatment. Hospital pharmacies also maintain precise inventory management, adherence to clinical protocols, and quality control, ensuring safe and effective therapy administration.

Online pharmacies are expected to witness the fastest CAGR of 7.9% from 2025 to 2032, driven by the growing adoption of e-commerce platforms and home delivery services. These platforms provide convenient access to CSFs, particularly for patients managing long-term treatments at home, and often offer value-added services such as dosage reminders, teleconsultation, and medication counseling. The ease of ordering, reduced need for hospital visits, and enhanced patient support contribute to the rapid growth of online pharmacy channels, improving therapy adherence and overall patient experience.

Colony Stimulating Factors Market Regional Analysis

- North America dominated the colony stimulating factors market with the largest revenue share of 23% in 2024, characterized by the early adoption of advanced treatment protocols, high healthcare expenditure, and a strong presence of key industry players. The region has well-established oncology and hematology departments, where CSFs are widely used to manage chemotherapy-induced neutropenia, bone marrow suppression, and other immune-compromised conditions

- Substantial growth in CSFs usage, driven by innovations from both established pharmaceutical companies and biotech startups focusing on biosimilars and novel formulations. Increased awareness of supportive care therapies, rising incidence of cancer and hematological disorders, and expanding hospital and specialty clinic infrastructure further contributed to market dominance

- Strong government healthcare initiatives, increasing insurance coverage for cancer therapies, and integration of CSFs into standardized treatment protocols have enhanced patient access and adherence. These factors collectively reinforce North America’s leadership in the global CSFs market

U.S. Colony Stimulating Factors Market Insight

The U.S. colony stimulating factors market dominated the North American colony stimulating factors market, capturing the largest revenue share in 2024, driven by widespread adoption of advanced treatment protocols in oncology and hematology departments. The country benefits from high healthcare expenditure, well-established hospital infrastructure, and a strong presence of key pharmaceutical and biotech players focusing on CSFs innovations. Substantial growth in the U.S. market is supported by the development of novel formulations and biosimilars, which improve patient outcomes, enhance safety profiles, and reduce therapy costs. Both established pharmaceutical companies and emerging biotech startups are investing heavily in research and development to introduce more effective and convenient CSF therapies.

Europe Colony Stimulating Factors Market Insight

The Europe colony stimulating factors market is projected to grow at a considerable CAGR during the forecast period, primarily driven by rising incidence of cancer and hematological disorders, coupled with growing healthcare expenditure across the region. Countries such as Germany and the U.K. are witnessing increased adoption of biosimilar CSFs and long-acting formulations due to regulatory support, strong healthcare infrastructure, and rising demand for effective supportive care therapies. Expansion of oncology and hematology departments, coupled with initiatives to improve patient outcomes and reduce infection-related complications, supports robust market growth across hospitals, specialty clinics, and homecare settings in Europe.

U.K. Colony Stimulating Factors Market Insight

The U.K. colony stimulating factors market is projected to grow at a notable CAGR during the forecast period, driven by rising incidence of cancer and hematological disorders, coupled with increasing awareness of supportive care therapies. Hospitals and specialty clinics in the U.K. are increasingly incorporating CSFs into standardized treatment protocols to improve patient outcomes and reduce infection-related complications. Adoption of biosimilar and long-acting CSFs is accelerating, supported by government healthcare initiatives, robust insurance coverage, and policies promoting cost-effective therapies. These developments enable broader patient access and reduce the financial burden of advanced treatments

Asia-Pacific Colony Stimulating Factors Market Insight

The Asia-Pacific colony stimulating factors market is expected to be the fastest-growing region in the CSFs market during the forecast period, driven by increasing urbanization, rising disposable incomes, and expanding access to healthcare services, particularly in countries like China and India. The growing middle-class population, increasing incidence of cancer, and improvements in hospital infrastructure are fueling demand for CSFs therapies. Government initiatives promoting cancer care, reimbursement programs, and awareness campaigns further accelerate market growth. China accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, high healthcare adoption rates, and strong domestic pharmaceutical manufacturing capabilities. Increasing availability of biosimilar CSFs and long-acting formulations enhances accessibility and affordability for a wider patient base.

India Colony Stimulating Factors Market Insight

The India colony stimulating factors market is expected to witness the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and expanding access to quality healthcare services. The growing prevalence of cancer and other hematological disorders in India is creating strong demand for effective supportive care therapies, including CSFs. Increasing awareness among healthcare providers and patients about the benefits of CSFs in managing chemotherapy-induced neutropenia, immune suppression, and post-transplant recovery is supporting market expansion. Long-acting and self-administered CSFs formulations are gaining popularity due to improved patient adherence and reduced hospital visits.

China Colony Stimulating Factors Market Insight

The China colony stimulating factors market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, increasing incidence of cancer, and high rates of healthcare adoption. Hospitals, specialty clinics, and homecare services are increasingly utilizing CSFs to manage chemotherapy-induced complications and support immune recovery. The market growth is supported by the expanding middle class, increasing healthcare expenditure, and strong domestic pharmaceutical manufacturing capabilities. Development and availability of biosimilars and long-acting CSFs formulations improve accessibility and affordability, driving widespread adoption across residential, commercial, and hospital settings.

Japan Colony Stimulating Factors Market Insight

The Japanese colony stimulating factors market is gaining traction due to a technologically advanced healthcare system, increasing incidence of cancer, and a focus on improving patient outcomes in oncology and hematology departments. Adoption of long-acting and biosimilar CSFs, coupled with homecare administration programs, supports ease of use, improved compliance, and better immune recovery for patients undergoing chemotherapy.

Colony Stimulating Factors Market Share

The Colony Stimulating Factors industry is primarily led by well-established companies, including:

- Intas Pharmaceuticals Ltd. (India)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Biocon (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Amgen Inc. (U.S.)

- Merck KGaA (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- STADA Arzneimittel AG (Germany)

- Emcure Pharmaceuticals Limited (India)

- CELLTRION INC. (South Korea)

- BIOCAD (Russia)

- Coherus Oncology (U.S.)

Latest Developments in Global Colony Stimulating Factors Market

- In March 2023, the FDA approved a single-dose prefilled autoinjector presentation of pegfilgrastim-cbqv, designed for administration the day after chemotherapy to reduce the incidence of infection as manifested by febrile neutropenia. This approval was based on a comprehensive analytical data package and a study assessing the pharmacokinetics, pharmacodynamics, and immunogenicity of the product

- In July 2024, Tanvex announced that the FDA approved its filgrastim biosimilar, Nypozi® (TX01), referencing Amgen’s Neupogen. Nypozi is indicated to decrease the incidence of infection, as manifested by febrile neutropenia, in patients with non-myeloid malignancies receiving myelosuppressive anticancer drugs associated with a significant incidence of severe neutropenia with fever

- In April 2024, Partner Therapeutics, Inc. announced that its partner Nobelpharma received approval from the Japanese Pharmaceuticals and Medical Device Agency (PMDA) for the inhaled use of Leukine (sargramostim), branded in Japan as Sargmalin, to treat autoimmune pulmonary alveolar proteinosis (aPAP)

- In May 2022, Amneal Pharmaceuticals announced that the U.S. Food and Drug Administration (FDA) approved the company’s Biologics License Application (BLA) for pegfilgrastim-pbbk, a biosimilar referencing Neulasta. The product is marketed under the proprietary name FYLNETRA

- In June 2021, the FDA accepted the biologics license application (BLA) for a proposed biosimilar for pegfilgrastim developed by Lupin Limited. The application was supported by similarity data from analytical, pharmacokinetic, pharmacodynamic, and immunogenicity studies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.