Global Color Concentrates Market

Market Size in USD Billion

CAGR :

%

USD

6.70 Billion

USD

10.20 Billion

2024

2032

USD

6.70 Billion

USD

10.20 Billion

2024

2032

| 2025 –2032 | |

| USD 6.70 Billion | |

| USD 10.20 Billion | |

|

|

|

|

Color Concentrates Market Size

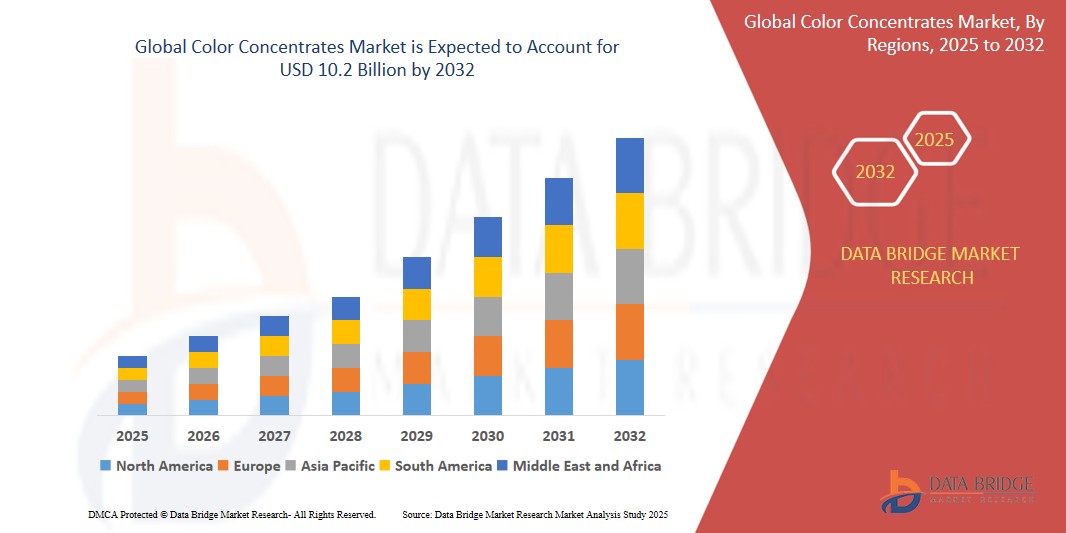

- The Global Color Concentrates Market size was valued at USD 6.7 billion in 2024 and is expected to reach USD 10.2 billion by 2032, at a CAGR of 6.25 during the forecast period

- This growth is driven by factors such as rising demand from packaging industry and growth in automotive and consumer goods sectors

Color Concentrates Market Analysis

- Color concentrates are essential additives used in plastics to impart color, improve appearance, and enhance functional properties across various applications such as packaging, automotive, consumer goods, and construction materials. They ensure uniform coloration and compatibility with polymer matrices.

- The demand for color concentrates is significantly driven by growing use in packaging, automotive interiors, and consumer appliances, coupled with the rising need for customized and sustainable color solutions. Industry shifts toward recyclable and bio-based plastics further fuel demand.

- North America is expected to dominate the Color Concentrates Market due to the presence of established plastic manufacturers, high demand in automotive and packaging sectors, and advanced R&D capabilities in polymer additive technologies.

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, driven by increasing industrialization, growth in end-use industries such as packaging and electronics, and rising demand for colored plastics in construction and infrastructure.

- The packaging segment is projected to dominate the market with a market share of 56.22%, driven by its widespread use in food, beverage, and personal care sectors. Growing branding needs and innovations in flexible and rigid packaging further reinforce its dominance.

Report Scope and Color Concentrates Market Segmentation

|

Attributes |

Color Concentrates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Color Concentrates Market Trends

“Increased Demand for Sustainable Solutions”

- The shift toward sustainability is driving demand for eco-friendly color concentrates. Manufacturers are focusing on biodegradable and recyclable colorants, as well as natural pigments, in response to environmental regulations and consumer preference for sustainable packaging and products.

- Advancements in color matching technologies and dispersion techniques have enabled greater customization of color concentrates. Manufacturers are increasingly offering tailored solutions, allowing for precise color applications in various industries, including automotive, packaging, and consumer goods, improving brand differentiation and aesthetics.

- In March 2024, LyondellBasell launched a new line of sustainable color concentrates made from post-consumer recycled materials for the packaging sector. This initiative responds to increasing demand for eco-friendly solutions in plastic packaging, aligning with the company’s commitment to reducing its carbon footprint and promoting circular economy practices.

- Packaging continues to be the largest end-use segment for color concentrates, driven by consumer goods and food packaging. Brands demand vibrant and long-lasting colors for packaging materials, spurring innovation in colorant formulations to meet performance and aesthetic requirements.

- As industrialization accelerates in regions like Asia-Pacific and Latin America, the demand for color concentrates is growing rapidly. The increase in production across packaging, automotive, and electronics industries in these regions is contributing to the global market’s expansion.

Color Concentrates Market Dynamics

Driver

“Rising Demand from Packaging Industry”

- The increasing use of color concentrates in packaging materials enhances product aesthetics and branding. This drives significant demand, particularly in food, beverage, and personal care packaging applications.

- Brand owners are using customized color solutions to differentiate products. This has intensified demand for color concentrates that offer high dispersion and UV stability across different packaging substrates like PET and HDPE.

- Flexible and rigid plastic packaging continues to dominate retail sectors. This shift encourages manufacturers to use color additives that comply with safety standards while maintaining vibrant and consistent coloration.

- Additionally, sustainability efforts in packaging require color concentrates compatible with biodegradable and recycled polymers. This trend is fostering innovation and driving market growth through eco-conscious coloring solutions.

For instance,

- In March 2024, Amcor announced increased demand for its PET packaging solutions in Asia-Pacific, citing a 12% rise in sales volume. The company attributed this growth to strong uptake of color concentrates used in visually distinctive, branded food and beverage packaging tailored for consumer appeal and regulatory compliance.

Opportunity

“Surge in Bioplastics and Sustainable Solutions”

- Rising demand for sustainable plastics opens doors for bio-based and compostable color concentrate solutions. Brands seek eco-friendly colorants compatible with PLA, PHA, and other biopolymers.

- Governments and NGOs encourage bioplastic adoption, boosting opportunities for color concentrate makers to innovate with renewable pigment and carrier systems.

- The need for transparent labeling and clean-label ingredients extends to packaging colorants. This offers market potential for natural, non-toxic color solutions in consumer-facing applications.

- As the circular economy gains traction, companies focusing on recyclable and biodegradable color systems will gain a competitive edge through strategic partnerships and product diversification.

Restraint/Challenge

“Environmental and Regulatory Pressures”

- Stringent regulations on plastic U.S.ge and waste management affect color concentrate applications. Authorities enforce limits on additives and pigments, especially in food contact and medical-grade polymers.

- Governments worldwide are tightening restrictions on heavy-metal-based pigments and non-biodegradable additives. This limits formulation options for manufacturers and increases regulatory compliance costs.

- Growing concerns over plastic pollution force companies to reevaluate color concentrate use, especially in single-use plastics. This causes shifts toward natural or biodegradable colorant alternatives.

- These environmental pressures require extensive R&D investments to develop eco-friendly colorants, which can strain margins for small and medium manufacturers

Color Concentrates Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Carrier |

|

|

By End User

|

|

In 2025, the Solid segment is projected to dominate the market with a largest share in form segment

the Solid segment is projected to dominate the global Color Concentrates Market due to its ease of handling, longer shelf life, and superior dispersion properties, making it the preferred choice across packaging, automotive, and consumer goods applications.

The Solid segment is expected to account for the largest share during the forecast period form segment

The Solid form segment is expected to account for the largest share during the forecast period owing to its cost-effectiveness, compatibility with various polymers, and wide acceptance in high-volume plastic manufacturing industries across both developed and emerging markets.

Color Concentrates Market Regional Analysis

“North America Holds the Largest Share in the Color Concentrates Market”

- North America dominates the Color Concentrates Market, driven by a mature plastics industry, high demand in packaging and automotive sectors, and the strong presence of leading color concentrate manufacturers and technology innovators across the region.

- The U.S. accounted for more than 85% of the market share in 2024, due to increasing demand for customized and sustainable color solutions in consumer goods, construction, and healthcare packaging, as well as robust infrastructure for advanced polymer processing and product innovation.

- The availability of well-established industrial standards, coupled with increased investments in research and development by key players, supports market growth and facilitates the launch of high-performance and regulatory-compliant color concentrate solutions.

- In addition, the growing need for visually distinctive and brand-specific packaging, along with the rapid adoption of bio-based and recyclable plastics, continues to fuel the expansion of the Color Concentrates Market across North America.

“Asia-Pacific is Projected to Register the Highest CAGR in the Color Concentrates Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Color Concentrates Market, driven by rapid industrialization, expanding manufacturing sectors, and growing demand for colored plastics in packaging, automotive, and consumer electronics industries.

- Countries such as China, India, and Japan are emerging as key markets due to increased plastic production, rising consumer demand for aesthetically appealing products, and the expanding footprint of global and regional plastic manufacturers.

- Japan, known for its technological advancements and high-quality production standards, continues to play a vital role in the market. The country's focus on precision manufacturing and innovation drives demand for high-performance color concentrates.

- China and India, with their large industrial bases and growing middle-class populations, are witnessing rising demand for packaged goods, infrastructure development, and automobiles. These factors, coupled with government initiatives supporting local manufacturing, significantly contribute to market expansion in the region.

Color Concentrates Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ferro Corporation (U.S.)

- Cromex S/A (Brazil

- Chroma Color Corporation (U.S.)

- Unicolor Masterbatching and Additives Incorporated (U.S.)

- Plastics Color Corporation (U.S.)

- AGC Inc. (Japan)

- LyondellBasell Industries Holdings B.V. (Netherlands)

Latest Developments in Global Color Concentrates Market

- In March 2024, Ampacet Corporation introduced FusionFx, a series of four innovative color palettes utilizing proprietary masterbatch technology. These palettes produce random color patterns, enabling designers to create unique products that celebrate natural imperfections and enhance aesthetic appeal.

- In September 2022, GNT launched a Non-GMO Project Verified range of EXBERRY® color concentrates. This development simplifies approval processes for manufacturers by eliminating the need for independent non-GMO verification, thereby enhancing product appeal and streamlining production workflows.

- In March 2024, PolyOne Corporation announced an agreement to purchase Clariant's global color and additives business. This strategic acquisition aims to expand PolyOne's product portfolio and strengthen its position in the global color concentrates market.

- In May 2024, Sherwin-Williams introduced the Color Expert app, powered by artificial intelligence technology. The app provides personalized color recommendations quickly, based on existing color schemes, enhancing user experience and aiding in efficient color selection.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Color Concentrates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Color Concentrates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Color Concentrates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.