Global Colostrum Market

Market Size in USD Million

CAGR :

%

USD

386.71 Million

USD

513.17 Million

2025

2033

USD

386.71 Million

USD

513.17 Million

2025

2033

| 2026 –2033 | |

| USD 386.71 Million | |

| USD 513.17 Million | |

|

|

|

|

Colostrum Market Size

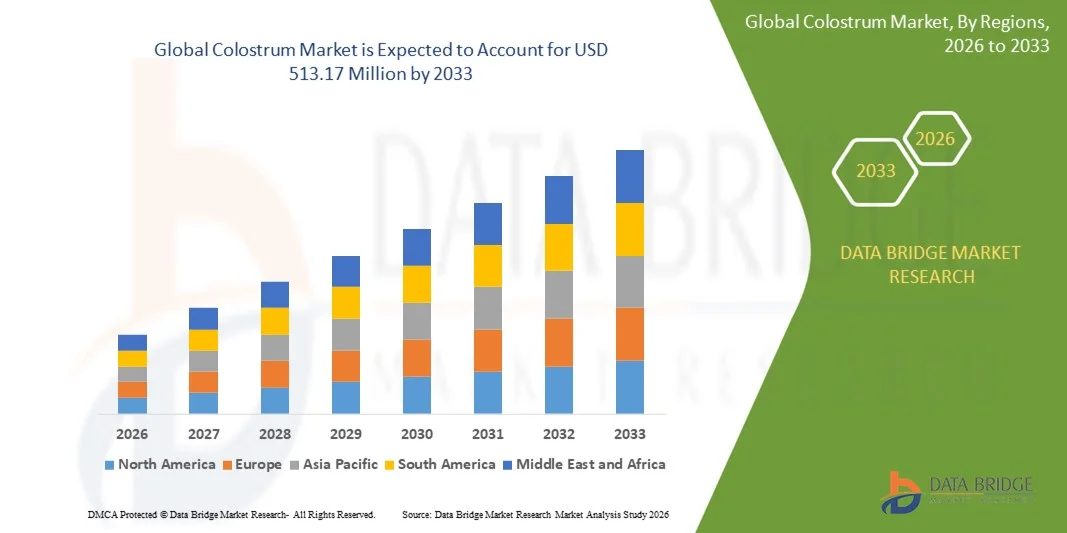

- The global colostrum market size was valued at USD 386.71 million in 2025 and is expected to reach USD 513.17 million by 2033, at a CAGR of 3.60% during the forecast period

- The market growth is largely fuelled by the rising adoption of colostrum-based supplements in sports nutrition and immune health

- Growing demand for functional foods enriched with bioactive compounds is further supporting market expansion

Colostrum Market Analysis

- The market is witnessing steady growth due to the increasing utilization of bovine colostrum in dietary supplements, pharmaceuticals, and functional food applications

- Rising awareness of gut health, immunity enhancement, and the anti-inflammatory properties of colostrum is shaping product innovation and portfolio diversification

- North America dominated the colostrum market with the largest revenue share in 2025, driven by strong consumer inclination toward high-nutrition dairy ingredients and increasing adoption of colostrum in functional foods and supplements

- Asia-Pacific region is expected to witness the highest growth rate in the global colostrum market, driven by rapid urbanization, expanding middle-class consumer base, and growing demand for immunity-enhancing dairy ingredients

- The conventional segment held the largest market revenue share in 2025, driven by its wide availability, lower production cost, and extensive use across dietary supplements, nutritional products, and animal feed formulations. Conventional colostrum also benefits from well-established distribution networks, supporting strong penetration in both developed and emerging markets

Report Scope and Colostrum Market Segmentation

|

Attributes |

Colostrum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Bionatin (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Colostrum Market Trends

Rise of Point-of-Care Testing In Livestock Diagnostics

- The increasing adoption of point-of-care (POC) testing is reshaping livestock diagnostics by enabling instant, on-site disease detection, helping farmers make quicker treatment decisions and reducing herd productivity losses. This shift is especially critical in large herds where disease spreads rapidly, making early diagnosis essential. The ability to generate reliable results within minutes allows veterinarians to implement timely interventions. Such rapid decision-making ultimately enhances animal welfare and operational efficiency

- The demand for rapid testing solutions in regions with limited veterinary laboratory access is driving the uptake of handheld kits and mobile diagnostic devices, supporting timely disease control in rural and underserved areas. These portable systems eliminate the need to transport biological samples over long distances, reducing degradation and improving accuracy. They also help streamline government-led disease surveillance activities. As a result, rural livestock communities experience improved disease monitoring and faster containment measures

- The cost-effectiveness and simplicity of modern POC devices are encouraging frequent herd screening, improving disease surveillance and overall livestock health management across farms of varying sizes. These devices reduce dependency on centralized laboratories and minimize repeated veterinary visits. Farmers can conduct routine checks independently with minimal training. Regular monitoring helps detect subclinical infections early, reducing long-term treatment costs and improving herd performance

- For instance, in 2023, dairy cooperatives in rural India achieved reduced mastitis-related contamination after adopting portable POC kits that enabled early detection and treatment, improving milk quality and reducing veterinary expenses. The initiative also enhanced farmer awareness about preventive health management. Cooperatives observed improved supply consistency, meeting stricter quality standards set by processors. This success is now encouraging wider adoption of similar diagnostic technologies across South Asian dairy sectors

- While POC diagnostics enhance surveillance and speed of intervention, sustained progress depends on continuous product innovation, farmer training programs, and affordable deployment tailored to local field conditions. Manufacturers must design rugged, weather-resistant devices suitable for challenging farm environments. Training initiatives and extension services are essential to address handling errors and maximize diagnostic accuracy. Long-term market growth will rely on partnerships between governments, veterinary institutions, and diagnostic companies

Colostrum Market Dynamics

Driver

Growing Prevalence Of Zoonotic Diseases And Rising Farmer Awareness

- Increasing cases of zoonotic infections are prompting producers and governments to prioritize early diagnostic solutions to prevent disease spread across livestock and human populations, accelerating investments in rapid testing. These diseases pose significant public health risks, raising the urgency for better surveillance systems. Timely diagnosis helps avoid large-scale culling and economic losses. This growing focus is spurring innovation in faster, more sensitive diagnostic platforms

- Rising farmer awareness about productivity losses from undiagnosed diseases is leading to more frequent diagnostic testing, supported by shifting consumer expectations for safe, traceable livestock products. Farmers are now more informed about disease economics due to training programs and government campaigns. Increasing export requirements also motivate producers to maintain disease-free herds. Traceability initiatives are reinforcing the need for consistent testing and documentation

- Government-backed disease surveillance programs and international regulatory frameworks are strengthening diagnostic adoption through subsidized testing schemes and mandatory screening protocols. These initiatives help reduce the cost burden on farmers and ensure standardized disease control measures. Programs such as national immunization and biosecurity campaigns are closely linked with diagnostic requirements. Strong institutional support is driving higher market penetration across developing regions

- For instance, in 2022, the European Union expanded mandatory screening requirements for selected zoonotic diseases, increasing demand for rapid test kits and portable livestock analyzers across the region. This regulatory shift encouraged producers to adopt digital diagnostic tools for real-time reporting. The policy strengthened cross-border disease monitoring and improved food safety compliance. As a result, diagnostic manufacturers experienced a surge in demand for field-friendly testing technologies

- While awareness remains a strong market driver, improvements in accessibility, affordability, and field-ready technology integration are needed for broader adoption among small and mid-scale livestock producers. Bridging the gap between advanced diagnostic capabilities and everyday farmer use remains essential. Affordable variants of molecular diagnostics will be key to scaling adoption. Collaboration between private companies and public health agencies can accelerate technology penetration in underserved areas

Restraint/Challenge

High Cost Of Advanced Diagnostic Systems And Limited Rural Access

- The elevated cost of advanced diagnostic technologies such as PCR and ELISA systems restricts adoption to large-scale farms and research institutions, creating a barrier for smallholder farmers. These systems require specialized infrastructure that many rural facilities lack. High maintenance and operational costs further limit use. Consequently, small producers often depend on slower, less reliable methods

- Rural regions often lack skilled personnel, technical infrastructure, and maintenance support, limiting the deployment and accuracy of advanced diagnostic tools and prolonging disease detection timelines. Many regions struggle with inconsistent electricity, limited internet access, and inadequate veterinary staffing. Training gaps reduce the effectiveness of advanced tools even when available. These challenges widen the disparity in livestock health management between urban and rural settings

- Limited supply chain reach in remote areas leads to inconsistent availability of diagnostic kits and reagents, pushing farmers to rely on less accurate symptomatic methods that increase mortality and economic losses. Interruptions in cold chain logistics further reduce the reliability of testing materials. Veterinary outreach programs often struggle to cover widely dispersed farming communities. This results in delayed detection and uncontrolled disease spread

- For instance, in 2023, agencies in Sub-Saharan Africa reported that over 70% of small and mid-scale farmers lacked reliable access to diagnostic services due to high equipment costs and infrastructure constraints. Many farmers rely heavily on local veterinarians with limited resources. This shortage affects early intervention and leads to higher incidence of preventable diseases. The findings highlight the urgent need for scalable, low-cost diagnostic alternatives

- While technology advancements continue, bridging cost barriers, strengthening last-mile delivery, and expanding decentralized testing solutions remain essential to unlock the market’s full potential. Affordable mobile labs, solar-powered diagnostic units, and simplified testing kits can address key accessibility gaps. Public-private partnerships will play an important role in improving distribution networks. Expanding rural veterinary training programs is crucial for sustainable growth in livestock diagnostics

Colostrum Market Scope

The colostrum market is segmented on the basis of nature, product type, form, application, end use, and distribution channel.

- By Nature

On the basis of nature, the colostrum market is segmented into organic and conventional. The conventional segment held the largest market revenue share in 2025, driven by its wide availability, lower production cost, and extensive use across dietary supplements, nutritional products, and animal feed formulations. Conventional colostrum also benefits from well-established distribution networks, supporting strong penetration in both developed and emerging markets.

The organic segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising consumer preference for clean-label, chemical-free, and naturally derived nutrition products. Growing demand for premium wellness supplements and stricter organic farming regulations further contribute to the segment’s rapid expansion.

- By Product Type

On the basis of product type, the colostrum market is segmented into whole colostrum powder, skimmed colostrum powder, and specialty. The whole colostrum powder segment accounted for the largest revenue share in 2025, supported by its high immunoglobulin content and broad usage in sports nutrition, infant formulas, and functional foods. Its strong nutritional profile and increasing application across health supplements drive its market dominance.

The specialty segment is expected to witness the fastest growth from 2026 to 2033, driven by demand for customized formulations such as hyperimmune colostrum, IgG-enriched powders, and targeted bioactive components for advanced health and therapeutic uses.

- By Form

On the basis of form, the colostrum market is segmented into powder, capsule, and tablet. The powder segment held the largest market revenue share in 2025, owing to its versatility in blending with beverages, foods, animal feed, and supplements. Its ease of incorporation into manufacturing processes and long shelf life makes it the preferred choice among producers.

The capsule segment is projected to record the fastest growth rate during 2026–2033, supported by increasing consumer demand for convenient, pre-dosed, and easy-to-consume colostrum supplements.

- By Application

On the basis of application, the colostrum market is segmented into functional foods, cosmetics, animal feed, dietary supplements, nutritional supplements, milk replacers, and others. The dietary supplements segment dominated the market in 2025, driven by strong consumer interest in immune-boosting, gut-health-enhancing, and anti-inflammatory products. The growing emphasis on preventive health supports high supplement usage globally.

The functional foods segment is expected to register the fastest growth from 2026 to 2033, fuelled by rising demand for fortified foods, high-protein snacks, and immunity-focused functional ingredients incorporated into daily nutrition.

- By End Use

On the basis of end use, the colostrum market is segmented into porcine, bovine, poultry, cat, dog, equine, and others. The bovine segment captured the largest market revenue share in 2025, attributed to high availability, strong nutrient composition, and widespread application across human nutrition and animal feed industries. Its established supply chain further strengthens segment dominance.

The pet categories such as dog and cat nutrition are expected to witness the fastest growth rate from 2026 to 2033, supported by rising pet humanization trends and increasing demand for immune-support and gut-health supplements for companion animals.

- By Distribution Channel

On the basis of distribution channel, the colostrum market is segmented into direct/B2B, hypermarkets/supermarkets, convenience stores, specialty stores, drug stores, health and wellness stores, other retailing formats, and online retailing. The direct/B2B segment accounted for the largest market revenue share in 2025, driven by bulk purchasing from supplement manufacturers, nutraceutical companies, and animal feed processors, ensuring consistent large-scale demand.

The online retailing segment is projected to grow the fastest from 2026 to 2033, supported by rising e-commerce penetration, increasing consumer preference for home-delivered health products, and the widespread availability of branded and specialty colostrum supplements on digital marketplaces.

Colostrum Market Regional Analysis

- North America dominated the colostrum market with the largest revenue share in 2025, driven by strong consumer inclination toward high-nutrition dairy ingredients and increasing adoption of colostrum in functional foods and supplements

- The region’s well-established dairy industry, advanced processing capabilities, and rising health awareness among consumers continue to support market expansion

- Growing demand for immunity-boosting products and premium nutraceutical formulations further reinforces North America’s leadership in the global colostrum landscape

U.S. Colostrum Market Insight

The U.S. captured the largest revenue share within North America in 2025, supported by high consumer spending on dietary supplements and growing interest in natural immune-support ingredients. Increasing incorporation of bovine colostrum in sports nutrition, gut-health formulas, and functional beverages contributes to strong domestic demand. In addition, the presence of leading manufacturers, robust retail penetration, and positive consumer perception of scientifically backed dairy bioactives drive continuous market growth in the country.

Europe Colostrum Market Insight

Europe is expected to witness a notable growth rate from 2026 to 2033, fuelled by rising consumption of functional foods and clean-label nutritional products. Heightened focus on preventive health and increasing integration of colostrum in infant nutrition, medical nutrition, and wellness formulations are shaping regional market development. Strong regulatory frameworks, coupled with consumer preference for high-quality, traceable dairy ingredients, are further enhancing market penetration across key European economies.

U.K. Colostrum Market Insight

The U.K. market is projected to experience strong growth from 2026 to 2033, driven by rising demand for immune-support supplements and growing acceptance of colostrum-based products among health-conscious consumers. Increased awareness of gut health, digestive wellness, and natural bioactive ingredients is strengthening product adoption. Expanding e-commerce availability and growing product launches in sports nutrition and premium dietary supplements further support market expansion in the U.K.

Germany Colostrum Market Insight

Germany is set to witness robust growth from 2026 to 2033, supported by the country’s strong dairy processing infrastructure and rising consumer preference for scientifically validated nutritional ingredients. German consumers increasingly seek high-purity, sustainable, and certified-quality colostrum products, particularly in infant formulas, nutraceuticals, and specialized dietary supplements. The market also benefits from heightened interest in immune health and advanced clinical research supporting colostrum efficacy.

Asia-Pacific Colostrum Market Insight

The Asia-Pacific region is expected to record the fastest growth rate from 2026 to 2033, driven by rising health awareness, expanding middle-class populations, and increasing adoption of nutritional supplements in countries such as China, India, and Japan. Growing demand for infant nutrition, functional dairy ingredients, and performance supplements fuels regional consumption. Government initiatives promoting health and wellness, coupled with expanding retail and online distribution networks, further accelerate market growth across APAC.

Japan Colostrum Market Insight

Japan is anticipated to grow significantly from 2026 to 2033 due to strong consumer preference for premium nutritional ingredients and advanced functional food products. The country’s aging population is increasingly turning to colostrum for immune support, digestive health, and vitality enhancement. Japan’s well-developed market for nutraceuticals, combined with high-quality manufacturing practices and interest in clinically supported dairy bioactives, continues to elevate colostrum demand.

China Colostrum Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, attributed to its rapidly expanding nutritional supplement market and strong emphasis on infant and maternal nutrition. Increasing disposable incomes and heightened consumer awareness of immunity-boosting ingredients are key factors driving growth. The presence of large domestic manufacturers, government focus on food-quality standards, and rising adoption of colostrum in functional beverages and sports nutrition further contribute to China’s market dominance.

Colostrum Market Share

The Colostrum industry is primarily led by well-established companies, including:

• Bionatin (U.S.)

• Provita Eurotech (U.K.)

• Sterling Technology (U.S.)

• ImmuCell Corporation (U.S.)

• Cuprem, Inc. (U.S.)

• Milligans Food Group (New Zealand)

• Pantheryx (U.S.)

• Colostrum BioTec GmbH (Germany)

• Farbest Brands (U.S.)

• Cure Nutraceutical PVT. LTD. (India)

• NOW Foods (U.S.)

• Good Health New Zealand (New Zealand)

• BIOSTRUM NUTRITECH PVT. LTD. (India)

• Immuno-Dynamics, Inc. (U.S.)

• Ingredia Nutritional (France)

• Deep Blue Health New Zealand Ltd (New Zealand)

• American Dairy Products Institute (U.S.)

• ZenithNutrition.com (India)

• SYMCO, Inc. (U.S.)

• The Renegade Pharmacist (U.K.)

• Swanson (U.S.)

Latest Developments in Global Colostrum Market

- In January 2024, Nuchev announced a product expansion, introducing new bovine-based formulations aimed at improving immunity and digestion. The launch included the Oli6 Immunity+ full cream milk powder, enriched with colostrum, vitamins A and D, and lactoferrin to support overall wellness. The product was rolled out across Australia and China through multiple retail and online channels. This expansion strengthens Nuchev’s portfolio beyond goat formulas and broadens its reach into colostrum-fortified nutrition. The development is expected to boost market competitiveness and accelerate adoption of functional dairy products in emerging Asia-Pacific markets

- In April 2023, PanTheryx unveiled a new practitioner-focused product line, introducing Life’s First Naturals PRO ColostrumOne Extra Strength. The formulation utilizes premium bovine colostrum and proprietary processing technology to deliver enhanced immune and digestive support for both adults and children. By targeting healthcare practitioners, the company aims to strengthen clinical trust and professional recommendations. This launch enhances PanTheryx’s position in the high-value premium supplement category. The development is anticipated to increase demand for advanced colostrum products and broaden their penetration into healthcare-guided nutrition segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Colostrum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Colostrum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Colostrum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.