Global Commerce Cloud Market

Market Size in USD Billion

CAGR :

%

USD

30.15 Billion

USD

154.92 Billion

2024

2032

USD

30.15 Billion

USD

154.92 Billion

2024

2032

| 2025 –2032 | |

| USD 30.15 Billion | |

| USD 154.92 Billion | |

|

|

|

|

Commerce Cloud Market Size

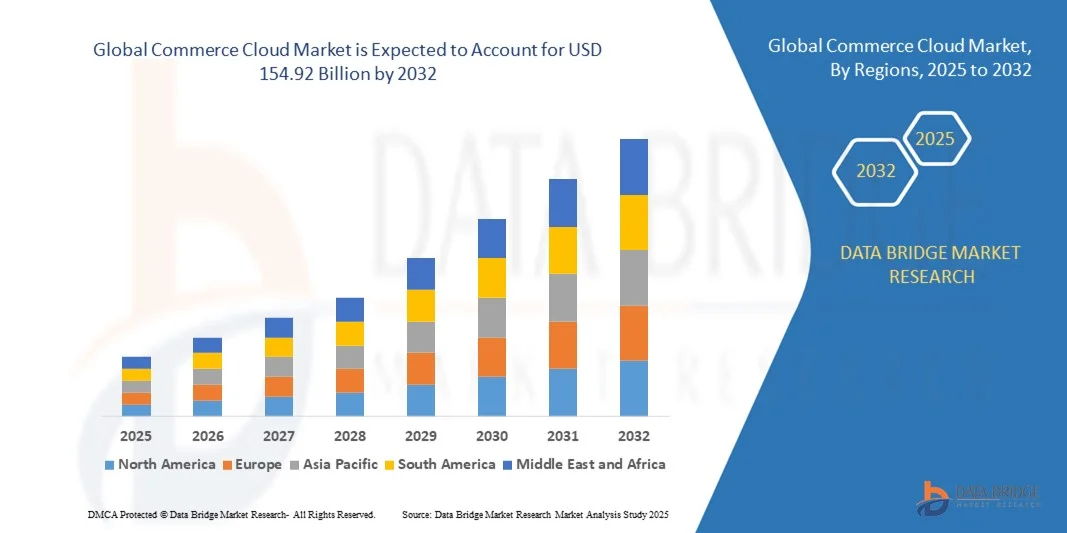

- The global commerce cloud market size was valued at USD 30.15 billion in 2024 and is expected to reach USD 154.92 billion by 2032, at a CAGR of 22.7% during the forecast period

- The market growth is largely fuelled by increasing adoption of cloud-based solutions for retail, e-commerce, and enterprise operations, enabling scalability, agility, and cost efficiency

- Rising demand for personalized shopping experiences and omnichannel retail strategies is driving investment in commerce cloud platforms

Commerce Cloud Market Analysis

- The market is witnessing significant innovation in cloud-based commerce platforms, focusing on AI-driven personalization, predictive analytics, and seamless multi-channel integration

- Retailers and enterprises are increasingly leveraging commerce cloud solutions to optimize inventory management, streamline operations, and improve customer satisfaction, fostering broader adoption across industries

- North America dominated the commerce cloud market with the largest revenue share of 38.7% in 2024, driven by the growing adoption of digital transformation initiatives, cloud-based retail solutions, and e-commerce expansion across the U.S. and Canada

- Asia-Pacific region is expected to witness the highest growth rate in the global commerce cloud market, driven by rapid urbanization, expanding retail and e-commerce sectors, and rising adoption of AI-enabled cloud solutions across small and medium enterprises

- The Large Enterprises segment held the largest market revenue share in 2024, driven by extensive adoption of cloud-based solutions to enhance digital transformation, streamline operations, and manage complex omnichannel retail strategies. Large enterprises benefit from scalable platforms that allow them to integrate multiple business functions, optimize inventory, and deliver personalized customer experiences at a global scale

Report Scope and Commerce Cloud Market Segmentation

|

Attributes |

Commerce Cloud Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Commerce Cloud Market Trends

Rise of AI-Driven and Omnichannel Commerce Cloud Solutions

The growing adoption of AI-driven commerce cloud platforms is transforming the retail and e-commerce landscape by enabling personalized customer experiences and predictive analytics. These platforms allow businesses to optimize inventory, pricing, and marketing strategies in real time, enhancing sales and operational efficiency. In addition, AI insights help anticipate customer behavior, reduce churn, and improve long-term customer loyalty. Businesses can also automate routine tasks, freeing resources for strategic decision-making

Increasing demand for omnichannel retail strategies is accelerating the deployment of commerce cloud solutions across physical stores, e-commerce websites, and mobile applications. Businesses benefit from seamless integration of sales channels, enabling consistent customer experiences and improved engagement. Omnichannel platforms also provide detailed analytics across channels, allowing companies to identify top-performing products and refine marketing campaigns effectively. The convergence of online and offline data strengthens operational efficiency and revenue growth

The scalability and flexibility of modern commerce cloud platforms are making them attractive for both SMEs and large enterprises. Organizations can quickly adapt to market trends, manage seasonal demand fluctuations, and implement new features without extensive infrastructure investments. Cloud platforms also enable rapid expansion into new geographic markets and the ability to handle large transaction volumes during peak seasons. Customizable modules allow firms to tailor solutions to their specific industry or business model

For instance, in 2023, several global retailers implemented cloud-based commerce platforms integrated with AI recommendation engines, resulting in improved customer retention, increased average order value, and streamlined operations. Retailers reported faster time-to-market for new promotions and personalized product offerings. This led to measurable improvements in operational efficiency, customer engagement, and sales performance across multiple channels

While commerce cloud solutions enhance personalization and operational efficiency, their impact depends on continuous innovation, data security measures, and ease of integration with existing IT infrastructure. Vendors must focus on tailored solutions and industry-specific deployment strategies to maximize adoption. In addition, solutions that support multi-currency and multilingual capabilities are increasingly important for global retail expansion

Commerce Cloud Market Dynamics

Driver

Increasing Demand for Digital Transformation and Personalized Customer Experiences

The rising focus on digital transformation across retail, FMCG, and e-commerce sectors is driving demand for advanced commerce cloud platforms. Organizations are investing in cloud solutions to improve customer engagement, operational efficiency, and real-time analytics. Platforms that integrate AI, machine learning, and IoT data help businesses make smarter decisions, optimize resource allocation, and enhance operational resilience

Businesses are increasingly prioritizing personalized shopping experiences using AI, machine learning, and data-driven insights. This trend is pushing cloud vendors to enhance platform capabilities for targeted marketing, dynamic pricing, and personalized recommendations. Organizations using these capabilities report higher conversion rates and improved customer satisfaction, resulting in stronger brand loyalty and repeat purchases. In addition, personalized engagement reduces marketing waste and improves ROI

Government initiatives and industry regulations promoting digital commerce and secure data handling are further supporting market growth. Organizations are adopting commerce cloud solutions to ensure compliance while improving customer experience. Enhanced regulatory compliance helps reduce legal risks and boosts consumer trust, especially in regions with stringent data privacy laws such as GDPR in Europe and CCPA in California

For instance, in 2022, major retail chains in Europe and North America upgraded their commerce cloud platforms to integrate AI-powered personalization and seamless omnichannel capabilities, boosting sales and operational efficiency. These upgrades enabled better inventory management, predictive forecasting, and improved digital engagement across all customer touchpoints. Retailers also gained insights into consumer preferences and purchasing trends to optimize future campaigns

While demand is increasing, successful deployment requires skilled personnel, robust IT infrastructure, and data integration capabilities. Vendors must provide scalable, secure, and customizable solutions to sustain growth. Cloud platforms that offer low-code/no-code tools are gaining traction as they allow business users to implement changes without heavy reliance on IT teams

Restraint/Challenge

High Implementation Costs and Integration Complexities

The high cost of deploying advanced commerce cloud platforms, including subscription fees, customization, and training, limits adoption among small and mid-sized enterprises. Budget constraints often restrict access to full-featured solutions. Companies must weigh investment costs against projected ROI, which can delay adoption or restrict deployment to select departments or regions

Integration complexities with legacy systems, ERPs, and existing IT infrastructure can hinder seamless deployment. Businesses require skilled IT teams and technical support to ensure smooth operations and maintain data consistency. Incompatibility issues or delayed data migration can lead to operational inefficiencies, downtime, and negative customer experiences. Full system integration may require months of planning and testing before going live

Security and privacy concerns around customer data and transaction information pose additional challenges, requiring robust cloud security measures and compliance with local regulations. A breach or data loss can significantly harm a brand’s reputation and incur financial penalties. Organizations must implement encryption, access control, and real-time monitoring systems to safeguard sensitive information across multiple channels

For instance, in 2023, several retailers in Asia-Pacific faced delays in cloud adoption due to integration issues with legacy systems and concerns over data protection, affecting rollout timelines. These challenges underscored the need for pre-deployment risk assessments, vendor support, and employee training to mitigate potential operational disruptions

While commerce cloud technology continues to advance, addressing cost, integration, and security challenges is critical. Vendors must offer flexible pricing, seamless integration tools, and comprehensive support to accelerate market adoption globally. Solutions that support multi-cloud environments and API-based integration are becoming key differentiators in enabling efficient deployments and long-term scalability

Commerce Cloud Market Scope

The market is segmented on the basis of organization size, component, and application.

- By Organization Size

On the basis of organization size, the commerce cloud market is segmented into Small and Medium Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment held the largest market revenue share in 2024, driven by extensive adoption of cloud-based solutions to enhance digital transformation, streamline operations, and manage complex omnichannel retail strategies. Large enterprises benefit from scalable platforms that allow them to integrate multiple business functions, optimize inventory, and deliver personalized customer experiences at a global scale.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the affordability, flexibility, and ease of deployment of commerce cloud solutions. SMEs increasingly rely on cloud platforms to compete with larger players by enabling personalized marketing, efficient order management, and seamless integration across digital and physical sales channels. Cloud adoption allows SMEs to scale operations without heavy upfront IT infrastructure investments.

- By Component

On the basis of component, the market is segmented into Platform and Services. The Platform segment accounted for the largest revenue share in 2024, as organizations prefer integrated, end-to-end commerce solutions that support inventory management, omnichannel retail, and AI-driven analytics. Platforms enable real-time insights, automation of business processes, and data-driven decision-making, improving operational efficiency and customer satisfaction.

The Services segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for implementation, consulting, and managed services. Vendors provide specialized support, customization, and training services to ensure seamless deployment, minimize downtime, and optimize the performance of commerce cloud platforms for clients of all sizes.

- By Application

On the basis of application, the commerce cloud market is segmented into Electronics, Furniture, and Bookstores, Grocery and Pharmaceutical, Automotive, Fashion and Apparel, Quick Service Restaurants, Travel and Hospitality, Beauty and Cosmetics, and Others. The Electronics segment held the largest market share in 2024, driven by high consumer demand, fast-changing product cycles, and the need for seamless omnichannel experiences.

The Grocery and Pharmaceutical segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising e-commerce adoption, home delivery services, and regulatory compliance requirements. Retailers leverage commerce cloud platforms to optimize supply chains, improve inventory accuracy, and provide personalized promotions, improving efficiency and customer satisfaction across these sectors.

Commerce Cloud Market Regional Analysis

- North America dominated the commerce cloud market with the largest revenue share of 38.7% in 2024, driven by the growing adoption of digital transformation initiatives, cloud-based retail solutions, and e-commerce expansion across the U.S. and Canada

- Businesses in the region are increasingly investing in AI-driven commerce platforms to optimize inventory, pricing, and customer engagement, resulting in enhanced operational efficiency and improved sales performance

- The market growth is further supported by high internet penetration, advanced IT infrastructure, and increasing preference for omnichannel retail strategies, establishing commerce cloud solutions as essential tools for both SMEs and large enterprises

U.S. Commerce Cloud Market Insight

The U.S. commerce cloud market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of AI-powered platforms, e-commerce expansion, and growing consumer demand for personalized shopping experiences. Businesses are prioritizing omnichannel integration, cloud scalability, and predictive analytics to drive customer engagement and operational efficiency. Furthermore, government initiatives supporting digital commerce and secure data handling are significantly contributing to the market's growth.

Europe Commerce Cloud Market Insight

The Europe commerce cloud market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing e-commerce penetration, stringent data privacy regulations, and rising investments in digital retail platforms. The demand for personalized shopping experiences and seamless integration across physical and online stores is fostering commerce cloud adoption. European retailers are also focused on sustainability and energy-efficient cloud solutions, contributing to overall market growth.

U.K. Commerce Cloud Market Insight

The U.K. commerce cloud market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising online retail sales, digital transformation initiatives, and increasing consumer preference for seamless omnichannel experiences. Businesses are adopting cloud solutions to enhance operational efficiency, improve customer engagement, and implement AI-driven personalization strategies. In addition, the country’s robust IT infrastructure and e-commerce ecosystem are expected to sustain market expansion.

Germany Commerce Cloud Market Insight

The Germany commerce cloud market is expected to witness the fastest growth rate from 2025 to 2032, driven by widespread adoption of cloud-based retail solutions, digitalization of SMEs, and government support for e-commerce initiatives. German businesses are investing in scalable cloud platforms to improve inventory management, optimize pricing, and deliver enhanced customer experiences. Integration of AI and analytics is becoming increasingly prevalent to enable data-driven decision-making across retail and service sectors.

Asia-Pacific Commerce Cloud Market Insight

The Asia-Pacific commerce cloud market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid e-commerce growth, rising smartphone penetration, and increasing digital transformation among retailers. Countries such as China, India, and Japan are witnessing high adoption of AI-enabled commerce platforms to provide personalized customer experiences and operational efficiency. In addition, government initiatives promoting smart retail infrastructure and digital payment solutions are further driving market expansion.

Japan Commerce Cloud Market Insight

The Japan commerce cloud market is expected to witness the fastest growth rate from 2025 to 2032 due to advanced digital infrastructure, rising e-commerce adoption, and demand for personalized and seamless shopping experiences. Retailers are implementing cloud platforms integrated with AI and analytics to optimize inventory, pricing, and customer engagement. The country’s aging population is also promoting the adoption of digital retail solutions for convenience and efficiency across both online and offline channels.

China Commerce Cloud Market Insight

The China commerce cloud market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid e-commerce penetration, high smartphone adoption, and increasing digital transformation among retailers. Businesses are leveraging AI-powered commerce platforms to deliver personalized experiences, optimize operations, and support omnichannel retail strategies. The push for smart retail cities and strong domestic cloud providers are key factors fueling the market growth in China.

Commerce Cloud Market Share

The Commerce Cloud industry is primarily led by well-established companies, including:

- SAP (Germany)

- IBM (U.S.)

- Oracle (U.S.)

- Optimizely, Inc. (U.S.)

- Elastic Path Software Inc. (Canada)

- Lightwell Inc. (U.S.)

- BigCommerce Pty. Ltd. (Australia)

- Accenture (Ireland)

- Apptus Technologies AB (Sweden)

- Adobe (U.S.)

- Shopify (Canada)

- Digital River, Inc. (U.S.)

- VTEX (Brazil)

- commercetools GmbH (Germany)

- Kibo Commerce (U.S.)

- Sitecore (U.S.)

- AOE (Germany)

Latest Developments in Global Commerce Cloud Market

- In May 2024, Salesforce introduced three new commerce cloud innovations aimed at enhancing commerce site development and checkout processes. These updates enable highly personalized customer experiences, optimize revenue generation, and support seamless omnichannel integration. By addressing rising consumer expectations for faster, more intuitive e-commerce interactions, the innovations strengthen Salesforce’s position in the global commerce cloud market and drive broader adoption among retailers

- In September 2023, Merkle launched a global accelerator for Salesforce Commerce Cloud, improving its integration with Contentful and Magnolia. This development provides a modern, composable, API-first architecture that accelerates brand implementation and front-end development. The tool streamlines content management integration, reduces time to market, enhances innovation in customer experiences, and reinforces Merkle’s leadership in eCommerce technology adoption globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.