Global Commercial Air Conditioner Market

Market Size in USD Billion

CAGR :

%

USD

34.43 Billion

USD

56.72 Billion

2024

2032

USD

34.43 Billion

USD

56.72 Billion

2024

2032

| 2025 –2032 | |

| USD 34.43 Billion | |

| USD 56.72 Billion | |

|

|

|

|

Commercial Air Conditioner Market Size

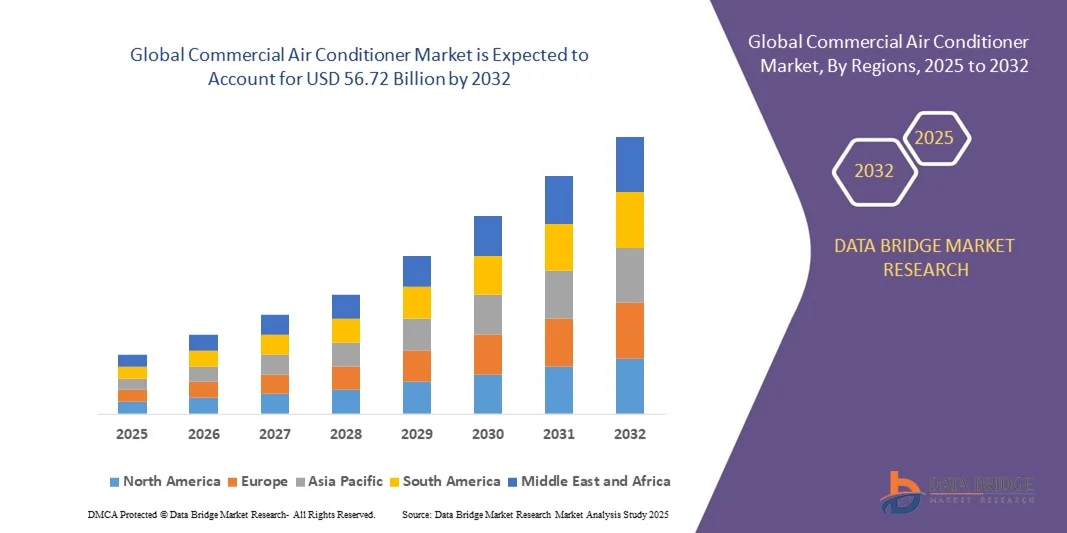

- The global commercial air conditioner market size was valued at USD 34.43 billion in 2024 and is expected to reach USD 56.72 billion by 2032, at a CAGR of 6.44% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient cooling solutions in commercial buildings, offices, and retail spaces

- Rising urbanization, infrastructure development, and expansion of the hospitality and healthcare sectors are driving higher adoption of commercial air conditioning systems

Commercial Air Conditioner Market Analysis

- The market is witnessing steady growth due to technological advancements in HVAC systems, including smart controls, inverter technology, and IoT-enabled solutions

- Increasing investments in retrofitting and upgrading existing commercial buildings with advanced cooling solutions are shaping the market dynamics

- North America dominated the commercial air conditioner market with the largest revenue share in 2024, driven by rapid commercial construction, urbanization, and growing adoption of energy-efficient and smart HVAC systems. Businesses and commercial buildings increasingly prioritize indoor comfort, energy savings, and sustainability compliance, fueling market growth

- Asia-Pacific region is expected to witness the highest growth rate in the global commercial air conditioner market, driven by rising urbanization, rapid industrial and commercial development, increasing disposable incomes, and growing adoption of energy-efficient and smart HVAC technologies in countries such as China, Japan, and India. Government initiatives promoting sustainable buildings and digitalization further accelerate market growth

- The Centralized AC segment held the largest market revenue share in 2024, driven by its ability to efficiently cool large commercial spaces such as offices, hotels, and hospitals. Centralized systems offer superior energy management, scalability, and integration with building management systems, making them highly preferred for large-scale commercial applications. These systems also support sustainability initiatives and reduce operational costs over time

Report Scope and Commercial Air Conditioner Market Segmentation

|

Attributes |

Commercial Air Conditioner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Commercial Air Conditioner Market Trends

Rise of Energy-Efficient and Smart Air Conditioning Solutions

- The growing focus on energy efficiency and smart building integration is transforming the commercial air conditioner landscape. Advanced systems with inverter technology, IoT connectivity, and automated controls allow precise temperature management, reducing energy consumption and operational costs in offices, retail spaces, and industrial facilities. These solutions also support sustainability goals and reduce carbon footprints across commercial buildings

- The increasing demand for smart HVAC solutions in urban and developing regions is accelerating the adoption of connected air conditioners. These systems enable remote monitoring, predictive maintenance, and seamless integration with building management systems, improving overall operational efficiency and occupant comfort. In addition, the analytics capabilities of these devices help in optimizing energy usage and reducing downtime

- The affordability and ease of installation of modern commercial air conditioners are making them attractive for retrofitting existing buildings as well as new constructions. Businesses benefit from reduced energy bills, improved indoor air quality, and enhanced environmental compliance. The modular design of many systems also allows for scalable deployment in varied commercial spaces

- For instance, in 2023, several commercial complexes in Southeast Asia reported a significant drop in energy usage after installing smart air conditioners with IoT-enabled monitoring, resulting in cost savings and improved sustainability credentials. Facility managers were able to track energy consumption patterns and adjust operations dynamically, maximizing efficiency and ROI

- While smart and energy-efficient AC solutions are driving market growth, their impact depends on continued innovation, affordability, and skilled installation. Manufacturers must focus on localized product development and deployment strategies to fully capitalize on this growing demand. Collaboration with service providers and training programs can further enhance adoption and system performance

Commercial Air Conditioner Market Dynamics

Driver

Rising Commercial Construction and Urbanization

- The rapid growth of commercial infrastructure, including offices, hotels, hospitals, and retail complexes, is driving the demand for advanced air conditioning systems. Modern buildings increasingly require efficient and reliable cooling solutions to ensure occupant comfort and meet regulatory standards. Expansion of smart cities and urban redevelopment projects further fuel this demand

- Businesses are recognizing the financial and operational benefits of energy-efficient HVAC systems, leading to higher adoption of smart and inverter-based commercial air conditioners. The push for green buildings and LEED certification further encourages investment in advanced cooling solutions. Efficient systems also enhance property value and reduce maintenance costs over the long term

- Government initiatives promoting sustainable urban development and energy-efficient building standards are supporting market growth. Subsidies, tax incentives, and energy efficiency regulations encourage adoption of advanced commercial AC systems. In addition, public awareness campaigns and green building certifications motivate commercial tenants to demand modern AC technologies

- For instance, in 2022, several urban development projects in North America and Europe mandated energy-efficient HVAC installations, boosting demand for smart commercial air conditioners across residential and commercial segments. The integration of automated and IoT-enabled HVAC systems helped building operators reduce energy consumption and meet regulatory benchmarks

- While infrastructure growth is driving the market, challenges such as high upfront costs and technical integration remain. Manufacturers must address these barriers through cost optimization, service support, and product innovation to sustain adoption. Partnerships with energy consultants and building management system integrators are helping to overcome these hurdles

Restraint/Challenge

High Capital Investment and Maintenance Costs

- The high upfront cost of advanced commercial air conditioning systems, including smart and inverter models, limits adoption among small and medium-sized enterprises. These systems often require specialized installation and maintenance, increasing overall expenditure. Additional expenses for training personnel and integrating with existing building systems can further delay adoption

- In many regions, the lack of trained personnel for installation, servicing, and system optimization reduces access to advanced AC solutions. This can lead to inefficiencies and lower performance if systems are not properly maintained. Continuous training programs and regional service centers are needed to support market expansion and ensure reliable system performance

- Supply chain disruptions and limited availability of high-quality components can further constrain market penetration, particularly in emerging economies. Businesses may rely on older, less efficient units due to cost and logistical limitations. In addition, fluctuating raw material prices and import dependencies can impact system pricing and deployment timelines

- For instance, in 2023, several commercial projects in Sub-Saharan Africa reported delays in AC installation due to limited availability of inverter-based units and skilled technicians. These delays affected construction timelines and increased operational costs for building developers. Governments and private stakeholders are exploring local manufacturing and training initiatives to mitigate such challenges

- While technological advancements continue to improve energy efficiency and system reliability, addressing capital costs and technical support challenges remains crucial for sustained market growth. Adoption of financing solutions, leasing models, and service contracts can help businesses overcome financial barriers while accelerating deployment of advanced commercial AC systems

Commercial Air Conditioner Market Scope

The market is segmented on the basis of product, application, distribution channel, and installation type

- By Product

On the basis of product, the commercial air conditioner market is segmented into Room AC, Ducted AC, Ductless AC, and Centralized AC. The Centralized AC segment held the largest market revenue share in 2024, driven by its ability to efficiently cool large commercial spaces such as offices, hotels, and hospitals. Centralized systems offer superior energy management, scalability, and integration with building management systems, making them highly preferred for large-scale commercial applications. These systems also support sustainability initiatives and reduce operational costs over time.

The Room AC segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its ease of installation, cost-effectiveness, and suitability for smaller commercial spaces. Room ACs are increasingly adopted in offices, retail outlets, and healthcare facilities where targeted cooling and energy efficiency are key priorities. The growing trend of modular and flexible installation solutions further supports this growth.

- By Application

On the basis of application, the market is segmented into Commercial Offices and Retail, Healthcare, Transportation, Hospitality, and Others. The Commercial Offices and Retail segment held the largest revenue share in 2024 due to rapid urbanization, the expansion of office complexes, malls, and retail chains, and the need for reliable cooling solutions. Energy-efficient and smart air conditioning systems are increasingly demanded to reduce operational costs and improve indoor comfort.

The Hospitality segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising number of hotels, resorts, and serviced apartments across urban and developing regions. Modern establishments are focusing on sustainability and guest comfort, driving adoption of energy-efficient and IoT-enabled commercial AC systems. The expansion of tourism and hospitality infrastructure further accelerates market growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Multi-brand Stores, Exclusive Stores, Online, and Other Distribution Channels. The Multi-brand Stores segment held the largest market share in 2024 due to wide physical presence, variety of products, and comprehensive after-sales support. Customers prefer multi-brand outlets for easier product comparisons and immediate availability of multiple AC models. These stores also provide installation and maintenance services, increasing consumer confidence.

The Online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising e-commerce adoption, convenience in comparing features and prices, and doorstep delivery options. Online platforms are increasingly offering installation packages and warranties, making digital sales an attractive option for commercial buyers. The shift toward digital procurement is further supported by the growing acceptance of smart AC technologies.

- By Installation Type

On the basis of installation type, the market is segmented into New Installation and Retrofit. The New Installation segment dominated in 2024, driven by rapid commercial construction, infrastructure development, and green building projects. Businesses prefer new installations to incorporate energy-efficient systems from the start, which reduces long-term operational costs and complies with environmental regulations.

The Retrofit segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the need to upgrade existing buildings with smart, IoT-enabled, and energy-efficient AC systems. Retrofitting helps organizations reduce energy bills, meet sustainability standards, and enhance indoor comfort. Rising awareness of green building certifications and government incentives further encourages retrofit installations.

Commercial Air Conditioner Market Regional Analysis

- North America dominated the commercial air conditioner market with the largest revenue share in 2024, driven by rapid commercial construction, urbanization, and growing adoption of energy-efficient and smart HVAC systems. Businesses and commercial buildings increasingly prioritize indoor comfort, energy savings, and sustainability compliance, fueling market growth

- Consumers and facility managers in the region highly value advanced features such as inverter technology, IoT-enabled monitoring, and integration with building management systems. The widespread adoption of smart building solutions and retrofitting projects further supports the demand for modern commercial AC systems

- The market is further bolstered by high disposable incomes, strong infrastructure development, and supportive government policies promoting energy-efficient buildings, establishing commercial air conditioners as a critical investment across offices, retail spaces, and hospitality facilities

U.S. Commercial Air Conditioner Market Insight

The U.S. commercial air conditioner market captured the largest revenue share in North America in 2024, driven by rapid urbanization, expansion of office complexes, hospitals, and retail chains, and increasing adoption of energy-efficient HVAC systems. Facility managers are prioritizing sustainability, operational efficiency, and reduced energy costs through smart and IoT-enabled AC installations. Government incentives, green building certifications, and growing demand for retrofitted systems in older buildings further accelerate market expansion.

Europe Commercial Air Conditioner Market Insight

The Europe commercial air conditioner market is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent energy efficiency regulations and rising urbanization. Businesses are increasingly investing in smart and eco-friendly HVAC solutions to comply with environmental standards and reduce operational costs. The demand spans across offices, commercial complexes, healthcare facilities, and hospitality projects, with a growing trend for retrofitting older buildings with energy-efficient systems.

U.K. Commercial Air Conditioner Market Insight

The U.K. commercial air conditioner market is expected to witness rapid growth from 2025 to 2032, driven by the expansion of commercial real estate, growing adoption of smart building solutions, and the push for sustainable energy management. Rising energy costs and regulatory mandates for energy efficiency are encouraging commercial establishments to upgrade or install advanced AC systems. The integration of smart thermostats, IoT controls, and predictive maintenance solutions is further propelling market adoption.

Germany Commercial Air Conditioner Market Insight

The Germany commercial air conditioner market is expected to witness significant growth from 2025 to 2032, fueled by high awareness of energy efficiency, strong infrastructure development, and a focus on environmentally sustainable solutions. Smart and inverter-based commercial AC systems are increasingly adopted in offices, hotels, hospitals, and industrial buildings. Integration with building management systems and the demand for retrofitting older constructions with energy-efficient solutions are key growth drivers.

Asia-Pacific Commercial Air Conditioner Market Insight

The Asia-Pacific commercial air conditioner market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expansion of commercial and industrial infrastructure in countries such as China, Japan, and India. The region is seeing a growing focus on energy-efficient, IoT-enabled, and smart AC solutions for offices, retail spaces, healthcare, and hospitality sectors. Government initiatives promoting digitalization and sustainable building practices further boost market adoption.

Japan Commercial Air Conditioner Market Insight

The Japan commercial air conditioner market is expected to witness significant growth from 2025 to 2032, supported by rapid urbanization, technological advancements, and rising demand for energy-efficient HVAC systems. The integration of AC systems with IoT-enabled building management, smart energy solutions, and predictive maintenance is driving adoption across commercial buildings. Japan’s aging population and emphasis on operational efficiency in commercial spaces are also creating additional demand for user-friendly and reliable cooling solutions.

China Commercial Air Conditioner Market Insight

The China commercial air conditioner market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expansion of commercial and industrial infrastructure, and high adoption of energy-efficient and smart AC solutions. China’s commercial real estate growth, smart city projects, and availability of affordable, technologically advanced AC systems are major factors propelling the market. Increasing awareness of energy efficiency and sustainability further supports adoption across offices, retail, hospitality, and healthcare sectors.

Commercial Air Conditioner Market Share

The Commercial Air Conditioner industry is primarily led by well-established companies, including:

• Carrier (U.S.)

• DAIKIN INDUSTRIES, Ltd (Japan)

• FUJITSU GENERAL (Japan)

• Haier Inc (China)

• Hitachi, Ltd. (Japan)

• LG Electronics (South Korea)

• Mitsubishi Electric Corporation (Japan)

• Panasonic Corporation (Japan)

• SAMSUNG (South Korea)

• AIREDALE INTERNATIONAL AIR CONDITIONING LTD. (U.K.)

• Gree (China)

• Emerson Electric Co. (U.S.)

• Midea Group (China)

• Ingersoll-Rand plc (Ireland)

• Toshiba India Pvt. Ltd. (India)

• Voltas, Inc. (India)

• Blue Star Limited (India)

• Danfoss A/S (Denmark)

• Secop GmbH (Germany)

• Embraco (Brazil)

Latest Developments in Global Commercial Air Conditioner Market

- In August 2025, Carrier (U.S.) launched a new line of eco-friendly commercial air conditioners. The systems feature advanced refrigerants with lower global warming potential, promoting sustainability and energy efficiency. This development positions Carrier as a leader in environmentally conscious HVAC technology, attracting environmentally aware clients and strengthening its brand in the green building sector. The launch is expected to drive adoption of sustainable cooling solutions across offices, retail spaces, and industrial facilities, positively impacting overall market growth

- In September 2025, Trane Technologies (Ireland) announced a strategic partnership with a technology firm to integrate AI-driven analytics into its HVAC systems. The initiative enables predictive maintenance, energy optimization, and real-time monitoring, enhancing operational efficiency for commercial buildings. By adopting advanced smart building technologies, Trane aims to gain a competitive edge in the digital transformation of the HVAC market. This development is expected to accelerate the adoption of connected and intelligent air conditioning solutions, particularly in urban and energy-conscious markets

- In July 2025, Daikin (Japan) expanded its manufacturing facilities in Southeast Asia. The expansion increases production capacity to meet rising regional demand for commercial air conditioners and reduces lead times for delivery. This move strengthens Daikin’s market position in rapidly growing Asian markets and supports faster response to changing customer requirements. The development is expected to enhance supply chain efficiency, improve market penetration, and contribute to overall growth in the Asia-Pacific commercial AC market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.