Global Commercial Air Filter Market

Market Size in USD Billion

CAGR :

%

USD

17.08 Billion

USD

26.91 Billion

2025

2033

USD

17.08 Billion

USD

26.91 Billion

2025

2033

| 2026 –2033 | |

| USD 17.08 Billion | |

| USD 26.91 Billion | |

|

|

|

|

Global Commercial Air Filter Market Size

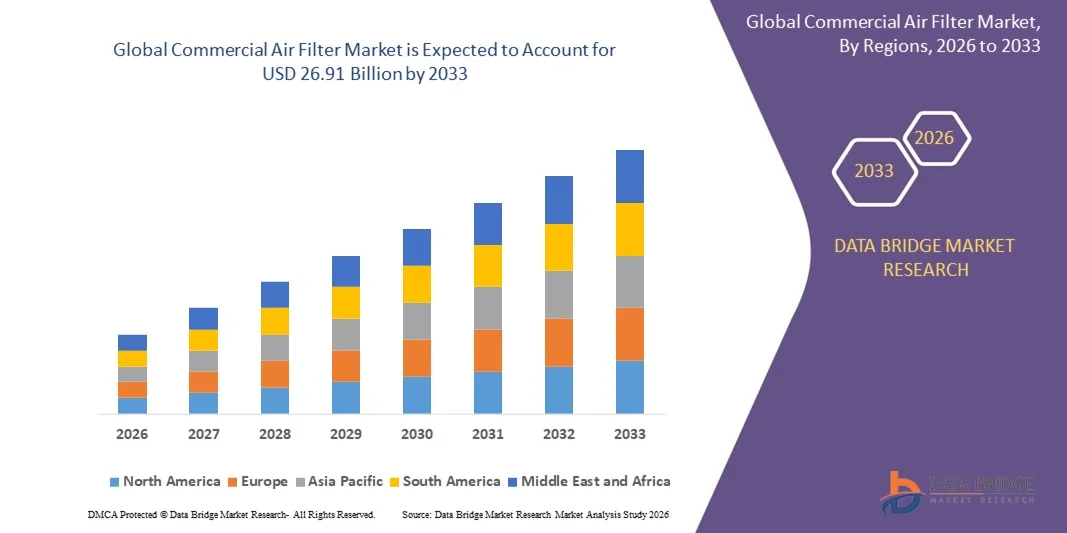

- The global Commercial Air Filter Market was valued at USD 17.08 billion in 2025 and is projected to reach USD 26.91 billion by 2033, registering a strong CAGR of 5.85% throughout the forecast period.

- Market expansion is primarily driven by the rising emphasis on indoor air quality, coupled with advancing filtration technologies across commercial, industrial, and institutional environments, supporting widespread digitalization and automation in air management systems.

- Additionally, increasing demand for efficient, reliable, and health-focused air purification solutions is positioning commercial air filters as essential components for modern facilities. These converging trends are accelerating product adoption and significantly propelling overall market growth.

Global Commercial Air Filter Market Analysis

- Commercial air filters, essential for removing particulate matter and contaminants from HVAC systems, are becoming increasingly critical components across commercial, industrial, and institutional facilities due to their ability to enhance indoor air quality, improve system efficiency, and support compliance with stringent ventilation and safety regulations.

- The rising demand for commercial air filters is primarily driven by growing awareness of air quality standards, heightened concerns about airborne pollutants, and an expanding preference for high-efficiency, low-maintenance filtration solutions across sectors such as healthcare, offices, data centers, and manufacturing.

- Europe dominated the Global Commercial Air Filter Market with the largest revenue share of 33.5% in 2025, supported by advanced HVAC infrastructure, strict environmental norms, and a strong presence of leading filtration manufacturers, with the U.S. experiencing significant adoption across hospitals, cleanrooms, and commercial buildings driven by technological advancements in HEPA, ULPA, and smart filtration systems.

- Asia-Pacific is expected to be the fastest-growing region in the Global Commercial Air Filter Market during the forecast period, attributed to rapid urbanization, expanding commercial construction, and rising concerns over pollution levels in densely populated cities.

- The HEPA Filters segment dominated the market with the largest market revenue share of 38.6% in 2025, driven by its proven ability to capture ultrafine particles and meet stringent indoor air quality standards across healthcare, cleanrooms, pharmaceutical facilities, and commercial buildings

Report Scope and Global Commercial Air Filter Market Segmentation

|

Attributes |

Commercial Air Filter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Commercial Air Filter Market Trends

Advancements in AI-Driven Filtration and Smart HVAC Integration

- A significant and accelerating trend in the Global Commercial Air Filter Market is the growing integration of artificial intelligence (AI) and smart building ecosystems, enabling more efficient, adaptive, and automated air quality management across commercial and industrial environments.

- For Instance, advanced HVAC systems equipped with AI-driven sensors can automatically adjust airflow and filtration levels based on real-time particulate concentration, occupancy, and environmental conditions, ensuring optimal indoor air quality while reducing energy consumption.

- AI-enabled commercial air filtration solutions can also learn building usage patterns, predict filter saturation, and provide intelligent maintenance alerts. Many modern filtration units now incorporate smart sensors that track air pollutant levels, temperature, and humidity, allowing facility managers to make data-driven decisions and schedule timely filter replacements.

- The seamless connectivity of commercial air filters with broader Building Management Systems (BMS) and smart HVAC platforms enables centralized control of ventilation, filtration, and climate systems through a unified interface, enhancing operational efficiency and enabling automated responses to fluctuating indoor air quality conditions.

- This shift toward intelligent, self-optimizing air filtration systems is reshaping expectations for commercial facility management. As a result, leading manufacturers are developing AI-integrated filters capable of adaptive airflow control, predictive diagnostics, and remote monitoring through cloud-based platforms.

- The demand for AI-enabled, smart-connected commercial air filtration solutions is rapidly increasing across sectors such as healthcare, cleanrooms, data centers, and office buildings, as organizations prioritize healthier indoor environments, energy efficiency, and comprehensive smart facility functionality.

Global Commercial Air Filter Market Dynamics

Driver

Growing Need Due to Rising Air Quality Concerns and Regulatory Compliance

- The increasing prevalence of indoor air quality concerns across commercial, industrial, and institutional facilities—combined with stricter global ventilation and safety regulations—is a major driver behind the escalating demand for commercial air filters.

- For instance, many governments and health agencies have strengthened air quality guidelines for workplaces, hospitals, and cleanrooms, prompting organizations to upgrade filtration systems and adopt higher-efficiency solutions such as HEPA and ULPA filters. Such regulatory initiatives are expected to drive market growth throughout the forecast period.

- As businesses and facility managers become more aware of the health risks associated with airborne pollutants, allergens, and industrial contaminants, commercial air filters provide critical benefits including improved occupant well-being, reduced HVAC system strain, and compliance with evolving standards.

- Furthermore, the rising adoption of smart building solutions and the push toward healthier, energy-efficient work environments are making advanced filtration systems essential components of modern infrastructure, offering seamless integration with HVAC equipment and Building Management Systems (BMS).

- The ability of commercial air filters to support cleaner environments, enhance ventilation performance, and provide measurable improvements in indoor air quality is driving adoption across sectors such as healthcare, manufacturing, hospitality, and commercial office spaces.

Restraint/Challenge

Concerns Regarding High Operational Costs and Filter Disposal Issues

- Despite strong market demand, concerns surrounding the high operational and maintenance costs of advanced commercial air filtration systems present a significant challenge to broader adoption, particularly for cost-sensitive facilities or small businesses.

- Frequent filter replacements, energy consumption associated with high-efficiency filters, and increased HVAC load can raise overall operational expenses, making some organizations hesitant to adopt premium filtration solutions.

- Addressing these concerns requires innovations such as low-resistance filter media, extended-life filters, and energy-efficient HVAC integration. Leading companies highlight the long-term cost savings of optimized filtration systems, emphasizing reduced downtime and improved equipment longevity.

- Another challenge is the environmental impact and disposal of used filters, especially those capturing hazardous particulate matter or requiring special handling. Disposal regulations and sustainability considerations may increase operational burdens for facility managers.

- While manufacturers are increasingly developing eco-friendly materials and recyclable filter components, concerns regarding cost, sustainability, and compliance continue to affect purchasing decisions.

- Overcoming these obstacles through technological advancements, cost-effective filter designs, and broader adoption of sustainable filtration materials will be crucial for long-term market expansion.

Global Commercial Air Filter Market Scope

The commercial air filter market is segmented on the basis of product and end use.

- By Product

On the basis of product, the Global Commercial Air Filter Market is segmented into Dust Collectors, Oil Mist Collectors, HEPA Filters, Cartridge Collectors & Filters (CC&F), Baghouse Filters, Welding Fume Extractors, Wet Scrubbers, and Dry Scrubbers. The HEPA Filters segment dominated the market with the largest market revenue share of 38.6% in 2025, driven by its proven ability to capture ultrafine particles and meet stringent indoor air quality standards across healthcare, cleanrooms, pharmaceutical facilities, and commercial buildings. HEPA filters remain the preferred option for environments requiring high air purity, and their compatibility with advanced HVAC systems further boosts adoption.

The Cartridge Collectors & Filters (CC&F) segment is anticipated to witness the fastest growth rate of 20.4% from 2026 to 2033, fueled by rising use in metalworking, industrial processing, and general manufacturing sectors. CC&F units offer high filtration efficiency, long filter life, and cost-effective maintenance, making them attractive for industries facing increasing regulatory pressure and expanding production operations.

- By End Use

On the basis of end use, the Global Commercial Air Filter Market is segmented into Manufacturing, Cement, Food, Metals, Power, Pharmaceutical, Agriculture, Paper & Pulp and Woodworking, Plastic, and Others. The Manufacturing segment accounted for the largest market revenue share of 34.1% in 2025, driven by the sector’s need to control airborne contaminants to protect equipment, ensure worker safety, and maintain product integrity. Manufacturing facilities rely heavily on dust collectors, baghouse systems, and HEPA filtration to comply with industrial emissions and workplace air quality standards.

The Pharmaceutical segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, supported by growing investment in cleanrooms, sterile production lines, and biotechnology expansion. Strict regulatory guidelines from global health authorities and the rising demand for biologics, vaccines, and precision medicines are accelerating the adoption of high-efficiency air filtration solutions, particularly HEPA and ULPA systems, across pharmaceutical plants and research facilities.

Global Commercial Air Filter Market Regional Analysis

- Europe dominated the Global Commercial Air Filter Market with the largest revenue share of 33.5% in 2025, driven by stringent indoor air quality regulations, widespread adoption of advanced HVAC systems, and increased emphasis on creating healthier commercial and industrial environments.

- Facilities across the region highly value the efficiency, reliability, and enhanced filtration performance offered by modern air filters, particularly HEPA, ULPA, and high-capacity dust collection systems that integrate seamlessly with smart HVAC and building management platforms.

- This strong adoption is further supported by high infrastructure investment, a technologically advanced industrial base, and growing awareness of airborne contaminants and workplace safety standards, positioning commercial air filtration solutions as essential for hospitals, offices, manufacturing plants, and cleanroom environments.

U.S. Commercial Air Filter Market Insight

The U.S. commercial air filter market captured the largest revenue share of 81% in North America in 2025, driven by stringent indoor air quality regulations and rapid adoption of advanced HVAC technologies across commercial, healthcare, and industrial facilities. Increasing concerns regarding airborne pollutants, allergens, and occupational safety continue to fuel demand for high-efficiency filtration solutions such as HEPA, ULPA, and baghouse systems. The trend toward smart buildings and automation also supports growth, as U.S. businesses increasingly integrate smart filtration systems with HVAC controls and building management platforms. Rising investments in hospitals, cleanrooms, and data centers further reinforce market expansion, positioning the U.S. as the dominant contributor within the region.

Europe Commercial Air Filter Market Insight

The Europe commercial air filter market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict environmental and workplace safety regulations and the rising need for enhanced indoor air quality in commercial, industrial, and public buildings. Urbanization and increased construction of residential and commercial complexes have heightened demand for efficient air purification systems. European consumers and businesses value energy-efficient, sustainable filtration solutions, aligning with the region’s strong emphasis on green building standards. Growth is prominent across sectors such as healthcare, pharmaceuticals, food processing, and manufacturing, with air filters being incorporated into both new infrastructure projects and modernization initiatives.

U.K. Commercial Air Filter Market Insight

The U.K. commercial air filter market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising emphasis on indoor air quality improvement, regulatory compliance, and increasing adoption of modern HVAC systems. Concerns related to pollution, allergens, and workplace health standards are prompting businesses, schools, and commercial buildings to adopt high-efficiency filtration systems. The country’s strong shift toward smart buildings and sustainable construction further supports air filter deployment. Additionally, the expansion of the healthcare, data center, and pharmaceutical industries contributes significantly to future market growth.

Germany Commercial Air Filter Market Insight

The Germany commercial air filter market is expected to expand at a considerable CAGR during the forecast period, supported by the nation’s well-established industrial base, high manufacturing activity, and strong emphasis on environmental sustainability and technological innovation. German consumers and businesses prioritize high-performance, eco-friendly filtration systems, resulting in rising demand for HEPA, ULPA, and advanced dust collection technologies. Integration of filtration systems with smart HVAC platforms is becoming increasingly common, particularly in commercial buildings and cleanroom environments. Germany’s continued investment in green buildings and industrial modernization is expected to further accelerate adoption.

Asia-Pacific Commercial Air Filter Market Insight

The Asia-Pacific commercial air filter market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by rapid urbanization, industrial expansion, and rising awareness of air pollution across countries such as China, Japan, India, and South Korea. Increasing construction of commercial complexes, hospitals, and manufacturing plants supports widespread adoption of high-efficiency filtration systems. Government initiatives promoting clean air, workplace safety, and smart infrastructure development further accelerate the shift toward advanced commercial air filters. As APAC emerges as a global manufacturing hub, the availability of cost-effective filtration systems enhances market penetration.

Japan Commercial Air Filter Market Insight

The Japan commercial air filter market is gaining traction owing to the country’s high-tech infrastructure, aging population, and strong focus on health, cleanliness, and efficiency. Japanese businesses prioritize advanced filtration systems to maintain safe, contaminant-free environments in offices, hospitals, electronics manufacturing, and cleanrooms. Integration with IoT-enabled HVAC systems and smart building platforms is becoming increasingly prevalent. Additionally, Japan’s commitment to sustainable design and strict ventilation standards fuels demand for high-efficiency HEPA and multi-stage filter systems across commercial and industrial sectors.

China Commercial Air Filter Market Insight

The China commercial air filter market accounted for the largest revenue share in Asia Pacific in 2025, driven by the country’s rapid industrialization, expanding middle class, and increasing emphasis on combating severe air pollution. China represents one of the world’s largest markets for HVAC systems and commercial filtration technologies, with strong adoption across manufacturing plants, hospitals, schools, and commercial buildings. Government initiatives promoting clean air and smart city development further boost demand for high-efficiency filtration systems. The presence of robust domestic manufacturers also enhances product affordability and accelerates deployment across diverse applications.

Global Commercial Air Filter Market Share

The Commercial Air Filter industry is primarily led by well-established companies, including:

• Camfil (Sweden)

• Donaldson Company (U.S.)

• Freudenberg Filtration Technologies (Germany)

• Filtration Group (U.S.)

• Parker Hannifin (U.S.)

• 3M (U.S.)

• Eaton Corporation (U.S.)

• MANN+HUMMEL (Germany)

• Ahlstrom-Munksjö (Finland)

• Alfa Laval (Sweden)

• Pall Corporation (U.S.)

• Graver Technologies (U.S.)

• AAF International (U.S.)

• Hollingsworth & Vose (U.S.)

• Sysco Filters (U.S.)

• NIHON FILTRATION (Japan)

• Koch Filter (U.S.)

• Mann+Hummel PowerCore (Germany)

• BOSS Filters (Switzerland)

• Parker Filtration Solutions (U.S.)

What are the Recent Developments in Global Commercial Air Filter Market?

- In April 2024, Camfil Group, a global leader in air filtration solutions, launched a strategic initiative in South Africa to enhance indoor air quality across commercial and industrial facilities. The program focuses on deploying advanced HEPA and cartridge filtration systems in hospitals, offices, and manufacturing plants. This initiative highlights Camfil’s commitment to delivering innovative, reliable air filtration solutions tailored to regional environmental and regulatory needs, while strengthening its position in the rapidly growing global commercial air filter market.

- In March 2024, Donaldson Company Inc., a U.S.-based filtration specialist, introduced its PowerCore Cartridge Collector System designed specifically for industrial manufacturing and food processing facilities. The system offers high-efficiency particulate removal and low-maintenance operation, addressing stringent air quality regulations and improving workplace safety. This launch underscores Donaldson’s focus on developing advanced filtration technologies that enhance operational efficiency and compliance in industrial environments.

- In March 2024, Honeywell International Inc. successfully deployed the Bengaluru Clean Air Initiative, a smart commercial air filtration project aimed at improving indoor air quality in urban public and commercial spaces. The project integrates state-of-the-art HEPA and smart HVAC filtration technologies to create healthier, more resilient environments. Honeywell’s involvement demonstrates the increasing role of advanced air filtration solutions in promoting urban health and workplace safety.

- In February 2024, AAF International, a leading provider of industrial and commercial filtration solutions, announced a strategic partnership with the European Clean Air Alliance to establish a marketplace for high-efficiency commercial air filters. This collaboration aims to streamline access to advanced filtration technologies for businesses and industrial facilities, enhancing air quality, operational efficiency, and regulatory compliance.

- In January 2024, Freudenberg Filtration Technologies unveiled its Next-Gen HEPA Smart Filter at the International Air Quality Expo 2024. This innovative product integrates IoT-enabled monitoring and predictive maintenance features, allowing facility managers to remotely track filter performance and optimize replacement schedules. The launch emphasizes Freudenberg’s commitment to combining advanced technology with sustainable air filtration solutions, ensuring cleaner, safer indoor environments for commercial and industrial applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.