Global Commercial Beverage Blender Market

Market Size in USD Billion

CAGR :

%

USD

10.88 Billion

USD

14.48 Billion

2024

2032

USD

10.88 Billion

USD

14.48 Billion

2024

2032

| 2025 –2032 | |

| USD 10.88 Billion | |

| USD 14.48 Billion | |

|

|

|

|

Commercial Beverage Blender Market Size

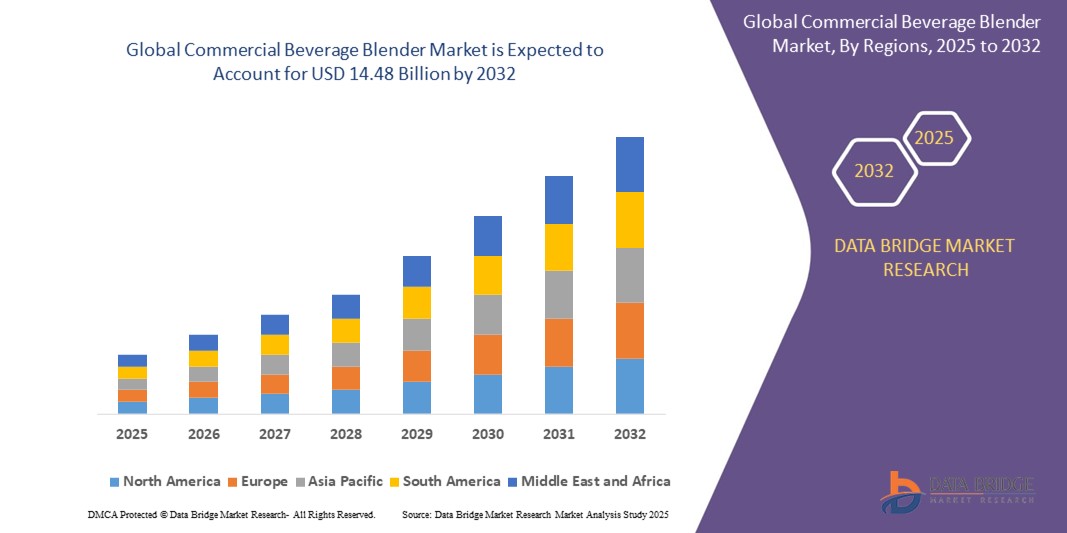

- The global commercial beverage blender market size was valued at USD 10.88 billion in 2024 and is expected to reach USD 14.48 billion by 2032, at a CAGR of 3.64% during the forecast period

- The market growth is largely fueled by the rising demand for high-performance, durable blending solutions across the foodservice industry, including cafés, juice bars, restaurants, and hotels. Increasing consumer preference for health-focused beverages such as smoothies, protein shakes, and cold-pressed juices is driving establishments to invest in advanced commercial blenders that offer speed, consistency, and multifunctionality

- Furthermore, the growing emphasis on energy-efficient appliances, combined with rapid innovation in motor technology and material durability, is encouraging widespread adoption. These converging factors are accelerating the deployment of commercial beverage blenders across diverse hospitality settings, thereby significantly boosting the industry's growth

Commercial Beverage Blender Market Analysis

- Commercial beverage blenders are high-powered appliances used in foodservice establishments to prepare a wide variety of beverages including smoothies, milkshakes, cocktails, and health drinks. These machines are designed for continuous use and are equipped with features such as variable speed control, high-capacity containers, noise reduction, and advanced blade technologies to ensure consistency and efficiency

- The rising demand for fresh, customized beverages and the global shift toward health-conscious consumption are primary drivers of market expansion. In addition, the surge in commercial food and beverage outlets, particularly in urban areas, is fostering increased adoption of commercial-grade blending solutions across both developed and emerging economies

- North America dominated commercial beverage blender market with a share of 38% in 2024, due to high demand from the foodservice industry, including cafes, restaurants, and quick-service chains

- Europe is expected to be the fastest growing region in the commercial beverage blender market during the forecast period due to growing demand for energy-efficient appliances and the rise in specialty beverage offerings in cafés and hotels

- Multifunction blender segment dominated the market with a market share of 48% in 2024, due to its versatility in handling a wide range of beverage preparation tasks including blending, pureeing, emulsifying, and even ice-crushing. This makes it the preferred choice for commercial establishments aiming to optimize kitchen operations and reduce the need for multiple appliances. The increasing demand from restaurants and juice bars for high-capacity, time-efficient machines that support diverse menu offerings further strengthens the dominance of this segment

Report Scope and Commercial Beverage Blender Market Segmentation

|

Attributes |

Commercial Beverage Blender Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Commercial Beverage Blender Market Trends

“Rising Demand for Health-Conscious Ingredients”

- The commercial beverage blender market is experiencing robust growth as consumer preferences shift toward healthier, customizable, and on-demand beverage solutions, such as smoothies, protein shakes, and plant-based drinks

- For instance, companies such as Blendtec, Vitamix, Hamilton Beach Brands Holding Company, and Breville USA Inc. are expanding their product lines with high-performance blenders designed to efficiently process fresh fruits, vegetables, and superfoods, catering to juice bars, cafes, and health-focused restaurants

- The adoption of advanced blender technologies—including digital interfaces, variable speed controls, and noise-reduction features—is improving operational efficiency and product consistency for foodservice operators

- The expansion of specialty beverage outlets, such as smoothie chains and cocktail lounges, is fueling demand for durable, large-capacity blenders that can handle continuous, high-volume use

- Sustainability trends are influencing manufacturers to introduce energy-efficient models and materials that are easier to clean and maintain, supporting hygiene and eco-friendly operations

- In conclusion, the convergence of health and wellness trends, technological innovation, and the growth of specialty beverage venues is positioning commercial beverage blenders as an essential tool for the evolving food and beverage industry

Commercial Beverage Blender Market Dynamics

Driver

“Growing Food and Beverage Industry”

- The ongoing expansion of the global food and beverage industry is a primary driver for the commercial beverage blender market, as restaurants, cafes, and hotels seek to diversify their beverage offerings and improve operational efficiency

- For instance, major chains and independent outlets are increasingly investing in commercial-grade blenders to meet rising demand for blended beverages, with companies such as Starbucks and Jamba Juice relying on high-performance equipment to ensure consistency and speed of service

- The proliferation of fast-casual and quick-service restaurants is accelerating blender adoption, as these venues prioritize customizable and healthy drink options to attract health-conscious consumers

- Technological advancements are enabling businesses to streamline workflows, reduce labor costs, and offer a wider variety of beverages, from smoothies to frozen cocktails

- The recovery of the hospitality sector post-pandemic is further boosting demand for commercial beverage blenders, as establishments upgrade equipment to handle increased customer traffic and evolving menu trends

Restraint/Challenge

“High Initial Cost”

- The relatively high upfront investment required for commercial-grade beverage blenders can be a barrier for small businesses and new market entrants

- For instance, independent cafes and juice bars may face challenges in allocating capital for premium blenders with advanced features, especially when compared to residential or entry-level alternatives

- Ongoing maintenance, repair, and replacement costs add to the total cost of ownership, impacting long-term profitability for operators with tight margins

- The need for regular staff training to operate and maintain sophisticated equipment can further strain resources, particularly in high-turnover environments

- Intense competition and price sensitivity in the foodservice industry make it difficult for some businesses to justify the investment in high-end blenders, potentially limiting market penetration among smaller operators

Commercial Beverage Blender Market Scope

The market is segmented on the basis of type, application, end-user, and material.

- By Type

On the basis of type, the commercial beverage blender market is segmented into monofunctional blender, undiluted liquid blender, and multifunction blender. The multifunction blender segment dominated the largest market revenue share of 48% in 2024 due to its versatility in handling a wide range of beverage preparation tasks including blending, pureeing, emulsifying, and even ice-crushing. This makes it the preferred choice for commercial establishments aiming to optimize kitchen operations and reduce the need for multiple appliances. The increasing demand from restaurants and juice bars for high-capacity, time-efficient machines that support diverse menu offerings further strengthens the dominance of this segment.

The undiluted liquid blender segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising demand in specialty beverage applications such as smoothies, concentrated juices, and protein-based drinks. These blenders are particularly suited for handling viscous or thick liquids without compromising on texture or consistency, making them highly suitable for health-conscious consumers and fitness-focused establishments. Their specialized design and increasing adoption across health food outlets and upscale juice bars are key contributors to this segment’s rapid growth.

- By Application

On the basis of application, the market is segmented into catering companies, juice bars, clubs, hotels, and others. The hotel segment accounted for the largest revenue share in 2024, driven by the increasing integration of beverage blenders in hotel kitchens and bars to meet the rising demand for fresh, made-to-order drinks. Hotels prioritize high-performance and durable equipment that can operate continuously during peak hours, and commercial blenders fulfill this need with advanced motor technology and large-capacity containers. The growing trend of health and wellness-focused beverage menus in hospitality chains is also contributing to steady segment growth.

The juice bars segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the global shift toward health-conscious consumption and plant-based diets. Juice bars require blenders that offer quick turnaround, fine texture consistency, and minimal operational noise, making commercial-grade machines indispensable. The proliferation of boutique juice franchises and the popularity of cold-pressed juices and smoothie bowls are fueling demand in this segment.

- By End-User

On the basis of end-user, the market is categorized into JCB, restaurants, and others. The restaurant segment held the highest revenue share in 2024, owing to the essential role beverage blenders play in beverage prep for cocktails, milkshakes, sauces, and mixed drinks. Restaurants rely heavily on blenders that can deliver both speed and consistency while accommodating a high daily volume of use. The rise in casual dining establishments and the expansion of menu offerings to include fresh beverages are central to the segment’s leadership.

The JCB (Juice and Coffee Bar) segment is projected to register the fastest growth from 2025 to 2032, reflecting the expansion of quick-service outlets and the demand for high-speed blending equipment. JCB operators prefer compact yet powerful machines capable of multitasking and handling a variety of textures. The increasing preference for customization in drinks, such as choosing ingredients or adjusting thickness, is pushing JCBs to invest in advanced blending solutions.

- By Material

On the basis of material, the commercial beverage blender market is segmented into plastic containers, stainless-steel containers, and glass containers. Stainless-steel containers dominated the market with the largest revenue share in 2024, primarily due to their superior durability, resistance to odor retention, and ease of sanitation, which are critical in commercial settings. Their ability to withstand high usage frequency and harsh cleaning processes makes them a top choice among hotels and restaurants.

The glass containers segment is expected to witness the fastest growth from 2025 to 2032, owing to the rising demand for aesthetic presentation and material safety. Glass is non-reactive and preferred by outlets emphasizing purity and transparency in beverage preparation, especially in boutique cafes and juice bars. Improvements in tempered glass durability and its compatibility with visual merchandising trends are key factors propelling segment growth.

Commercial Beverage Blender Market Regional Analysis

- North America dominated the commercial beverage blender market with the largest revenue share of 38% in 2024, driven by high demand from the foodservice industry, including cafes, restaurants, and quick-service chains

- The region's well-established hospitality sector, coupled with the rising popularity of smoothies, protein shakes, and specialty beverages, is fueling the adoption of high-performance commercial blenders

- Strong purchasing power, widespread health consciousness, and the rapid expansion of health-focused franchises are contributing to sustained market growth across both the U.S. and Canada

U.S. Commercial Beverage Blender Market Insight

The U.S. commercial beverage blender market captured the largest revenue share in 2024 within North America, owing to the consistent expansion of cafés, juice bars, and health-food chains. The increasing demand for fresh, customized beverages, combined with advancements in blender technologies such as noise reduction and multi-speed functionality, is encouraging widespread adoption. In addition, evolving consumer preferences for plant-based and functional beverages continue to drive market demand.

Europe Commercial Beverage Blender Market Insight

The Europe commercial beverage blender market is projected to register the fastest CAGR over the forecast period, supported by growing demand for energy-efficient appliances and the rise in specialty beverage offerings in cafés and hotels. As wellness and sustainability trends strengthen across European countries, the adoption of blenders made with durable materials and efficient motors is accelerating. The emphasis on healthy lifestyles and premium beverage experiences is pushing establishments to upgrade their blending equipment.

U.K. Commercial Beverage Blender Market Insight

The U.K. commercial beverage blender market is expected to grow significantly, propelled by the proliferation of juice bars, coffee chains, and smoothie-focused outlets. Increased consumer interest in organic and nutrient-rich drinks is prompting foodservice operators to adopt advanced blenders with higher power, speed control, and safety features. The push for reduced food waste and improved energy efficiency also aligns with the adoption of commercial-grade blending solutions.

Germany Commercial Beverage Blender Market Insight

Germany’s market is witnessing steady growth, fueled by demand from both large hotel chains and independent cafés emphasizing high-quality drink offerings. With strong engineering standards and a focus on product longevity and hygiene, German businesses are investing in stainless-steel, high-capacity blenders. Government emphasis on eco-friendly equipment in commercial kitchens is further boosting the market.

Asia-Pacific Commercial Beverage Blender Market Insight

The Asia-Pacific market is experiencing robust growth, driven by rising urbanization, growing middle-class income, and the expansion of international food and beverage chains. Countries such as China, Japan, and India are witnessing an increased demand for fresh beverages, particularly in urban areas. The growth of quick-service restaurants and health-focused cafés is boosting adoption of durable, high-speed blenders that can meet high-volume needs efficiently.

China Commercial Beverage Blender Market Insight

China accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by the booming foodservice sector and an expanding consumer base. With the rise of milk tea chains, juice bars, and Western-style cafés, demand for reliable and high-capacity commercial blenders is surging. Local manufacturers offering cost-effective and technologically advanced solutions are also accelerating market penetration.

Japan Commercial Beverage Blender Market Insight

Japan’s market is growing steadily due to its culture of technological refinement and compact, multifunctional appliances. Demand is especially high in urban cafés and hospitality settings that require efficient, quiet, and space-saving blending solutions. Consumer focus on quality and precision is driving preference for premium models with customizable blending modes and noise-control features.

Commercial Beverage Blender Market Share

The commercial beverage blender industry is primarily led by well-established companies, including:

- Blendtec (U.S.)

- Hamilton Beach Brands, Inc. (U.S.)

- Santos Ltd (France)

- JTC Electronics (Taiwan)

- WARING COMMERCIAL (U.S.)

- Ceado srl (Italy)

- Sammic S.L (Spain)

- Techmate Industries (India)

- Naru Equipment (India)

- Mish Horeca Services (India)

- United Kitchen Equipment (India)

- B S Kitchen Equipments (India)

- Sas Bakery Equipments (India)

- Manibhadra Hotelwares (India)

- Hotelaid (India)

Latest Developments in Global Commercial Beverage Blender Market

- In July 2022, Philips Domestic Appliances India Ltd. launched the HL7703 Mixer Grinder, further expanding its portfolio in the Indian small kitchen appliances market. This model is designed to meet the evolving demands of modern Indian kitchens, featuring a powerful 1000W motor that enables efficient grinding of even the toughest ingredients such as lentils, spices, and ice in just 90 seconds. The appliance is equipped with advanced air ventilation and durable couplers to ensure long-lasting performance. It is available through both offline retail stores and the company’s official e-store, reflecting Philips’ omnichannel approach to reach a wide consumer base across urban and semi-urban regions

- In March 2022, Power Motor introduced a new range of motor solutions specifically engineered for cordless hand blenders, targeting manufacturers seeking lightweight, compact, and energy-efficient designs. Among the offerings were the PT2730 and PT555PM models, which feature a complete motion system integrating a low-voltage permanent magnet DC motor, a dedicated motor driver, and a rechargeable battery pack. These innovations enable cordless hand blenders to deliver consistent torque and speed while improving user mobility and convenience. The development is aimed at enhancing blending performance without compromising on portability, making it ideal for modern kitchen setups and on-the-go usage

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.