Global Commercial Boiler Market

Market Size in USD Billion

CAGR :

%

USD

10.71 Billion

USD

14.88 Billion

2024

2032

USD

10.71 Billion

USD

14.88 Billion

2024

2032

| 2025 –2032 | |

| USD 10.71 Billion | |

| USD 14.88 Billion | |

|

|

|

|

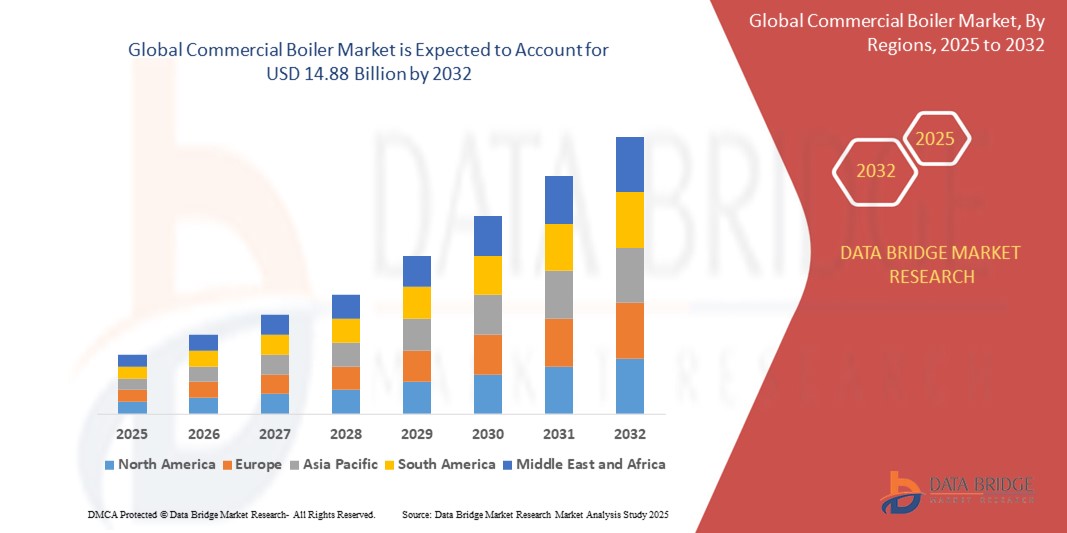

What is the Global Commercial Boiler Market Size and Growth Rate?

- The global commercial boiler market size was valued at USD 10.71 billion in 2024 and is expected to reach USD 14.88 billion by 2032, at a CAGR of 4.20% during the forecast period

- The commercial boiler market is experiencing robust growth due to the increasing demand for efficient and reliable heating solutions across various sectors. As businesses and institutions seek to enhance their operational efficiency and reduce energy costs, commercial boilers are becoming essential components in modern infrastructure. Several factors, including advancements in boiler technology, stringent energy efficiency regulations, and the need for sustainable energy solutions drive the market

What are the Major Takeaways of Commercial Boiler Market?

- Technological advancements play a significant role in shaping the market. Innovations such as condensing boilers, which offer high efficiency by recovering and reusing heat from flue gases, are gaining traction. These technologies improve energy efficiency and contribute to lower operational costs and reduced carbon emissions

- In addition, the integration of advanced control systems and automation features allows for precise temperature management and better performance monitoring, further boosting the appeal of commercial boilers

- North America dominated the commercial boiler market with the largest revenue share of 38.5% in 2024, driven by high demand from commercial buildings, hospitals, and educational institutions, along with stringent energy efficiency regulations

- Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2025 to 2032, led by infrastructure development, urbanization, and rising commercial construction activity across China, India, and Southeast Asia

- The Natural Gas segment dominated the market with the largest revenue share of 46.3% in 2024, owing to its cleaner combustion profile, cost-effectiveness, and widespread availability across developed and emerging economies

Report Scope and Commercial Boiler Market Segmentation

|

Attributes |

Commercial Boiler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Commercial Boiler Market?

“Shift toward Smart, Sustainable, and Hybrid Boiler Solutions”

- The commercial boiler market is undergoing a technology-driven transformation led by rising environmental concerns, stricter emission norms, and demand for high energy efficiency in heating systems

- Manufacturers are increasingly investing in condensing and hybrid boiler systems that combine gas-fired units with electric or renewable-powered heating elements to optimize energy use and reduce carbon emissions

- In June 2024, Bosch Thermotechnology (Germany) launched a new line of condensing boilers integrated with IoT-based smart controls for real-time diagnostics, efficiency optimization, and predictive maintenance in commercial buildings

- The trend also includes integration of AI-powered building energy management systems (BEMS) to dynamically adjust boiler operations based on occupancy, ambient conditions, and energy tariffs

- Adoption of biofuel-compatible and hydrogen-ready boilers is growing in regions such as Europe and North America as governments set long-term decarbonization targets and offer green retrofit incentives

- This evolution is reshaping the market by aligning commercial heating infrastructure with ESG mandates, operational cost reduction goals, and the push for smart building technologies in urban developments

What are the Key Drivers of Commercial Boiler Market?

- Stringent regulations on industrial and building emissions, such as the U.S. EPA Boiler MACT standards and the EU Ecodesign Directive, are pushing companies toward low-emission and high-efficiency boilers

- In March 2024, the U.K. government introduced a new grant under its Boiler Upgrade Scheme to accelerate the adoption of commercial biomass and hybrid boiler systems in public buildings and commercial estates

- Growing demand from commercial real estate especially in healthcare, education, and hospitality sectors is driving upgrades to energy-efficient boilers for better indoor air quality and reduced lifecycle costs

- Increasing urbanization and smart city initiatives are expanding the need for automated and remote-monitored heating systems that ensure uptime, regulatory compliance, and energy optimization

- Expansion in emerging economies such as India, Brazil, and Southeast Asia is fueling market demand due to rising investments in infrastructure, hotels, and manufacturing facilities needing reliable heat sources

Which Factor is challenging the Growth of the Commercial Boiler Market?

- A major constraint is the high upfront cost of advanced condensing and hybrid boilers, which often discourages small-to-medium businesses from replacing legacy systems despite long-term savings

- For instance, several SMEs in the hospitality sector have reported capital expenditure barriers in adopting low-NOx compliant systems or switching to biofuel-ready units, slowing market penetration

- Retrofitting challenges in old buildings, especially those with limited space or outdated piping infrastructure, make integration of modern boiler systems technically complex and cost-intensive

- There is also a lack of skilled workforce for installation, commissioning, and maintenance of advanced commercial boilers, particularly in developing markets where training and certification are limited

- While global players such as Viessmann (Germany) and Cleaver-Brooks (U.S.) are developing modular and plug-and-play solutions to ease adoption, market fragmentation and high customization needs remain significant hurdles

How is the Commercial Boiler Market Segmented?

The market is segmented on the basis of fuel type, technology, capacity, and end-use.

- By Fuel Type

On the basis of fuel type, the commercial boiler market is segmented into Natural Gas, Oil, Coal, and Others. The Natural Gas segment dominated the market with the largest revenue share of 46.3% in 2024, owing to its cleaner combustion profile, cost-effectiveness, and widespread availability across developed and emerging economies. The increasing regulatory focus on reducing carbon emissions has led many commercial facilities to replace coal- and oil-fired boilers with natural gas-based systems.

The Oil segment is expected to register moderate growth over the forecast period, particularly in remote or rural areas where pipeline gas access is limited and infrastructure development is slower.

- By Technology

On the basis of technology, the market is divided into Condensing and Non-Condensing. The Condensing segment led the Commercial Boiler market in 2024 with a dominant share of 57.8%, due to its high energy efficiency and ability to capture latent heat from exhaust gases. Its adoption is being driven by stricter energy performance regulations in the U.S., U.K., and Europe, alongside growing demand from schools, hotels, and office complexes for low-emission heating solutions.

Meanwhile, the Non-Condensing segment continues to serve legacy systems but is expected to gradually decline due to energy inefficiency and retrofit mandates.

- By Capacity

On the basis of capacity, the market is segmented into Less Than 10 MMBTU/hr, 10–50 MMBTU/hr, and Others. The 10–50 MMBTU/hr segment dominated the market with a revenue share of 39.2% in 2024, primarily driven by demand from mid- to large-scale institutions such as hospitals, universities, and commercial real estate requiring consistent, high-output heating.

The Less Than 10 MMBTU/hr segment is projected to grow steadily, supported by installations in smaller establishments such as cafes, motels, and schools where space and energy needs are more limited.

- By End-Use

On the basis of end-use, the market is segmented into Offices, Hospitals, Educational Institutions, Lodging, and Others. The Hospitals segment accounted for the largest market share of 33.7% in 2024, owing to 24/7 heating demand, high water usage, and strict indoor air quality and comfort regulations. Investment in healthcare infrastructure, especially across Asia-Pacific and North America, is a major contributor to this dominance.

The Educational Institutions segment is expected to exhibit the fastest growth, driven by ongoing school renovations, rising student enrollments, and increasing sustainability investments in campus operations globally.

Which Region Holds the Largest Share of the Commercial Boiler Market?

- North America dominated the commercial boiler market with the largest revenue share of 38.5% in 2024, driven by high demand from commercial buildings, hospitals, and educational institutions, along with stringent energy efficiency regulations. The region’s focus on upgrading legacy heating systems with low-emission boilers is a major growth enabler

- The U.S. leads regional demand due to aging infrastructure replacements, federal incentives for energy-efficient equipment, and a rising shift toward condensing boilers across offices, schools, and lodging facilities

- North America’s dominance is further supported by strong investment in green building initiatives, presence of key boiler manufacturers, and increasing awareness around reducing carbon footprints in commercial heating systems

U.S. Commercial Boiler Market Insight

The U.S. commercial boiler market held the largest share in North America in 2024, fueled by modern infrastructure demands, the widespread adoption of natural gas boilers, and regulatory mandates such as ENERGY STAR compliance. High usage across hospitals, university campuses, and government buildings continues to support sustained growth.

Canada Commercial Boiler Market Insight

The Canada commercial boiler market is growing steadily, supported by energy retrofitting programs, carbon-neutral targets, and a cold climate that sustains year-round heating requirements. Increased adoption in institutional and lodging segments is driving further investment in condensing technologies.

Which Region is the Fastest Growing in the Commercial Boiler Market?

Asia-Pacific is projected to register the fastest CAGR of 7.9% from 2025 to 2032, led by infrastructure development, urbanization, and rising commercial construction activity across China, India, and Southeast Asia. The region is witnessing a surge in demand for cost-effective and efficient heating systems. Countries such as China and India are rapidly investing in commercial real estate, educational institutions, and healthcare facilities, boosting installations of mid- to large-capacity commercial boilers. The growing adoption of natural gas-based and energy-efficient boilers especially condensing models is accelerating the regional transition away from coal-fired systems.

China Commercial Boiler Market Insight

The China commercial boiler market accounted for the largest share in Asia-Pacific in 2024, driven by rapid urban expansion, energy transition policies, and retrofitting of outdated systems in hospitals and commercial offices. Government mandates on emission reductions are promoting condensing boiler installations at scale.

India Commercial Boiler Market Insight

The India commercial boiler market is experiencing rapid growth due to increased commercial construction, smart city development, and rising investments in healthcare and hospitality sectors. Supportive policies such as the “Unnat Jyoti” scheme and gas infrastructure expansion are driving adoption of cleaner and more efficient heating systems.

Which are the Top Companies in Commercial Boiler Market?

The commercial boiler industry is primarily led by well-established companies, including:

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- Thermax Ltd. (India)

- General Electric (U.S.)

- Doosan Heavy Industries & Construction (South Korea)

- Siemens (Germany)

- IHI Corporation (Japan)

- DEC (Dongfang Electric Corporation) (China)

- Bharat Heavy Electricals Ltd. (India)

- Hurst Boiler & Welding Co, Inc. (U.S.)

- Bryan Steam (U.S.)

- Superior Boiler Works, Inc. (U.S.)

- Vapor Power (U.S.)

- Sofinter S.p.a (Italy)

- AB&CO GROUP (Denmark)

- Suzhou Hailu Heavy Industry Co. Ltd. (China)

- Cleaver-Brooks, Inc. (U.S.)

- ZOZEN Boiler Co., Ltd. (China)

- Harbin Asia Power Engineering Company Limited (China)

- Mitsubishi Electric Corporation (Japan)

- Hitachi Ltd. (Japan)

What are the Recent Developments in Global Commercial Boiler Market?

- In March 2024, Raypak unveiled the XVers + KŌR line of commercial boilers, which showcase the innovative high-efficiency stainless steel KŌR fire tube heat exchanger. According to the company, the XVers + KŌR delivers exceptional heating performance in a compact design, offering significant value to customers. This new line is designed to meet the hydronic heating needs of various commercial applications, including hospitals, schools, multi-family housing, and more

- In November 2023, the new FT Series light commercial boilers were introduced, available in sizes of 301 and 399 MBH. These boilers feature stainless steel firetube heat exchangers and operate with a turndown ratio of up to 10:1. They can utilize either natural gas or propane and achieve an impressive thermal efficiency of over 95%. Each unit in the FT Series comes with onboard high- and low-temperature zone control and DHW Smart Priority functionality, enabling simultaneous space and domestic water heating

- In April 2022, Bosch Commercial & Industrial introduced its new Condens 7000 WP commercial boiler series. This latest series is designed to replace the well-regarded Worcester Bosch GB162 V2, featuring a new design that emphasizes ease of installation. Installers can achieve up to a 60% reduction in average installation times with the Condens 7000 WP compared to the GB162 V2, allowing them to allocate more time to additional installations or other administrative tasks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Commercial Boiler Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Commercial Boiler Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Commercial Boiler Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.