Global Commercial Coffee Bean Grinders Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

3.61 Billion

2025

2033

USD

2.10 Billion

USD

3.61 Billion

2025

2033

| 2026 –2033 | |

| USD 2.10 Billion | |

| USD 3.61 Billion | |

|

|

|

|

Commercial Coffee Bean Grinders Market Size

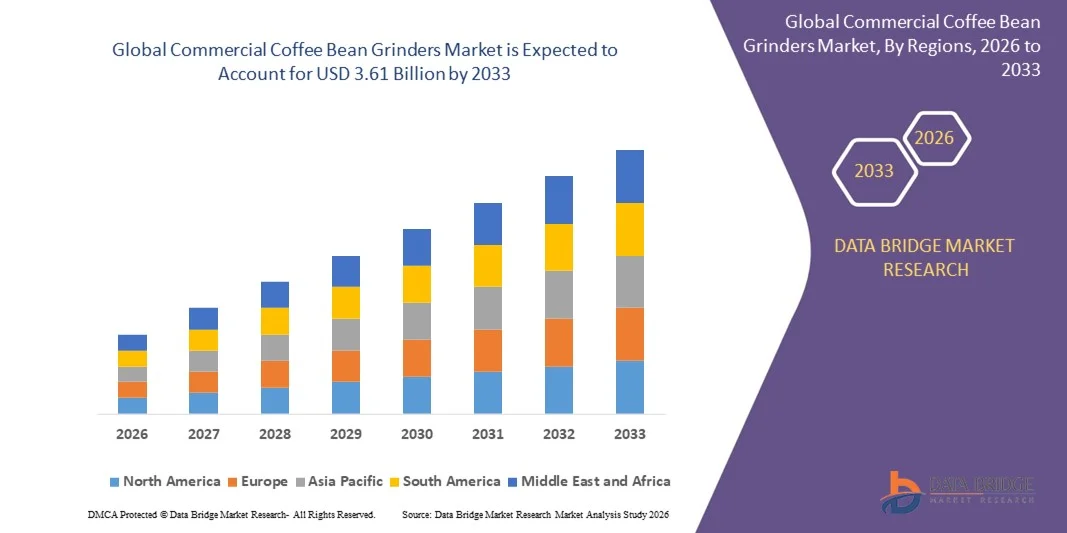

- The global commercial coffee bean grinders market size was valued at USD 2.10 billion in 2025 and is expected to reach USD 3.61 billion by 2033, at a CAGR of 7.00% during the forecast period

- The market growth is largely fuelled by the rising demand for specialty coffee and café culture expansion, along with increasing adoption of automated and high-efficiency grinding machines

- Growing preference for freshly ground coffee in restaurants, coffee shops, and hotels is further driving market demand

Commercial Coffee Bean Grinders Market Analysis

- The market is witnessing strong growth due to increased global coffee consumption and the rise of specialty coffee chains

- Continuous innovation in commercial grinders, such as smart and high-capacity models, is boosting their attractiveness for professional use

- North America dominated the commercial coffee bean grinders market in 2025, driven by the strong growth of specialty coffee shops, premium cafés, and quick-service restaurants across the region.

- Asia-Pacific region is expected to witness the highest growth rate in the global commercial coffee bean grinders market, driven by rapid foodservice expansion, rising disposable incomes, and increasing adoption of modern coffee brewing equipment

- The Electric Burr Coffee Bean Grinders segment held the largest market revenue share in 2025, driven by their ability to deliver consistent grind size, enhanced flavor extraction, and suitability for high-volume commercial operations. Burr grinders are preferred for their precision, durability, and minimal heat generation, ensuring optimal coffee quality

Report Scope and Commercial Coffee Bean Grinders Market Segmentation

|

Attributes |

Commercial Coffee Bean Grinders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Commercial Coffee Bean Grinders Market Trends

Rise of Automated and High-Efficiency Grinders

- The growing shift toward automated and high-efficiency commercial coffee bean grinders is transforming the foodservice landscape by enabling faster, consistent, and precise grinding of coffee beans. This allows cafés, restaurants, and hotels to maintain coffee quality while improving operational efficiency and reducing preparation time. High-performance grinders also minimize human error and ensure consistent particle size, critical for specialty coffee extraction

- Increasing demand for specialty coffee and freshly ground beans in cafés, restaurants, and hotels is accelerating the adoption of commercial coffee grinders. These devices ensure uniform particle size, enhancing flavor extraction and customer satisfaction. In addition, grinders with programmable features allow baristas to deliver consistent quality across high-volume service periods

- The affordability, ease of use, and durability of modern grinders are making them attractive for small, mid-sized, and large-scale operations. Frequent use of high-performance grinders reduces maintenance downtime and improves overall workflow efficiency. Energy-efficient designs also lower operating costs and contribute to sustainability initiatives

- For instance, in 2023, several coffee chains in North America reported improved beverage consistency and faster service times after upgrading to programmable, automated grinders, resulting in higher customer satisfaction and repeat business. The implementation of grinders with advanced dosing and grinding speed controls also enhanced operational scalability and reduced waste

- While adoption of advanced grinders is increasing, continued innovation, energy-efficient designs, and cost-effective solutions remain critical for sustained growth. Manufacturers must focus on tailored products for different commercial settings to fully capitalize on market demand. Integrating smart features such as IoT connectivity and remote monitoring is emerging as a key differentiator in competitive markets

Commercial Coffee Bean Grinders Market Dynamics

Driver

Growing Coffee Culture and Increasing Specialty Coffee Consumption

- The rising global preference for specialty coffee and freshly ground beans is driving commercial coffee grinder demand. Cafés and restaurants are investing in grinders to meet consumer expectations for high-quality beverages. This trend is further supported by increasing coffee consumption in emerging markets and a surge in boutique coffee shops

- Increasing awareness of coffee quality, aroma, and flavor consistency is encouraging businesses to adopt high-performance grinders. This shift is supported by the growing café culture and premium coffee trends worldwide. Businesses are leveraging grinders with customizable settings to meet diverse consumer preferences and beverage styles

- Technological advancements in grinder design, including programmable dosing, low-noise operation, and energy efficiency, are creating new growth opportunities. Manufacturers offering innovative, user-friendly machines are gaining competitive advantage. Advanced grinders with integrated cleaning features and smart maintenance alerts further reduce downtime and enhance efficiency

- For instance, in 2022, several European and North American coffee chains upgraded to smart, automated grinders, improving operational efficiency and customer satisfaction. These upgrades also allowed for standardization across multiple locations, reducing variability in beverage quality

- While specialty coffee trends and technological innovation are driving growth, consistent product reliability, maintenance support, and affordability remain key for widespread adoption. Market players focusing on compact, low-maintenance designs for small and medium enterprises are likely to capture additional growth opportunities

Restraint/Challenge

High Equipment Costs and Maintenance Requirements

- The high cost of advanced commercial grinders limits adoption among small-scale cafés and restaurants. Premium grinders often require significant upfront investment, restricting market penetration in cost-sensitive regions. The return on investment is sometimes slow for small operators, which may delay upgrades

- Maintenance complexity and need for skilled operators can be a barrier in some markets. Inadequate servicing infrastructure and training challenges may lead to reduced equipment efficiency and lifespan. Lack of local technical support often forces operators to rely on costly third-party services

- Supply chain challenges, including availability of replacement parts and components, can affect timely installation and operation, particularly in remote areas or emerging markets. Disruptions in component supply may lead to prolonged downtime and affect business continuity. Manufacturers need to ensure robust distribution networks to mitigate these risks

- For instance, in 2023, several small-scale coffee shops in Sub-Saharan Africa reported difficulties in acquiring and maintaining high-end grinders, affecting service consistency and customer satisfaction. The limited access to spare parts and trained technicians created operational inefficiencies and increased operational costs

- While grinder technology continues to evolve, addressing cost, maintenance, and support challenges is crucial to expand market adoption and unlock long-term growth potential. Companies focusing on modular, easy-to-maintain designs and after-sales service programs are positioned to capture wider market share

Commercial Coffee Bean Grinders Market Scope

The market is segmented on the basis of product type, machine type, price, and end user

- By Product Type

On the basis of product type, the global commercial coffee bean grinders market is segmented into Electric Burr Coffee Bean Grinders, Electric Blade Coffee Bean Grinders, and Manual Coffee Bean Grinders. The Electric Burr Coffee Bean Grinders segment held the largest market revenue share in 2025, driven by their ability to deliver consistent grind size, enhanced flavor extraction, and suitability for high-volume commercial operations. Burr grinders are preferred for their precision, durability, and minimal heat generation, ensuring optimal coffee quality.

The Electric Blade Coffee Bean Grinders segment is expected to witness the fastest growth rate from 2026 to 2033, driven by affordability, ease of use, and compatibility with smaller commercial settings. Blade grinders are popular in cafés and small restaurants for quick, convenient grinding, offering reasonable performance at lower cost.

- By Machine Type

On the basis of machine type, the market is segmented into Fully Automatic Coffee Bean Grinder, Super Automatic Coffee Bean Grinder, and Semi-Automatic Coffee Bean Grinder. The Fully Automatic segment held the largest market revenue share in 2025 due to its ability to grind and dispense coffee with minimal manual intervention, improving efficiency and consistency in high-volume operations.

The Super Automatic Coffee Bean Grinder segment is expected to witness the fastest growth rate from 2026 to 2033, driven by advanced features such as programmable dosing, integrated brewing, and high-speed operation. Super automatic machines are particularly popular in premium cafés and restaurants aiming to reduce labor costs while maintaining product quality.

- By Price

On the basis of price, the market is segmented into Low, Medium, and High. The Medium-priced segment held the largest revenue share in 2025, driven by its balance between performance, durability, and affordability, making it suitable for most commercial users.

The High-priced segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by demand for premium, technologically advanced grinders with features such as precision dosing, noise reduction, and long-lasting components. These high-end grinders are particularly favored by specialty coffee shops and luxury hotels.

- By End User

On the basis of end user, the market is segmented into Hotel, Restaurant, Café, Coffee Shops, Institutional, and Residential. The Café segment held the largest market revenue share in 2025, driven by the rapid growth of specialty coffee culture and the increasing number of cafés offering freshly ground coffee to consumers.

The Coffee Shops segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising entrepreneurial ventures, growing demand for premium coffee experiences, and adoption of automated grinders to ensure consistency, speed, and quality for on-the-go customers.

Commercial Coffee Bean Grinders Market Regional Analysis

- North America dominated the commercial coffee bean grinders market in 2025, driven by the strong growth of specialty coffee shops, premium cafés, and quick-service restaurants across the region.

- Consumers increasingly prefer freshly ground, high-quality coffee, encouraging foodservice businesses to invest in advanced grinding equipment to maintain consistency and enhance beverage quality

- The region’s high adoption of automation, rising café culture, and strong presence of leading coffee chains further support market expansion, making grinders an essential part of commercial coffee operations

U.S. Commercial Coffee Bean Grinders Market Insight

The U.S. captured the largest market revenue share in 2025 within North America due to its highly developed coffee culture and strong demand for specialty beverages. Foodservice operators are prioritizing consistent grind quality and faster service, driving investment in electric burr and fully automatic grinders. Growing consumer expectations for premium coffee, combined with the expansion of national coffee chains and independent cafés, is accelerating equipment modernization. In addition, the rising popularity of on-the-go beverages and smart, programmable grinders is strengthening market growth across commercial settings.

Europe Commercial Coffee Bean Grinders Market Insight

Europe is expected to witness the fastest growth rate from 2026 to 2033, supported by a well-established café tradition and increasing demand for specialty drinks. Stringent quality standards and a strong emphasis on flavor consistency encourage businesses to adopt high-precision grinders. Rapid expansion of boutique coffee shops, combined with rising consumer spending on premium beverages, is boosting market penetration. The region is also seeing significant upgrades in commercial equipment across both new and existing foodservice establishments.

U.K. Commercial Coffee Bean Grinders Market Insight

The U.K. market is expected to witness strong growth from 2026 to 2033 due to the rising popularity of specialty coffee, expanding café chains, and increasing consumer preference for high-quality beverages. The growth of urban coffee culture and demand for faster service is encouraging restaurants and cafés to adopt modern grinding solutions. Moreover, evolving customer expectations for consistency and aroma are pushing businesses to upgrade to automated and high-performance grinders.

Germany Commercial Coffee Bean Grinders Market Insight

The Germany market is expected to experience rapid growth from 2026 to 2033, driven by the country’s strong engineering culture, emphasis on quality, and preference for precision-based coffee preparation. Commercial establishments increasingly invest in durable, energy-efficient grinders with advanced grinding technology. The rise of premium cafés, micro-roasters, and high-quality foodservice outlets is further boosting demand for professional-grade grinders, especially within urban centers.

Asia-Pacific Commercial Coffee Bean Grinders Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2026 to 2033, supported by rapid urbanization, rising disposable incomes, and strong coffee shop expansion in countries such as China, Japan, South Korea, and India. Growing western influence, an expanding young consumer base, and increasing café culture are driving grinder adoption. As APAC continues to develop into a major manufacturing and consumption hub, affordability and wide availability of commercial grinders are improving market accessibility.

Japan Commercial Coffee Bean Grinders Market Insight

Japan is expected to witness significant growth from 2026 to 2033 due to its deep-rooted café culture, high demand for premium beverages, and focus on precision in coffee brewing. Businesses continually invest in advanced grinding technologies to meet customer expectations for consistency and quality. The integration of automated grinders in cafés, restaurants, and convenience stores is also contributing to market expansion, alongside the increasing popularity of specialty coffee.

China Commercial Coffee Bean Grinders Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid café expansion, rising middle-class consumption, and strong interest in premium coffee. The country’s growing specialty coffee movement and fast-developing foodservice sector are fueling demand for commercial grinders. Affordable pricing, strong local manufacturing, and government support for urban coffee culture further enhance market growth, making China one of the largest and fastest-evolving markets for commercial coffee grinding equipment.

Commercial Coffee Bean Grinders Market Share

The Commercial Coffee Bean Grinders industry is primarily led by well-established companies, including:

- BUNN (U.S.)

- Wilbur Curtis Co. (U.S.)

- Food Equipment Technologies Company FETCO (U.S.)

- Sanremo Coffee Machines (Italy)

- Hemro Manufacturing Germany GmbH (Germany)

- MAZZER LUIGI S.p.A. (Italy)

- ANFIM S.r.l. (Italy)

- Baratza (U.S.)

- Compak (Spain)

- Beanmachines (U.K.)

- FRESH AND HONEST CAFE LIMITED (India)

- KitchenAid (U.S.)

- Hamilton Beach Brands, Inc. (U.S.)

- KRUPS (Germany)

- Gourmia, Inc. (U.S.)

- bodum (Switzerland)

- Cuisinart (U.S.)

- JURA Inc. (Switzerland)

- Rancilio Group (Italy)

- SIMPLY GREAT COFFEE (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.