Global Commercial Drones Market

Market Size in USD Billion

CAGR :

%

USD

12.28 Billion

USD

102.04 Billion

2022

2030

USD

12.28 Billion

USD

102.04 Billion

2022

2030

| 2023 –2030 | |

| USD 12.28 Billion | |

| USD 102.04 Billion | |

|

|

|

|

Commercial Drones Market Analysis and Size

Commercial drones are becoming gradually common in many countries. Although commercial drone technology has been around for years, its use was limited to only some sectors such as construction and agriculture. However, the introduction of innovative and new and solutions in recent years has changed this scenery. Now, more than ever before, we are seeing a rise in demand for unmanned aerial systems such as commercial drones that can be used for numerous purposes such as mapping, surveillance, and even delivery services.

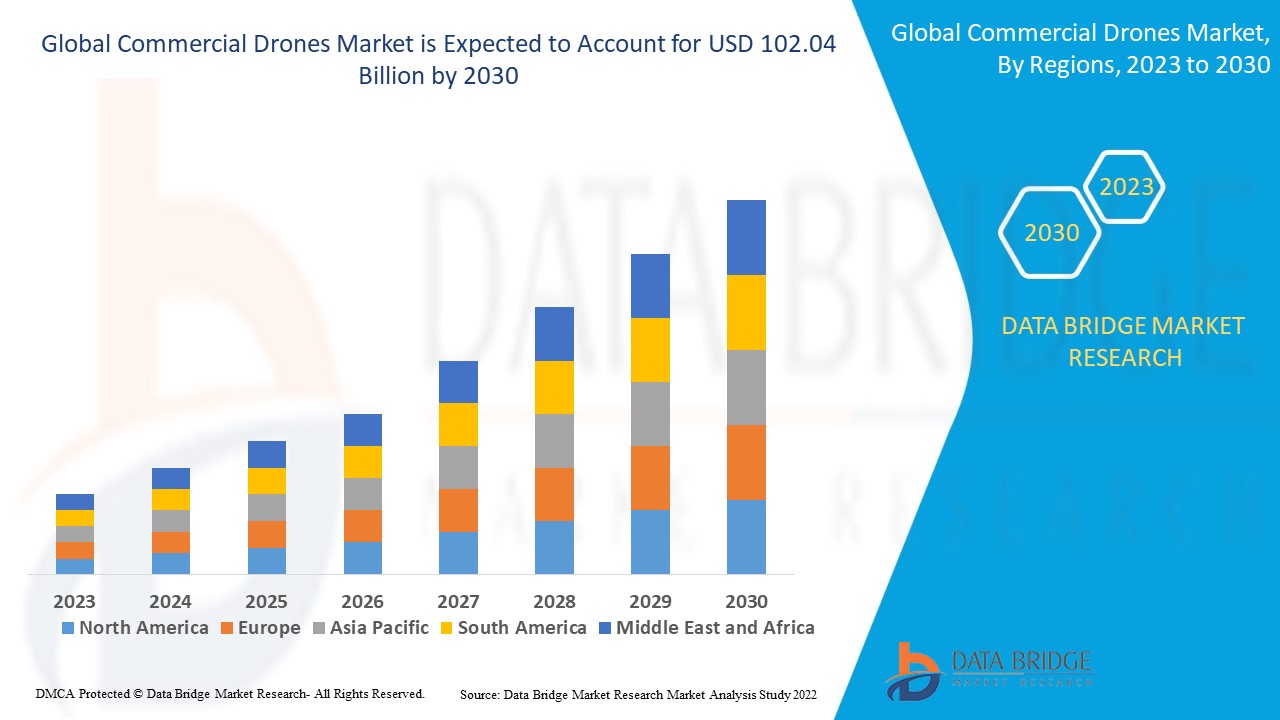

Data Bridge Market Research analyses that the commercial drones market was valued at USD 12.28 billion in 2022 and is expected to reach the value of USD 102.04 billion by 2030, at a CAGR of 30.30% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Commercial Drones Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Payload (<5kg, 5–25Kg, 26–50Kg, 51–100Kg, Above 100Kg), Technology (Fully Autonomous, Semi-Autonomous, Remotely), Component (Hardware, Software), Application (Delivery & Logistics, Filming & Photography, Horticulture & Agriculture, Inspection & Maintenance, Mapping & Surveying, Surveillance & Monitoring, Others), Type (Fixed Wing Drones, Rotary Bade Drones, Hybrid Drones) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

AeroTargets International LLC. (U.S.), Airbus (Netherlands), BAE Systems (U.S.), Anadrone Systems Private Limited (India), Denel Dynamics (South Africa), Embention (Spain), Johnson Controls Inc. (Ireland), General Atomics (U.S.), IAI. (Israel), Lockheed Martin Corporation (U.S.), AeroVironment Inc. (U.S.), Textron Systems (U.S.), Aeryon Labs Inc. (Canada), Northrop Grumman (U.S.), BAE Systems (U.K.), Boeing (U.S.), Thales (France), Leonardo S.p.A. (Italy), Elbit Systems Ltd.(Israel), SAAB (Sweden) |

|

Market Opportunities |

|

Market Definition

Commercial drones are also known as unmanned aerial vehicles (UAVs). Commercial drones are those aircraft which are used for industrial and business purposes. These aircraft are sophisticated in function and capable of handling complicated tasks. Commercial drones are remotely controlled from the ground by professional and trained and pilots.

Commercial Drones Market Dynamics

Drivers

- Increasing usage of commercial drones public safety

Commercial unmanned aerial vehicles (UAVs) such as commercial drones have come a long way since their initial days of limited functionalities. Numerous trades, businesses and industries have readily incorporated them to simplify their operational workflow. As a result of this, commercial drones have found plenty of progressive impact on the public safety operations due to their ability to save lives. Commercial drones have been extensively used in firefighting, search and rescue, law enforcement and disaster response as a life-saving tool.

- Rising demand of commercial drones for firefighting

Firefighters are progressively using commercial drones. Commercial drones have proved to be very proficient in containing and tracking wildfires. Considering the unpredictability of wildfires, it's almost incredible for firefighters to get a scale of the fire without having any extra pair of eyes in the sky. Commercial drones are equipped with thermal cameras and other sensors that can predict a wildfires' likely course and give firefighters an overview of the terrain. Commercial drones can also prevent wildfires by assisting the fire department perform controlled vegetation from areas prone to wildfire and burns to clear dry brush.

Opportunities

- Surging usage of commercial drones in mining industry

Commercial drones are highly used in the mining industry. They are used to conduct inspections of underground shafts, mining equipment and tunnels. Commercial drones are mainly useful when conducting maintenance checks on machinery or equipment. It also allows inspectors to access inspect equipment and hard-to-reach places that would otherwise require heavy equipment such as excavators and cranes. Thus, the surging usage of commercial drones in mining industry is anticipated to create new and ample opportunities for the market growth.

- Advancements in surveillance and remote sensing technologies

Continuous advances in sensing technology, component and size have boosted the growth of monitoring and automation systems, including UAVs or commercial drones, which use large number of methods and tools to forecast data. This has also ensure higher reliability, productivity, reduced operating costs and increased performance. Furthermore, the steadily increasing focus on improving field productivity and efficiency has augmented the demand for commercial drone in agriculture. Furthermore, advancement in sensing technologies aids in ensuring that the soil and crop receive proper care. So, farmers will be able to plan their activities or actions accordingly.

Restraints

- Strict regulation and growing adoption of satellite

Strict government administrations related to the satellite imagery and national security as a replacement option are projected to hamper the commercial drone market growth. Another factor which is hampering the growth of the commercial drone market is the increasing acceptance of satellite imagery during the forecast period.

This commercial drones market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the commercial drones market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In September 2022 - The U.S. Federal Aviation Administration (FAA) approved the Declarations of Compliance for seven of DJI’s new drone models. DJI is a China based leading provider of imaging technology and civilian drones.

Global Commercial Drones Market Scope

The commercial drones market is segmented based on the payload, technology, component, application and type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Payload

- <5kg

- 5–25Kg

- 26–50Kg

- 51–100Kg

- Above 100Kg

Technology

- Fully Autonomous

- Semi-Autonomous

- Remotely

Component

- Hardware

- Software

Application

- Delivery & Logistics

- Filming & Photography

- Horticulture & Agriculture

- Inspection & Maintenance

- Mapping & Surveying

- Surveillance & Monitoring

- Others

Type

- Fixed Wing Drones

- Rotary Bade Drones

- Hybrid Drones

Commercial Drones Market Regional Analysis/Insights

The commercial drones market is analyzed and market size insights and trends are provided by country, payload, technology, component, application and type as referenced above.

The countries covered in the commercial drones market report are report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the commercial drones market in revenue growth due to the growing population in several regions and the rapid urbanization in the economy. Moreover, the availability of agricultural land in India, China, Japan, and Australia will likely boost the market's growth.

North America is projected to be the fastest developing region during the forecast period of 2023-2030. This is mainly due to growing demand for indoor farms and greenhouses vertical. Furthermore, commercial drones is energy proficient and the energy consumption of this lighting is less than regular farming which will likely to boost the growth e market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Commercial drones Market Share Analysis

The commercial drones market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to commercial drones market.

Some of the major players operating in the commercial drones market are:

- AeroTargets International LLC. (U.S.)

- Airbus (Netherlands)

- BAE Systems (U.S.)

- Anadrone Systems Private Limited (India)

- Denel Dynamics (South Africa)

- Embention (Spain),

- Johnson Controls Inc. (Ireland)

- General Atomics (U.S.)

- IAI. (Israel)

- Lockheed Martin Corporation (U.S.)

- AeroVironment Inc. (U.S.)

- Textron Systems (U.S.)

- Aeryon Labs Inc. (Canada)

- Northrop Grumman (U.S.)

- BAE Systems (U.K.)

- Boeing (U.S.)

- Thales (France)

- Leonardo S.p.A. (Italy)

- Elbit Systems Ltd. (Israel)

- SAAB (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL COMMERCIAL DRONES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL COMMERCIAL DRONES MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL COMMERCIAL DRONES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL COMMERCIAL DRONES MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 PAYLOAD

6.2.1.1. SMALL DRONES MARKET PAYLOAD, BY TYPE

6.2.1.1.1. CAMERAS, BY TYPE

6.2.1.1.1.1 HIGH-RESOLUTION CAMERAS

6.2.1.1.1.2 MULTISPECTRAL CAMERAS

6.2.1.1.1.3 HYPERSPECTRAL CAMERAS

6.2.1.1.1.4 THERMAL CAMERAS

6.2.1.1.1.5 EO/IR CAMERAS

6.2.1.1.2. CAMERAS, BY RESOLUTION

6.2.1.1.2.1 LESS THAN 20 MP

6.2.1.1.2.2 MORE THAN 20 MP

6.2.1.1.3. ELECTRONIC INTELLIGENCE PAYLOADS

6.2.1.1.4. UAV RADAR, BY TYPE

6.2.1.1.4.1 SYNTHETIC APERTURE RADAR (SAR)

6.2.1.1.4.2 ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA) RADAR

6.2.2 GUIDANCE NAVIGATION

6.2.3 CONTROL PROPULSION SYSTEMS

6.2.4 AIRFRAME

6.2.5 OTHERS

6.3 SOFTWARE

6.3.1 FLEET MANAGEMENT

6.3.2 FLIGHT OPERATIONS

6.3.3 MAPPING SOFTWARE

6.3.4 OTHERS

6.4 SERVICES

6.4.1 TRAINING & CONSULTING

6.4.2 IMPLEMENTATION & INTEGRATION

6.4.3 SUPPORT & MAINTENANCE

7 GLOBAL COMMERCIAL DRONES MARKET, BY MODE OF OPERATION

7.1 OVERVIEW

7.2 FULLY AUTONOMOUS

7.3 SEMI-AUTONOMOUS

7.4 REMOTE OPERATED

8 GLOBAL COMMERCIAL DRONES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 FIXED WING COMMERCIAL DRONES

8.3 HELICOPTER COMMERCIAL DRONES

8.4 ROTARY BLADE COMMERCIAL DRONES

8.5 OTHERS

9 GLOBAL COMMERCIAL DRONES MARKET, BY DRONES DATA

9.1 OVERVIEW

9.2 PHOTOS AND VIDEOS

9.3 3 MAPS

9.4 ORTHOMOSAICS

9.5 ACTIONABLE REPORTS

10 GLOBAL COMMERCIAL DRONES MARKET, BY PROPELLER

10.1 OVERVIEW

10.2 LESS THAN 250 MM

10.3 MORE THAN 250 MM

11 GLOBAL COMMERCIAL DRONES MARKET, BY FLIGHT TIME

11.1 OVERVIEW

11.2 LESS THAN 30 MIN

11.3 MORE THAN 30 MIN

12 GLOBAL COMMERCIAL DRONES MARKET, BY TAKE-OFF WEIGHT

12.1 OVERVIEW

12.2 LESS THAN 5 KILOGRAMS

12.3 5 KILOGRAMS TO 10 KILOGRAMS

12.4 MORE THAN 10 KILOGRAMS

13 GLOBAL COMMERCIAL DRONES MARKET, BY PAYLOAD

13.1 OVERVIEW

13.2 LESS THAN 5 KG

13.3 5 – 25 KG

13.4 26 – 50 KG

13.5 51 – 100 KG

13.6 ABOVE 100 KG

14 GLOBAL COMMERCIAL DRONES MARKET, BY POWER SOURCE

14.1 OVERVIEW

14.2 LITHIUM–ION

14.3 SOLAR CELLS

14.4 HYBRID CELLS

14.5 FUEL CELLS

15 GLOBAL COMMERCIAL DRONES MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 OUTDOOR INSPECTIONS

15.2.1 FIXED WING COMMERCIAL DRONES

15.2.2 HELICOPTER COMMERCIAL DRONES

15.2.3 ROTARY BLADE COMMERCIAL DRONES

15.2.4 OTHERS

15.3 INDOOR INSPECTIONS

15.3.1 FIXED WING COMMERCIAL DRONES

15.3.2 HELICOPTER COMMERCIAL DRONES

15.3.3 ROTARY BLADE COMMERCIAL DRONES

15.3.4 OTHERS

15.4 AERIAL PHOTOGRAPHY/VIDEOGRAPHY

15.4.1 FIXED WING COMMERCIAL DRONES

15.4.2 HELICOPTER COMMERCIAL DRONES

15.4.3 ROTARY BLADE COMMERCIAL DRONES

15.4.4 OTHERS

15.5 PUBLIC SAFETY

15.5.1 FIXED WING COMMERCIAL DRONES

15.5.2 HELICOPTER COMMERCIAL DRONES

15.5.3 ROTARY BLADE COMMERCIAL DRONES

15.5.4 OTHERS

15.6 MAPPING & SURVEYING

15.6.1 FIXED WING COMMERCIAL DRONES

15.6.2 HELICOPTER COMMERCIAL DRONES

15.6.3 ROTARY BLADE COMMERCIAL DRONES

15.6.4 OTHERS

15.7 OTHERS

16 GLOBAL COMMERCIAL DRONES MARKET, BY INDUSTRY

16.1 OVERVIEW

16.2 AGRICULTURE

16.2.1 BY COMPONENT

16.2.1.1. PAYLOAD

16.2.1.2. GUIDANCE NAVIGATION

16.2.1.3. CONTROL PROPULSION SYSTEMS

16.2.1.4. AIRFRAME

16.2.1.5. OTHERS

16.3 CHEMICALS

16.3.1 BY COMPONENT

16.3.1.1. PAYLOAD

16.3.1.2. GUIDANCE NAVIGATION

16.3.1.3. CONTROL PROPULSION SYSTEMS

16.3.1.4. AIRFRAME

16.3.1.5. OTHERS

16.4 CONSERVATIONS

16.4.1 BY COMPONENT

16.4.1.1. PAYLOAD

16.4.1.2. GUIDANCE NAVIGATION

16.4.1.3. CONTROL PROPULSION SYSTEMS

16.4.1.4. AIRFRAME

16.4.1.5. OTHERS

16.5 CONSTRUCTIONS

16.5.1 BY COMPONENT

16.5.1.1. PAYLOAD

16.5.1.2. GUIDANCE NAVIGATION

16.5.1.3. CONTROL PROPULSION SYSTEMS

16.5.1.4. AIRFRAME

16.5.1.5. OTHERS

16.6 E-COMMERCE

16.6.1 BY COMPONENT

16.6.1.1. PAYLOAD

16.6.1.2. GUIDANCE NAVIGATION

16.6.1.3. CONTROL PROPULSION SYSTEMS

16.6.1.4. AIRFRAME

16.6.1.5. OTHERS

16.7 FILMMAKING

16.7.1 BY COMPONENT

16.7.1.1. PAYLOAD

16.7.1.2. GUIDANCE NAVIGATION

16.7.1.3. CONTROL PROPULSION SYSTEMS

16.7.1.4. AIRFRAME

16.7.1.5. OTHERS

16.8 MINING

16.8.1 BY COMPONENT

16.8.1.1. PAYLOAD

16.8.1.2. GUIDANCE NAVIGATION

16.8.1.3. CONTROL PROPULSION SYSTEMS

16.8.1.4. AIRFRAME

16.8.1.5. OTHERS

16.9 INSURANCE

16.9.1 BY COMPONENT

16.9.1.1. PAYLOAD

16.9.1.2. GUIDANCE NAVIGATION

16.9.1.3. CONTROL PROPULSION SYSTEMS

16.9.1.4. AIRFRAME

16.9.1.5. OTHERS

16.1 OIL & GAS

16.10.1 BY TYPE

16.10.1.1. UP-STREAM

16.10.1.2. MID STREAM

16.10.1.3. DOWN STREAM

16.10.2 BY COMPONENT

16.10.2.1. PAYLOAD

16.10.2.2. GUIDANCE NAVIGATION

16.10.2.3. CONTROL PROPULSION SYSTEMS

16.10.2.4. AIRFRAME

16.10.2.5. OTHERS

16.11 POWER GENERATION

16.11.1 BY COMPONENT

16.11.1.1. PAYLOAD

16.11.1.2. GUIDANCE NAVIGATION

16.11.1.3. CONTROL PROPULSION SYSTEMS

16.11.1.4. AIRFRAME

16.11.1.5. OTHERS

16.12 MILITARY & SECURITY AGENCY/FIRMS

16.12.1 BY COMPONENT

16.12.1.1. PAYLOAD

16.12.1.2. GUIDANCE NAVIGATION

16.12.1.3. CONTROL PROPULSION SYSTEMS

16.12.1.4. AIRFRAME

16.12.1.5. OTHERS

16.13 SEWER MAINTENANCE

16.13.1 BY COMPONENT

16.13.1.1. PAYLOAD

16.13.1.2. GUIDANCE NAVIGATION

16.13.1.3. CONTROL PROPULSION SYSTEMS

16.13.1.4. AIRFRAME

16.13.1.5. OTHERS

16.14 TRANSPORTATION & LOGISTICS

16.14.1 BY COMPONENT

16.14.1.1. PAYLOAD

16.14.1.2. GUIDANCE NAVIGATION

16.14.1.3. CONTROL PROPULSION SYSTEMS

16.14.1.4. AIRFRAME

16.14.1.5. OTHERS

16.15 OTHERS

17 GLOBAL COMMERCIAL DRONES MARKET, BY GEOGRAPHY

GLOBAL COMMERCIAL DRONES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 FRANCE

17.2.3 U.K.

17.2.4 ITALY

17.2.5 SPAIN

17.2.6 RUSSIA

17.2.7 TURKEY

17.2.8 BELGIUM

17.2.9 NETHERLANDS

17.2.10 NORWAY

17.2.11 FINLAND

17.2.12 SWITZERLAND

17.2.13 DENMARK

17.2.14 SWEDEN

17.2.15 POLAND

17.2.16 REST OF EUROPE

17.3 ASIA PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 NEW ZEALAND

17.3.7 SINGAPORE

17.3.8 THAILAND

17.3.9 MALAYSIA

17.3.10 INDONESIA

17.3.11 PHILIPPINES

17.3.12 TAIWAN

17.3.13 VIETNAM

17.3.14 REST OF ASIA PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 EGYPT

17.5.3 SAUDI ARABIA

17.5.4 U.A.E

17.5.5 OMAN

17.5.6 BAHRAIN

17.5.7 ISRAEL

17.5.8 KUWAIT

17.5.9 QATAR

17.5.10 REST OF MIDDLE EAST AND AFRICA

17.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18 GLOBAL COMMERCIAL DRONES MARKET,COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL COMMERCIAL DRONES MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL COMMERCIAL DRONES MARKET, COMPANY PROFILE

20.1 IBM

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 SKYGRID, LLC

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 FLYTBASE, INC.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 DRONEDEPLOY

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 PRECISIONHAWK

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 AERONAVICS LTD.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENT

20.7 NORTHROP GRUMMAN

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 ELBIT SYSTEMS LTD.

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 ISRAEL AEROSPACE INDUSTRIES

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 AEROVIRONMENT INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 LOCKHEED MARTIN

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 BOEING

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 THALES

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENT

20.14 DJI

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENT

20.15 PARROT DRONES SAS

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 3D ROBOTICS

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 TEXTRON SYSTEMS

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 AARAV UNMANNED SYSTEMS.

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENT

20.19 TURKISH AEROSPACE INDUSTRIES

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENT

20.2 SAAB

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 MICRODRONES

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

20.22 YAMAHA MOTOR CO., LTD.

20.22.1 COMPANY SNAPSHOT

20.22.2 REVENUE ANALYSIS

20.22.3 PRODUCT PORTFOLIO

20.22.4 RECENT DEVELOPMENT

20.23 DRAGANFLY INC.

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENT

20.24 EHANG

20.24.1 COMPANY SNAPSHOT

20.24.2 REVENUE ANALYSIS

20.24.3 PRODUCT PORTFOLIO

20.24.4 RECENT DEVELOPMENT

20.25 INTEL CORPORATION

20.25.1 COMPANY SNAPSHOT

20.25.2 REVENUE ANALYSIS

20.25.3 PRODUCT PORTFOLIO

20.25.4 RECENT DEVELOPMENT

20.26 YUNEEC HOLDING LTD.

20.26.1 COMPANY SNAPSHOT

20.26.2 REVENUE ANALYSIS

20.26.3 PRODUCT PORTFOLIO

20.26.4 RECENT DEVELOPMENT

20.27 IDEAFORGE TECHNOLOGY LTD.

20.27.1 COMPANY SNAPSHOT

20.27.2 REVENUE ANALYSIS

20.27.3 PRODUCT PORTFOLIO

20.27.4 RECENT DEVELOPMENT

20.28 XAG CO., LTD.

20.28.1 COMPANY SNAPSHOT

20.28.2 REVENUE ANALYSIS

20.28.3 PRODUCT PORTFOLIO

20.28.4 RECENT DEVELOPMENT

20.29 QUALCOMM INCORPORATED (ZEROTECH)

20.29.1 COMPANY SNAPSHOT

20.29.2 REVENUE ANALYSIS

20.29.3 PRODUCT PORTFOLIO

20.29.4 RECENT DEVELOPMENT

20.3 AERIALTRONICS

20.30.1 COMPANY SNAPSHOT

20.30.2 REVENUE ANALYSIS

20.30.3 PRODUCT PORTFOLIO

20.30.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 CONCLUSION

22 QUESTIONNAIRE

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

Global Commercial Drones Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Commercial Drones Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Commercial Drones Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.