Global Commercial Fitness Equipment Market

Market Size in USD Billion

CAGR :

%

USD

13.41 Billion

USD

19.92 Billion

2025

2033

USD

13.41 Billion

USD

19.92 Billion

2025

2033

| 2026 –2033 | |

| USD 13.41 Billion | |

| USD 19.92 Billion | |

|

|

|

|

Commercial Fitness Equipment Market Size

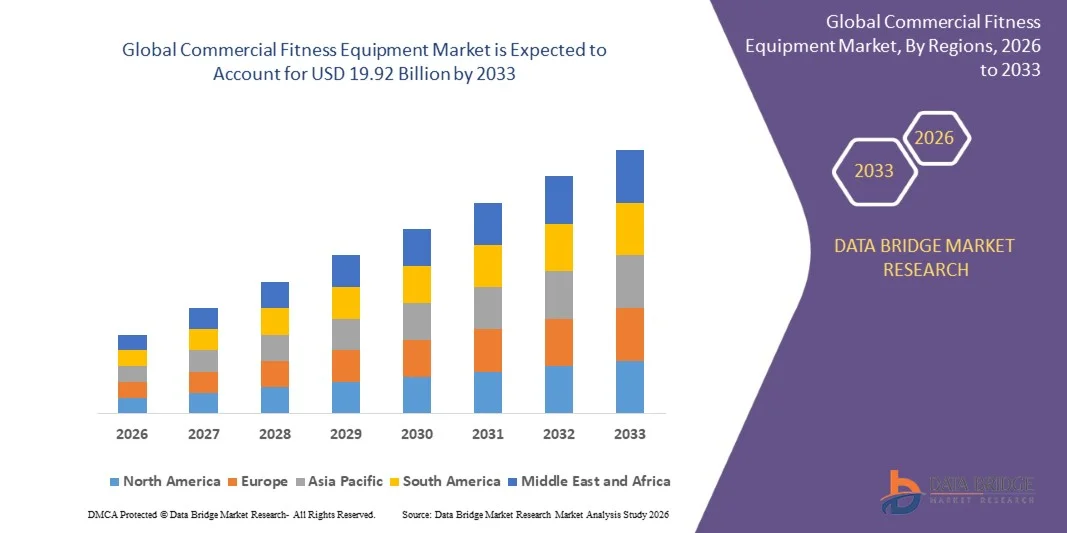

- The global commercial fitness equipment market size was valued at USD 13.41 billion in 2025 and is expected to reach USD 19.92 billion by 2033, at a CAGR of 5.07% during the forecast period

- The market growth is largely fuelled by the increasing adoption of fitness and wellness programs by corporate organizations and gyms, rising health awareness, and the growing trend of smart and connected fitness equipment

- The surge in gym memberships, boutique fitness studios, and demand for technologically advanced cardio and strength training equipment is further supporting market expansion

Commercial Fitness Equipment Market Analysis

- The market is witnessing strong innovation in smart fitness equipment, including AI-powered machines, connected devices, and app-integrated solutions that enhance user engagement and performance tracking

- Increasing government initiatives promoting healthy lifestyles, corporate wellness programs, and the rising number of fitness centers globally are creating a favorable environment for market growth

- North America dominated the commercial fitness equipment market with the largest revenue share of 42.3% in 2025, driven by a growing focus on health and wellness, increasing gym memberships, and widespread adoption of smart and connected fitness equipment

- Asia-Pacific region is expected to witness the highest growth rate in the global commercial fitness equipment market, driven by rising urban populations, government initiatives promoting health and wellness, expanding gym infrastructure, and increasing adoption of smart and connected fitness equipment

- The Cardiovascular Training Equipment segment held the largest market revenue share in 2025, driven by high demand for treadmills, elliptical machines, and stationary bikes in gyms, hotels, and wellness centers. These machines are popular for their ability to support weight management, improve endurance, and provide customizable workout programs for diverse users

Report Scope and Commercial Fitness Equipment Market Segmentation

|

Attributes |

Commercial Fitness Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Commercial Fitness Equipment Market Trends

“Rising Demand for Smart and Connected Fitness Solutions”

- The growing adoption of smart, connected, and AI-enabled fitness equipment is significantly shaping the commercial fitness equipment market, as gyms and fitness centers increasingly prefer machines that provide performance tracking, virtual coaching, and personalized workouts. Smart fitness solutions are gaining traction due to their ability to enhance user engagement, monitor progress, and improve training outcomes, encouraging manufacturers to innovate with advanced technologies and integrated software platforms

- Increasing awareness around health, wellness, and corporate fitness programs has accelerated demand for commercial-grade equipment in gyms, hotels, corporate wellness centers, and boutique fitness studios. Fitness-conscious consumers and professionals are seeking high-quality, durable, and technologically advanced equipment, prompting brands to focus on user-friendly, connected solutions that provide measurable results

- Technological advancements, including IoT integration, AI analytics, and virtual training programs, are influencing purchasing decisions, with gyms and commercial facilities emphasizing equipment that enhances the overall user experience. These factors are helping fitness brands differentiate their offerings in a competitive market and drive higher adoption rates

- For instance, in 2024, Life Fitness in the U.S. and Technogym in Italy expanded their commercial fitness equipment portfolios by incorporating AI-enabled treadmills and connected strength training machines. These launches were introduced in response to rising demand for smart, interactive workout experiences, with distribution across gyms, hotels, and online commercial channels. The products were also marketed as premium, tech-forward solutions, enhancing brand recognition and repeat orders

- While demand for commercial fitness equipment is growing, sustained market expansion depends on continuous R&D, cost-efficient production, and ensuring equipment durability and safety. Manufacturers are also focusing on improving scalability, supply chain efficiency, and developing innovative solutions that balance technology, quality, and affordability for broader adoption

Commercial Fitness Equipment Market Dynamics

Driver

“Growing Adoption of Smart and Connected Fitness Equipment”

- Rising demand for technologically advanced, connected, and AI-enabled fitness machines is a major driver for the commercial fitness equipment market. Gyms and wellness centers are increasingly integrating smart equipment to improve user engagement, track performance metrics, and provide personalized training programs

- Expanding applications across commercial gyms, boutique fitness studios, hotels, and corporate wellness programs are influencing market growth. Smart equipment enhances workout efficiency, monitoring, and overall member experience, encouraging facilities to upgrade or expand their equipment portfolios

- Equipment manufacturers are actively promoting smart and interactive solutions through product innovation, partnerships with fitness apps, and integrated software platforms. These efforts are supported by the growing preference for health-oriented, results-driven fitness experiences, driving repeat usage and client retention

- For instance, in 2023, Precor in the U.S. and Johnson Health Tech in Taiwan reported increased adoption of smart treadmills and connected strength equipment in commercial gyms, responding to higher consumer demand for interactive and performance-tracking machines

- Although rising smart and connected fitness trends support growth, wider adoption depends on cost optimization, equipment maintenance, and training for gym staff. Investment in IoT integration, software updates, and durable design is critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“High Cost and Maintenance of Advanced Commercial Equipment”

- The relatively high cost of commercial-grade smart fitness equipment compared to traditional machines remains a key challenge, limiting adoption among smaller gyms or price-sensitive facilities. High R&D, manufacturing, and installation costs contribute to elevated pricing

- Maintenance and operational requirements for technologically advanced equipment can also hinder adoption. Regular software updates, calibration, and service support are necessary to ensure functionality and safety, adding to operational expenses

- Limited awareness of the benefits of smart and connected equipment in certain regions further restricts growth, particularly in developing markets where traditional fitness setups dominate

- For instance, in 2024, small gyms in Southeast Asia and Latin America reported slower uptake of AI-enabled treadmills and connected strength machines due to higher costs and limited technical knowledge. Maintenance and software support challenges also affected purchasing decisions

- Overcoming these challenges will require cost-efficient production, expanded service networks, and targeted education initiatives for gym operators and facility managers. Collaboration with commercial fitness chains, technology providers, and distributors can help unlock long-term growth potential in the global commercial fitness equipment market

Commercial Fitness Equipment Market Scope

The market is segmented on the basis of type, product type, distribution channel, and end user

• By Type

On the basis of type, the commercial fitness equipment market is segmented into Strength Training Equipment, Cardiovascular Training Equipment, and Others. The Cardiovascular Training Equipment segment held the largest market revenue share in 2025, driven by high demand for treadmills, elliptical machines, and stationary bikes in gyms, hotels, and wellness centers. These machines are popular for their ability to support weight management, improve endurance, and provide customizable workout programs for diverse users.

The Strength Training Equipment segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of resistance and functional training in commercial fitness centers. Strength equipment such as free weights, ab machines, and multi-gyms are highly valued for enhancing muscle development, overall fitness, and rehabilitation programs.

• By Product Type

On the basis of product type, the market is segmented into Treadmills, Elliptical Machines, Stationary Machines, Rowing Machines, Free Weights, Exercise Cycles, Ab Machines, and Others. Treadmills held the largest market share in 2025, owing to their widespread use in commercial gyms and fitness studios for cardio training. Treadmills are preferred for their versatility, ease of use, and integration with digital tracking systems.

Rowing Machines are expected to register the fastest growth from 2026 to 2033, supported by increasing interest in full-body workouts and compact, multifunctional cardio equipment for gyms and corporate wellness facilities.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Sports Goods Stores, Specialty Sports Shops, Online Retailing, Discount Stores, and Departmental Stores. Sports Goods Stores held the largest market share in 2025 due to their extensive product variety, expert guidance, and strong presence in urban areas. Customers often prefer in-store purchases for high-value commercial equipment requiring demonstration and setup support.

Online Retailing is expected to witness the fastest growth from 2026 to 2033, driven by the convenience of home delivery, detailed product information, and the growing adoption of e-commerce platforms by gyms and wellness centers for bulk equipment purchases.

• By End User

On the basis of end user, the market is segmented into Gym, University and School, Community, and Sports Center. Gyms held the largest market revenue share in 2025, supported by the increasing number of fitness enthusiasts and membership-driven growth in commercial fitness facilities. Gyms prioritize advanced cardio and strength equipment to attract and retain members.

Community and Sports Centers are expected to witness the fastest growth from 2026 to 2033, driven by rising government and private investment in public fitness infrastructure and the growing popularity of group fitness, recreational activities, and wellness programs.

Commercial Fitness Equipment Market Regional Analysis

- North America dominated the commercial fitness equipment market with the largest revenue share of 42.3% in 2025, driven by a growing focus on health and wellness, increasing gym memberships, and widespread adoption of smart and connected fitness equipment

- Consumers in the region highly value advanced training solutions, personalized workout tracking, and integrated digital features offered by modern commercial fitness machines

- This widespread adoption is further supported by high disposable incomes, a fitness-conscious population, and the growing preference for corporate wellness programs and boutique fitness studios, establishing commercial fitness equipment as a favored investment for gyms and wellness centers

U.S. Commercial Fitness Equipment Market Insight

The U.S. commercial fitness equipment market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of gyms, health clubs, and boutique fitness studios. Consumers are increasingly prioritizing performance-tracking, connected machines, and interactive workout solutions. The growing preference for AI-enabled and app-integrated fitness equipment further propels the industry. Moreover, the integration of smart fitness technology, such as virtual training programs, IoT-connected machines, and performance analytics, is significantly contributing to market growth

Europe Commercial Fitness Equipment Market Insight

The Europe commercial fitness equipment market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing health awareness, government fitness initiatives, and rising adoption of smart and energy-efficient gym equipment. Urbanization and growing disposable incomes are fostering the uptake of commercial fitness solutions. The region is seeing significant growth across gyms, wellness centers, and corporate fitness programs, with smart and connected equipment being incorporated into both new facilities and renovations

U.K. Commercial Fitness Equipment Market Insight

The U.K. commercial fitness equipment market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health consciousness and demand for technologically advanced, connected fitness solutions. Concerns regarding lifestyle-related health issues are encouraging gyms, schools, and wellness centers to adopt modern equipment. The U.K.’s robust e-commerce and retail infrastructure for fitness products is expected to further stimulate market growth.

Germany Commercial Fitness Equipment Market Insight

The Germany commercial fitness equipment market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of smart and eco-friendly fitness machines and a growing focus on wellness and functional training. Germany’s strong infrastructure and emphasis on innovation promote the adoption of advanced equipment, particularly in commercial gyms and corporate wellness facilities. Integration of connected solutions for training monitoring and energy efficiency is becoming increasingly prevalent, aligning with consumer expectations.

Asia-Pacific Commercial Fitness Equipment Market Insight

The Asia-Pacific commercial fitness equipment market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and expanding awareness of health and wellness in countries such as China, Japan, and India. The region’s growing inclination toward fitness centers and government initiatives promoting physical activity are driving adoption. Furthermore, as APAC emerges as a manufacturing hub for fitness equipment, affordability and accessibility are expanding to a wider consumer base.

Japan Commercial Fitness Equipment Market Insight

The Japan commercial fitness equipment market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech culture, increasing fitness awareness, and demand for convenience. The market emphasizes performance tracking and smart connectivity, with gyms and wellness centers integrating AI-enabled and IoT-connected machines. Moreover, Japan’s aging population is likely to spur demand for easy-to-use, safe, and effective fitness solutions in both commercial and community settings.

China Commercial Fitness Equipment Market Insight

The China commercial fitness equipment market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rapid urbanization, and rising health consciousness. China represents one of the largest markets for gyms and wellness centers, with increasing adoption of smart, connected, and high-performance fitness equipment. Government initiatives promoting public health, along with local manufacturing of affordable commercial-grade equipment, are key factors propelling market growth in China.

Commercial Fitness Equipment Market Share

The Commercial Fitness Equipment industry is primarily led by well-established companies, including:

- PlayCore, Inc. (U.S.)

- Acquapole S.a.s. (Italy)

- HYDRO-FIT (U.S.)

- Technogym S.p.A. (Italy)

- Johnson Fitness (U.S.)

- Precor Incorporated (U.S.)

- Cybex International, Inc. (U.S.)

- Amer Sports (Finland)

- Keiser (U.S.)

- Matrix Fitness (U.S.)

- Life Fitness (U.S.)

- Yanre Fitness (China)

- Trinity Interface Systems Pvt Ltd. (India)

- Cosco (India) Limited (India)

- United Fitness (U.S.)

- Aerofit (India)

- Nautilus, Inc. (U.S.)

- TRUE Fitness Technology, Inc. (U.S.)

- Torque Fitness (U.S.)

- ICON Health & Fitness, Inc. (U.S.)

Latest Developments in Global Commercial Fitness Equipment Market

- In August 2025, Life Fitness (U.S.) launched a new line of smart cardio equipment, integrating AI-driven personal training features. The development aims to enhance user engagement, attract tech-savvy consumers, and provide a personalized workout experience. This strategic move strengthens Life Fitness’s market leadership and positions the company at the forefront of the digital fitness revolution, expanding its customer base and boosting brand competitiveness

- In September 2025, Technogym (Italy) announced a partnership with a leading health and wellness app to offer a seamless, integrated fitness experience. The collaboration focuses on digital integration and personalized solutions, allowing users to track and optimize their workouts. This initiative enhances Technogym’s brand visibility, appeals to health-conscious consumers, and drives adoption of connected fitness equipment in commercial and home settings

- In July 2025, Nautilus (U.S.) acquired a regional fitness equipment distributor to strengthen its supply chain and expand market access. The acquisition improves distribution efficiency, enables faster response to regional demands, and enhances customer service. By consolidating its supply chain, Nautilus gains a competitive edge, increases operational effectiveness, and reinforces its position in the growing commercial fitness equipment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.