Global Commercial Helicopter Market

Market Size in USD Billion

CAGR :

%

USD

6.65 Billion

USD

9.30 Billion

2024

2032

USD

6.65 Billion

USD

9.30 Billion

2024

2032

| 2025 –2032 | |

| USD 6.65 Billion | |

| USD 9.30 Billion | |

|

|

|

|

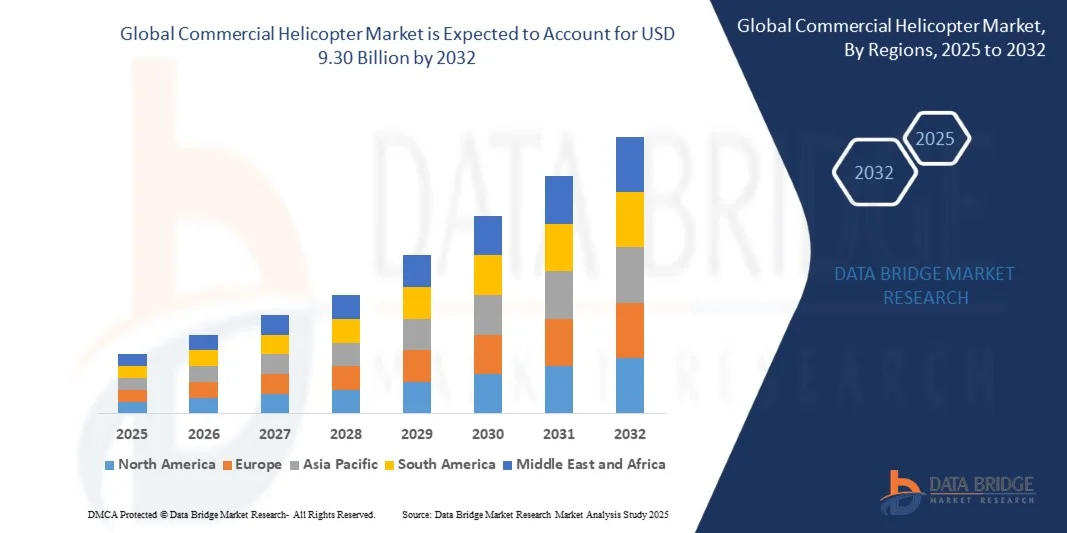

What is the Global Commercial Helicopter Market Size and Growth Rate?

- The global commercial helicopter market size was valued at USD 6.65 billion in 2024 and is expected to reach USD 9.30 billion by 2032, at a CAGR of 4.29% during the forecast period

- Market growth is primarily driven by increasing adoption of advanced aviation technologies, rising demand for air mobility solutions, and the expansion of commercial operations in sectors such as oil & gas, emergency medical services, and transport

- In addition, the growing need for rapid and efficient transportation in urban and remote areas, combined with advancements in safety, navigation, and fuel efficiency, is reinforcing the adoption of commercial helicopters, thereby propelling the industry forward

What are the Major Takeaways of Commercial Helicopter Market?

- Commercial helicopters, used across passenger transport, emergency medical services, law enforcement, and industrial operations, are increasingly integral for fast, reliable, and versatile air mobility solutions

- The market is further driven by rising infrastructure development, government investments in air transport services, and an increasing preference for rotary-wing aircraft in sectors requiring agility, rapid deployment, and operational efficiency

- Europe dominated the commercial helicopter market with the largest revenue share of 34.58% in 2024, driven by the strong presence of key manufacturers, stringent aviation regulations, and growing demand for commercial air transport solutions across the continent

- The Asia-Pacific commercial helicopter market is poised to grow at the fastest CAGR of 10.36% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing investments in infrastructure and regional connectivity in countries such as China, Japan, and India

- The Light segment dominated the market with the largest revenue share of 38.5% in 2024, primarily driven by its cost-effectiveness, fuel efficiency, and versatility for short-range operations and urban mobility

Report Scope and Commercial Helicopter Market Segmentation

|

Attributes |

Commercial Helicopter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Commercial Helicopter Market?

“Advancements in Autonomous and Electric Propulsion Technologies”

- A key and accelerating trend in the global commercial helicopter market is the integration of autonomous flight systems and electric propulsion technologies, aimed at enhancing operational efficiency, reducing noise, and minimizing carbon emissions. This innovation is transforming the aviation landscape and improving overall flight safety

- For instance, several new electric and hybrid-electric helicopter prototypes are being developed with autonomous navigation capabilities, allowing pilots to focus on critical tasks while automated systems handle routine flight operations. These solutions also reduce pilot workload in congested urban airspace

- Autonomous features in commercial helicopters enable route optimization, real-time traffic awareness, and predictive maintenance alerts. Companies are integrating AI-driven flight systems to improve fuel efficiency, reduce wear and tear, and ensure safer operations under varying environmental conditions

- The integration of electric propulsion with advanced avionics facilitates quieter, eco-friendly, and cost-efficient operations, particularly for urban air mobility (UAM) applications. Through centralized control systems, operators can monitor multiple parameters from battery status to flight telemetry

- This trend toward electrification and autonomous capability is redefining user and operator expectations, driving demand for more efficient, sustainable, and safe air transport solutions. Companies such as Airbus, Bell Textron, and Leonardo are actively developing next-generation electric and autonomous helicopter models

- The adoption of autonomous and electric technologies in commercial helicopters is rapidly increasing, as operators prioritize sustainability, operational efficiency, and enhanced passenger experience in both urban and regional transport sectors

What are the Key Drivers of Commercial Helicopter Market?

- Rising demand for efficient, sustainable, and technologically advanced air transport solutions is a major driver for the commercial helicopter market. Operators seek to reduce operational costs while improving safety and reliability

- For instance, Airbus and Bell Textron are actively investing in electric and hybrid propulsion technologies to lower emissions and comply with increasingly stringent environmental regulations, boosting market expansion

- Increasing urbanization and the emergence of urban air mobility (UAM) initiatives are driving the adoption of quieter, low-emission, and compact helicopter solutions for passenger transport, emergency medical services, and cargo delivery

- Government support and investments in advanced aviation infrastructure, particularly in Europe and North America, are fostering adoption of commercial helicopters equipped with electric and autonomous capabilities

- Operational convenience, such as reduced maintenance downtime, extended range, and enhanced safety features through advanced avionics, are propelling helicopter adoption across urban transport, emergency services, and offshore operations. The growing focus on eco-friendly aviation solutions further accelerates market growth

Which Factor is Challenging the Growth of the Commercial Helicopter Market?

- High initial investment costs of electric and autonomous helicopters compared to traditional models pose a significant challenge for market expansion. Smaller operators may hesitate due to the premium pricing of next-generation aircraft

- Regulatory hurdles and certification processes for autonomous and electric helicopters are time-consuming and complex, creating entry barriers for new market participants

- Limited infrastructure for electric charging, battery swapping, and urban landing pads can hinder rapid deployment of these helicopters in emerging markets

- Safety concerns and public apprehension regarding autonomous flight systems may slow adoption, despite advancements in AI and automation. Companies such as Lockheed Martin and Robinson Helicopter are focusing on rigorous testing and certification to mitigate these concerns

- Overcoming these challenges through regulatory support, cost optimization, expansion of charging infrastructure, and public awareness campaigns will be crucial for the sustained growth of the global commercial helicopter market

How is the Commercial Helicopter Market Segmented?

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the commercial helicopter market is segmented into Light, Medium, Heavy, and Very Large. The Light segment dominated the market with the largest revenue share of 38.5% in 2024, primarily driven by its cost-effectiveness, fuel efficiency, and versatility for short-range operations and urban mobility. Light helicopters are widely adopted for emergency medical services, aerial surveys, and tourism applications, where maneuverability and low operational costs are key priorities. Their compact design allows landing in confined areas, making them ideal for urban and semi-urban operations.

The Medium segment is expected to witness the fastest CAGR of 6.2% from 2025 to 2032, fueled by increasing demand in offshore operations, corporate transport, and regional connectivity. Medium helicopters provide higher payload capacity and longer range while maintaining relative operational flexibility. Advancements in avionics, hybrid propulsion, and safety systems further enhance the adoption of medium helicopters across commercial and government sectors.

• By Application

On the basis of application, the commercial helicopter market is segmented into Oil & Gas, Transport, Medical Services, Law Enforcement & Public Safety, and Others. The Transport segment dominated the market with the largest revenue share of 41% in 2024, driven by the rising demand for corporate travel, urban air mobility, and regional connectivity solutions. Helicopters in transport applications provide fast, flexible, and point-to-point travel, bypassing traffic congestion and enhancing efficiency for businesses and private operators. Innovations in passenger comfort, digital avionics, and electric propulsion are further accelerating adoption in this segment.

The Oil & Gas segment is anticipated to witness the fastest CAGR of 7.1% from 2025 to 2032, fueled by offshore exploration, maintenance activities, and the need for reliable personnel transport to remote oil rigs. Helicopters in this segment must meet high safety and endurance standards, driving investment in advanced, heavy-lift, and medium-lift models. The growing focus on energy infrastructure development globally supports the expansion of this segment.

Which Region Holds the Largest Share of the Commercial Helicopter Market?

- Europe dominated the commercial helicopter market with the largest revenue share of 34.58% in 2024, driven by the strong presence of key manufacturers, stringent aviation regulations, and growing demand for commercial air transport solutions across the continent

- European operators highly value advanced safety features, fuel efficiency, and technological innovations in helicopters, which are crucial for offshore, emergency medical, and corporate transport applications

- This widespread adoption is further supported by well-developed aviation infrastructure, high investment in commercial fleet modernization, and a strong focus on environmental compliance, making Europe the preferred region for both helicopter operations and procurement

Germany Commercial Helicopter Market Insight

The Germany commercial helicopter market captured the largest revenue share of 28% in Europe in 2024, driven by the country’s mature aviation sector, advanced helicopter manufacturing capabilities, and rising demand for corporate, medical, and law enforcement applications. Germany’s strong focus on technological advancements, eco-friendly operations, and pilot training programs further promotes market expansion.

U.K. Commercial Helicopter Market Insight

The U.K. commercial helicopter market is projected to expand at a significant CAGR during the forecast period, fueled by increasing corporate transport needs, offshore operations in the North Sea, and rising investments in emergency medical and law enforcement aviation services. The country’s strategic adoption of hybrid and electric helicopter solutions also supports long-term growth.

France Commercial Helicopter Market Insight

The France commercial helicopter market is expected to grow steadily, driven by government contracts for emergency medical services, defense-related civil operations, and regional transport solutions. The country’s emphasis on safety regulations and eco-efficient rotorcraft adoption encourages fleet modernization and technological upgrades.

Which Region is the Fastest Growing Region in the Commercial Helicopter Market?

The Asia-Pacific commercial helicopter market is poised to grow at the fastest CAGR of 10.36% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing investments in infrastructure and regional connectivity in countries such as China, Japan, and India. The region’s expanding offshore oil and gas operations, rising demand for medical air transport, and growing corporate travel requirements further propel market growth.

Japan Commercial Helicopter Market Insight

The Japan commercial helicopter market is gaining traction due to the country’s high-tech aviation ecosystem, aging population requiring emergency transport, and strong emphasis on safety and efficiency. The integration of advanced avionics and hybrid propulsion helicopters is fueling adoption in both commercial and government operations.

China Commercial Helicopter Market Insight

The China commercial helicopter market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by a booming corporate sector, expanding urban air mobility initiatives, and strong government incentives for regional connectivity. The presence of domestic manufacturers offering cost-effective and technologically advanced helicopters is further accelerating market penetration across transport, medical, and law enforcement applications.

Which are the Top Companies in Commercial Helicopter Market?

The commercial helicopter industry is primarily led by well-established companies, including:

- Airbus (France)

- Bell Textron Inc. (U.S.)

- Leonardo S.p.A. (Italy)

- Lockheed Martin Corporation (U.S.)

- Robinson Helicopter Company (U.S.)

- Russian Helicopters (Rostec) (Russia)

- Enstrom Helicopter Corporation (U.S.)

- MD Helicopters, Inc. (U.S.)

- Kaman Corporation (U.S.)

- Hindustan Aeronautics Limited (HAL) (India)

What are the Recent Developments in Global Commercial Helicopter Market?

- In June 2025, Shin-Nihon Helicopters signed a purchase agreement with Bell Textron, Inc., acquiring its first two Bell 429 helicopters, further expanding Japan's largest Bell fleet. These aircraft will be deployed for powerline patrol and personnel transportation missions, complementing their existing Bell 206, Bell 412, and Bell 427 models, strengthening operational efficiency and coverage

- In May 2025, Airbus Helicopters Canada (Airbus SE) inaugurated its new integrated distribution center in the Niagara region, a 21,000-square-foot facility that expands spare parts storage capacity and strengthens industrial operations, supporting faster maintenance and enhanced service capabilities

- In March 2025, at Verticon 2025 in Dallas, Leonardo S.P.A. announced substantial growth in the global commercial helicopter market with new orders for nearly 30 helicopters across multiple models, including the AW109 GrandNew, AW169, AW139, and AW189, reinforcing its leadership in diversified mission solutions

- In March 2025, Leonardo S.p.A booked nearly 30 helicopters valued at EUR 370 million (USD 423.39 million) for energy, public service, and VIP roles, highlighting strong market demand and strategic expansion across critical commercial and government segments.

- In March 2025, Airbus S.A.S unveiled the new H140, a light twin-engine helicopter in the 3-tonne class, at the VERTICON vertical lift industry show in Dallas, Texas. The rotorcraft is designed to improve performance, cost-efficiency, and passenger and crew comfort, positioning Airbus to address emerging multi-mission requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.