Global Commercial Microwave Ovens Market

Market Size in USD Billion

CAGR :

%

USD

14.27 Billion

USD

22.74 Billion

2025

2033

USD

14.27 Billion

USD

22.74 Billion

2025

2033

| 2026 –2033 | |

| USD 14.27 Billion | |

| USD 22.74 Billion | |

|

|

|

|

Commercial Microwave Ovens Market Size

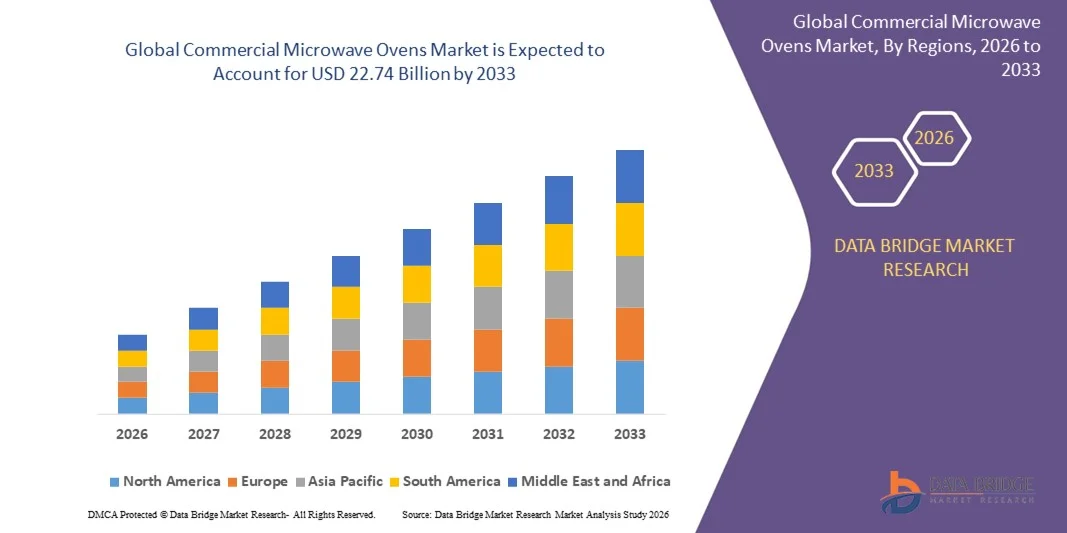

- The global commercial microwave ovens market size was valued at USD 14.27 billion in 2025 and is expected to reach USD 22.74 billion by 2033, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the rising demand for quick-service restaurants, hotels, and institutional kitchens, where efficient and high-speed cooking solutions are critical

- Increasing adoption of energy-efficient and smart microwave ovens with programmable settings is driving modernization of commercial kitchens and reducing operational costs

Commercial Microwave Ovens Market Analysis

- Technological advancements such as inverter technology, sensor cooking, and multi-stage cooking are enhancing the performance, energy efficiency, and versatility of commercial microwave ovens

- Rising awareness of food safety, hygiene standards, and demand for consistent cooking outcomes in commercial kitchens are boosting the adoption of high-performance microwave ovens

- North America dominated the commercial microwave ovens market with the largest revenue share of 35.50% in 2025, driven by the growing demand for energy-efficient, high-speed cooking appliances and the expansion of quick-service restaurants, hotels, and institutional kitchens

- Asia-Pacific region is expected to witness the highest growth rate in the global commercial microwave ovens market, driven by increasing modernization of commercial kitchens, adoption of energy-efficient and smart appliances, and supportive government initiatives for foodservice infrastructure development

- The 1 to 1.9 Cu. Ft Type segment held the largest market revenue share in 2025, driven by its optimal balance between capacity, energy efficiency, and versatility, making it suitable for a wide range of commercial kitchens. These ovens are widely adopted in restaurants, hotels, and institutional kitchens for consistent cooking, reheating, and defrosting performance

Report Scope and Commercial Microwave Ovens Market Segmentation

|

Attributes |

Commercial Microwave Ovens Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• DAEWOO Electronics UK Ltd (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Commercial Microwave Ovens Market Trends

Rise of Energy-Efficient And Smart Commercial Microwave Ovens

- The growing emphasis on operational efficiency and speed in commercial kitchens is driving the adoption of advanced commercial microwave ovens. These ovens provide rapid cooking, defrosting, and reheating capabilities, reducing food preparation time and improving service efficiency in restaurants, hotels, and institutional kitchens. Increasing consumer demand for consistent food quality and hygiene standards further supports the widespread adoption of these ovens

- The high demand for energy-efficient and programmable microwave ovens is accelerating the adoption of inverter-based and sensor-controlled models. These devices optimize energy consumption, maintain consistent cooking quality, and reduce operational costs for large-scale foodservice operations. Integration with IoT-based kitchen management systems is also encouraging broader adoption across commercial kitchens

- The ease of integration with kitchen automation systems and digital interfaces is making modern microwave ovens more attractive for commercial operators. This allows better workflow management, consistent results, and enhanced kitchen productivity. Advanced features such as multi-stage cooking programs, programmable recipes, and connectivity to cloud-based monitoring systems enhance operational efficiency

- For instance, in 2023, several quick-service restaurant chains implemented inverter-based microwave ovens across multiple locations, resulting in reduced energy consumption, faster service times, and improved food quality. The deployment also led to decreased equipment downtime and lower maintenance costs, boosting overall operational performance

- While smart and energy-efficient microwave ovens are transforming commercial kitchens, market growth depends on continued innovation, user training, and affordability. Manufacturers must focus on localized solutions and after-sales support to maximize adoption. Continuous development of compact, multifunctional, and eco-friendly ovens is expected to further strengthen the market

Commercial Microwave Ovens Market Dynamics

Driver

Increasing Demand For Quick Service Restaurants And Institutional Kitchens

- The rise in quick-service restaurants, hotels, and catering services is driving demand for commercial microwave ovens as a primary tool for fast and consistent food preparation. This growth is further supported by increasing consumer preference for ready-to-eat and convenience meals. Expansion of urban centers and rising disposable incomes are also stimulating market adoption

- Restaurant operators and institutional kitchens are increasingly aware of the operational and cost-saving benefits of programmable and energy-efficient ovens. The adoption of advanced microwave technologies helps reduce cooking time, maintain food quality, and lower energy bills. High-capacity ovens capable of handling large batches are particularly in demand for peak-hour operations

- Government regulations and industry standards promoting energy efficiency, food safety, and hygiene are encouraging the use of modern microwave ovens in commercial kitchens. These standards are pushing operators to upgrade outdated equipment. Certification requirements and eco-label initiatives are also contributing to adoption

- For instance, in 2022, multiple institutional foodservice chains in North America upgraded to sensor-based microwave ovens to comply with energy and safety regulations, improving operational efficiency and reducing costs. These upgrades also enhanced compliance with hygiene protocols and reduced food wastage

- While growing QSR chains and institutional kitchens are boosting market demand, accessibility, affordability, and training for advanced microwave systems remain critical for sustained adoption. Partnerships with training providers and equipment leasing options can help overcome adoption barriers

Restraint/Challenge

High Cost Of Advanced Microwave Ovens And Limited Technical Expertise

- The premium price of advanced commercial microwave ovens, including inverter, sensor, and smart-connected models, limits accessibility for small restaurants and catering businesses. High investment costs restrict widespread adoption among smaller operators. Additional costs for installation, calibration, and warranty extensions further deter buyers

- In many regions, lack of trained personnel to operate and maintain modern microwave systems hinders market penetration. Operational inefficiencies and maintenance challenges can lead to reduced adoption rates. Continuous technical support and staff upskilling are required to fully utilize advanced features

- Supply chain challenges, including inconsistent availability of replacement parts and specialized components, further limit access, particularly in remote or underdeveloped regions. Delays in spare parts procurement and limited after-sales service negatively impact the operational continuity of commercial kitchens

- For instance, in 2023, surveys in Sub-Saharan Africa revealed that over 60% of small-scale foodservice operators could not upgrade to modern microwave ovens due to cost and technical skill gaps. Similar challenges were reported in rural parts of Asia, highlighting the need for affordable solutions and training programs

- While commercial microwave technologies continue to advance, addressing affordability, training, and support infrastructure is essential to expand market reach and ensure long-term growth. Strategic partnerships, leasing options, and remote troubleshooting services can mitigate these challenges and drive broader adoption

Commercial Microwave Ovens Market Scope

The market is segmented on the basis of product type, grade, and application.

- By Product Type

On the basis of product type, the global commercial microwave ovens market is segmented into Under 1 Cu. Ft Type, 1 to 1.9 Cu. Ft Type, and Over 2 Cu. Ft Type. The 1 to 1.9 Cu. Ft Type segment held the largest market revenue share in 2025, driven by its optimal balance between capacity, energy efficiency, and versatility, making it suitable for a wide range of commercial kitchens. These ovens are widely adopted in restaurants, hotels, and institutional kitchens for consistent cooking, reheating, and defrosting performance.

The Over 2 Cu. Ft Type segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for high-capacity ovens capable of handling large volumes of food. These models are particularly popular in quick-service restaurants, catering services, and large institutional kitchens where speed, efficiency, and multi-stage cooking capabilities are essential.

- By Grade

On the basis of grade, the market is segmented into Light Duty, Medium-Duty, and Heavy-Duty. The Medium-Duty segment held the largest market revenue share in 2025 due to its durability, energy efficiency, and ability to withstand frequent use while maintaining consistent performance. Medium-duty ovens are preferred by small and mid-sized restaurants and commercial kitchens for day-to-day operations without the need for heavy industrial-grade equipment.

The Heavy-Duty segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising investments in large-scale foodservice operations and institutional kitchens. Heavy-duty ovens offer superior reliability, advanced features, and extended operational life, making them ideal for high-volume food preparation environments and chain restaurants.

- By Application

On the basis of application, the market is segmented into Food Service Industry, Food Industry, and Others. The Food Service Industry segment held the largest market revenue share in 2025, fueled by the growing number of restaurants, cafes, hotels, and catering services that require quick and efficient cooking solutions. Commercial microwave ovens provide consistent results, operational efficiency, and energy savings, which are critical for maintaining service quality.

The Food Industry segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand from food processing plants, packaged meal producers, and ready-to-eat product manufacturers. These ovens help streamline production, reduce cooking time, and maintain product quality across large batches, supporting the growing trend of convenience foods globally.

Commercial Microwave Ovens Market Regional Analysis

- North America dominated the commercial microwave ovens market with the largest revenue share of 35.50% in 2025, driven by the growing demand for energy-efficient, high-speed cooking appliances and the expansion of quick-service restaurants, hotels, and institutional kitchens

- Operators in the region highly value advanced features such as inverter technology, programmable settings, and smart connectivity, which enhance kitchen efficiency, reduce energy consumption, and ensure consistent food quality

- This widespread adoption is further supported by high disposable incomes, strong foodservice infrastructure, and rising consumer preference for convenience foods, establishing commercial microwave ovens as an essential tool in professional kitchens

U.S. Commercial Microwave Ovens Market Insight

The U.S. commercial microwave ovens market captured the largest revenue share in 2025 within North America, fueled by the expansion of quick-service restaurants, catering services, and institutional kitchens. Operators are increasingly investing in energy-efficient, programmable, and inverter-based microwave ovens to reduce cooking times, improve workflow, and minimize energy costs. The growing integration of kitchen automation systems and digital interfaces is further propelling market growth, allowing for enhanced operational efficiency and consistent cooking outcomes.

Europe Commercial Microwave Ovens Market Insight

The Europe commercial microwave ovens market is expected to witness the fastest growth rate from 2026 to 2033, driven by the demand for modern, energy-efficient cooking solutions and compliance with strict food safety and hygiene regulations. Urbanization, the growth of multi-chain restaurants, and the rising adoption of connected appliances are fostering market expansion. European operators are also drawn to smart microwave ovens that offer programmable cooking, sensor-based automation, and integration with kitchen management systems.

U.K. Commercial Microwave Ovens Market Insight

The U.K. commercial microwave ovens market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing quick-service restaurant chains and institutional kitchen modernization. The adoption of inverter-based, energy-saving, and programmable microwave ovens helps operators reduce operational costs, improve food quality, and comply with energy-efficiency regulations. Consumer demand for faster service and consistent cooking results further supports market growth.

Germany Commercial Microwave Ovens Market Insight

The Germany commercial microwave ovens market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong regulatory support for energy efficiency, the growth of the hospitality sector, and increasing awareness of smart kitchen solutions. Commercial kitchens are adopting advanced microwave ovens with programmable functions, sensor controls, and high-speed cooking capabilities. Integration with kitchen automation and workflow optimization systems is enhancing productivity and reducing energy consumption in professional foodservice settings.

Asia-Pacific Commercial Microwave Ovens Market Insight

The Asia-Pacific commercial microwave ovens market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rapid expansion of restaurants, hotels, and institutional kitchens across China, Japan, and India. Rising disposable incomes, urbanization, and technological advancements are driving demand for energy-efficient, high-speed, and programmable microwave ovens. Government initiatives promoting modern kitchen infrastructure and digitalization of foodservice operations are further fueling market adoption.

Japan Commercial Microwave Ovens Market Insight

The Japan commercial microwave ovens market is expected to witness the fastest growth rate from 2026 to 2033 due to high adoption of smart kitchen appliances, advanced restaurant automation, and consumer demand for convenience and speed. Operators are increasingly investing in sensor-controlled and inverter-based microwave ovens that provide consistent cooking, energy efficiency, and seamless integration with other kitchen equipment. The trend is also supported by Japan’s focus on modernizing institutional kitchens and optimizing workflow efficiency.

China Commercial Microwave Ovens Market Insight

The China commercial microwave ovens market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding foodservice industry, rapid urbanization, and growing demand for fast, energy-efficient cooking appliances. Commercial kitchens are increasingly adopting programmable, inverter-based, and sensor-equipped microwave ovens to improve efficiency, reduce cooking times, and maintain consistent food quality. The push toward modern, automated kitchen solutions and the availability of competitively priced domestic products are key factors propelling market growth.

Commercial Microwave Ovens Market Share

The Commercial Microwave Ovens industry is primarily led by well-established companies, including:

• DAEWOO Electronics UK Ltd (U.K.)

• Panasonic Corporation (Japan)

• SMEG S.p.A. (Italy)

• BSH Hausgeräte GmbH (Germany)

• LG Electronics (South Korea)

• Whirlpool Corporation (U.S.)

• Haier Inc. (China)

• SHARP CORPORATION (Japan)

• Electrolux (Sweden)

• Alto-Shaam, Inc. (U.S.)

• Illinois Tool Works Inc. (U.S.)

• Galanz (China)

• Midea Group (China)

• SAMSUNG (South Korea)

• Brandt (France)

• Moulinex (France)

• Breville USA, Inc. (U.S.)

Latest Developments in Global Commercial Microwave Ovens Market

- In March 2025, Panasonic Corporation expanded its product innovation by collaborating with Fresco to integrate AI-powered cooking assistants into its HomeCHEF 4-in-1 ovens. This development allows automated recipe adaptation, enhancing convenience and consistency for end-users while strengthening Panasonic’s position in the smart commercial kitchen segment

- In March 2025, Ali Group North America completed the rebranding of its operations under the Welbilt name following the acquisition of Welbilt Inc. This strategic move reinforces brand recognition and equity among quick-service restaurant (QSR) operators, improving market visibility and customer trust in its commercial kitchen solutions

- In February 2025, Middleby Corporation acquired GBT GmbH Bakery Technology to expand its European operations. The acquisition enables the integration of high-volume microwave modules into full-line bakery solutions, improving production efficiency and supporting Middleby’s growth in the European commercial kitchen equipment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.