Global Compact Construction Equipment Market

Market Size in USD Billion

CAGR :

%

USD

45.20 Billion

USD

67.80 Billion

2024

2032

USD

45.20 Billion

USD

67.80 Billion

2024

2032

| 2025 –2032 | |

| USD 45.20 Billion | |

| USD 67.80 Billion | |

|

|

|

|

Compact Construction Equipment Market Size

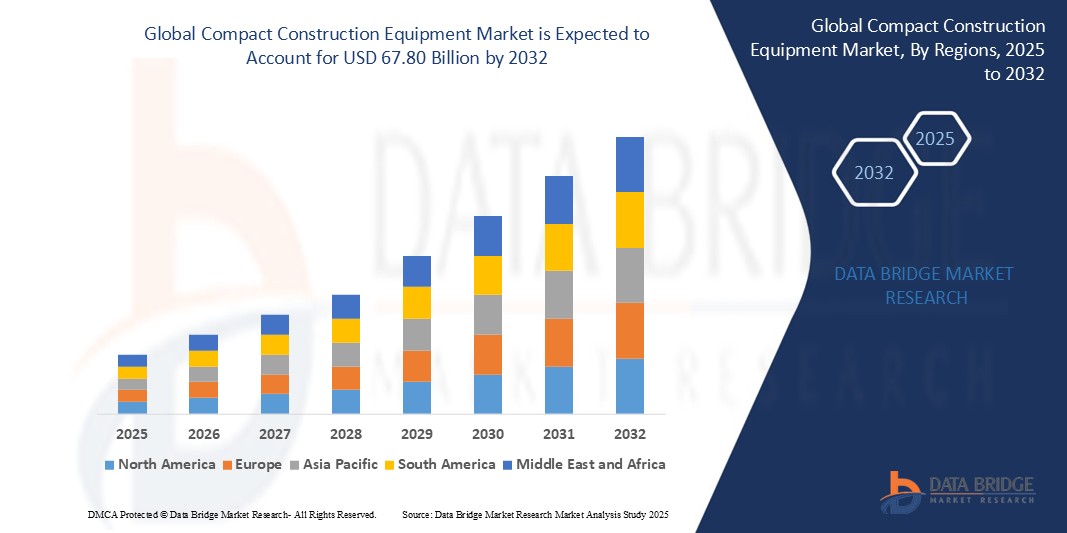

- The global compact construction equipment market size was valued at USD 45.2 billion in 2024 and is expected to reach USD 67.80 billion by 2032, at a CAGR of 5.2% during the forecast period

- This growth is driven by factors such as the increasing demand for versatile, space-saving equipment in construction projects, particularly in urban areas with limited space

Compact Construction Equipment Market Analysis

- Compact construction equipment refers to small, versatile machinery such as mini excavators, skid-steer loaders, compact track loaders, backhoe loaders, and compact wheel loaders. These machines are widely used across construction, agriculture, landscaping, and utility sectors for tasks that require agility and operation in confined spaces.

- The market for compact construction equipment is experiencing strong growth due to rapid urbanization, rising infrastructure development projects, and increasing adoption by small and medium-sized contractors.

- North America is expected to dominate the compact construction equipment market due to robust infrastructure development and residential construction activities

- Asia-Pacific is expected to be the fastest growing region in the compact construction equipment market during the forecast period due to urbanization and infrastructure development

- Excavator’s segment is expected to dominate the market with a market share of 66.41% due to its versatility in urban construction, trenching, and landscaping; compact size suitable for confined spaces

Report Scope and Compact Construction Equipment Market Segmentation

|

Attributes |

Compact Construction Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Compact Construction Equipment Market Trends

“Electrification and Automation”

- The compact construction equipment market is experiencing a significant shift towards electrification and automation

- Manufacturers are introducing electric and hybrid models to meet stringent emission regulations and reduce operational costs

- For instance, CASE Construction Equipment launched the CX15EV and CX25EV mini excavators, offering zero emissions and reduced noise levels

- Automation features such as GPS navigation and remote diagnostics are enhancing productivity and safety on construction sites

- These advancements align with the industry's move towards sustainable and efficient construction practices

Compact Construction Equipment Market Dynamics

Driver

“Urbanization and Infrastructure Development”

- Rapid urbanization is driving the demand for compact construction equipment

- As cities expand, there's an increased need for infrastructure development, including roads, bridges, and residential complexes

- Compact equipment's ability to operate in confined urban spaces makes it ideal for such projects

- Governments worldwide are investing heavily in infrastructure, further fueling the demand for these machines

Opportunity

“Rental Market Expansion”

- The high initial cost of compact construction equipment is leading to a surge in rental services

- Renting allows contractors to access advanced machinery without significant capital investment

- Rental companies often provide maintenance and repair services, reducing operational burdens for contractors

- This trend is particularly pronounced in regions with fragmented construction markets, where contractors prefer flexible equipment usage options

Restraint/Challenge

“High Initial Investment”

- Despite their long-term cost savings, compact construction equipment requires a significant upfront investment

- This can be a barrier for small and medium-sized construction firms with limited capital

- Additionally, the need for specialized training to operate these machines can lead to increased labor costs

- In some developing regions, the lack of awareness about the benefits of compact equipment and the preference for conventional methods can slow down market penetration and growth

Compact Construction Equipment Market Scope

The market is segmented on the basis of type, propulsion, power output, engine capacity, function, electric construction, and battery chemistry.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Propulsion |

|

|

By Power Output |

|

|

By Engine Capacity |

|

|

By Function |

|

|

By Electric Construction Equipment |

|

|

By Battery Chemistry |

|

In 2025, the excavator is projected to dominate the market with a largest share in type segment

The excavator segment is expected to dominate the Compact Construction Equipment market with the largest share of 66.41% in 2025 due to its Versatility in urban construction, trenching, and landscaping; compact size suitable for confined spaces.

The diesel is expected to account for the largest share during the forecast period in propulsion market

In 2025, the hybrid microscopes segment is expected to dominate the market with the largest market share of 60.5%. This dominance is attributed to diesel engines’ high torque output, fuel efficiency for heavy-duty operations, and widespread availability across construction sites. Despite increasing regulatory pressure for cleaner energy sources, diesel remains the preferred choice for most equipment types due to its proven performance in demanding applications.

Compact Construction Equipment Market Regional Analysis

“North America Holds the Largest Share in the Compact Construction Equipment Market”

- North America holds a significant share of the compact construction equipment market, primarily driven by robust infrastructure development and residential construction activities.

- For Instance, In the U.S., the approval of 1.48 million building permits and the completion of 1.54 million housing units in December 2024 indicate a strong demand for compact construction equipment

- The Canadian construction equipment market is also experiencing growth, with building construction investment

- The presence of major manufacturers such as Caterpillar and Deere & Company in the region further supports the demand for compact construction equipment

- Government initiatives and investments in infrastructure, such as the Canada Infrastructure Bank's plan to contribute to the market's expansion

“Asia-Pacific is Projected to Register the Highest CAGR in the Compact Construction Equipment Market”

- The Asia-Pacific region is witnessing rapid growth in the compact construction equipment market, driven by urbanization and infrastructure development in countries such as China, India, and Indonesia

- China's extensive infrastructure projects, such as the Zhoushan High-End New Material Plant and the Beijing Daxing International Airport Expansion, are significant contributors to the demand for compact construction equipment

- For Instance, India's initiatives, including the Mumbai-Ahmedabad High-Speed Rail Project and the Delhi-Mumbai Industrial Corridor, further boost the market's growth in the region

- The increasing adoption of electric and hybrid compact construction equipment aligns with the region's focus on sustainability and environmental considerations

- Key original equipment manufacturers (OEMs) such as Komatsu Ltd., Sany Group, Hitachi Construction Machinery Ltd., and Hyundai Construction Equipment Ltd. are enhancing their presence in the Asia-Pacific market, driving technological advancements and market expansion

Compact Construction Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Doosan Bobcat (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- XCMG Group (China)

- Caterpillar (U.S.)

- AB Volvo (Sweden)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- Komatsu (Japan)

- CNH Industrial N.V. (U.K.)

- Kobelco Construction Machinery Co., Ltd. (Japan)

- Deere & Company (U.S.)

- Sany Group (China)

- HD Hyundai Construction Equipment Co., Ltd. (South Korea)

- Kubota Corporation (Japan)

- JC Bamford Excavators Ltd. (U.K.)

Latest Developments in Global Compact Construction Equipment Market

- In January 2025, Kubota Corporation launched three new models of compact construction equipment, including two mini excavators and one compact track loader

- In July 2024, Deere & Company launched a 326 P-Tier Telescopic Compact Wheel Loader. The equipment provides enhanced operator confidence and effortless operation efficiency

- In March 2024, New Holland Construction Equipment launched three models of compact wheel loaders: W60C, W70C, and W80C LR

- In December 2023, Kubota Corporation launched the KX038-4e electric mini excavator in the European market.

- In October 2024, JCB India launched the JCB NXT 215 LC Fuel Master Tracked Excavator.

- In June 2024, Deere & Company launched five new P-Tier Skid Steer Loader (SSL) and Compact Track Loader (CTL) models, including 330 and 334 P-Tier Skid Steer Loaders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.