Global Companion Animal Diagnostic Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

3.95 Billion

2025

2033

USD

2.42 Billion

USD

3.95 Billion

2025

2033

| 2026 –2033 | |

| USD 2.42 Billion | |

| USD 3.95 Billion | |

|

|

|

|

Companion Animal Diagnostic Market Size

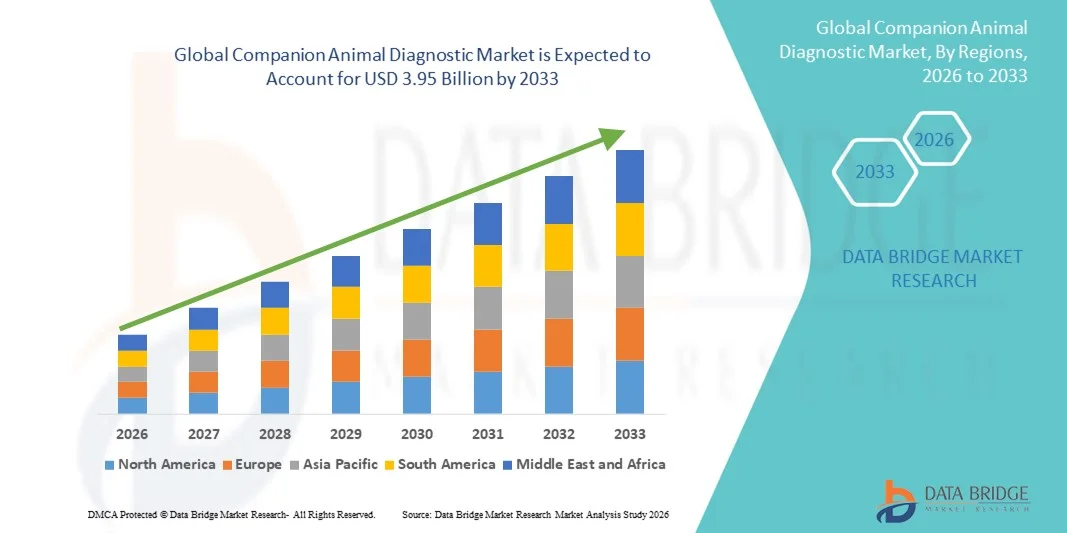

- The global companion animal diagnostic market size was valued at USD 2.42 billion in 2025 and is expected to reach USD 3.95 billion by 2033, at a CAGR of 6.34% during the forecast period

- The market growth is primarily driven by the rising pet adoption rates, increasing awareness of animal health, and the growing prevalence of chronic and infectious diseases among companion animals, leading to higher demand for advanced diagnostic solutions in veterinary practices

- Furthermore, technological advancements in veterinary diagnostics, increasing expenditure on pet healthcare, and the expanding availability of point-of-care and laboratory-based testing solutions are positioning companion animal diagnostics as a critical component of modern veterinary care, thereby significantly supporting overall market growth

Companion Animal Diagnostic Market Analysis

- Companion animal diagnostics, encompassing in-clinic and laboratory-based testing solutions for disease detection, monitoring, and preventive care in pets, have become an essential component of modern veterinary practice due to their role in early diagnosis, treatment planning, and overall improvement of animal health outcomes

- The increasing demand for companion animal diagnostics is primarily driven by rising pet ownership, growing humanization of pets, increasing prevalence of chronic and infectious diseases, and higher spending on pet healthcare by owners

- North America dominated the companion animal diagnostic market with the largest revenue share of 39.1% in 2025, supported by advanced veterinary healthcare infrastructure, high awareness of preventive pet care, and strong presence of leading diagnostic companies, with the U.S. witnessing significant adoption of advanced imaging, immunoassays, and molecular diagnostics in both clinics and reference laboratories

- Asia-Pacific is expected to be the fastest growing region in the companion animal diagnostic market during the forecast period, driven by increasing pet adoption, expanding veterinary services, improving disposable incomes, and rising awareness of animal health in countries such as China, Japan, and India

- Immunodiagnostics segment dominated the companion animal diagnostic market with a market share of 42.5% in 2025, owing to its widespread use in detecting infectious diseases, hormonal disorders, and chronic conditions, along with its suitability for rapid and accurate in-clinic testing

Report Scope and Companion Animal Diagnostic Market Segmentation

|

Attributes |

Companion Animal Diagnostic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Companion Animal Diagnostic Market Trends

Expansion of Point-of-Care and AI-Enabled Veterinary Diagnostics

- A significant and accelerating trend in the global companion animal diagnostic market is the increasing adoption of point-of-care (POC) diagnostic devices integrated with artificial intelligence (AI) to enable faster, more accurate, and in-clinic disease detection across veterinary practices

- For instance, IDEXX Laboratories offers the Catalyst One and Pro analyzers, which provide rapid blood chemistry and electrolyte results within minutes, allowing veterinarians to make immediate clinical decisions during a single patient visit

- AI integration in companion animal diagnostics enables automated result interpretation, trend analysis of patient health data, and improved detection of subtle abnormalities. For instance, AI-supported imaging and hematology platforms can flag irregular patterns and assist veterinarians in identifying early-stage diseases more efficiently. Furthermore, POC testing reduces diagnostic turnaround time and improves workflow efficiency in busy clinics

- The seamless integration of diagnostic instruments with cloud-based practice management software allows veterinarians to store, analyze, and access patient diagnostic data centrally. Through a single digital interface, clinics can manage diagnostic results, treatment histories, and follow-up care, creating a more connected and data-driven veterinary care environment

- This trend toward faster, smarter, and more accessible diagnostic solutions is reshaping expectations for veterinary healthcare delivery. Consequently, companies such as Zoetis are developing AI-enhanced diagnostic platforms and digital cytology tools to support clinical decision-making and improve diagnostic accuracy

- The demand for advanced point-of-care and AI-enabled companion animal diagnostics is growing rapidly across veterinary hospitals and clinics, as pet owners increasingly expect timely, high-quality care comparable to human healthcare standards

Companion Animal Diagnostic Market Dynamics

Driver

Rising Pet Humanization and Increasing Focus on Preventive Veterinary Care

- The growing humanization of pets, combined with rising awareness of preventive veterinary care, is a major driver fueling demand for companion animal diagnostic solutions

- For instance, in June 2025, Mars Petcare expanded its veterinary diagnostics and preventive care initiatives through its Banfield Pet Hospital network, emphasizing routine screening and early disease detection for companion animals

- As pet owners increasingly view pets as family members, they are more willing to invest in regular health check-ups, diagnostic testing, and early intervention, driving higher utilization of blood tests, imaging, and immunodiagnostics

- Furthermore, the increasing prevalence of chronic conditions such as diabetes, kidney disease, and obesity in companion animals is reinforcing the need for routine monitoring and diagnostic testing throughout an animal’s lifespan

- Rising penetration of corporate veterinary chains and specialty hospitals is accelerating diagnostic volumes, as these organizations standardize advanced diagnostic protocols across their networks

- Increasing regulatory emphasis on animal health surveillance and disease monitoring, particularly for zoonotic diseases, is further driving the adoption of companion animal diagnostic testing

- The growing availability of pet insurance and corporate veterinary chains is further supporting diagnostic adoption, as insured and wellness-plan-covered pets undergo more frequent diagnostic evaluations, thereby accelerating market growth

Restraint/Challenge

High Diagnostic Costs and Limited Access in Emerging Markets

- The relatively high cost of advanced companion animal diagnostic equipment and tests poses a significant challenge to market expansion, particularly for small veterinary clinics and pet owners in price-sensitive regions

- For instance, advanced imaging modalities such as CT scanners and molecular diagnostic systems require substantial upfront investment and ongoing maintenance, limiting their adoption outside large veterinary hospitals and reference laboratories

- Addressing affordability concerns through scalable diagnostic platforms, reagent rental models, and lower-cost point-of-care solutions is critical for expanding access. Companies such as Heska have introduced flexible diagnostic leasing programs to help clinics adopt advanced testing without heavy capital expenditure. In addition, limited availability of skilled veterinary professionals trained to operate advanced diagnostic systems can further restrict adoption in emerging markets

- While diagnostic awareness is increasing, disparities in veterinary infrastructure and uneven access to diagnostic laboratories continue to hinder consistent service delivery, particularly in rural and underdeveloped regions

- Variability in diagnostic test accuracy and lack of standardization across different testing platforms can create inconsistencies in clinical outcomes, affecting veterinarian confidence in certain diagnostic solutions

- Limited awareness among pet owners in developing regions regarding the importance of routine diagnostic testing continues to restrain market growth, despite rising pet ownership levels

- Overcoming these challenges through cost-effective diagnostic innovation, training programs for veterinary professionals, and expansion of diagnostic networks will be essential for sustaining long-term growth in the global companion animal diagnostic market

Companion Animal Diagnostic Market Scope

The market is segmented on the basis of technology, application, animal type, and end user.

- By Technology

On the basis of technology, the companion animal diagnostic market is segmented into immunodiagnostics, clinical biochemistry, hematology, urinalysis, molecular diagnostics, and others. The immunodiagnostics segment dominated the market with the largest market revenue share of 42.5% in 2025, driven by its extensive application in detecting infectious diseases, hormonal disorders, and chronic conditions in companion animals. Immunodiagnostic tests are widely used due to their high sensitivity, reliability, and suitability for both in-clinic and laboratory-based testing. The availability of rapid test kits and automated immunoassay analyzers enables faster clinical decision-making. In addition, immunodiagnostics play a key role in routine wellness screening and preventive healthcare programs. Their cost-effectiveness compared to advanced molecular tests further supports widespread adoption. As a result, immunodiagnostics continue to maintain a strong position in veterinary diagnostic workflows.

The molecular diagnostics segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising demand for early, precise, and pathogen-specific disease detection. Techniques such as PCR and DNA-based testing are increasingly used for identifying infectious agents and genetic disorders in companion animals. Growing emphasis on precision veterinary medicine is accelerating adoption of molecular platforms. Advancements in technology are improving test accuracy and reducing turnaround time. Furthermore, declining costs and expanding availability of molecular diagnostic kits are making these tests more accessible. These factors collectively contribute to the rapid growth of this segment.

- By Application

On the basis of application, the companion animal diagnostic market is segmented into clinical pathology, bacteriology, virology, parasitology, and other applications. The clinical pathology segment held the largest market share in 2025 due to its critical role in routine diagnostic evaluation of companion animals. Clinical pathology includes commonly performed tests such as blood chemistry, hematology, and urinalysis. These tests are frequently used for health screening, disease diagnosis, and treatment monitoring. High testing volumes in veterinary clinics significantly contribute to segment dominance. Integration of clinical pathology with point-of-care testing systems further supports its widespread use. Consequently, clinical pathology remains the backbone of companion animal diagnostics.

The virology segment is anticipated to register the fastest growth during the forecast period, driven by increasing prevalence of viral infections in companion animals. Diseases such as canine parvovirus, feline leukemia virus, and rabies require timely and accurate viral diagnostics. Rising awareness of early disease detection among pet owners and veterinarians is boosting demand for virology testing. Advancements in molecular and immunodiagnostic techniques are improving sensitivity and specificity of viral tests. Growing concerns regarding zoonotic disease transmission further reinforce testing demand. These factors are collectively driving rapid growth in the virology segment.

- By Animal Type

On the basis of animal type, the market is segmented into dogs, cats, horses, and other companion animals. The dogs segment dominated the market in 2025, supported by the large global dog population and higher healthcare expenditure on dogs compared to other companion animals. Dogs are more likely to undergo routine diagnostic testing due to regular veterinary visits. High prevalence of chronic conditions such as diabetes, arthritis, and cardiovascular diseases increases diagnostic demand. Pet owners also prioritize preventive care and wellness screening for dogs. Well-established diagnostic protocols for canine diseases further support segment dominance. As a result, dogs account for the largest share of companion animal diagnostic testing.

The cats segment is expected to witness the fastest growth over the forecast period, driven by increasing cat adoption and rising awareness of feline healthcare. Historically, cats received fewer diagnostic tests, but this trend is shifting with improved owner education. Growing focus on early detection of kidney disease, thyroid disorders, and infectious conditions in cats is boosting testing volumes. Veterinarians are increasingly recommending routine diagnostic screening for aging cats. The availability of cat-specific diagnostic assays is also improving. These developments are accelerating growth in the feline diagnostics segment.

- By End User

On the basis of end user, the companion animal diagnostic market is segmented into laboratories, veterinary hospitals and clinics, point-of-care/in-house testing, and research institutes and universities. The veterinary hospitals and clinics segment accounted for the largest market revenue share in 2025, as these facilities serve as the primary point of care for companion animals. High patient footfall and frequent diagnostic testing contribute to strong demand. Many clinics are equipped with in-house diagnostic instruments, enabling faster turnaround times. The presence of trained veterinary professionals supports accurate test interpretation. Expansion of corporate veterinary hospital networks is further strengthening this segment. Consequently, veterinary hospitals and clinics remain the dominant end users of companion animal diagnostics.

The point-of-care/in-house testing segment is projected to witness the fastest growth from 2026 to 2033, driven by the demand for rapid and same-visit diagnostic results. Veterinarians increasingly prefer in-house testing to improve workflow efficiency and clinical outcomes. Advancements in compact and user-friendly diagnostic devices are facilitating wider adoption. Reduced dependence on external laboratories is also lowering turnaround times and operational costs. Pet owners increasingly expect immediate diagnosis and treatment. These factors are driving strong growth in point-of-care and in-house diagnostic testing solutions.

Companion Animal Diagnostic Market Regional Analysis

- North America dominated the companion animal diagnostic market with the largest revenue share of 39.1% in 2025, supported by advanced veterinary healthcare infrastructure, high awareness of preventive pet care, and strong presence of leading diagnostic companies

- Veterinarians and pet owners in the region place strong value on early disease detection, advanced diagnostic accuracy, and rapid test turnaround, supported by widespread adoption of in-clinic analyzers, reference laboratories, and advanced imaging technologies

- This widespread adoption is further reinforced by high spending on pet healthcare, strong presence of leading diagnostic companies, growing penetration of pet insurance, and increased awareness of chronic and infectious diseases, establishing companion animal diagnostics as a core component of veterinary care delivery

U.S. Companion Animal Diagnostic Market Insight

The U.S. companion animal diagnostic market captured the largest revenue share within North America in 2025, driven by high pet ownership rates, strong pet humanization trends, and advanced veterinary healthcare infrastructure. Pet owners increasingly prioritize preventive care, early disease detection, and routine wellness testing for companion animals. The widespread presence of corporate veterinary chains and reference laboratories further supports diagnostic adoption. Growing penetration of pet insurance and higher spending on animal healthcare continue to propel market expansion. Moreover, rapid adoption of point-of-care diagnostics and advanced imaging technologies is significantly contributing to sustained market growth.

Europe Companion Animal Diagnostic Market Insight

The Europe companion animal diagnostic market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing awareness of animal health and rising emphasis on preventive veterinary care. The region’s well-established veterinary services and regulatory focus on animal welfare are supporting diagnostic utilization. Growing pet ownership and urbanization are fostering demand for routine diagnostic testing. European veterinarians increasingly adopt advanced laboratory and in-clinic diagnostic solutions. The market is witnessing growth across companion animal clinics and specialty hospitals. Diagnostics are being integrated into both routine check-ups and chronic disease management programs.

U.K. Companion Animal Diagnostic Market Insight

The U.K. companion animal diagnostic market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising pet ownership and increasing expenditure on pet healthcare. Growing awareness of early disease detection and preventive screening is encouraging diagnostic testing. Veterinary practices in the U.K. are increasingly adopting in-house diagnostic analyzers to improve efficiency. The presence of strong veterinary networks and pet insurance coverage supports testing volumes. In addition, rising cases of chronic conditions in aging pets are driving demand. These factors are collectively supporting sustained market growth in the country.

Germany Companion Animal Diagnostic Market Insight

The Germany companion animal diagnostic market is expected to expand at a considerable CAGR during the forecast period, fueled by strong awareness of animal health and a technologically advanced veterinary ecosystem. Germany’s emphasis on quality healthcare and preventive medicine supports diagnostic adoption. Veterinary clinics increasingly utilize advanced laboratory and imaging diagnostics. High standards of veterinary education and infrastructure further promote accurate disease diagnosis. Growing focus on chronic disease management in companion animals is boosting testing demand. The market also benefits from strong regulatory frameworks supporting animal welfare and healthcare quality.

Asia-Pacific Companion Animal Diagnostic Market Insight

The Asia-Pacific companion animal diagnostic market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapidly increasing pet adoption, urbanization, and rising disposable incomes. Improving awareness of animal health and expanding veterinary services are accelerating diagnostic utilization. Countries such as China, Japan, and India are witnessing strong growth in companion animal clinics. The increasing availability of affordable diagnostic technologies is expanding market access. Government initiatives supporting animal health and disease control further aid growth. The region’s large untapped market potential positions it as a key growth hub.

Japan Companion Animal Diagnostic Market Insight

The Japan companion animal diagnostic market is gaining momentum due to the country’s advanced veterinary practices, aging pet population, and strong emphasis on preventive care. Japanese pet owners place high importance on early diagnosis and regular health monitoring. Increasing adoption of point-of-care diagnostic devices is improving in-clinic testing capabilities. Integration of diagnostics with digital veterinary records is becoming more common. The demand for diagnostics is also supported by high standards of animal welfare. These factors collectively drive steady growth in the Japanese market.

India Companion Animal Diagnostic Market Insight

The India companion animal diagnostic market accounted for a significant market share in Asia-Pacific in 2025, supported by rapid urbanization and rising pet ownership. Growing middle-class income levels are increasing spending on pet healthcare services. Awareness of preventive care and routine diagnostic testing is gradually improving among pet owners. Expansion of veterinary clinics and diagnostic laboratories is supporting market growth. The availability of cost-effective diagnostic solutions is enhancing accessibility. In addition, increasing focus on companion animal health in urban areas is propelling the market forward.

Companion Animal Diagnostic Market Share

The Companion Animal Diagnostic industry is primarily led by well-established companies, including:

- IDEXX Laboratories, Inc. (U.S.)

- Zoetis Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Heska Corporation (U.S.)

- Virbac SA (France)

- Neogen Corporation (U.S.)

- BIOMÉRIEUX (France)

- IDVet (France)

- Randox Laboratories Ltd. (U.K.)

- Agrolabo S.p.A. (Italy)

- Innovative Diagnostics SAS (France)

- AniCell Biotech (U.S.)

- Abaxis, Inc. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Bionote Inc. (South Korea)

- Eurofins Scientific SE (Luxembourg)

- Animalytix LLC (U.S.)

- Advanced Animal Diagnostics (U.S.)

- VCA Inc. (U.S.)

What are the Recent Developments in Global Companion Animal Diagnostic Market?

- In October 2025, Antech expanded the availability of its trūRapid™ tests (including trūRapid™ FOUR and a feline FIV/FeLV rapid test) to Canada after approval by the Canadian Food Inspection Agency (CFIA), broadening access to rapid in-house infectious disease screening for companion animals in North America

- In March 2025, Antech, a global veterinary diagnostics company, announced the launch of trūRapid™ FOUR, a new comprehensive rapid screening test for canine vector-borne diseases that detects antibodies for Lyme, Ehrlichia, Anaplasma, and heartworm antigen in-clinic, offering veterinarians a faster, affordable alternative to traditional testing protocols

- In November 2024, Primerdesign (part of Novacyt Group) launched new genesig®PLEX multiplex PCR assays for gastrointestinal pathogens in dogs and cats at the London Vet Show enabling labs to detect six GI disease-causing pathogens in one test, significantly reducing processing time and improving veterinary diagnostic efficiency

- In April 2024, Antech announced the availability of two new breakthrough veterinary diagnostic innovations: an AI‑powered radiology interpretation tool (AIS RapidRead) that delivers rapid image insights, and the in‑house Nu.Q® Canine Cancer Test for quick cancer screening in veterinary clinics, accelerating diagnostics and clinical decision‑making for companion animal care

- In February 2024, BioStone Animal Health launched the AsurDx™ Rabies Antibody Test Kit, a rapid ELISA‑based diagnostic kit designed to detect rabies‑specific antibodies in mammalian serum samples, offering veterinarians and animal health professionals a sensitive, cost‑effective tool for assessing rabies immunity in pets and other animals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.