Global Companion Animal Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

5.47 Billion

2024

2032

USD

3.53 Billion

USD

5.47 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 5.47 Billion | |

|

|

|

|

Companion Animal Vaccines Market Size

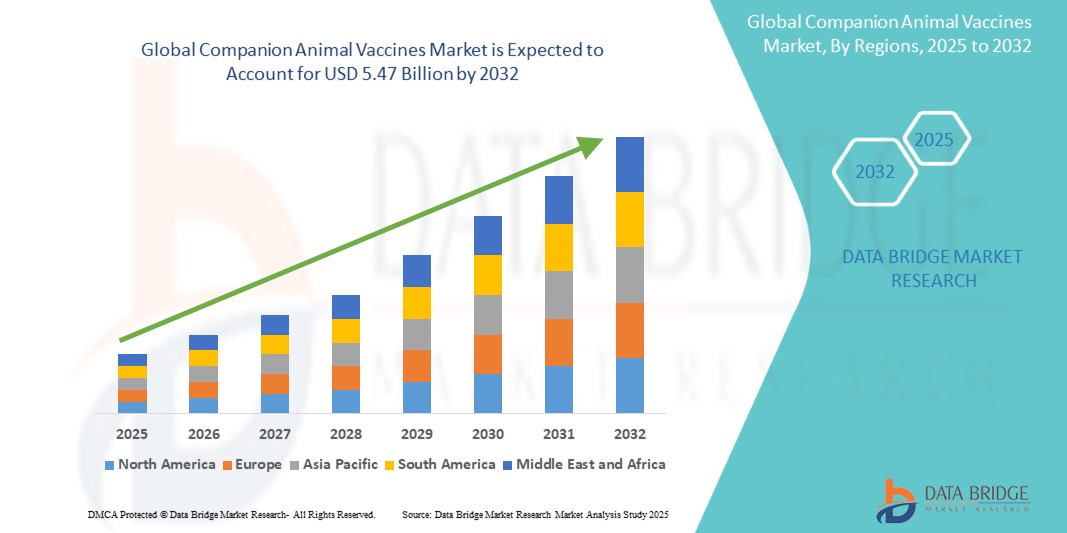

- The global companion animal vaccines market size was valued at USD 3.53 billion in 2024 and is expected to reach USD 5.47 billion by 2032, at a CAGR of 5.60% during the forecast period

- This growth is driven by factors such as the rising pet ownership, increased awareness of animal health, and advancements in vaccine technology

Companion Animal Vaccines Market Analysis

- Companion animal vaccines are essential for preventing a wide range of diseases in pets, such as dogs, cats, and horses. These vaccines play a crucial role in ensuring the health and longevity of companion animals by providing immunity against infectious diseases

- The demand for companion animal vaccines is driven by increasing pet ownership, rising awareness of preventive healthcare, and advancements in vaccine technology, including more effective and longer-lasting vaccines

- North America is expected to dominate the companion animal vaccines market with a market share of 40.5%, due to high pet ownership, a well-established veterinary healthcare system, and strong demand for advanced preventive care for pets

- Asia Pacific is expected to be the fastest growing region in the companion animal vaccines market with a market share of 23.5%, during the forecast period due to rapid expansion in healthcare infrastructure, increasing awareness about pet health, and rising pet ownership in the region

- Attenuated Live Vaccines segment is expected to dominate the market with a market share of 37.5% due to its ability to induce strong, long-lasting immune responses with fewer doses. These vaccines closely mimic natural infections, offering superior protection

Report Scope and Companion Animal Vaccines Market Segmentation

|

Attributes |

Companion Animal Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Companion Animal Vaccines Market Trends

“Advancements in Vaccine Technology & Increased Focus on Preventive Healthcare for Pets”

- One prominent trend in the companion animal vaccines market is the development of more effective and longer-lasting vaccines, incorporating advanced technologies such as recombinant DNA and mRNA platforms, offering enhanced immune responses and broader protection

- These innovations improve vaccine safety and efficacy, reducing the number of doses required and extending the duration of immunity. As a result, pet owners are increasingly opting for vaccines that offer prolonged protection and fewer visits to the veterinarian

- For instance, the development of combined vaccines, which protect against multiple diseases with a single shot, is gaining popularity. This is especially beneficial for dogs and cats, as it simplifies vaccination schedules and improves compliance

- These advancements are reshaping the companion animal healthcare landscape, improving pet health outcomes, and driving the demand for next-generation vaccines that offer superior protection with enhanced convenience for pet owners

Companion Animal Vaccines Market Dynamics

Driver

“Increasing Pet Ownership and Awareness of Preventive Health”

- The growing trend of pet ownership, coupled with heightened awareness of the importance of preventive healthcare, is significantly driving the demand for companion animal vaccines. As more people adopt pets, the need for effective vaccination to protect against various diseases becomes increasingly important

- With rising disposable income, especially in emerging markets, pet owners are becoming more willing to invest in their pets' health, leading to a growing demand for high-quality vaccines that ensure long-term immunity

- In addition, as awareness about the risks of zoonotic diseases and the importance of preventive measures grows, pet owners are more likely to vaccinate their animals, ensuring better health outcomes for their pets and reducing the spread of diseases

For instance,

- According to a 2023 report by the American Pet Products Association, pet ownership in the U.S. has reached historic highs, with over 70 million households now owning pets. This surge in pet ownership has directly contributed to an increased demand for veterinary care, including vaccinations

- As a result, the increasing pet ownership and awareness of preventive healthcare continue to drive the demand for companion animal vaccines, contributing to market growth globally

Opportunity

“Advancements in Vaccine Development and Customization for Different Species”

- The continuous development of new and improved vaccines tailored to specific species and age groups presents significant growth opportunities in the companion animal vaccines market. Innovations in vaccine formulation, such as DNA-based and mRNA vaccines, are enhancing their effectiveness and safety profiles for different types of companion animals

- Personalized vaccines, which are designed to target specific health concerns based on the breed or genetic makeup of the animal, offer an opportunity to provide more effective and targeted healthcare, reducing the risk of side effects and improving overall health outcomes

- In addition, advancements in adjuvants and vaccine delivery systems are increasing the effectiveness of vaccines and expanding their applications across various species, including dogs, cats, and exotic pets

For instance,

- In March 2025, a study published in Veterinary Research Communications highlighted the development of a novel vaccine for cats, targeting feline leukemia virus (FeLV), which is a major concern for feline health. The new vaccine uses a unique adjuvant system that increases immunity without causing adverse reactions

- These advancements in vaccine technology and the ability to tailor vaccines to the specific needs of different companion animals provide an opportunity for the growth of the global companion animal vaccines market, offering better protection and improved health outcomes for pets

Restraint/Challenge

“High Costs of Vaccines and Distribution Challenges”

- The high cost of companion animal vaccines, especially for premium vaccines with advanced technologies, poses a significant challenge for the market. This is particularly concerning in emerging markets, where the affordability of veterinary care is a key barrier to widespread vaccination

- Premium vaccines, such as those using recombinant DNA or mRNA technology, can be significantly more expensive than traditional vaccines, which may deter pet owners in lower-income regions from seeking timely vaccinations for their pets

- In addition, logistical challenges related to the cold-chain distribution required for some vaccines, particularly in regions with limited infrastructure, further complicate vaccine accessibility and affordability, limiting market penetration

For instance,

- In December 2023, an article published by the Global Health Review highlighted that in rural areas of India, the high cost of vaccines and distribution barriers such as poor infrastructure and lack of refrigeration often prevent pet owners from vaccinating their animals. This leads to low vaccination rates, increasing the risk of outbreaks of preventable diseases

- Consequently, these financial and logistical limitations hinder the growth of the companion animal vaccines market, particularly in regions with fewer resources and limited access to veterinary services, affecting overall market expansion

Companion Animal Vaccines Market Scope

The market is segmented on the basis of product type, species type, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Species Type |

|

|

By Distribution Channel

|

|

In 2025, the attenuated live vaccines is projected to dominate the market with a largest share in product type segment

The attenuated live vaccines segment is expected to dominate the companion animal vaccines market with the largest share of 37.5% in 2025 due to its ability to induce strong, long-lasting immune responses with fewer doses. These vaccines closely mimic natural infections, offering superior protection. In addition, growing demand for effective disease prevention in pets is boosting their adoption

The canine is expected to account for the largest share during the forecast period in species type market

In 2025, the canine segment is expected to dominate the market with the largest market share of 53.9% due to its high prevalence of canine diseases and increasing pet ownership worldwide. Dogs are the most commonly kept companion animals, driving demand for vaccines. In addition, growing awareness of preventive healthcare for pets is contributing to the segment's dominance

Companion Animal Vaccines Market Regional Analysis

“North America Holds the Largest Share in the Companion Animal Vaccines Market”

- North America dominates the companion animal vaccines market with a market share of estimated 40.5%, driven, by high pet ownership, a well-established veterinary healthcare system, and strong demand for advanced preventive care for pets

- U.S. holds a market share of 75.4%, due to the increasing adoption of pets, heightened awareness about the importance of vaccination, and a strong presence of key market players offering innovative vaccine solutions

- The availability of robust healthcare infrastructure, favorable reimbursement policies for veterinary care, and high spending on pet health contribute significantly to the growth of the market in this region

- In addition, the increasing focus on preventive healthcare for pets and rising concerns about zoonotic diseases further support the market expansion

“Asia-Pacific is Projected to Register the Highest CAGR in the Companion Animal Vaccines Market”

- Asia-Pacific is expected to witness the highest growth rate in the companion animal vaccines market with a market share of 23.5%, driven by rapid expansion in healthcare infrastructure, increasing awareness about pet health, and rising pet ownership in the region

- Countries such as China, India, and Japan are emerging as key markets for companion animal vaccines. The growing middle-class population in these countries, combined with increasing disposable income, is encouraging pet ownership and driving demand for veterinary services, including vaccinations

- Japan remains a significant market in the region, with a high rate of pet ownership and a strong focus on advanced veterinary technologies. As awareness about preventive healthcare continues to rise, Japan is expected to contribute substantially to market growth

- India is projected to register the highest CAGR of 13.2% in the market, driven by expanding veterinary care infrastructure, increasing awareness about the importance of vaccines, and rising prevalence of pet diseases

Companion Animal Vaccines Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zoetis Services LLC (U.S.)

- Merck & Co., Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Elanco (U.S.)

- Virbac (France)

- Ceva (France)

- Vetoquinol (France)

- Heska Corporation (U.S.)

- Phibro Animal Health (U.S.)

- Richmond Veterinary Laboratory (U.K.)

- Hubei Wudang Animal Pharmaceutical Co., Ltd. (China)

- DAIICHI SANKYO COMPANY, LIMITED. (Japan)

- Bioveta, a.s. (Czech Republic)

- HIPRA, S.A. (Spain)

- HESTER BIOSCIENCES LIMITED (India)

- Neogen Corporation (U.S.)

- Bayer AG (U.S.)

- IDEXX (U.S.)

Latest Developments in Global Companion Animal Vaccines Market

- In September 2024, Elanco Animal Health partnered with the University of Veterinary Medicine Vienna to develop vaccines for feline infectious peritonitis (FIP). This collaboration aims to bring more effective and affordable vaccines to market, particularly in Europe and Asia, where FIP has been a growing concern due to limited vaccine availability

- In October 2024, Boehringer Ingelheim announced the launch of a new canine vaccine line in Latin America. The updated vaccines offer broader protection against diseases such as kennel cough, leptospirosis, and parvovirus, addressing increasing concerns about infectious diseases among pets in urban areas

- In April 2020, Boehringer Ingelheim U.K. collaborated with VetHelpDirect, that offered all U.K. veterinary practices free access to an online video consultation platform for a period of three months during the pandemic

- In September 2020, Applied DNA Sciences Inc. and Evvivax SRL announced their plans to initiate a veterinary clinical trial for LineaDNA vaccine candidates upon receiving approval for the clinical plan from the US Department of Agriculture. The goal of the vaccine trial is to evaluate the vaccine candidate as a strategy for preventing the COVID-19 (a zoonotic disease) infection in companion felines of humans

- In June 2020, Elanco received regulatory clearance for the acquisition of Bayer AG's animal health business

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.