Global Complex Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

45.76 Billion

USD

62.15 Billion

2025

2033

USD

45.76 Billion

USD

62.15 Billion

2025

2033

| 2026 –2033 | |

| USD 45.76 Billion | |

| USD 62.15 Billion | |

|

|

|

|

What is the Global Complex Fertilizers Market Size and Growth Rate?

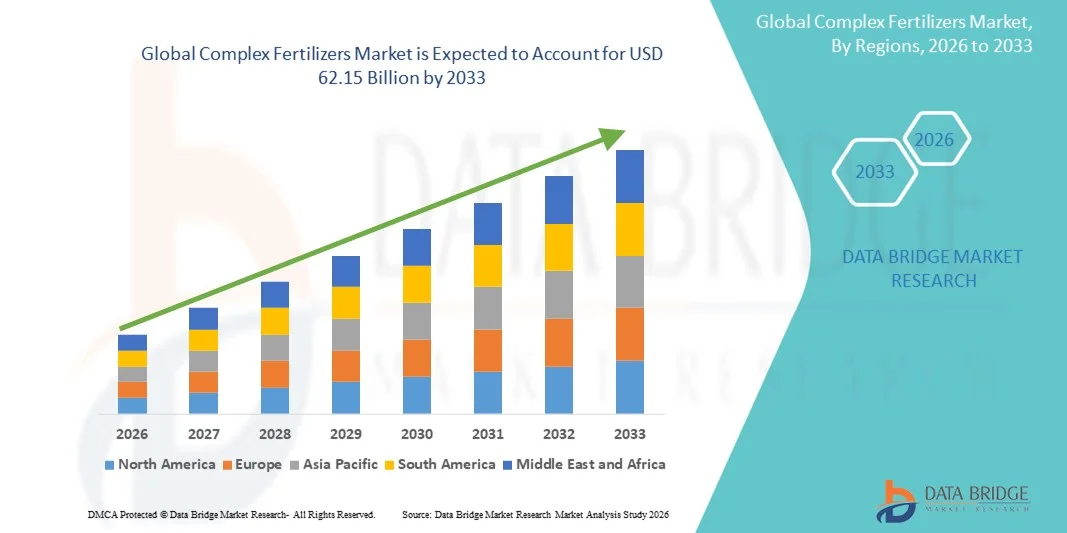

- The global complex fertilizers market size was valued at USD 45.76 billion in 2025 and is expected to reach USD 62.15 billion by 2033, at a CAGR of3.90% during the forecast period

- The complex fertilizers market is expected to gain growth, due to the better physical and chemical properties

- Also, the rise in crop demand for biofuel and high crop demand for animal feed are also expected to drive the market for complex fertilizers

- The several coupled with use of complex fertilizers which includes convenience in the field and economic savings is also likely to lift the growth of the complex fertilizers market

What are the Major Takeaways of Complex Fertilizers Market?

- The demand for complex fertilizers owing to its high nutritional contents is also expected to act as a major driving factor leading towards the growth of the complex fertilizers market

- However, the high growth of the organic fertilizers industry and depressed commodity prices and low farm incomes are expected to curb the growth of the complex fertilizers market in the above mentioned forecast period, whereas the fluctuations in raw material prices and unfavorable regulatory stance can challenge the growth of the target market

- Asia-Pacific dominated the complex fertilizers market with a 41.8% revenue share in 2025, driven by rapid growth in agricultural modernization, large-scale adoption of high-efficiency NPK blends, and increasing farm productivity initiatives across China, India, Japan, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by large-scale adoption of sustainable nutrient solutions, precision farming expansion, and increasing focus on soil health across the U.S. and Canada

- The Complete complex fertilizers segment dominated the market with a 63.4% share in 2025, driven by rising adoption of nutrient-balanced NPK blends that provide essential macro- and micronutrients in a single formulation

Report Scope and Complex Fertilizers Market Segmentation

|

Attributes |

Complex Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Complex Fertilizers Market?

Growing Shift Toward High-Efficiency, Nutrient-Balanced and Crop-Specific Complex Fertilizers

- The complex fertilizers market is experiencing increasing adoption of nutrient-balanced, high-efficiency NPK and NP blends designed to enhance soil fertility, improve nutrient uptake, and support precision-based crop production

- Manufacturers are developing crop-specific, water-soluble, and controlled-release formulations that improve nutrient-use efficiency, reduce wastage, and support sustainable agricultural practices

- Rising demand for cost-effective, easy-to-apply, and yield-enhancing fertilizers is boosting deployment across large farms, horticulture, and commercial agriculture

- For instance, companies such as Yara, Nutrien, EuroChem, PhosAgro, and Mosaic have expanded their portfolios with premium-grade NPK complexes, sulphur-enhanced blends, and micronutrient-fortified products to support diverse crop requirements

- Increasing focus on precision farming, fertigation systems, and sustainable soil management continues to accelerate the adoption of complex fertilizers

- As global agriculture shifts toward high-yield, resource-efficient, and climate-resilient farming, complex fertilizers are expected to remain central to improving productivity and nutrient efficiency across all major crop types

What are the Key Drivers of Complex Fertilizers Market?

- Rising demand for nutrient-rich, balanced NPK fertilizers that support high agricultural productivity across cereals, fruits, vegetables, and oilseeds

- For instance, in 2025, leading players such as Yara, ICL Fertilizers, and CF Industries strengthened their complex fertilizer lines to support large-scale farming and enhance soil nutrition

- Growing emphasis on precision agriculture, fertigation, and modern irrigation systems is accelerating the adoption of water-soluble and customized NPK blends across Asia-Pacific and Europe

- Advancements in granulation technology, nutrient stabilization, and micronutrient fortification have significantly improved fertilizer efficiency, crop response, and soil health

- Rising global demand driven by population growth, shrinking arable land, and increasing food security concerns continues to boost complex fertilizer consumption

- With ongoing investments in production capacity, R&D, strategic partnerships, and sustainability-driven formulations, the Complex Fertilizers market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Complex Fertilizers Market?

- High production and processing costs associated with premium NPK blends, specialty micronutrients, and water-soluble fertilizers limit adoption in price-sensitive markets

- For instance, during 2024–2025, fluctuations in phosphate rock prices, ammonia costs, gas supply, and global trade disruptions significantly impacted fertilizer production economics

- Stringent regulations related to nutrient runoff, environmental impact, and soil contamination increase compliance burdens for manufacturers

- Limited awareness among small and marginal farmers about balanced fertilization, nutrient management, and complex NPK advantages restricts market penetration

- Competition from straight fertilizers (Urea, DAP), organic fertilizers, and low-cost blended products adds pricing pressure and affects adoption

- To address these challenges, companies are focusing on cost optimization, farmer education programs, regulatory compliance, and high-efficiency nutrient technologies to support sustainable market expansion

How is the Complex Fertilizers Market Segmented?

The market is segmented on the basis of product type, crop type, form, and mode of application.

- By Product Type

On the basis of product type, the complex fertilizers market is segmented into Incomplete Complex Fertilizers and Complete Complex Fertilizers. The Complete Complex Fertilizers segment dominated the market with a 63.4% share in 2025, driven by rising adoption of nutrient-balanced NPK blends that provide essential macro- and micronutrients in a single formulation. These fertilizers enhance soil nutrition, support higher crop yields, and are widely preferred in commercial farming, horticulture, and large-scale cereal production. Their uniform nutrient distribution, improved dissolution rate, and compatibility with mechanized farming make them a preferred choice among growers aiming for efficiency and consistency in application.

The Incomplete Complex Fertilizers segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand from small and medium farms for cost-effective formulations containing selective nutrients tailored to specific soil deficiencies. Growing awareness of targeted fertilization and lower product pricing is further boosting adoption.

- By Crop Type

On the basis of crop type, the complex fertilizers market is segmented into Cereals, Grains, Oilseeds, Fruits and Vegetables, and Others. The Cereals and Grains segment dominated the market with a 48.7% share in 2025, driven by large-scale global cultivation of rice, wheat, barley, and corn, which require consistent nutrient inputs to maintain yield levels. Complex fertilizers are widely used in cereal farming due to their high nitrogen, phosphorus, and potassium content, which improves root development, crop vigor, and nutrient uptake efficiency.

The Fruits and Vegetables segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by expanding horticulture production, rising demand for premium food crops, and increased adoption of drip irrigation and precision nutrient application. High-value crop growers increasingly prefer complex fertilizers for improved quality, shelf life, and nutrient density.

- By Form

On the basis of form, the complex fertilizers market is segmented into Solid and Liquid. The Solid segment dominated the market with a 72.1% share in 2025, attributed to its long shelf life, cost-effectiveness, ease of storage, and suitability for broad-acre farming. Solid complex fertilizers are widely used in conventional agriculture, cereals, oilseeds, and plantation crops due to their slow-release characteristics and compatibility with mechanized spreading systems. In addition, their wide availability in granular and prilled forms supports large-scale commercial farming.

The Liquid segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of fertigation and precision agriculture practices. Liquid formulations provide better nutrient absorption, uniform distribution, and higher efficiency in high-value crops grown under controlled irrigation systems. Rising greenhouse farming and hydroponics adoption further support the segment’s expansion.

- By Mode of Application

On the basis of mode of application, the complex fertilizers market is segmented into Foliar and Fertigation. The Fertigation segment dominated the market with a 58.4% share in 2025, driven by the rapid expansion of drip and sprinkler irrigation systems across Asia-Pacific, Europe, and the Middle East. Fertigation allows precise nutrient delivery directly to plant roots, enhancing nutrient-use efficiency, reducing wastage, and improving crop quality. It is widely used in high-value crops, orchards, protected cultivation, and commercial horticulture.

The Foliar segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by its ability to provide immediate nutrient correction, especially in micronutrient-deficient soils. Foliar application supports rapid absorption, reduces soil fixation losses, and is increasingly preferred in fruits, vegetables, and specialty crops.

Which Region Holds the Largest Share of the Complex Fertilizers Market?

- Asia-Pacific dominated the complex fertilizers market with a 41.8% revenue share in 2025, driven by rapid growth in agricultural modernization, large-scale adoption of high-efficiency NPK blends, and increasing farm productivity initiatives across China, India, Japan, and Southeast Asia. Rising food demand, expanding cultivation areas, and government subsidies supporting balanced fertilization practices continue to accelerate complex fertilizer consumption across the region

- Leading manufacturers are expanding portfolios with customized nutrient formulations, water-soluble variants, controlled-release technologies, and crop-specific blends to meet diverse soil and climatic conditions. Strong emphasis on sustainable farming, precision agriculture, and improved nutrient-use efficiency further enhances regional leadership

- Rapid population growth, expanding horticulture output, and increasing farmer awareness regarding nutrient balance continue to support long-term demand

China Complex Fertilizers Market Insight

China leads the regional market, supported by high fertilizer consumption, government-backed soil fertility programs, and strong adoption of high-efficiency NPK blends. Growing use of specialty fertilizers for fruits, vegetables, and cash crops, combined with rapid agricultural modernization, continues to drive market expansion. Local manufacturing strength and strong R&D capabilities further support domestic and export growth.

Japan Complex Fertilizers Market Insight

Japan shows steady demand growth driven by advanced farming practices, high-value crop cultivation, and strong focus on premium nutrient blends. Adoption of precision farming, eco-friendly fertilizers, and efficient nutrient-management systems continues to support market expansion. Regulatory focus on soil improvement and sustainable agricultural productivity drives further demand.

India Complex Fertilizers Market Insight

India is emerging as a major growth market due to increasing adoption of complex NPK fertilizers, government subsidies, and rising awareness of balanced fertilization among farmers. Expanding horticulture production, drip irrigation adoption, and large-scale cultivation of cereals, sugarcane, and vegetables fuel rapid demand growth. Ongoing agricultural modernization initiatives continue to boost usage.

South Korea Complex Fertilizers Market Insight

South Korea contributes significantly due to rising demand for specialty fertilizers, strong greenhouse farming activity, and focus on high-value horticulture. Adoption of advanced nutrient technologies, precision irrigation, and quality-focused crop production supports increasing consumption. Growing reliance on imported fertilizers and rising food demand further strengthen market growth.

North America Complex Fertilizers Market Insight

North America is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by large-scale adoption of sustainable nutrient solutions, precision farming expansion, and increasing focus on soil health across the U.S. and Canada. Rising demand for specialty NPK blends, micronutrient-enhanced products, and coated fertilizers continues to accelerate market growth. Strong digital agriculture integration and advanced farm mechanization further support widespread adoption of complex fertilizers.

U.S. Complex Fertilizers Market Insight

The U.S. is the largest contributor in North America, supported by extensive corn, soybean, and wheat cultivation, high agricultural productivity, and rising adoption of multi-nutrient fertilizers for yield optimization. Farmers are increasingly investing in soil testing, variable-rate application, and precision nutrient management, driving demand for high-quality NPK blends. Expansion of commercial farming, strong agritech adoption, and focus on sustainable nutrient practices further enhance market growth.

Canada Complex Fertilizers Market Insight

Canada shows steady growth driven by expanding cultivation of cereals, oilseeds, and specialty crops, alongside rising demand for controlled-release and water-soluble NPK formulations. Government programs promoting balanced fertilization, soil-improvement initiatives, and adoption of modern farming technologies support increasing fertilizer usage. Greenhouse farming expansion and rising focus on crop quality further strengthen market penetration.

Which are the Top Companies in Complex Fertilizers Market?

The complex fertilizers industry is primarily led by well-established companies, including:

- Yara (Norway)

- EuroChem Group (Switzerland)

- CF Industries Holdings Inc. (U.S.)

- Nutrien Ltd. (Canada)

- PhosAgro Group of Companies (Russia)

- Koch Fertilizer, LLC (U.S.)

- Coromandel International Limited (India)

- Bunge Limited (U.S.)

- Agrium, Inc. (Canada)

- AgroCare (Australia)

- Zuari Agro Chemicals LTD. (India)

- Sinofert Holdings Limited (China)

- OCI Nitrogen (Netherlands)

- Haifa Group (Israel)

- Ekhande Agro Fertilizers Pvt Ltd (India)

- ICL Fertilizers (Israel)

- Helena Agri-Enterprises, LLC (U.S.)

- Borealis AG (Austria)

- SABIC (Saudi Arabia)

What are the Recent Developments in Global Complex Fertilizers Market?

- In May 2025, Iraq achieved a key milestone in its industrial development by inaugurating a new phosphate fertilizer production facility in the Al-Anbar province, strengthening the nation’s agricultural input capabilities and supporting long-term domestic fertilizer security

- In June 2024, Coromandel International introduced its magnesium-enriched complex fertilizer, ‘Paramfos Plus,’ in Bengaluru, India, enhancing nutrient efficiency for farmers and reinforcing the company’s commitment to advanced crop nutrition solutions

- In March 2024, EuroChem opened its modern phosphate fertilizer complex in Serra do Salitre, Brazil, with a production capacity of nearly 1 million tonnes per year, bolstering the regional supply and strengthening its global fertilizer manufacturing footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.