Global Composite Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

3.15 Billion

USD

4.56 Billion

2024

2032

USD

3.15 Billion

USD

4.56 Billion

2024

2032

| 2025 –2032 | |

| USD 3.15 Billion | |

| USD 4.56 Billion | |

|

|

|

|

Composite Sdhesives Market Size

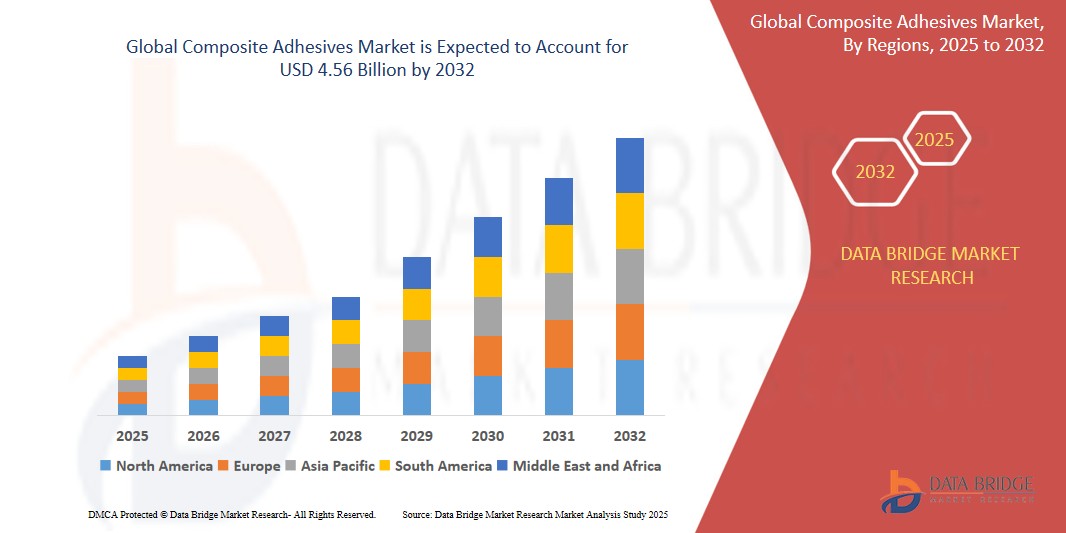

- The global Composite adhesives market was valued at USD 3.15 billion in 2024 and is expected to reach USD 4.56 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.90%, primarily driven by the Rising Demand for Lightweight and High-Performance Materials in Aerospace and Automotive Applications.

- This growth is driven by factors such as growing adoption of composites in electric vehicles (EVs) and expansion of the aerospace sector.

Composite Sdhesives Market Analysis

- The composite adhesives market is driven by the increasing demand for high-performance bonding solutions in industries such as automotive, aerospace, construction, and wind energy. The need for lightweight materials, high-strength bonding, and resistance to extreme conditions is pushing the demand for advanced composite adhesives, especially those based on epoxy, polyurethane, and methacrylate resins.

- The growing adoption of composites, particularly in electric vehicles (EVs), automotive lightweight components, and renewable energy solutions, is fueling innovation in composite adhesives. Manufacturers are focusing on developing adhesive solutions that can bond dissimilar materials like metals and plastics while providing enhanced durability, temperature stability, and chemical resistance.

- Asia Pacific, North America, and Europe are key regions for the composite adhesives market, with Asia Pacific expected to dominate due to rapid industrialization, increasing automotive production, and growing investments in renewable energy projects. The strong automotive and aerospace industries in North America and Europe are also contributing to the growth of the market.

- For instance, in 2024, Henkel showcased its commitment to sustainability by unveiling new adhesive solutions tailored for wind turbine assembly and maintenance, emphasizing safety and environmental considerations.

Report Scope and Composite adhesives market Segmentation

|

Attributes |

Composite adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Composite Sdhesives Market Trends

“Rising Demand for Lightweight and High-Performance Materials in Aerospace and Automotive Applications”

- Composite adhesives are gaining significant traction as industries like aerospace and automotive shift toward lightweight materials to improve fuel efficiency and reduce emissions. These adhesives offer superior bonding strength without adding bulk or weight, making them ideal for high-performance applications.

- In aerospace, composite adhesives are increasingly used for bonding carbon fiber-reinforced polymer (CFRP) components in aircraft structures, contributing to weight reduction and improved aerodynamics.

- In the automotive sector, manufacturers are adopting structural adhesives to bond dissimilar materials such as carbon fiber, aluminum, and plastics—enabling better crash durability and design flexibility.

- For instance, in February 2024, Huntsman Corporation launched a next-generation composite adhesive system tailored for automotive battery assemblies, designed to offer excellent thermal conductivity, structural integrity, and long-term durability.

- As sustainability and efficiency goals rise, industries are moving away from mechanical fasteners and opting for high-performance adhesives to meet both environmental and functional demands.

Composite adhesives market Dynamics

Driver

“Growing Adoption of Composites in Electric Vehicles (EVs) and Lightweight Automotive Components”

- The transition to electric vehicles is accelerating the demand for lightweight materials to improve battery efficiency, range, and overall vehicle performance—driving up the use of structural composite adhesives over traditional fasteners.

- Composite adhesives enable the integration of diverse materials such as carbon fiber, aluminum, and thermoplastics in EVs, providing enhanced crash resistance, design flexibility, and weight reduction.

- Adhesives are being used for bonding battery packs, exterior panels, and structural components, replacing welds and rivets for improved sealing, noise reduction, and production efficiency.

- Lightweight composite bonding plays a crucial role in meeting global emissions targets and sustainability goals in the automotive industry by enabling reduced vehicle weight and improved energy efficiency.

For instance,

- Sika introduced the SikaPower R-880, a gap-filling, two-component epoxy adhesive suitable for bonding metallic and composite substrates in electric vehicles, offering high strength and elevated heat resistance.

Opportunity

“Rising Demand from Renewable Energy Sector (Wind Energy in Particular)”

- Wind turbine blades are increasingly built with composite materials such as fiberglass and carbon fiber, requiring structural adhesives with high shear strength and environmental durability.

- Adhesives are crucial for bonding blade segments, nacelles, and other structural components, offering uniform stress distribution and reducing weight compared to mechanical fasteners.

- The growth of offshore and onshore wind projects worldwide—especially in China, the U.S., and Europe—is creating new demand for high-strength, weather-resistant composite adhesives.

- As blade sizes increase to boost turbine efficiency, manufacturers are using more advanced bonding technologies for structural integrity and fatigue resistance.

- Sustainability efforts in the energy sector are encouraging the use of recyclable and lower-VOC adhesive systems, opening new R&D opportunities for manufacturers.

For instance,

- In 2024, Henkel showcased its commitment to sustainability by unveiling new adhesive solutions tailored for wind turbine assembly and maintenance, emphasizing safety and environmental considerations.

Restraint/Challenge

“Stringent Environmental Regulations and Compliance Barriers”

- Composite adhesives often contain volatile organic compounds (VOCs), which are tightly regulated by environmental agencies such as the U.S. EPA and the European Chemicals Agency (ECHA) under REACH legislation. These emissions are linked to air pollution and health risks, prompting stricter usage limitations across multiple sectors.

- To comply with these evolving regulations, manufacturers must reformulate products to reduce or eliminate harmful solvents, which requires significant R&D investment and reformulation costs.

- In addition, recyclability concerns related to adhesively bonded composite structures are growing, as adhesives complicate the separation and reuse of materials, especially in automotive and aerospace end-of-life scenarios.

- Companies must navigate a complex web of regional regulations, testing protocols, and compliance documentation, which increases operational burdens and slows time-to-market for new adhesive systems.

For instance,.

- Composite adhesives often contain volatile organic compounds (VOCs), which are tightly regulated by environmental bodies like the U.S. EPA and EU REACH. Manufacturers must reformulate products to meet these stringent VOC emission standards, which can be technically challenging and costly.

Composite Sdhesives Market Scope

The market is segmented on the basis of resin, type, component and application.

|

Segmentation |

Sub-Segmentation |

|

By Resin |

|

|

By Type |

|

|

By Component |

|

|

By Application |

|

Composite Sdhesives Market Regional Analysis

“Asia Pacific is the Dominant Region in the Composite adhesives market”

- Asia-Pacific leads the global composite adhesives market, driven by rapid industrialization, expansion of end-use sectors like automotive, aerospace, construction, and wind energy, and the presence of major composite manufacturers in countries such as China, India, and Japan.

- China holds a dominant share due to massive investments in EV production, aerospace components, and wind turbine manufacturing, which extensively utilize composite bonding technologies.

- Japan and South Korea are also key contributors, backed by innovation in high-performance materials, strong R&D infrastructure, and stringent quality standards in industries like electronics and transportation.

- Government initiatives promoting green energy (e.g., China’s wind energy targets and India’s solar and wind expansion plans) are supporting increased demand for lightweight, durable composite structures—fueling adhesive consumption.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The region is expected to grow at the fastest rate due to booming infrastructure development, rising automotive production (especially electric vehicles), and increasing local production of aircraft components.

- India and Southeast Asia are emerging as attractive manufacturing hubs due to low production costs, foreign investments, and supportive policies under initiatives like “Make in India” and Vietnam’s “National Supporting Industry Development Program.”

- Growing adoption of lightweight materials in rail, marine, and sporting goods industries is driving the uptake of composite adhesives across Asia-Pacific.

- The continued rise of regional suppliers and international players establishing facilities in the region is also enhancing accessibility and market penetration of composite adhesives.

Composite Sdhesives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Huntsman International LLC (U.S.)

- Sika AG (Switzerland)

- DOWLORD Corporation (Not identified)

- Bostik (France)

- Ashland (U.S.)

- Royal Adhesives & Sealants (U.S.)

- Integra Adhesives (U.S.)

- Arkema Group (France)

- SCIGRIP (U.S.)

- Dymax Corporation (U.S.)

- H.B. Fuller Company (U.S.)

- Scott Bader Company Ltd (U.K.)

- HERNON Manufacturing, Inc. (U.S.)

- Gurit (Switzerland)

- Hybond Inc (U.S.)

Latest Developments in Global Composite Adhesives market

- In May 2023, Mitsui Chemicals Inc. secured certification for its epoxy resins, a crucial segment of the biomass phenol chain. This certification comes from the esteemed International Sustainability and Carbon Certification (ISCC) PLUS system, renowned for validating sustainable products.

- In February 2023, Henkel AG & Co. KGaA announced a collaboration with the International Centre for Industrial Transformation’s participation program. The business’s adhesive technologies business department wants to employ INCIT’s tools and frameworks to accelerate its processes’ digital transformation by joining INCIT’s partner network.

- In March 2022, 3M, a diversified technology business, introduced their new Scotch-Weld Multi-Material Composite Urethane Adhesive DP6310NS. This glue is intended to attach a variety of composite components and has good impact resistance and durability.

- In February 2022, Arkema completed its acquisition of Ashland's Performance Adhesives division. Structural adhesives are among the products available in this area. The acquisition was worth USD 1.65 billion. The acquisition bolstered Arkema's Adhesive Solutions sector and was in line with the company's objective of becoming a pure specialty material provider by 2024.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Composite Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Composite Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Composite Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.