Global Compostable Food Service Packaging Market

Market Size in USD Billion

CAGR :

%

USD

20.92 Billion

USD

39.88 Billion

2024

2032

USD

20.92 Billion

USD

39.88 Billion

2024

2032

| 2025 –2032 | |

| USD 20.92 Billion | |

| USD 39.88 Billion | |

|

|

|

|

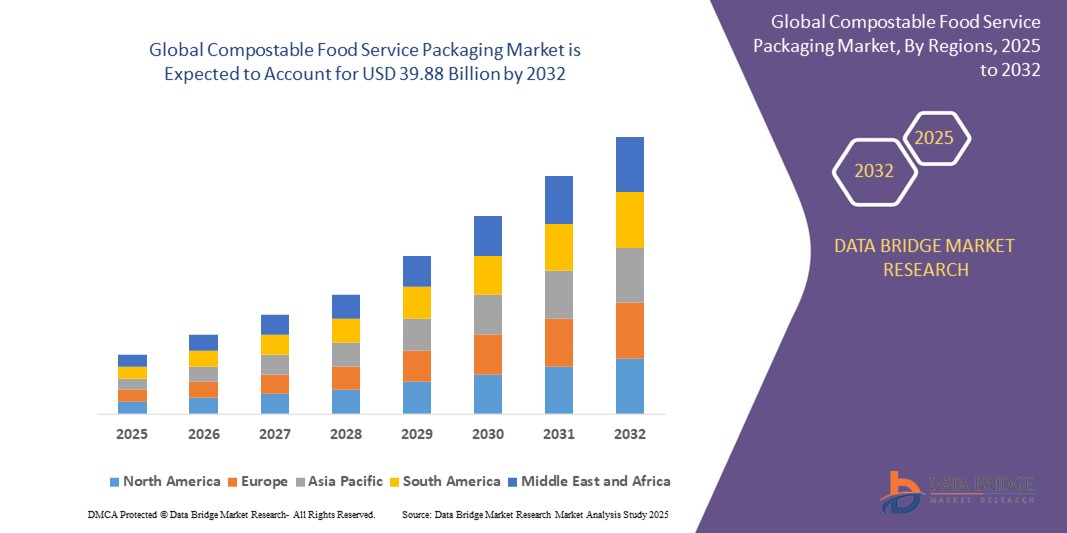

What is the Global Compostable Food Service Packaging Market Size and Growth Rate?

- The global compostable food service packaging market size was valued at USD 20.92 billion in 2024 and is expected to reach USD 39.88 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market expansion is primarily driven by the rising environmental concerns, stringent government regulations on single-use plastics, and growing consumer awareness regarding sustainable and biodegradable alternatives in the food service industry

- In addition, increasing demand from quick-service restaurants (QSRs), cafes, and institutional catering services is accelerating the adoption of compostable packaging solutions, positioning the industry for significant growth in the coming years

- Innovations in biopolymer materials, alongside advancements in compostable packaging designs and manufacturing technologies, are further enabling scalability and cost-efficiency, attracting new market entrants and expanding consumer acceptance

What are the Major Takeaways of Compostable Food Service Packaging Market?

- Compostable Food Service Packaging offers a sustainable alternative to conventional plastic-based food containers and cutlery by utilizing eco-friendly materials such as PLA, bagasse, and molded fiber, which degrade naturally and support circular economy initiatives

- The market is experiencing robust demand, particularly across restaurants, take-out services, and food delivery platforms, driven by consumer preference for green packaging and corporate initiatives toward carbon footprint reduction

- Key growth enablers include global bans on plastic packaging, increased investments in biodegradable material R&D, and enhanced brand positioning by food service providers opting for compostable solutions to appeal to eco-conscious consumers

- Europe dominated the compostable food service packaging market, accounting for the largest revenue share of 38.2% in 2024, driven by stringent environmental regulations and a strong cultural emphasis on sustainability and circular economy practices

- Asia-Pacific compostable food service packaging market is projected to grow at the fastest CAGR of 14.3% from 2025 to 2032, driven by rapid urbanization, expanding food delivery services, and rising environmental concerns

- The Plates segment dominated the market with the largest revenue share of 26.4% in 2024, driven by their high-volume usage in quick-service restaurants, cafeterias, and food delivery services

Report Scope and Compostable Food Service Packaging Market Segmentation

|

Attributes |

Compostable Food Service Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Compostable Food Service Packaging Market?

“Sustainable Innovation through Biodegradable Materials and Circular Economy Practices”

- A prominent trend in the global compostable food service packaging market is the rapid shift toward biodegradable materials and circular economy models to address the mounting concerns over plastic pollution and landfill waste

- Leading manufacturers are investing in innovative materials such as polylactic acid (PLA), bagasse, molded fiber, and seaweed-based polymers to enhance product performance while ensuring compostability and minimal environmental impact

- For instance, in April 2024, Vegware, a U.K.-based compostable packaging firm, introduced a new line of home-compostable hot cup lids, demonstrating a continued push toward eco-design and zero-waste solutions

- In addition, companies are adopting closed-loop supply chains that support post-consumer collection and industrial composting, reducing carbon footprint and aligning with global sustainability mandates

- This trend reflects a broader consumer and regulatory push for eco-responsible packaging alternatives, encouraging food service providers to integrate compostable solutions as part of their ESG commitments

- As sustainability becomes a key market differentiator, biodegradable innovation is driving environmental compliance and long-term brand loyalty and market competitiveness

What are the Key Drivers of Compostable Food Service Packaging Market?

- The surging global demand for sustainable alternatives to single-use plastics is a major driver accelerating the adoption of compostable food service packaging across restaurants, cafes, and institutional food services

- For instance, in March 2024, Sabert Corporation expanded its eco-friendly packaging line under the EcoEdge brand, offering recyclable and compostable solutions to meet increasing demand from QSRs and retailers

- Heightened regulatory pressures such as plastic bags and Extended Producer Responsibility (EPR) programs in regions such as Europe, North America, and parts of Asia are compelling food service providers to transition toward compostable options

- Consumer awareness about environmental issues and preference for eco-conscious dining experiences are further fueling the market, with many brands showcasing sustainable packaging as part of their brand identity

- The combination of regulatory mandates, green consumerism, and corporate sustainability initiatives is driving continuous growth and innovation within the compostable packaging segment

Which Factor is challenging the Growth of the Compostable Food Service Packaging Market?

- One of the key challenges facing the compostable food service packaging market is the lack of widespread composting infrastructure, which hinders proper end-of-life disposal and limits environmental benefits

- For instance, despite growing adoption in urban centers, many municipalities lack access to industrial composting facilities, making it difficult for businesses and consumers to properly compost packaging waste

- In addition, higher production costs compared to traditional plastic and foam packaging remain a barrier for cost-sensitive food outlets, especially in developing economies

- Misconceptions around the terms “biodegradable” and “compostable,” coupled with inconsistent labeling and certifications, can create confusion among consumers and result in improper disposal

- To overcome these issues, companies and policymakers must work together to standardize compostability guidelines, improve waste management systems, and educate both consumers and businesses about proper usage and disposal practices

- Addressing these barriers is essential for achieving scalability and maximizing the environmental benefits promised by compostable food service packaging solutions

How is the Compostable Food Service Packaging Market Segmented?

The market is segmented on the basis of packaging type, material, and end-user.

• By Packaging Type

On the basis of packaging type, the compostable food service packaging market is segmented into Plates, Trays, Bowls, Cups, Clamshell, Cutlery, Pouches and Sachets, and Others. The Plates segment dominated the market with the largest revenue share of 26.4% in 2024, driven by their high-volume usage in quick-service restaurants, cafeterias, and food delivery services. Compostable plates made from bagasse and molded fiber are preferred for their sturdiness, sustainability, and ease of disposal in commercial composting systems.

The Cups segment is anticipated to register the fastest growth rate of 9.7% from 2025 to 2032, owing to rising demand in beverage chains and coffee shops. The shift from plastic-lined paper cups to fully compostable alternatives, coupled with government mandates banning single-use plastics, supports segment expansion.

• By Material

On the basis of material, the market is segmented into Plastic, Paper and Paperboard, Bagasse and Seaweed, and Others. The Bagasse and Seaweed segment led the market in 2024, capturing a market share of 34.1%, attributed to the growing preference for natural, renewable materials that offer strong performance while being fully compostable. These materials are widely used across plates, clamshells, and bowls due to their durability and suitability for both hot and cold foods.

The Paper and Paperboard segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increased adoption across pouches, wrappers, and trays. The segment's growth is also supported by advancements in barrier coatings that improve the moisture and grease resistance of compostable paper packaging.

• By End-User

On the basis of end-user, the market is segmented into Chain Restaurants, Non-Chain Restaurants, Chain Cafés, Non-Chain Cafés, Delivery Catering, Independent Sellers and Kiosks, and Others. The Chain Restaurants segment held the largest revenue share in 2024 at 29.6%, driven by their scale of operations and growing commitment to sustainability goals. Many global food chains have adopted compostable packaging to align with their ESG strategies and to comply with regional regulations on plastic reduction.

The Delivery Catering segment is projected to witness the highest growth rate of 10.1% from 2025 to 2032, fueled by the surge in online food ordering and third-party delivery services. Compostable packaging options such as clamshells, pouches, and cutlery are gaining traction for their eco-friendliness and improved consumer perception.

Which Region Holds the Largest Share of the Compostable Food Service Packaging Maret?

- Europe dominated the compostable food service packaging market, accounting for the largest revenue share of 38.2% in 2024, driven by stringent environmental regulations and a strong cultural emphasis on sustainability and circular economy practices

- Countries across the region are implementing bans on single-use plastics and mandating compostable alternatives, leading to high demand from foodservice operators, quick-service restaurants, and catering services

- The market benefits from well-established waste management infrastructure and high consumer awareness regarding eco-friendly packaging. Adoption is further supported by government initiatives promoting green packaging and public-private partnerships encouraging composting systems

U.K. Compostable Food Service Packaging Market Insight

The U.K. compostable food service packaging market captured the largest share within Europe, driven by regulatory mandates on plastic reduction and growing sustainability commitments from large foodservice chains. The country’s robust hospitality and takeaway food culture supports the demand for compostable plates, cups, and clamshells. In addition, innovations in biodegradable coatings and material strength are enabling wider application in hot food and liquid packaging.

Germany Compostable Food Service Packaging Market Insight

Germany is expected to register strong growth due to its rigorous waste management systems and environmentally conscious consumer base. Government subsidies for green packaging innovations and increasing adoption by retailers and institutional food providers are fostering market expansion. Local packaging manufacturers are also investing in R&D for high-performance compostable materials such as bagasse and seaweed-based alternatives.

France Compostable Food Service Packaging Market Insight

France is emerging as a key contributor to the European market, backed by the 2020 Anti-Waste Law for a Circular Economy, which mandates compostable solutions in food packaging. The growing trend of zero-waste cafes and eco-conscious catering services is accelerating demand. Supportive policies and the rise of organic food outlets further position France as a strategic market for growth in compostable packaging.

Which Region is the Fastest Growing in the Compostable Food Service Packaging Market?

Asia-Pacific compostable food service packaging market is projected to grow at the fastest CAGR of 14.3% from 2025 to 2032, driven by rapid urbanization, expanding food delivery services, and rising environmental concerns. Governments across the region are introducing plastic bans and incentivizing compostable alternatives, making APAC a hotspot for innovation and investment in sustainable foodservice packaging.

China Compostable Food Service Packaging Market Insight

China led the Asia-Pacific market in 2024, supported by national policies banning single-use plastics and the expansion of domestic compostable material manufacturers. With a booming e-commerce food delivery sector, compostable clamshells, trays, and cutlery are in high demand. The rise of green consumerism among the urban middle class and smart city initiatives also contribute to robust market growth.

India Compostable Food Service Packaging Market Insight

India is experiencing fast-paced growth, primarily due to government campaigns such as Swachh Bharat Abhiyan and state-level bans on plastic. Start-ups and traditional packaging companies are increasingly adopting bagasse and paperboard-based compostable options. Rising health awareness and preference for hygienic, eco-friendly packaging are boosting adoption across street vendors, cafes, and food delivery operators.

Japan Compostable Food Service Packaging Market Insight

Japan’s market growth is supported by a culture of cleanliness and efficiency, as well as rising interest in biodegradable packaging for convenience foods. The integration of compostable materials in ready-meal trays, convenience store packaging, and Bento boxes is gaining traction. With continued technological advancements and regulatory support, Japan is positioned for steady expansion in the segment.

Which are the Top Companies in Compostable Food Service Packaging Market?

The compostable food service packaging industry is primarily led by well-established companies, including:

- BioSphere Plastic LLC (U.S.)

- Anchor Packaging LLC (U.S.)

- Eco-Products, Inc. (U.S.)

- Genpak (U.S.)

- BioBag Americas, Inc. (U.S.)

- International Paper (U.S.)

- Novolex (U.S.)

- Dart Container Corporation (U.S.)

- Good Start Packaging (U.S.)

- Be Green Packaging LLC (U.S.)

- ecoenclose.com (U.S.)

- Huhtamäki (Finland)

- Georgia-Pacific (U.S.)

- WestRock Company (U.S.)

- Virosac (Italy)

- BioGreen (U.S.)

- Elevate Packaging (U.S.)

- Vegware Ltd (U.K.)

What are the Recent Developments in Global Compostable Food Service Packaging Market?

- In March 2022, Winpak Ltd announced plans to build a new facility in Augusta, Georgia, dedicated to producing Ultra-Pure Recycled (UPR) Polypropylene (PP). This initiative enhances Winpak's recyclable packaging options by incorporating post-consumer recycled (PCR) content, thereby expanding access to PureCycled plastic and supporting sustainability goals

- In February 2022, WestRock Company revealed plans to construct a new corrugated box plant in Longview, Washington. This facility aims to meet rising regional demand in the Pacific Northwest, replace existing operations in Longview, and align with WestRock's sustainability objectives, serving various industry segments and markets

- In February 2022, Stora Enso partnered with Picadeli, a leading European take-away salad bar company, to launch renewable formed fiber lids. These lids are recyclable, biodegradable, and free of plastics, designed to replace single-use plastics in take-away packaging, aligning with environmental sustainability efforts

- In March 2021, Eco-Products achieved CMA-W approval from the Compost Manufacturing Alliance (CMA) for its Vanguard clamshells. This approval marks the clamshells as the first-ever molded fiber items produced without added PFAS, highlighting Eco-Products' commitment to compostable and environmentally friendly packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.