Global Compostable Multilayer Films Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

2.62 Billion

2024

2032

USD

1.48 Billion

USD

2.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.48 Billion | |

| USD 2.62 Billion | |

|

|

|

|

Compostable Multilayer Films Market Size

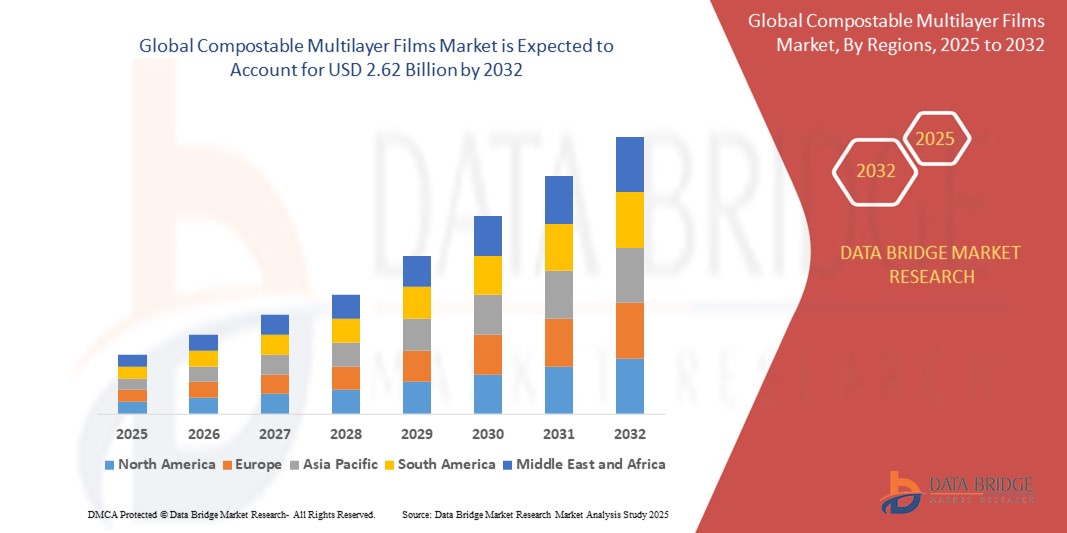

- The global compostable multilayer films market size was valued at USD 1.48 billion in 2024 and is expected to reach USD 2.62 billion by 2032, at a CAGR of 7.4% during the forecast period

- This growth is driven by factors such as increasing adoption of sustainable packaging across food and beverage industries, rising government regulations on single-use plastics, and growing consumer awareness regarding environmental impact, which is fueling the demand for compostable alternatives to conventional plastic multilayer films

Compostable Multilayer Films Market Analysis

- Compostable multilayer films are environmentally friendly packaging materials designed to decompose under composting conditions, widely used across industries such as food & beverages, personal care, pharmaceuticals, and agriculture due to their sustainability and performance benefits

- The rising demand for compostable multilayer films is significantly driven by the growing focus on reducing plastic waste, increasing consumer preference for eco-friendly packaging, and stricter government regulations banning or limiting single-use plastics

- North America dominated the compostable multilayer films market with the largest revenue share of 37.24% in 2024, driven by heightened environmental awareness, strong regulatory support for compostable packaging, and the presence of major sustainable packaging manufacturers in the U.S. and Canada

- Asia-Pacific is projected to witness robust growth in the compostable multilayer films market, with a market share of around 30% by 2032, fueled by rising urbanization, growing demand for packaged food, and increasing governmental initiatives promoting biodegradable materials in countries like China, India, and Japan

- The starch-based films segment is expected to dominate the global compostable multilayer films market with the largest share of over 45% in 2025, owing to their excellent biodegradability, cost-effectiveness, and increasing use in food packaging and agricultural applications

Report Scope and Compostable Multilayer Films Market Segmentation

|

Attributes |

Compostable Multilayer Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Compostable Multilayer Films Market Trends

“Growing Shift Toward Sustainable and High-Barrier Packaging Solutions”

- One prominent trend in the global compostable multilayer films market is the increasing demand for sustainable packaging materials that offer both environmental benefits and advanced barrier properties, particularly in food and pharmaceutical applications

- These films, made from renewable and compostable polymers such as PLA, PBAT, and starch blends, are gaining popularity as they combine biodegradability with the ability to protect contents from moisture, oxygen, and contamination

- For instance, In February 2024, TIPA Corp. introduced a new line of high-barrier compostable multilayer films designed specifically for food packaging, offering extended shelf life and full compostability under industrial conditions

- The trend is also fueled by rising consumer awareness, global regulatory pressure on single-use plastics, and the push for circular economy practices. Manufacturers are increasingly focusing on innovation to produce multilayer films that meet performance expectations without compromising on sustainability

Compostable Multilayer Films Market Dynamics

Driver

“Rising Demand for Sustainable and Compostable Packaging Solutions”

- The growing focus on reducing plastic waste and the environmental impact of packaging is driving the global compostable multilayer films market, as industries seek alternatives that are both functional and environmentally responsible

- With increasing consumer awareness about sustainability and the harmful effects of traditional plastic films, the demand for compostable films is rising, particularly in the food and beverage industry, where packaging plays a significant role in environmental impact

- Regulatory pressures and initiatives to reduce plastic pollution are encouraging the adoption of compostable multilayer films as a viable alternative, helping businesses meet stringent environmental standards and improve their sustainability credentials

For instance,

- In April 2024, BASF launched a new range of compostable multilayer films designed for food packaging applications, which are made from renewable materials and meet compostability standards, aligning with the growing demand for eco-friendly alternatives

- As sustainability initiatives gain momentum globally, demand for compostable multilayer films is expected to continue growing, particularly in markets such as Europe and North America, where governments and consumers are actively pushing for greener packaging solutions

Opportunity

“Advancements in Technology and Innovation in Packaging Materials”

- Technological advancements in material science are paving the way for the development of high-performance compostable multilayer films that offer improved durability, flexibility, and barrier properties, making them suitable for a wider range of applications

- Innovations in processing techniques, such as extrusion and co-extrusion technologies, are enabling the production of multilayer films with enhanced performance while maintaining their compostable nature, which is key for industries such as food and pharmaceuticals that require packaging to meet strict standards

- As research and development in biodegradable materials continue to evolve, the creation of new, more efficient compostable films that meet both consumer and industry demands for functionality and sustainability will further drive market growth

For instance,

- In January 2024, a collaboration between Mondi and a leading research institute led to the development of a new compostable film technology that provides better oxygen and moisture barriers, ideal for use in food packaging without compromising environmental benefits

- The ongoing technological progress and innovations in compostable packaging materials are providing new opportunities for businesses to differentiate their offerings and stay ahead of the competition in the sustainable packaging market

Restraint/Challenge

“High Production Costs of Compostable Multilayer Films Hindering Widespread Adoption”

- The high production cost of compostable multilayer films presents a significant challenge for the global market, especially for small and medium-sized enterprises (SMEs) and companies in developing regions with limited resources for sustainable packaging innovation

- Compostable multilayer films, which are derived from renewable and biodegradable materials, often incur higher production costs compared to traditional plastic films, mainly due to the cost of raw materials and more complex manufacturing processes. This price disparity can make it difficult for manufacturers, especially in price-sensitive industries, to adopt compostable packaging on a large scale

- The higher cost of compostable films, coupled with the need for specialized production techniques, creates an economic barrier for widespread adoption, particularly in industries where cost efficiency is crucial, such as the food and beverage sector

For instance,

- In March 2024, a report from Innovia Films highlighted that while demand for compostable multilayer films is growing, the high raw material costs and the complex production processes involved in creating these films remain significant barriers for smaller producers, especially in the retail and food packaging markets

- As a result, many companies continue to rely on more affordable traditional plastic packaging solutions, which limits the potential for widespread adoption of compostable multilayer films, especially in price-sensitive markets

Surfactant Market Scope

The market is segmented on the basis of type, material type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material Type |

|

|

By Application |

|

In 2025, the starch-based films is projected to dominate the market with a largest share in material type segment

In 2025, the starch-based films segment is projected to dominate the global compostable multilayer films market with the largest share of 45%, driven by their cost-effectiveness, biodegradability, and renewable sourcing. Derived from plant starches such as corn, potato, and tapioca, these films are increasingly popular in food packaging due to their ability to break down naturally in composting environments, offering a sustainable alternative to conventional plastics. Their versatility, combined with advances in processing techniques that improve their barrier properties, positions starch-based films to meet the rising demand for eco-friendly packaging solutions.

The Food Packaging is expected to account for the largest share during the forecast period in application segments

The food packaging segment is expected to dominate the global compostable multilayer films market with the largest market share in 2025, driven by the growing demand for sustainable and eco-friendly packaging solutions in the food industry. Compostable multilayer films play a key role in reducing the environmental impact of food packaging, as they are made from renewable, biodegradable materials that decompose naturally in composting environments. These films help meet consumer demand for packaging that aligns with sustainability goals and regulatory requirements aimed at reducing plastic waste.

Compostable Multilayer Films Market Regional Analysis

“North America Holds the Largest Share in the Compostable Multilayer Films Market”

- North America is expected to dominate the global compostable multilayer films market, holding a 37.24% share during the forecast period, driven by increasing demand for sustainable packaging solutions across industries such as food and beverage, retail, and healthcare

- The U.S. is anticipated to account for over 18% of the global compostable multilayer films market, fueled by rising consumer preference for eco-friendly packaging, as well as stringent regulations aimed at reducing plastic waste. The presence of advanced manufacturing facilities and high demand for sustainable packaging in both domestic and export markets further support the region's dominance

- The shift towards compostable and bio-based packaging materials is also gaining momentum in Canada and Mexico, where governments are enacting policies to promote sustainable packaging practices and reduce the environmental impact of plastic waste

- In addition, multinational companies and regional players are investing in R&D and expanding production capacity.

“Asia - Pacific is Projected to Register the Highest CAGR in the Compostable Multilayer Films Market”

- Asia-Pacific is projected to witness robust growth in the global compostable multilayer films market, with the highest compound annual growth rate (CAGR) during the forecast period, and is expected to hold a market share of approximately 30% by 2025. This growth is driven by increasing industrialization, rising environmental awareness, and the growing demand for sustainable packaging solutions across key sectors such as food and beverage, retail, and healthcare

- China, as the leading market in the region, benefits from its large manufacturing base, government regulations promoting eco-friendly packaging, and an expanding consumer base for sustainable products. The country’s focus on reducing plastic waste and adopting bio-based packaging materials is fueling market expansion

- The growing shift towards biodegradable and compostable packaging solutions is further supported by regional government policies, including bans and restrictions on single-use plastics and incentives for companies to adopt sustainable packaging alternatives

- In addition, major companies in Asia-Pacific are investing in R&D, enhancing production capacity, and developing new compostable film technologies.

Compostable Multilayer Films Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- Futamura Chemical Co., Ltd. (Japan)

- NatureWorks LLC (U.S.)

- TotalEnergies Corbion (Thailand)

- Mitsubishi Chemical Corporation (Japan)

- Toray Industries, Inc. (Japan)

- Evonik Industries AG (Germany)

- Polyvel Inc. (U.S.)

- UNITIKA LTD. (Japan)

- Jiangxi Academy of Sciences Biological New Materials Co., Ltd. (China)

- Shanghai Tong-jie-liang Biomaterials Co., Ltd. (China)

- Zhejiang Hisun Biomaterials Co., Ltd. (China)

- Radici Partecipazioni SpA (Italy)

- Vegware (U.K.)

- Ecologic Brands, Inc. (U.S.)

Latest Developments in Global Compostable Multilayer Films Market

- In November 2024, Earthfirst Films launched a new line of unprinted compostable laminations, advancing sustainable packaging solutions. These market-ready pre-laminations are designed for high barrier performance, ensuring durability while supporting eco-friendly commercialization. The first offering, Earthfirst PouchReady Metallized film, features a 4-mil multi-layer structure, optimized for pouch-making applications and zipper receptivity. This innovation addresses the growing demand from small and medium-sized brands (SMBs), enabling faster product launches with customization-friendly digital printing. Earthfirst Films continues to bridge sustainability and functionality in packaging

- In October 2024, Sway, a material innovation company, introduced compostable poly bags made from seaweed, plants, and compostable polymers. These eco-friendly bags, printed with algae-derived ink, are designed to degrade in both home and industrial compost environments. Four fashion brands—Prana, Faherty, Alex Crane, and Florence—have adopted these sustainable packaging solutions to reduce plastic waste in the industry. Sway’s initiative aligns with its mission to create regenerative, biodegradable alternatives for fashion packaging

- In April 2023, BASF SE announced the expansion of Ecovio, a certified compostable polymer, across the Asia-Pacific region. Starting mid-2023, commercial quantities of Ecovio film grades became available for applications such as compostable shopping bags, organic waste bags, soil-biodegradable agricultural mulch films, and packaging materials. This initiative supports sustainability efforts by providing biodegradable alternatives that comply with international compostability standards. BASF’s local compounding capabilities in Shanghai, China, ensure faster delivery and adaptation to evolving regulations

- In March 2023, Polymateria Limited partnered with Toppan Printing Co. Ltd. to introduce a fully biodegradable biaxially oriented polypropylene (BOPP) film, revolutionizing food and cosmetic packaging. This innovative film utilizes Polymateria’s biotransformation technology, enabling accelerated biodegradation without leaving behind microplastics or toxins. Verified by the AIMPLAS Technological Institute of Plastic, the film meets ISO 17556 biodegradability standards and supports global efforts to reduce plastic pollution. The partnership aims to scale sustainable packaging solutions, offering biodegradable alternatives for industries seeking eco-friendly materials

- In June 2022, BASF SE partnered with Confoil, an Australian food packaging manufacturer, to develop DualPakECO, a certified compostable, dual oven-able paper tray for ready-to-eat meals. These trays, made from lightweight paperboard and coated with BASF’s biopolymer ecovio® PS 1606, offer excellent barrier properties against fats, liquids, and odors. They can be microwaved, oven-heated, refrigerated, or frozen, ensuring versatility for food packaging. Certified under Australian standard AS4736-2006, these trays support organic waste recycling, reducing landfill impact

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Compostable Multilayer Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Compostable Multilayer Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Compostable Multilayer Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.