Global Computed Radiography Market

Market Size in USD Billion

CAGR :

%

USD

3.42 Billion

USD

4.87 Billion

2025

2033

USD

3.42 Billion

USD

4.87 Billion

2025

2033

| 2026 –2033 | |

| USD 3.42 Billion | |

| USD 4.87 Billion | |

|

|

|

|

Computed Radiography Market Size

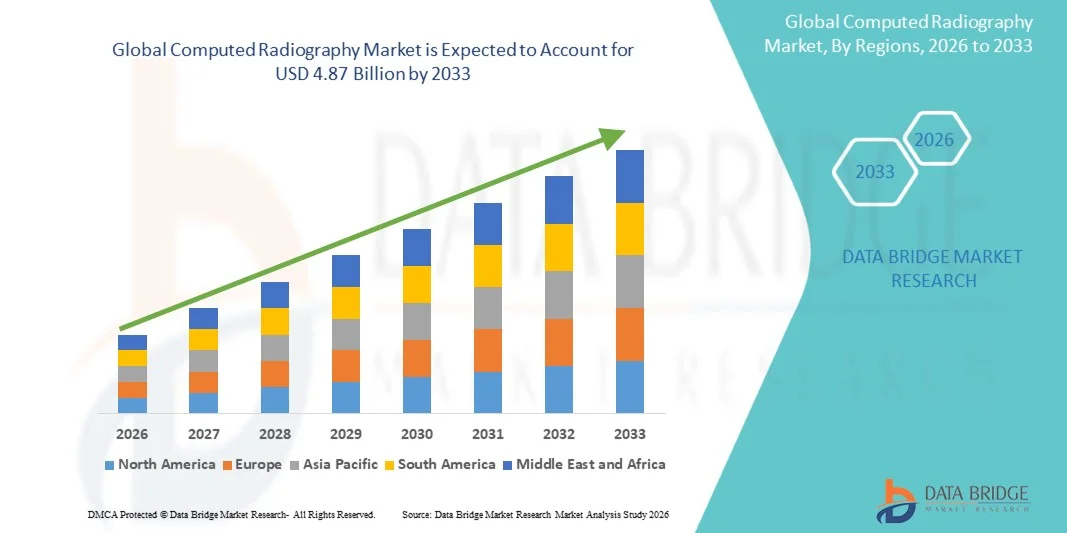

- The global computed radiography market size was valued at USD 3.42 billion in 2025 and is expected to reach USD 4.87 billion by 2033, at a CAGR of 4.53% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital imaging technologies and continuous technological advancements in healthcare infrastructure, leading to enhanced digitalization across hospitals, diagnostic centers, and clinics

- Furthermore, rising demand from healthcare providers for cost-effective, reliable, and user-friendly diagnostic imaging solutions is establishing computed radiography as a preferred transitional technology between conventional film-based systems and fully digital radiography. These converging factors are accelerating the uptake of computed radiography solutions, thereby significantly boosting the market’s growth

Computed Radiography Market Analysis

- Computed Radiography (CR) systems, which use photostimulable phosphor imaging plates for X-ray image capture, remain an important diagnostic imaging solution across hospitals and diagnostic centers due to their cost-effectiveness, reliability, and compatibility with existing X-ray infrastructure in both developed and emerging healthcare markets

- The growing demand for CR systems is primarily driven by the ongoing replacement of conventional film-based radiography, budget constraints limiting full digital radiography adoption, and the need for dependable imaging solutions in small to mid-sized healthcare facilities

- North America dominated the computed radiography market in 2025, accounting for approximately 36% of global revenue, supported by a well-established healthcare system, steady replacement of legacy imaging equipment, and continued use of CR systems in outpatient clinics, emergency departments, and rural healthcare facilities, particularly in the United States

- Asia-Pacific is expected to be the fastest-growing region in the computed radiography market during the forecast period, driven by expanding healthcare infrastructure, rising diagnostic imaging demand, increasing government healthcare investments, and widespread adoption of affordable imaging solutions across China, India, and Southeast Asia

- The hospitals segment accounted for the largest market revenue share of 63.8% in 2025, driven by high patient inflow and the need for continuous diagnostic imaging services

Report Scope and Computed Radiography Market Segmentation

|

Attributes |

Computed Radiography Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Computed Radiography Market Trends

“Technological Advancements and Workflow Optimization in Computed Radiography”

- A significant and accelerating trend in the global computed radiography (CR) market is the continuous improvement in detector plate technology and image processing capabilities, aimed at enhancing diagnostic accuracy while maintaining cost efficiency for healthcare providers

- For instance, in May 2024, Fujifilm Healthcare introduced an upgraded FCR PRIMA system with enhanced phosphor imaging plate sensitivity, enabling improved image clarity at lower radiation doses and faster image readout times

- Manufacturers are increasingly focusing on improving image resolution, contrast optimization, and noise reduction to support accurate diagnosis across applications such as orthopedics, chest imaging, trauma care, and general radiography

- The integration of computed radiography systems with hospital information systems (HIS) and picture archiving and communication systems (PACS) is streamlining clinical workflows, enabling faster image access, storage, and sharing across departments

- This shift toward more efficient and digitally connected radiography environments is reinforcing the role of computed radiography as a reliable and cost-effective imaging solution, particularly for facilities transitioning from analog to digital imaging systems

- The growing demand for affordable digital imaging solutions continues to sustain the adoption of computed radiography systems across small hospitals, diagnostic centers, and resource-limited healthcare settings

Computed Radiography Market Dynamics

Driver

“Rising Demand for Diagnostic Imaging and Expansion of Healthcare Infrastructure”

- The increasing prevalence of chronic diseases, traumatic injuries, and age-related health conditions is driving the demand for diagnostic imaging procedures, thereby supporting the growth of the computed radiography market

- For instance, in February 2025, Carestream Health announced the expansion of its CR systems portfolio to support growing diagnostic imaging needs in emerging markets, targeting community hospitals and standalone diagnostic centers

- Computed radiography systems offer a cost-effective alternative to fully digital radiography, making them an attractive choice for healthcare facilities seeking digital imaging capabilities without high upfront investment

- Rapid expansion of healthcare infrastructure in developing regions, supported by government healthcare programs and private investments, is further boosting demand for reliable and scalable radiography solutions

- In addition, the increasing number of diagnostic imaging centers and rising patient volumes are encouraging healthcare providers to adopt computed radiography systems due to their durability, ease of operation, and compatibility with existing X-ray equipment

Restraint/Challenge

“Gradual Shift Toward Digital Radiography and Operational Limitations”

- The gradual transition from computed radiography to advanced digital radiography (DR) systems presents a challenge to the long-term growth of the computed radiography market, as DR systems offer faster image acquisition and higher workflow efficiency

- For instance, in August 2023, several large hospital networks in Europe announced upgrades from CR to DR systems, citing reduced processing time and improved patient throughput as key decision factors

- Computed radiography systems typically involve additional steps such as cassette handling and image plate processing, which can limit operational efficiency in high-volume healthcare environments

- Maintenance requirements, including periodic replacement of imaging plates and reader components, add to the total cost of ownership and may impact purchasing decisions for cost-conscious healthcare providers

- While computed radiography remains a viable solution in many settings, overcoming these challenges through technological refinement, cost optimization, and targeted deployment in appropriate care environments will be essential for sustaining market relevance

Computed Radiography Market Scope

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the Computed Radiography market is segmented into Computed Radiography (CR) and Digital Radiography (DR). The Computed Radiography (CR) segment dominated the largest market revenue share of 56.4% in 2025, driven by its widespread adoption as a transitional technology between analog and fully digital imaging systems. CR systems are preferred by hospitals and clinics due to their lower upfront cost compared to DR systems and their ability to integrate with existing X-ray infrastructure. Healthcare facilities upgrading from film-based radiography often adopt CR to minimize capital expenditure. CR plates offer reusable imaging solutions, reducing long-term operational costs. The flexibility of CR systems allows use across multiple imaging applications, including chest, orthopaedics, and dental imaging. CR technology provides improved image quality over analog systems while maintaining affordability. Ease of installation and minimal workflow disruption further support adoption. CR systems are widely used in small and mid-sized hospitals, particularly in emerging economies. Availability of trained technicians familiar with CR workflows strengthens dominance. Government healthcare expansion programs in developing regions also promote CR adoption. Compatibility with PACS and hospital IT systems enhances operational efficiency. Overall, CR remains the preferred choice where cost efficiency and gradual digital transition are priorities.

The Digital Radiography (DR) segment is anticipated to witness the fastest CAGR of 15.9% from 2026 to 2033, driven by the growing demand for high-speed imaging and superior diagnostic accuracy. DR systems offer instant image acquisition, eliminating the need for image plate processing, which significantly improves workflow efficiency. Hospitals and diagnostic centers increasingly adopt DR to handle high patient volumes and reduce examination turnaround time. DR systems provide enhanced image resolution and lower radiation exposure, improving patient safety. Integration with AI-based diagnostic tools supports early disease detection and automated reporting. Growing investments in advanced healthcare infrastructure fuel DR adoption. Increasing use in emergency departments and trauma care accelerates growth. DR systems are highly compatible with telemedicine platforms and cloud-based image sharing. Technological advancements such as wireless detectors and portable DR units enhance flexibility. Rising preference for fully digital hospitals supports demand. Declining costs of DR detectors make systems more accessible. Strong adoption in developed markets further accelerates CAGR.

• By Application

On the basis of application, the Computed Radiography market is segmented into hospitals, clinics, and others. The hospitals segment accounted for the largest market revenue share of 63.8% in 2025, driven by high patient inflow and the need for continuous diagnostic imaging services. Hospitals rely heavily on CR systems for routine imaging procedures such as chest, orthopaedic, and trauma diagnostics. Multi-departmental usage increases equipment utilization rates, enhancing return on investment. CR systems support emergency care, inpatient diagnostics, and outpatient imaging within hospital settings. Integration with PACS and electronic health records ensures seamless image storage and retrieval. Hospitals prefer CR systems due to cost efficiency and adaptability across multiple imaging rooms. Government funding for hospital infrastructure development boosts adoption. Public hospitals in emerging markets rely on CR for affordable digital imaging solutions. Availability of trained radiology staff supports smooth operations. Hospitals benefit from CR’s ability to handle large imaging volumes reliably. Compatibility with existing X-ray machines minimizes upgrade costs. Overall, hospitals remain the dominant end users of computed radiography systems globally.

The clinics segment is expected to witness the fastest CAGR of 14.6% from 2026 to 2033, driven by the rapid expansion of private clinics and outpatient diagnostic facilities. Clinics prefer CR systems due to their compact design and lower installation costs compared to DR systems. Rising demand for quick diagnostic services in urban and semi-urban areas fuels adoption. Clinics benefit from CR’s ability to deliver high-quality images without requiring extensive infrastructure upgrades. Increasing emphasis on preventive healthcare and routine checkups supports imaging demand. CR systems enable clinics to offer a wide range of diagnostic services cost-effectively. Growth in specialty clinics, including orthopaedic and dental centers, boosts adoption. Technological improvements in CR plate durability and image processing enhance efficiency. Clinics increasingly integrate CR systems with cloud-based storage solutions. Growing medical tourism and outpatient care trends support market growth. Lower maintenance requirements attract small and mid-sized clinics. Expansion of private healthcare networks accelerates adoption globally.

Computed Radiography Market Regional Analysis

- North America dominated the computed radiography market in 2025, accounting for approximately 36–38% of global revenue

- This dominance is supported by a well-established healthcare system, steady replacement of legacy imaging equipment, and the continued use of CR systems in outpatient clinics, emergency departments, and rural healthcare facilities

- The region benefits from high diagnostic imaging volumes, strong reimbursement frameworks, and sustained demand for cost-effective radiography solutions, particularly where full transition to direct radiography (DR) is not yet feasible

U.S. Computed Radiography Market Insight

The U.S. computed radiography market captured the largest revenue share within North America in 2025, driven by the widespread presence of CR systems across hospitals, independent diagnostic centers, and smaller healthcare facilities. The continued reliance on computed radiography in emergency care, mobile imaging, and rural healthcare settings, combined with routine equipment upgrades and refurbishment programs, is sustaining market growth. In addition, the need for economical imaging solutions in outpatient and community-based healthcare facilities continues to support CR adoption.

Europe Computed Radiography Market Insight

The Europe computed radiography market is expected to grow steadily during the forecast period, supported by the ongoing use of CR systems in public hospitals, diagnostic centers, and transitional healthcare facilities. Budget constraints within public healthcare systems and the need to modernize imaging infrastructure at a controlled cost are encouraging the continued deployment of CR solutions. The region also benefits from strong regulatory oversight and emphasis on diagnostic accuracy and patient safety.

U.K. Computed Radiography Market Insight

The U.K. computed radiography market is projected to grow at a moderate CAGR, driven by sustained demand from NHS hospitals and diagnostic centers that continue to utilize CR systems alongside digital radiography. Equipment replacement cycles, coupled with the need for cost-efficient imaging technologies in high-patient-volume settings, are supporting market stability across the country.

Germany Computed Radiography Market Insight

Germany computed radiography market is expected to witness steady growth in the Computed Radiography market, supported by its advanced healthcare infrastructure and strong diagnostic imaging demand. While the country is gradually transitioning toward DR systems, CR remains widely used in secondary hospitals, outpatient clinics, and specialized diagnostic centers due to its reliability, lower upfront costs, and compatibility with existing X-ray systems.

Asia-Pacific Computed Radiography Market Insight

Asia-Pacific computed radiography market is expected to be the fastest-growing region in the Computed Radiography market during the forecast period. Growth is driven by expanding healthcare infrastructure, rising diagnostic imaging demand, increasing government healthcare investments, and widespread adoption of affordable imaging solutions across China, India, and Southeast Asia. CR systems remain a preferred choice in emerging markets due to their cost efficiency, ease of deployment, and suitability for high-volume diagnostic environments.

China Computed Radiography Market Insight

China computed radiography market accounted for the largest revenue share in the Asia-Pacific Computed Radiography market in 2025. Rapid expansion of hospitals, increasing access to diagnostic imaging in lower-tier cities, and government initiatives to improve healthcare coverage are key growth drivers. The availability of domestically manufactured CR systems at competitive prices is further accelerating adoption across public hospitals and diagnostic centers.

Japan Computed Radiography Market Insight

The Japan computed radiography market continues to show stable growth, supported by consistent diagnostic imaging demand and the presence of advanced healthcare facilities. While Japan is a leader in high-end imaging technologies, CR systems remain in use for routine diagnostics, backup imaging, and in facilities where cost control and operational flexibility are prioritized.

Computed Radiography Market Share

The Computed Radiography industry is primarily led by well-established companies, including:

- Fujifilm Holdings Corporation (Japan)

- Carestream Health (U.S.)

- Agfa-Gevaert Group (Belgium)

- Konica Minolta Healthcare (Japan)

- GE Healthcare (U.S.)

- Siemens Healthineers (Germany)

- Philips Healthcare (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Shimadzu Corporation (Japan)

- Hitachi Medical Systems (Japan)

- Allengers Medical Systems (India)

- Neusoft Medical Systems (China)

- United Imaging Healthcare (China)

- MinFound Medical Systems (China)

- Delft Imaging Systems (Netherlands)

- Varex Imaging Corporation (U.S.)

- Thales Group (France)

- Analogic Corporation (U.S.)

- Planmed Oy (Finland)

- Toshiba Medical Systems (Japan)

Latest Developments in Global Computed Radiography Market

- In March 2024, Agfa-Gevaert Group introduced the DX-D 100 wireless detector system compatible with existing computed radiography infrastructure. This system enables healthcare facilities to upgrade imaging capabilities without replacing entire CR units, improving workflow efficiency and image quality in cost-sensitive environments

- In January 2024, Konica Minolta Healthcare expanded its computed radiography services and distribution network in emerging markets of Southeast Asia and Latin America, partnering with local distributors to improve access to CR systems, service support, and maintenance — driving broader adoption of CR solutions

- In June 2024, Carestream Health announced a strategic partnership with Philips Healthcare to integrate advanced healthcare IT and imaging solutions, enhancing interoperability between CR systems and enterprise electronic health records (EHRs). This collaboration aims to streamline clinical workflows and improve diagnostic coordination

- In July 2023, Canon Medical Systems introduced the Zexira i9 Digital X-ray RF System, expanding its imaging portfolio with enhanced flexibility and design tailored to versatile clinical environments — underscoring broader market innovation that affects CR and digital radiography adoption globally

- In May 2023, Carestream Health launched the DRX-Rise Mobile X-ray System, a mobile radiography solution designed to improve point-of-care imaging and diagnostic confidence in both hospital and outpatient settings — reflecting the ongoing shift toward mobile digital imaging platforms

- In September 2022, DÜRR NDT GmbH & Co. KG partnered with JME Ltd. to develop an innovative computed radiography-based X-ray solution using D-Tect X software and DXB:1 technology for industrial applications such as pipeline inspection — highlighting cross-sector CR technology advancement

- In July 2022, L3Harris Technologies teamed up with DÜRR NDT GmbH & Co. KG to utilize the ScanX Discover HC computed radiography scanner, enabling electronic capture and digital evaluation of X-ray images for industrial and non-destructive testing applications

- In February 2021, DÜRR NDT GmbH & Co. KG launched the D-Tect X NDT software, delivering high performance, user-friendly capabilities and flexible CR system integration for industrial imaging workflows, signaling ongoing innovation in computed radiography tools

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.