Global Concrete Bonding Agent Market

Market Size in USD Billion

CAGR :

%

USD

5.13 Billion

USD

10.08 Billion

2024

2032

USD

5.13 Billion

USD

10.08 Billion

2024

2032

| 2025 –2032 | |

| USD 5.13 Billion | |

| USD 10.08 Billion | |

|

|

|

|

Concrete Bonding Agent Market Size

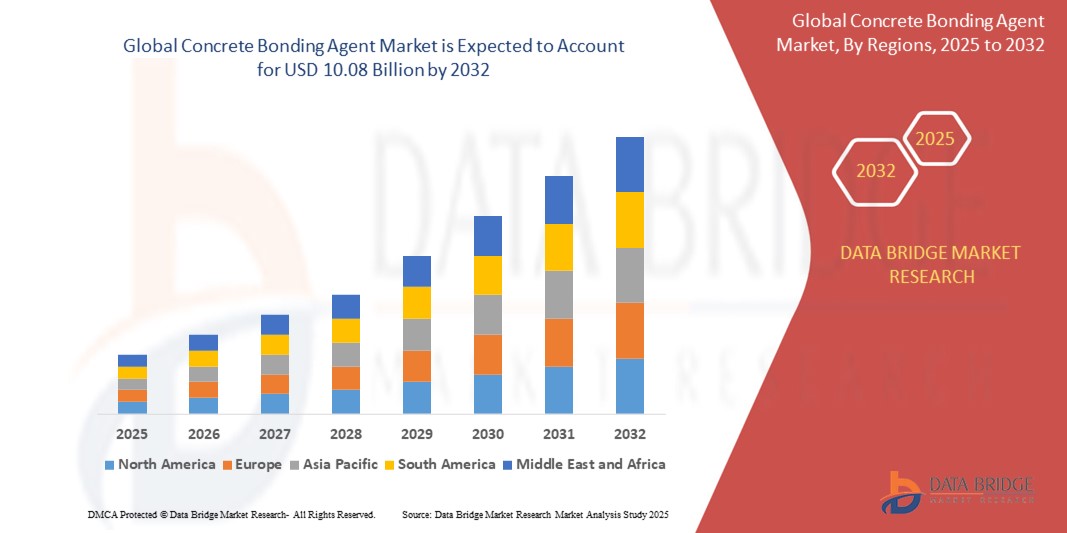

- The global concrete bonding agent market size was valued at USD 5.13 billion in 2024 and is expected to reach USD 10.08 billion by 2032, at a CAGR of 8.80% during the forecast period

- The market growth is largely fueled by increasing demand for repair and rehabilitation of aging infrastructure across residential, commercial, and industrial sectors, driving widespread use of bonding agents for structural integrity and durability

- Furthermore, rising emphasis on sustainable construction practices and enhanced performance materials is encouraging adoption of advanced bonding agents, particularly epoxy and latex-based types, thereby significantly boosting the industry's growth

Concrete Bonding Agent Market Analysis

- A concrete bonding agent is a substance applied to existing concrete surfaces before new concrete is poured or applied. It enhances the adhesion between old and new concrete layers, ensuring a strong bond and preventing separation or delamination. Bonding agents typically improve the durability and structural integrity of concrete structures by promoting a reliable bond that withstands stress, weathering, and other environmental factors

- The escalating demand for concrete bonding agents is primarily fueled by aging infrastructure, rapid urbanization, rising renovation and repair activities, and a growing focus on high-performance, sustainable building materials across residential, commercial, and industrial sectors

- Asia-Pacific dominated the concrete bonding agent market with a share of 48.33% in 2024, due to extensive infrastructure development, urban housing projects, and growing renovation activities across emerging economies

- North America is expected to be the fastest growing region in the concrete bonding agent market during the forecast period due to the ongoing need to rehabilitate aging infrastructure and growing investments in smart cities and green construction

- Repairing segment dominated the market with a market share of 64.52% in 2024, due to the growing need to rehabilitate aging infrastructure, especially in urban areas where replacement is less feasible due to space and cost constraints. Concrete bonding agents play a crucial role in extending the service life of existing structures by enabling strong adhesion between old and new concrete layers. Governments and municipalities are increasingly investing in concrete repair projects to restore roads, tunnels, and public buildings, thereby boosting the demand for bonding agents

Report Scope and Concrete Bonding Agent Market Segmentation

|

Attributes |

Concrete Bonding Agent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Concrete Bonding Agent Market Trends

“Growing Demand for Eco-Friendly Bonding Agents”

- A major trend shaping the concrete bonding agent market is the rising demand for eco-friendly, low-emission formulations that support sustainable construction practices. As global environmental regulations tighten and green building certifications such as LEED, BREEAM, and IGBC gain prominence, contractors and infrastructure developers are actively seeking bonding solutions that minimize environmental impact without compromising performance

- For instance, manufacturers are launching latex-based and water-dispersible agents with reduced volatile organic compound (VOC) emissions, which are increasingly favored in both residential and commercial settings. These products align with global sustainability goals and help builders achieve compliance with regional environmental mandates

- The shift toward circular construction, where recyclability and life-cycle sustainability of building materials are prioritized, has encouraged R&D in bonding agents that are compatible with recycled aggregates and green concrete

- Key players such as BASF and Sika are investing in next-generation polymer technologies and bio-based chemical components that lower the environmental footprint and also enhance adhesion, flexibility, and resistance to chemicals and moisture

- Adoption of these sustainable bonding agents is particularly high in government-backed infrastructure projects and institutional construction, where environmental benchmarks are increasingly stringent. Urban infrastructure upgrades in Europe, clean construction initiatives in North America, and green building codes in the Asia-Pacific are accelerating the trend

- This eco-conscious shift is reshaping procurement strategies, pushing manufacturers to innovate and differentiate through sustainability, and expanding opportunities for green bonding solutions in both new and retrofit markets

Concrete Bonding Agent Market Dynamics

Driver

“Growing Construction Industry”

- The surge in global construction activity, coupled with the urgent need to rehabilitate deteriorating infrastructure, is a primary driver for the concrete bonding agent market. Governments and private developers are prioritizing cost-effective repair solutions to extend the lifespan of bridges, roads, tunnels, dams, and buildings, thereby creating significant demand for high-performance bonding agents

- For instance, in developing economies such as India, Indonesia, and Vietnam, urbanization is accelerating at an unprecedented pace, prompting massive investments in housing, commercial buildings, and public infrastructure. In these markets, bonding agents are widely used in vertical extensions, structural overlays, and column-beam joint strengthening

- Simultaneously, mature markets in Europe and North America are facing aging infrastructure challenges, with thousands of kilometers of roads, highways, and water systems requiring urgent repair. Epoxy and cementitious bonding agents are critical in such applications, ensuring reliable adhesion and structural continuity between old and new concrete

- The market is also benefiting from increased investment in resilient and disaster-proof infrastructure, particularly in earthquake-prone and flood-affected regions, where reliable bonding materials can make a difference in long-term structural safety

- Overall, the expanding footprint of infrastructure and commercial renovation—driven by policy incentives, real estate expansion, and public-private partnerships—is expected to sustain high demand for advanced concrete bonding agents across all regions

Restraint/Challenge

“High Regulatory Challenges”

- One of the key challenges restraining the concrete bonding agent market is the highly complex and region-specific regulatory landscape governing chemical composition, safety, and environmental compliance. Regulations targeting VOC emissions, toxic additives, and chemical disposal practices can significantly limit product formulations and delay new launches

- For instance, in North America and Europe, strict guidelines imposed by agencies such as the U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA) necessitate extensive testing and documentation, especially for products used in public infrastructure and government-funded projects

- These regulatory constraints require manufacturers to invest heavily in R&D to develop compliant alternatives, including bio-based agents and solvent-free systems, which can increase production costs and affect profit margins

- Furthermore, achieving consistent product performance across varying climatic and construction conditions presents a technical challenge. Bonding agents must exhibit reliable adhesion in hot, humid, or freezing environments, while remaining compliant with region-specific building codes and material standards

- Despite these challenges, companies that proactively align their product development with global regulatory trends and invest in green chemistry innovations are expected to gain a competitive edge in the evolving construction materials landscape

Concrete Bonding Agent Market Scope

The market is segmented on the basis of agent type and application.

• By Agent

On the basis of agent, the concrete bonding agent market is segmented into cementitious latex-based agents and epoxy-based agents. The cementitious latex-based agents segment accounted for the largest market revenue share in 2024, primarily due to its strong adhesion properties, affordability, and compatibility with a wide range of cementitious substrates. These agents are commonly used in residential and commercial construction for repair and overlay applications, where flexibility and breathability are critical. Their ease of application, coupled with good water resistance and durability, makes them ideal for bonding new concrete to old surfaces, especially in repair works involving sidewalks, slabs, and driveways.

The epoxy-based agents segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their superior mechanical strength, chemical resistance, and ability to form high-performance bonds under harsh environmental conditions. These agents are increasingly adopted in industrial and infrastructure projects where heavy load-bearing and resistance to aggressive chemicals or moisture is essential. Their two-part formulation offers precise control over curing time and performance, making them suitable for structural repairs and overlays in bridges, highways, and marine structures.

• By Application

On the basis of application, the concrete bonding agent market is segmented into repairing, decorative, flooring, and marine. The repairing segment dominated the market with the largest share of 64.52% in 2024, driven by the growing need to rehabilitate aging infrastructure, especially in urban areas where replacement is less feasible due to space and cost constraints. Concrete bonding agents play a crucial role in extending the service life of existing structures by enabling strong adhesion between old and new concrete layers. Governments and municipalities are increasingly investing in concrete repair projects to restore roads, tunnels, and public buildings, thereby boosting the demand for bonding agents.

The marine segment is projected to register the fastest growth rate from 2025 to 2032 due to the rising demand for bonding agents in offshore and coastal construction projects, which require materials capable of withstanding constant exposure to water, salt, and temperature fluctuations. Epoxy-based bonding agents, in particular, are gaining traction for their resilience in these environments. The expansion of marine infrastructure such as ports, docks, and underwater tunnels—especially in Asia-Pacific and Middle East coastal regions—is expected to drive rapid growth in this segment.

Concrete Bonding Agent Market Regional Analysis

- Asia-Pacific dominated the concrete bonding agent market with the largest revenue share of 48.33% in 2024, driven by extensive infrastructure development, urban housing projects, and growing renovation activities across emerging economies

- Rising government investments in transportation networks, water infrastructure, and residential construction are fueling demand for bonding agents in both new construction and repair works

- In addition, expanding industrialization, supportive policy frameworks, and increasing awareness regarding structural durability are accelerating adoption of bonding agents in the region’s civil engineering sector

Japan Concrete Bonding Agent Market Insight

The Japan market is expanding due to the country’s aging infrastructure and emphasis on high-quality, durable repair materials. Japan’s focus on seismic resilience and retrofitting older buildings is driving the use of advanced bonding agents. Domestic manufacturers are prioritizing low-shrinkage, high-performance agents to meet stringent engineering standards and improve the longevity of concrete structures in public and private sectors.

China Concrete Bonding Agent Market Insight

The China concrete bonding agent market held the largest share of 47.01% in Asia-Pacific in 2024, supported by rapid urban expansion, industrial upgrades, and large-scale public infrastructure projects. The nation’s aggressive push toward modernizing its roadways, bridges, and transit systems, along with an aging urban building stock, is creating consistent demand for effective concrete bonding solutions. Local suppliers are expanding production capacities and focusing on latex- and epoxy-based agents for high-volume repair and overlay applications.

Europe Concrete Bonding Agent Market Insight

The Europe concrete bonding agent market is projected to grow at a significant CAGR over the forecast period, driven by increasing renovation and restoration projects aimed at meeting sustainability and safety regulations. Aging building stock and infrastructure across Western Europe is creating a sustained need for durable bonding solutions. The region's strong emphasis on low-VOC, environmentally compliant products is supporting the adoption of eco-friendly bonding agents in residential and commercial renovations.

U.K. Concrete Bonding Agent Market Insight

The U.K. market is anticipated to grow steadily during the forecast period, fueled by refurbishment programs in urban housing and public infrastructure. Government initiatives targeting green building standards and carbon footprint reduction are encouraging the use of low-emission bonding agents. Growing interest in decorative concrete applications, such as overlays and stained flooring, is also boosting demand for bonding agents compatible with aesthetic finishes.

Germany Concrete Bonding Agent Market Insight

The Germany concrete bonding agent market is expected to witness strong expansion, underpinned by a highly regulated construction environment focused on structural integrity and energy efficiency. Germany's extensive efforts in retrofitting buildings for climate resilience and sustainable living are increasing the adoption of high-strength epoxy bonding agents. Demand is also rising in industrial flooring and repair of heritage structures where precision and long-term performance are critical.

North America Concrete Bonding Agent Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by the ongoing need to rehabilitate aging infrastructure and growing investments in smart cities and green construction. The rise in commercial remodeling, increased federal infrastructure funding, and stricter building codes are accelerating the use of high-performance bonding agents. Adoption is also supported by heightened awareness of structural safety, rising labor costs, and a preference for low-maintenance repair technologies.

U.S. Concrete Bonding Agent Market Insight

The U.S. concrete bonding agent market captured the largest revenue share in 2024 within North America, supported by widespread demand for infrastructure rehabilitation, bridge repair, and industrial floor resurfacing. Bonding agents are extensively used in federal and municipal projects where rapid curing, structural bonding, and long-term durability are crucial. The adoption of epoxy-based agents is growing, particularly in projects focused on resilience against weather extremes and traffic loads.

Concrete Bonding Agent Market Share

The concrete bonding agent industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Arkema (France)

- Hexion (U.S.)

- Huntsman International LLC (U.S.)

- BASF (Germany)

- KUKDO CHEMICAL CO., LTD. (South Korea)

- Bostik (France)

- H.B. Fuller Company (U.S.)

- Sika AG (Switzerland)

- Freudenberg SE (Germany)

- Aditya Birla Chemicals (Thailand) Pvt. Ltd (India)

- Mitsubishi Chemical Corporation (Japan)

- DOW (U.S.)

- SOLVAY (Belgium)

- Air Products, Inc. (U.S.)

- Momentive (U.S.)

Latest Developments in Global Concrete Bonding Agent Market

- In May 2023, Sika Group successfully finalized the acquisition of MBCC Group, a strategic move aimed at enhancing the company's sustainable transformation in the construction sector. This acquisition is expected to bolster Sika's position in the concrete bonding agents market

- In May 2022, Euclid Chemical Company acquired Chryso's North American cement grinding aids and additives business. The acquisition aims to improve cement performance and reduce CO2 emissions during production, aligning with sustainability goals

- In April 2022, Euclid Chemical Company further strengthened its presence in the North American construction industry by acquiring Chryso's cement grinding aids and additives business. This acquisition enhances Euclid's capabilities in providing advanced solutions for concrete and masonry construction

- In August 2021, Sika AG launched an innovative concrete repair solution designed to offer long-term protection for buildings while significantly reducing CO2 emissions. This new product sets a benchmark for low environmental impact in concrete repair solutions

- In January 2020, Euclid Chemical Company launched three new concrete bonding agent products: Eucoweld 2.0, Level Top PC-AGG, and an improved Kurez DR VOX. These products aim to enhance the performance and durability of concrete in construction projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Concrete Bonding Agent Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Concrete Bonding Agent Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Concrete Bonding Agent Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.