Global Concrete Floor Coatings Market

Market Size in USD Billion

CAGR :

%

USD

2.03 Billion

USD

3.29 Billion

2024

2032

USD

2.03 Billion

USD

3.29 Billion

2024

2032

| 2025 –2032 | |

| USD 2.03 Billion | |

| USD 3.29 Billion | |

|

|

|

|

What is the Global Concrete Floor Coatings Market Size and Growth Rate?

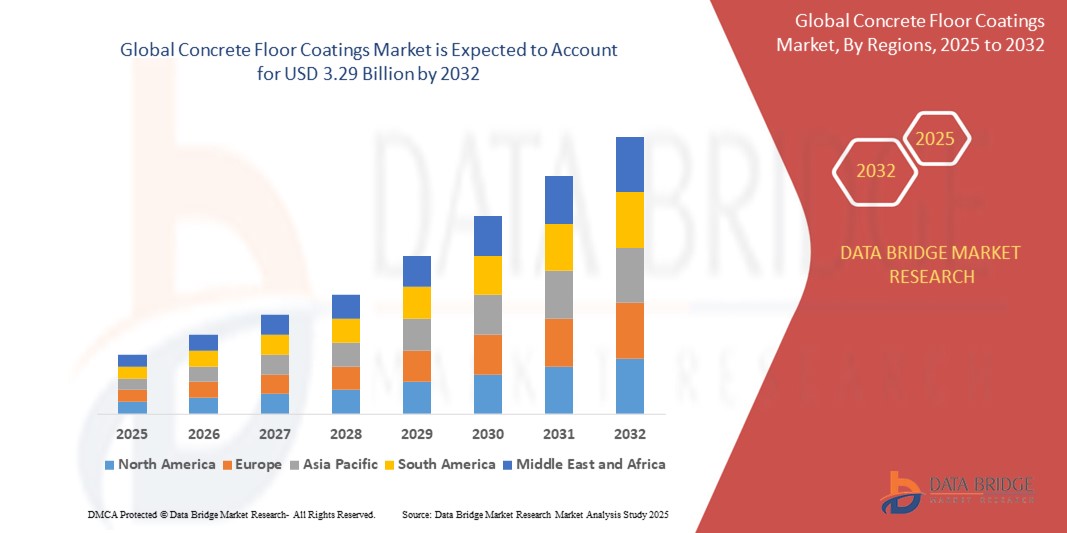

- The global concrete floor coatings market size was valued at USD 2.03 billion in 2024 and is expected to reach USD 3.29 billion by 2032, at a CAGR of 6.20% during the forecast period

- The concrete floor coatings market is seeing growth due to advancements in UV-cured coatings and polyaspartic technology, which offer rapid curing and enhanced durability. These coatings are used in commercial and industrial spaces for improved aesthetics and protection. The rising demand for sustainable and low-VOC products is also driving market growth, reflecting an increased focus on eco-friendly solutions

What are the Major Takeaways of Concrete Floor Coatings Market?

- Increasing construction activities, particularly in commercial and industrial sectors, significantly boost demand for concrete floor coatings. For instance, the expansion of shopping malls and industrial warehouses requires durable, low-maintenance flooring solutions. As these projects grow, the need for coatings that offer both aesthetics and resilience becomes crucial. This trend drives the market as developers and property owners seek high-quality, long-lasting concrete floor coatings for their new and renovated spaces

- Asia-Pacific dominated the concrete floor coatings market with the largest revenue share of 44.6% in 2024, fueled by the region’s construction boom, rapid urbanization, and industrial infrastructure development, especially in China, India, and Southeast Asia

- Europe is projected to grow at the fastest CAGR of 19.2% from 2025 to 2032, driven by stringent environmental regulations, sustainability initiatives, and energy-efficient construction practices

- The epoxy segment dominated the concrete floor coatings market with the largest market revenue share of 46.2% in 2024, owing to its superior durability, chemical resistance, and cost-effectiveness across residential, commercial, and industrial flooring applications

Report Scope and Concrete Floor Coatings Market Segmentation

|

Attributes |

Concrete Floor Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Concrete Floor Coatings Market?

“Sustainable and High-Performance Coating Technologies”

- A major trend in the concrete floor coatings market is the shift toward eco-friendly and high-durability formulations, driven by growing environmental concerns and regulatory pressure. Water-based, low-VOC, and solvent-free coatings are gaining momentum as industrial and commercial users prioritize sustainability

- Manufacturers such as Sherwin-Williams and BASF SE are developing bio-based coatings and introducing epoxy and polyurethane systems that offer enhanced abrasion resistance, reduced curing times, and minimal environmental impact

- Smart coatings with features such as anti-slip, antimicrobial, and UV resistance are also entering the market, particularly in healthcare, food processing, and warehousing sectors

- For instance, in 2023, Sika AG introduced a range of low-emission resin-based coatings under its Sikafloor® brand, aligning with green building certifications such as LEED and BREEAM

- Digitalization is further enabling predictive maintenance through sensor-integrated floor coatings and IoT-based wear tracking. These innovations allow facility managers to reduce downtime and extend flooring lifespans

- This trend is expected to strengthen as regulatory frameworks tighten and demand for durable, safe, and green flooring solutions accelerates across North America, Europe, and Asia-Pacific

What are the Key Drivers of Concrete Floor Coatings Market?

- The rise in industrial construction and rapid expansion of logistics and warehousing facilities, especially post-eCommerce boom, is significantly driving the demand for concrete floor coatings to enhance surface durability and aesthetics

- For instance, in June 2024, Amazon announced new fulfillment centers across the U.S. and India, requiring extensive coating solutions for heavy-duty warehouse flooring

- Growing infrastructure investments in commercial real estate including malls, hospitals, data centers, and airports are also fueling market growth due to their need for seamless and easy-to-maintain surfaces

- The demand for chemical-resistant and thermal-stable coatings is increasing in sectors such as manufacturing, pharmaceuticals, and food processing, where hygiene and resistance are critical

- In emerging markets such as Southeast Asia, Latin America, and the Middle East, urbanization and industrialization are boosting the adoption of concrete floor coatings in new construction and retrofit projects

- Further, rising awareness about workplace safety, aesthetics, and compliance standards is influencing facility operators to invest in performance-driven floor coating solutions

Which Factor is challenging the Growth of the Concrete Floor Coatings Market?

- A major challenge is the volatile price of raw materials such as epoxy resins, polyurethanes, and additives, which are often derived from petrochemical sources. Price fluctuations affect profit margins and project budgeting

- For instance, resin prices surged in early 2023 due to global supply chain disruptions, affecting the delivery timelines of key infrastructure projects across Europe and the U.S.

- Strict environmental regulations on VOC emissions and chemical handling further complicate production and formulation processes, especially for solvent-based coatings

- Small and medium-sized manufacturers often struggle to adapt due to limited capital for R&D and regulatory compliance, leading to a fragmented competitive landscape

- Installation complexity and high labor costs associated with multi-layered coating systems can deter adoption, particularly in cost-sensitive residential or small commercial projects

- To counter these challenges, players are investing in recyclable and pre-mixed coatings, robotic application technologies, and green chemistry, but these transitions involve substantial upfront costs and long development timelines

How is the Concrete Floor Coatings Market Segmented?

The market is segmented on the basis of product, application, component, and end-use sector.

- By Product

On the basis of product, the concrete floor coatings market is segmented into epoxy, polyaspartic, acrylic, and polyurethane. The epoxy segment dominated the market with the largest market revenue share of 46.2% in 2024, driven by its exceptional durability, chemical resistance, and strong adhesion properties. Epoxy coatings are widely used in both residential and industrial settings for providing long-lasting protection and aesthetic finish. Their ability to withstand heavy traffic and harsh environmental conditions contributes to their widespread preference across sectors.

The polyaspartic segment is anticipated to witness the fastest CAGR from 2025 to 2032, attributed to its quick curing time, UV stability, and excellent gloss retention. These coatings are increasingly favored in time-sensitive projects such as commercial showrooms and warehouses, offering fast return-to-service benefits and reduced downtime.

- By Application

On the basis of application, the concrete floor coatings market is segmented into indoor and outdoor. The indoor segment held the largest market revenue share of 58.9% in 2024, fueled by the increasing demand for protective coatings in residential basements, garages, and industrial indoor flooring. Indoor coatings enhance surface strength, improve hygiene, and reduce wear from foot and machinery traffic.

The outdoor segment is expected to register the fastest CAGR during the forecast period, driven by rising construction of patios, driveways, and parking decks. Outdoor coatings must endure weather extremes and UV exposure, prompting innovations in weather-resistant formulations and high-performance finishes.

- By Component

On the basis of component, the concrete floor coatings market is segmented into one component, two component, three component, and four component. The two component segment dominated the market with the largest revenue share of 39.6% in 2024, due to its superior durability, customizable mixing ratios, and resistance to mechanical stress and chemicals. These coatings are extensively used in industrial and commercial applications requiring high-performance surfaces.

The three component segment is projected to witness the fastest CAGR through 2032, supported by increasing demand for multifunctional coatings with enhanced aesthetics, thickness control, and crack-bridging ability in decorative and specialty flooring projects.

- By End Use Sector

On the basis of end use sector, the concrete floor coatings market is segmented into residential, commercial, and industrial. The industrial segment accounted for the largest market revenue share of 42.3% in 2024, driven by stringent regulations for worker safety, demand for cleanroom environments, and heavy machinery operation. Floor coatings in industrial settings are critical for preventing dust, corrosion, and chemical damage.

The commercial segment is expected to witness the fastest CAGR during the forecast period, fueled by increasing infrastructure investments, rising demand for attractive and easy-to-clean surfaces in malls, hospitals, schools, and office complexes.

Which Region Holds the Largest Share of the Concrete Floor Coatings Market?

- Asia-Pacific dominated the concrete floor coatings market with the largest revenue share of 44.6% in 2024, fueled by the region’s construction boom, rapid urbanization, and industrial infrastructure development, especially in China, India, and Southeast Asia

- The growing demand for aesthetically appealing, durable, and easy-to-maintain flooring solutions in commercial and residential sectors is supporting market growth. Industrial hubs across the region are adopting coatings for enhanced chemical and abrasion resistance

- Government investments in smart cities and infrastructure projects, alongside rising consumer awareness of sustainable flooring, are key drivers behind Asia-Pacific’s leadership in this market

China Concrete Floor Coatings Market Insight

The China concrete floor coatings market held the largest share within Asia-Pacific in 2024, driven by robust urban development, increasing commercial construction, and industrial plant expansions. The presence of major domestic manufacturers and supportive government infrastructure spending also contribute to sustained growth. Demand for epoxy and polyurethane coatings remains high, especially in manufacturing and logistics facilities, thanks to their superior performance and longevity.

India Concrete Floor Coatings Market Insight

The India concrete floor coatings market is expanding due to rapid infrastructure growth, government smart city missions, and rising demand for decorative as well as functional flooring in urban households. The rise of warehousing, automotive, and pharmaceutical industries is also boosting demand for high-durability floor coatings. Local manufacturers are increasingly investing in product innovation to cater to industrial and residential needs.

Japan Concrete Floor Coatings Market Insight

The Japan concrete floor coatings market is mature but growing steadily due to the country’s stringent quality standards and a focus on sustainability. The demand is driven by renovation activities in public infrastructure, cleanroom environments, and the use of antimicrobial floor coatings in healthcare and food sectors. Innovation and product differentiation remain key strategies for players in this space.

Which Region is the Fastest Growing Region in the Concrete Floor Coatings Market?

Europe is projected to grow at the fastest CAGR of 19.2% from 2025 to 2032, driven by stringent environmental regulations, sustainability initiatives, and energy-efficient construction practices. Countries such as Germany, France, and the U.K. are increasingly using low-VOC and water-based floor coatings to meet EU directives. Rising demand in commercial and institutional buildings, coupled with refurbishment projects, is propelling market growth across the region.

Germany Concrete Floor Coatings Market Insight

The Germany concrete floor coatings market is witnessing strong growth, supported by the country’s leadership in eco-friendly building practices and high-performance materials. Epoxy coatings are in high demand in the industrial sector due to their chemical and mechanical resistance. Government incentives promoting sustainable construction materials are fostering the adoption of greener coating technologies.

France Concrete Floor Coatings Market Insight

The France concrete floor coatings market is growing due to modernization in public buildings and strict compliance with environmental norms. The commercial sector, especially retail and hospitality, is adopting decorative coatings to improve aesthetics and durability. Supportive energy-efficiency policies and urban infrastructure upgrades are driving demand across both new builds and renovation projects.

U.K. Concrete Floor Coatings Market Insight

The U.K. concrete floor coatings market is expanding on the back of rising investments in infrastructure renewal and smart city developments. The demand is particularly high in the healthcare, education, and industrial sectors. The government’s push for sustainable construction practices and adoption of VOC-free coatings are expected to sustain momentum in the coming years.

Which are the Top Companies in Concrete Floor Coatings Market?

The concrete floor coatings industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- The Sherwin-Williams Company (U.S.)

- RPM International Inc. (U.S.)

- Sika AG (Switzerland)

- PPG Industries, Inc. (U.S.)

- DSM (Netherlands)

- BASF SE (Germany)

- DAW SE (Germany)

- BEHR Process Corporation (U.S.)

- Vanguard Concrete Coating (U.S.)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Epmar Corporation (U.S.)

- Rodda Paint Co. (U.S.)

- CPC Floor Coatings (U.S.)

- Tennant Coatings (U.S.)

- Citadel Contractors (U.S.)

- Watco Industrial Flooring (U.K.)

- ARCAT, Inc. (U.S.)

What are the Recent Developments in Global Concrete Floor Coatings Market?

- In January 2024, Saint-Gobain strengthened its footprint in the construction chemicals sector by acquiring two companies in the non-residential flooring market. These include R.SOL, a French firm specializing in resin-based flooring solutions, and Technical Finishes, a prominent resin flooring provider based in South Africa. These acquisitions enhance Saint-Gobain’s access to innovative technologies and broaden its geographical reach, particularly in Europe and Africa

- In June 2023, PPG expanded its concrete coatings portfolio by introducing a comprehensive line of integrated systems that include primers, base coats, and topcoats. These systems are specifically engineered for electrostatic-sensitive environments, mechanical rooms, and installations that require rapid return to service. This expansion underscores PPG’s commitment to delivering advanced, high-performance solutions for critical infrastructure and industrial applications

- In September 2022, Seal for Life Industries, a portfolio company of Arsenal Capital Partners, acquired Verdia, Inc. and Mascoat Ltd. to bolster its presence in protective coatings and sealing technologies. These acquisitions aim to enhance Seal for Life's ability to serve the global infrastructure market with expanded sealing and corrosion protection offerings. This step marks Arsenal's strategic investment in infrastructure resilience and product innovation

- In February 2021, Tennant Company completed the sale of its coatings division, Tennant Coatings, to The Sherwin-Williams Company. The transaction was part of Tennant’s strategy to sharpen its focus on core cleaning equipment businesses, while Sherwin-Williams leveraged the deal to strengthen its industrial coatings portfolio. This strategic divestiture allowed both companies to realign their business priorities for future growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Concrete Floor Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Concrete Floor Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Concrete Floor Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.