Global Conductive Foam Market

Market Size in USD Billion

CAGR :

%

USD

1.79 Billion

USD

2.37 Billion

2024

2032

USD

1.79 Billion

USD

2.37 Billion

2024

2032

| 2025 –2032 | |

| USD 1.79 Billion | |

| USD 2.37 Billion | |

|

|

|

|

Conductive Foam Market Size

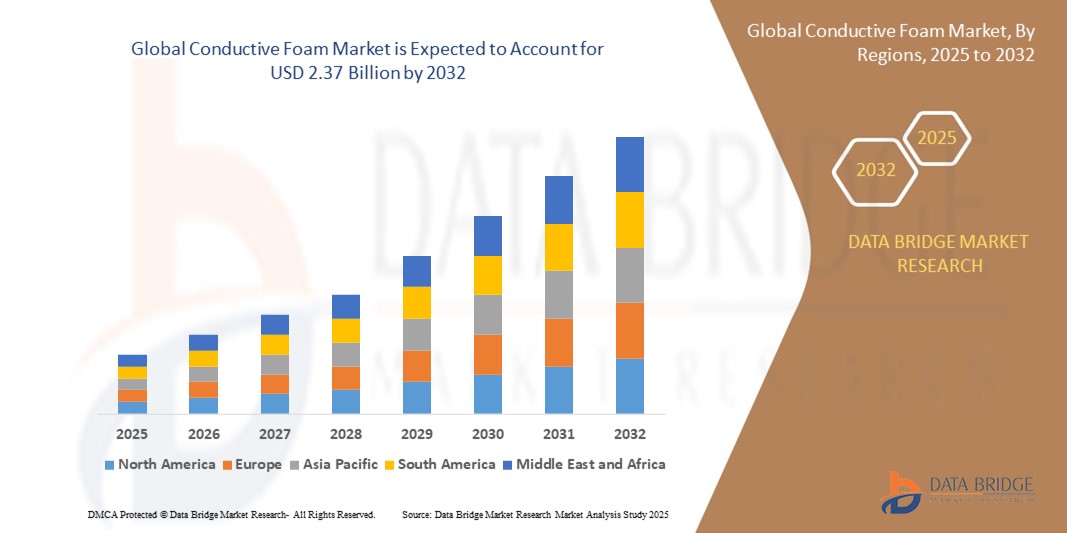

- The global conductive foam market size was valued at USD 1.79 billion in 2024 and is expected to reach USD 2.37 billion by 2032, at a CAGR of 3.6% during the forecast period

- The market growth is largely fueled by the increasing demand for EMI shielding materials in consumer electronics, automotive, and telecommunications, as devices become more compact and technologically advanced, driving the adoption of conductive foams across industries

- Furthermore, rising investments in electric vehicles, aerospace systems, and 5G infrastructure are establishing conductive foams as essential materials for ensuring reliability, safety, and performance in critical applications. These converging factors are accelerating the uptake of conductive foam solutions, thereby significantly boosting the industry’s growth

Conductive Foam Market Analysis

- Conductive foams are lightweight, compressible materials that combine cushioning properties with electromagnetic interference shielding, making them indispensable in electronic devices, automotive assemblies, aerospace equipment, and medical technologies

- The escalating demand for conductive foams is primarily fueled by the proliferation of next-generation electronics, increasing integration of electronic systems in vehicles, and stringent EMI compliance regulations in defense and aerospace sectors, firmly positioning conductive foams as a critical material for advanced industrial applications

- North America dominated the conductive foam market with a share of 45.73% in 2024, due to the strong presence of consumer electronics manufacturers, automotive leaders, and advanced aerospace industries

- Asia-Pacific is expected to be the fastest growing region in the conductive foam market during the forecast period due to the rapid expansion of consumer electronics, telecom, and automotive industries across China, Japan, and India

- Polyurethane segment dominated the market with a market share of 47% in 2024, due to its wide use in EMI shielding and gasketing applications due to excellent cushioning, flexibility, and conductivity retention. Polyurethane conductive foam offers superior resilience, making it suitable for repeated compression in electronic devices without performance loss. Its balance between cost-effectiveness and functional properties has made it the preferred choice across consumer electronics and telecom equipment manufacturing

Report Scope and Conductive Foam Market Segmentation

|

Attributes |

Conductive Foam Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Conductive Foam Market Trends

Growing Demand in Electronics

- The growing penetration of conductive foams in the electronics sector is driven by their excellent shielding, cushioning, and conductivity characteristics. Devices such as smartphones, tablets, and advanced computing systems require these materials to address electromagnetic interference and ensure reliable performance

- For instance, companies such as Laird Performance Materials have expanded product portfolios by developing conductive foams that meet the demands of compact consumer electronics. Their foams provide both EMI shielding and cushioning for sensitive electronic components, supporting reliability and longevity in high-demand devices

- The surging complexity of electronic devices requires enhanced insulation, lightweight materials, and improved heat management. Conductive foams provide multipurpose solutions by simultaneously addressing electrical conductivity, EMI protection, and structural support, making them indispensable to next-generation designs

- In addition, as consumer electronics become more miniaturized and sophisticated, manufacturers are prioritizing versatile materials that combine durability and energy absorption. Conductive foams play this role effectively, preventing performance degradation in smaller, denser devices with sensitive circuits

- The rapid expansion of connected and smart devices is further reinforcing demand in both consumer and industrial electronics applications. By ensuring signal integrity and mitigating interference, conductive foams enhance the efficiency of IoT systems, wearables, and advanced computing systems

- This upward trend highlights the indispensable role of conductive foam in modern electronics, with demand expected to grow as integration of 5G technologies, AI-powered devices, and compact IoT solutions expands across consumer and industrial markets

Conductive Foam Market Dynamics

Driver

Increasing Use of Conductive Foam in Automotive

- Automotive manufacturers are incorporating conductive foams to enhance safety and functionality in vehicles as cars integrate more electronics ranging from driver assistance features to advanced infotainment systems. Conductive foam ensures protection of sensitive systems while minimizing EMI disruptions

- For instance, General Motors and other leading automakers are deploying conductive materials to protect autonomous driving systems, sensor modules, and infotainment control units. Suppliers such as Parker Chomerics deliver conductive foam solutions tailored for advanced automotive platforms

- The increasing reliance on electric vehicles and hybrid cars has amplified the need for high-performing conductive foams. EV batteries, control units, and safety sensors require insulation and shielding that conductive foams are designed to provide effectively in high-voltage environments

- In addition, the growth of connected car ecosystems demands higher standards of signal integrity and robustness. Conductive foam prevents interference issues that could hinder communication modules or compromise driver-assistance technologies, thereby ensuring system reliability across multiple functions

- This rising demand within automotive systems demonstrates the growing importance of conductive foams in enabling the transformation of vehicles into electronically advanced and interconnected platforms, reinforcing their significance in shaping the future of mobility

Restraint/Challenge

Volatility in Costs Affects Production and Pricing Stability

- The market for conductive foam faces considerable challenges due to fluctuations in raw material costs, which significantly affect production planning and profitability. Dependence on materials such as polymers and metal coatings exposes manufacturers to volatility in global supply and pricing

- For instance, sharp changes in polymer and conductive metal costs experienced by manufacturers such as Rogers Corporation have impacted production schedules and market pricing strategies, ultimately influencing competitiveness in the sector

- Uncertainty in cost structures raises pricing pressures and also creates challenges for companies attempting to secure long-term supply agreements. This unpredictability can hamper expansion plans and adoption in cost-sensitive industries, where stability of input costs is critical

- In addition, currency fluctuations and logistical uncertainties across global supply chains amplify the challenge for manufacturers. These risks can affect consistent material sourcing and raise the costs of delivering finished conductive foam products to key demand regions

- Overcoming these restraints requires strategies such as diversifying supply chains, negotiating stronger material contracts, and innovating around alternative composites. Successfully addressing pricing volatility will be crucial to ensuring sustainable growth of the conductive foam industry in the coming years

Conductive Foam Market Scope

The market is segmented on the basis of material, application, and end-use.

- By Material

On the basis of material, the conductive foam market is segmented into polyurethane, polyethylene, polyvinyl chloride, and others. The polyurethane segment dominated the largest market revenue share of 47% in 2024, supported by its wide use in EMI shielding and gasketing applications due to excellent cushioning, flexibility, and conductivity retention. Polyurethane conductive foam offers superior resilience, making it suitable for repeated compression in electronic devices without performance loss. Its balance between cost-effectiveness and functional properties has made it the preferred choice across consumer electronics and telecom equipment manufacturing.

The polyethylene segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its lightweight structure, durability, and cost competitiveness in mass production. The material’s adaptability in precision cutting and shaping makes it highly suitable for customized packaging and EMI shielding in compact electronics. In addition, polyethylene’s recyclability and growing preference in sustainable product design are fueling its rapid adoption, particularly in industries shifting toward environmentally conscious solutions.

- By Application

On the basis of application, the conductive foam market is segmented into EMI shielding, cushioning, gasketing, grounding, and others. The EMI shielding segment accounted for the largest revenue share in 2024, primarily due to the rising need for protection against electromagnetic interference in high-performance electronic devices. With increasing complexity in smartphones, laptops, servers, and communication equipment, conductive foams provide an efficient and lightweight shielding solution. The strong regulatory focus on limiting EMI levels in defense, aerospace, and automotive sectors also supports the continued dominance of this application.

The gasketing segment is expected to register the fastest growth during the forecast period, supported by the rising demand for secure sealing solutions in electronic enclosures and automotive assemblies. Conductive gaskets made of foam combine mechanical protection with electrical conductivity, ensuring both structural integrity and interference protection. The miniaturization of devices and the shift toward electric vehicles have created significant growth potential for gasketing applications, particularly in high-density electronic environments.

- By End-Use

On the basis of end-use, the conductive foam market is segmented into electrical & electronics, automotive, aerospace & defense, medical devices, and other industrial applications. The electrical & electronics segment dominated the largest market revenue share in 2024, fueled by the exponential growth in consumer electronics, telecommunication equipment, and data storage devices. Conductive foam plays a critical role in ensuring EMI shielding and thermal management, enabling manufacturers to maintain device performance and regulatory compliance. The proliferation of 5G networks and IoT ecosystems further strengthens its dominance in this sector.

The automotive segment is projected to witness the fastest growth from 2025 to 2032, driven by the rising integration of electronic control units, sensors, and infotainment systems in modern vehicles. The shift toward electric and hybrid vehicles is intensifying the demand for EMI shielding materials, where conductive foam provides lightweight and adaptable solutions. As automakers prioritize energy efficiency and reliability, conductive foams are gaining importance in ensuring uninterrupted signal performance and safety within increasingly electronic vehicle architectures.

Conductive Foam Market Regional Analysis

- North America dominated the conductive foam market with the largest revenue share of 45.73% in 2024, driven by the strong presence of consumer electronics manufacturers, automotive leaders, and advanced aerospace industries

- The region’s focus on EMI shielding materials in high-performance devices and defense applications strengthens demand

- The adoption of conductive foams is further supported by strict regulatory standards for electromagnetic compatibility and the rapid rollout of 5G networks, making North America a key hub for innovation in this market

U.S. Conductive Foam Market Insight

The U.S. conductive foam market captured the largest revenue share in 2024 within North America, fueled by rising investments in electronics, medical devices, and defense-grade technologies. The country’s robust R&D ecosystem, coupled with the expanding deployment of IoT and connected devices, drives strong demand for EMI shielding solutions. In addiiton, increasing adoption in EV manufacturing and high consumer demand for advanced electronics significantly bolster the U.S. conductive foam industry.

Europe Conductive Foam Market Insight

The Europe conductive foam market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent EMI shielding standards and sustainability requirements. The region’s automotive and aerospace sectors heavily rely on conductive foams for lightweight, reliable, and energy-efficient solutions. European consumers and manufacturers also prioritize recyclable and eco-friendly materials, contributing to rising demand. Conductive foams are increasingly incorporated into industrial equipment, EVs, and next-gen consumer electronics.

U.K. Conductive Foam Market Insight

The U.K. conductive foam market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing adoption in telecommunications, EV manufacturing, and consumer electronics. Rising concerns over EMI compliance and the government’s push toward advanced manufacturing enhance market opportunities. The country’s strong electronics import and export ecosystem also ensures steady demand for conductive foams in multiple end-use industries.

Germany Conductive Foam Market Insight

The Germany conductive foam market is expected to expand at a considerable CAGR during the forecast period, fueled by its advanced automotive and aerospace manufacturing base. Strong emphasis on precision engineering and innovation supports the integration of conductive foams into electronic components and lightweight systems. The demand is further bolstered by the rapid growth of electric vehicles and smart factories, where EMI shielding remains a critical requirement.

Asia-Pacific Conductive Foam Market Insight

The Asia-Pacific conductive foam market is poised to grow at the fastest CAGR from 2025 to 2032, driven by the rapid expansion of consumer electronics, telecom, and automotive industries across China, Japan, and India. Rising disposable incomes and urbanization, coupled with government-led digitalization initiatives, are fueling market growth. APAC’s role as a global manufacturing hub further ensures large-scale production and affordability of conductive foams, enabling wider adoption across end-use industries.

Japan Conductive Foam Market Insight

The Japan conductive foam market is gaining momentum due to its high-tech electronics manufacturing ecosystem and strong automotive sector. Conductive foams are increasingly used in precision devices, IoT systems, and EMI-sensitive components. The country’s emphasis on miniaturized, high-performance electronics and advanced automotive engineering is spurring adoption, while its innovation-driven economy supports the integration of conductive foams in next-generation technologies.

China Conductive Foam Market Insight

The China conductive foam market accounted for the largest revenue share in Asia-Pacific in 2024, supported by its strong electronics manufacturing base and rapid industrialization. With high production volumes in smartphones, telecom equipment, and EVs, China represents one of the most significant demand centers for conductive foams. Domestic manufacturers, government initiatives toward smart cities, and the affordability of conductive materials further enhance China’s leadership in this market.

Conductive Foam Market Share

The conductive foam industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Parker Hannifin Corporation (U.S.)

- Henkel Adhesives Technologies (Germany)

- Electrostatics (U.S.)

- Desco Industries Inc. (U.S.)

- Electroflex Engineering. (U.S.)

- Laird Technologies (U.K.)

- EIS Legacy (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Bourns, Inc. (U.S.)

Latest Developments in Global Conductive Foam Market

- In August 2024, Laird Performance Materials unveiled a high-density conductive foam engineered for 5G infrastructure and advanced communication systems. With 5G networks demanding higher bandwidth and stronger EMI protection, this product is positioned to solve critical interference issues in base stations, antennas, and data centers. By strengthening its product line for telecom applications, Laird is reinforcing its role as a key supplier in next-generation connectivity solutions. This development enhances performance reliability for telecom providers and also expands conductive foam adoption in one of the fastest-growing technology sectors

- In July 2024, Henkel AG & Co. KGaA expanded its portfolio with thermally conductive foam solutions tailored for electric vehicle battery packs and electronic control units. As EVs increasingly rely on compact, high-powered systems, the need for materials that deliver both EMI shielding and thermal regulation is growing rapidly. Henkel’s innovation addresses these dual challenges, providing automakers with multifunctional, lightweight solutions that improve vehicle safety and efficiency. This positions Henkel to capture significant opportunities within the booming EV market, reinforcing conductive foams as essential materials in modern automotive design

- In June 2024, Electro-Tech Industries introduced a new range of eco-friendly conductive foams, incorporating recyclable and low-carbon materials. With sustainability becoming a critical purchasing factor across electronics and industrial applications, this launch caters to customers seeking environmentally responsible alternatives without compromising performance. By aligning with global green manufacturing trends and stricter environmental regulations, Electro-Tech is enhancing its competitive edge. This move is expected to attract major electronics manufacturers focused on reducing their carbon footprint, thereby strengthening market adoption of sustainable conductive foams

- In May 2024, 3M launched an advanced conductive foam solution designed to improve performance in next-generation consumer electronics, including smartphones, wearables, and tablets. With device miniaturization and increasing functionality creating higher EMI risks, 3M’s product delivers enhanced shielding while maintaining flexibility and durability. This innovation enables manufacturers to integrate conductive foams into compact designs more efficiently, improving reliability and device longevity. By addressing the needs of high-tech markets, 3M is well-positioned to secure a larger share of the electronics sector, accelerating demand for premium conductive foams

- In April 2024, Seiren Co., Ltd. announced the launch of lightweight conductive foams tailored for aerospace and defense applications. These foams provide robust EMI shielding while meeting the industry’s strict requirements for weight reduction and material efficiency in aircraft and military systems. As defense agencies and aerospace manufacturers prioritize advanced shielding solutions that enhance both safety and performance, Seiren’s product fills a critical gap. This development opens up new revenue streams in high-value sectors where material performance is closely linked to mission success, boosting conductive foam penetration in specialized markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Conductive Foam Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Conductive Foam Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Conductive Foam Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.