Global Cone Rod Dystrophy Market

Market Size in USD Million

CAGR :

%

USD

131.79 Million

USD

202.25 Million

2024

2032

USD

131.79 Million

USD

202.25 Million

2024

2032

| 2025 –2032 | |

| USD 131.79 Million | |

| USD 202.25 Million | |

|

|

|

|

Cone- Rod Dystrophy Market Size

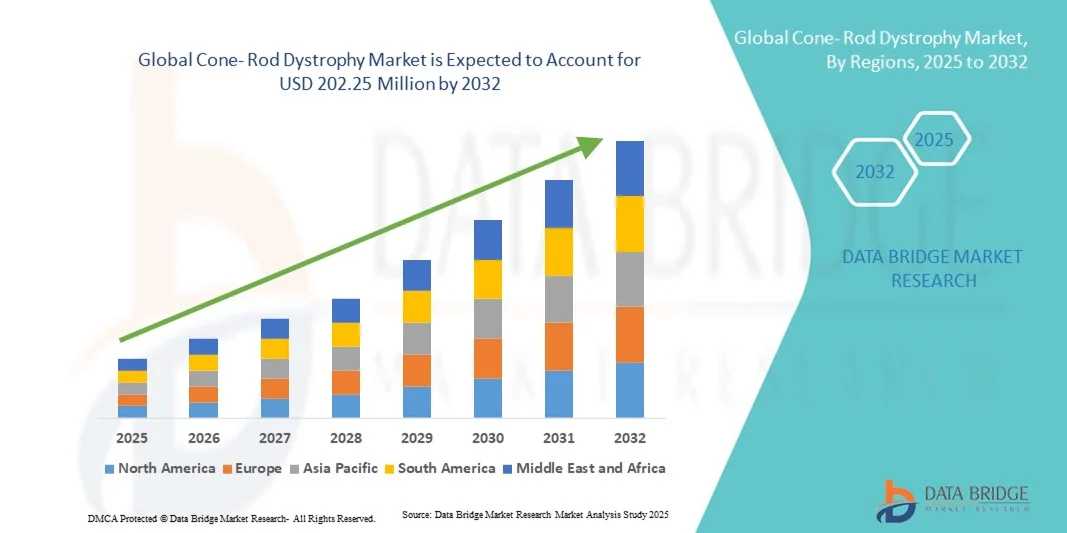

- The global cone- rod dystrophy market size was valued at USD 131.79 Million in 2024 and is expected to reach USD 202.25 Million by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the growing prevalence of inherited retinal disorders and advancements in genetic testing and molecular diagnostics, which have improved early detection and accurate diagnosis of Cone-Rod Dystrophy (CRD). Increased awareness among healthcare professionals and patients about the genetic basis of retinal degenerations is driving demand for specialized care and research into novel therapeutic approaches

- Furthermore, the rising focus on gene therapy, stem cell therapy, and neuroprotective drugs is establishing Cone-Rod Dystrophy as a key area of innovation within the ophthalmology and rare disease sectors. These converging factors, along with growing investments by biotechnology and pharmaceutical companies in ophthalmic research, are accelerating the development of effective treatment options and significantly boosting the industry’s growth

Cone- Rod Dystrophy Market Analysis

- The Cone-Rod Dystrophy (CRD) market is gaining momentum due to the rising prevalence of genetic retinal disorders and increasing advancements in molecular diagnostics and gene sequencing technologies. Growing awareness about inherited eye diseases and the availability of advanced genetic counseling services are significantly improving diagnosis rates and patient management across both developed and emerging economies

- The growing investment in gene therapy research, clinical trials for retinal degenerative diseases, and technological progress in retinal imaging and drug delivery systems are further fueling market expansion. Pharmaceutical and biotech companies are increasingly focusing on developing targeted therapies and regenerative medicine approaches, which are expected to reshape the treatment landscape for CRD

- North America dominated the cone-rod dystrophy market with the largest revenue share of 38.5% in 2024, attributed to the presence of leading research institutions, favorable funding for rare disease studies, and early adoption of gene therapy innovations. The U.S. continues to lead in clinical trials for CRD treatments, supported by the FDA’s fast-track designations and strong patient advocacy networks

- Asia-Pacific is projected to be the fastest-growing region in the cone-rod dystrophy market, registering a CAGR of 8.9% during the forecast period, driven by expanding genetic testing infrastructure, increased healthcare spending, and growing participation of regional biotechnology firms in ophthalmic research. Countries such as Japan, China, and South Korea are making significant contributions to retinal disease studies and emerging as key markets for CRD treatment innovation

- The gene therapy segment held the largest revenue share of 41.3% in 2024, attributed to growing research investments and multiple gene replacement trials for CRD

Report Scope and Cone- Rod Dystrophy Market Segmentation

|

Attributes |

Cone- Rod Dystrophy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cone- Rod Dystrophy Market Trends

Advances in Gene-Based Therapies and Diagnostic Imaging

- A major and accelerating trend in the global cone–rod dystrophy market is the rapid advancement of gene-based therapeutic approaches (gene replacement, gene editing, and RNA therapies) aimed at correcting or mitigating inherited photoreceptor dysfunction

- Improved retinal imaging technologies (adaptive optics, OCT angiography, wide-field imaging) and functional testing (microperimetry, multifocal ERG) are enabling earlier diagnosis, finer patient stratification, and more sensitive monitoring of disease progression and treatment response

- The convergence of precision diagnostics and molecular therapies is facilitating more targeted clinical trials, faster proof-of-concept readouts, and the development of companion diagnostics to identify suitable candidates

- Increased collaboration between academic centers, biotech firms, and specialty ophthalmology clinics is accelerating translational research and helping move promising therapies from preclinical stages into human studies

- Growing patient registries and natural-history studies are improving understanding of genotype–phenotype correlations, which supports more efficient trial design and endpoint selection

- This shift toward mechanism-based therapies plus advanced diagnostics is reshaping clinical practice and commercial strategy in inherited retinal disorders, including cone–rod dystrophy

Cone- Rod Dystrophy Market Dynamics

Driver

Increasing R&D Investment and Improved Diagnostic Reach

- Rising R&D investment from pharmaceutical and biotechnology companies targeting rare retinal diseases is a key driver for cone–rod dystrophy market growth. Substantial funding supports both early-stage discovery and late-stage clinical trials focused on photoreceptor gene restoration

- For instance, in 2023, Beacon Therapeutics launched with an investment of approximately £96 million to develop gene therapies for Cone–Rod Dystrophy and related inherited retinal diseases, marking a major milestone in retinal therapeutics

- The accessibility of genetic testing has significantly improved due to broader gene panel sequencing and reduced testing costs, leading to more accurate diagnosis and patient enrolment in trials

- In 2022, researchers at the University of Oxford demonstrated successful visual function rescue in CDHR1-related Cone–Rod Dystrophy models through AAV-based gene therapy, paving the way for human clinical studies

- Regulatory initiatives such as orphan drug designations and accelerated approval pathways are encouraging the advancement of innovative treatment modalities

- Multidisciplinary care centers combining ophthalmology, genetics, and vision rehabilitation are enhancing early detection and facilitating treatment access

- As awareness and funding increase, the number of clinical trials and partnerships between research institutes and industry players continues to expand, boosting innovation and accelerating market growth

Restraint/Challenge

High Development Costs, Small Patient Populations, and Access Inequities

- High development and manufacturing costs associated with gene and cell therapies pose a major restraint to cone–rod dystrophy market expansion, as the small patient population limits commercial scalability

- For instance, while several therapies for Cone–Rod Dystrophy are in preclinical or early-stage development, only a few have reached Phase I/II trials, delaying market entry and revenue generation

- In July 2025, BlueRock Therapeutics initiated a first-in-human trial for OpCT-001, a cell therapy targeting primary photoreceptor diseases including Cone–Rod Dystrophy, but its high production costs and complex delivery process remain challenges

- The variability of disease expression between genotypes complicates the design of standardised clinical endpoints and makes it difficult to demonstrate measurable visual improvements

- Unequal distribution of specialised treatment centers and advanced diagnostic infrastructure across regions restricts access to timely diagnosis and therapy

- Furthermore, regulatory agencies require extensive long-term safety data for gene and cell therapies, extending approval timelines and development expenditure

- To overcome these barriers, manufacturers are focusing on scalable manufacturing processes, pricing models that ensure affordability, and partnerships with healthcare systems to expand access and diagnostic coverage

Cone- Rod Dystrophy Market Scope

The market is segmented on the basis of diagnosis, treatment type, and end-user.

- By Diagnosis

On the basis of diagnosis, the Cone-Rod Dystrophy market is segmented into ERG, clinical history, fundus examination, and molecular diagnosis. The molecular diagnosis segment dominated the market with the largest revenue share of 38.6% in 2024, driven by the rising adoption of next-generation sequencing (NGS) and whole-exome sequencing (WES) for identifying genetic mutations responsible for cone-rod dystrophy (CRD). The increasing awareness among clinicians regarding the genetic heterogeneity of CRD, coupled with improved accessibility of molecular testing, has accelerated its use. Partnerships between genetic testing laboratories and healthcare institutions have enhanced the diagnostic accuracy and reduced turnaround time. Furthermore, the growing inclusion of molecular diagnostic testing in rare disease panels supports early detection and personalized treatment strategies. The emphasis on precision medicine and data-driven diagnostics continues to strengthen the dominance of molecular approaches in the CRD landscape.

The ERG (Electroretinography) segment is projected to register the fastest CAGR of 17.9% from 2025 to 2032, driven by its ability to provide objective, functional assessment of retinal response. Technological advancements such as portable ERG devices and non-invasive retinal imaging have made this diagnostic tool more accessible in both hospital and clinic settings. Increasing government support for early detection of hereditary retinal disorders is fueling the adoption of ERG, particularly in emerging economies. Moreover, the rising use of ERG in clinical trials for gene and stem cell therapies ensures its expanding role in both diagnosis and disease progression monitoring.

- By Treatment Type

On the basis of treatment type, the Cone-Rod Dystrophy market is segmented into gene therapy, stem cell therapy, surgery for retinal implants, and supportive therapies. The gene therapy segment held the largest revenue share of 41.3% in 2024, attributed to growing research investments and multiple gene replacement trials for CRD. Companies such as MeiraGTx, Nanoscope Therapeutics, and AGTC are advancing adeno-associated virus (AAV)-based vectors targeting specific gene mutations. The U.S. FDA’s increasing approval rate for orphan drug designations in inherited retinal diseases has supported commercial prospects. Rising collaboration between biotech firms and academic centers, alongside promising preclinical results showing improved visual acuity, have reinforced confidence in this segment. Moreover, ongoing regulatory flexibility for rare diseases has expedited clinical development timelines, strengthening gene therapy’s market leadership.

The stem cell therapy segment is anticipated to witness the fastest CAGR of 19.2% from 2025 to 2032, driven by advancements in pluripotent stem cell (iPSC)-derived photoreceptor transplantation. Increasing R&D funding by institutes such as the National Eye Institute (NEI) and growing partnerships between biotechnology companies and universities are promoting pipeline expansion. Stem cell approaches aim to replace degenerated photoreceptors and restore vision, offering potential long-term functional improvement. Ongoing clinical studies and ethical acceptance of cell-based interventions are further accelerating market growth. The shift toward regenerative medicine and patient-specific therapies positions this segment as a key growth driver for the forecast period.

- By End-User

On the basis of end-user, the Cone-Rod Dystrophy market is segmented into hospitals and ophthalmic centers. The hospitals segment accounted for the largest market revenue share of 57.5% in 2024, primarily due to the availability of advanced diagnostic infrastructure, multidisciplinary care teams, and access to clinical trials. Hospitals serve as major centers for administering gene and cell therapies, genetic counseling, and long-term follow-up care. Rising patient referrals from smaller clinics and increasing healthcare expenditure on rare genetic disorders contribute to this segment’s dominance. In addition, government-funded tertiary hospitals are playing a vital role in early detection programs and patient management for inherited retinal diseases.

The ophthalmic centers segment is projected to grow at the fastest CAGR of 16.5% from 2025 to 2032, driven by the expansion of specialized retinal care facilities and private eye clinics equipped with advanced imaging technologies. Ophthalmic centers are increasingly collaborating with biotechnology firms to conduct post-market surveillance and gene therapy trials. Their personalized patient engagement, shorter appointment wait times, and growing insurance coverage for genetic testing make them an emerging preferred point of care. The segment also benefits from rising patient awareness and accessibility to targeted diagnostic services in both developed and developing economies.

Cone- Rod Dystrophy Market Regional Analysis

- North America dominated the cone-rod dystrophy market with the largest revenue share of 38.5% in 2024, attributed to the presence of leading research institutions, favorable funding for rare disease studies, and early adoption of gene therapy innovations

- The region benefits from strong support by organizations such as the Foundation Fighting Blindness and the National Eye Institute, which promote awareness and research on inherited retinal diseases

- The march remains at the forefront of Cone-Rod Dystrophy clinical trials, driven by increasing FDA approvals, patient registry expansions, and the commercialization of gene-based treatment approaches. Growing collaboration between biotechnology firms and academic research centers continues to fuel innovation and accelerate treatment accessibility

U.S. Cone-Rod Dystrophy Market Insight

The U.S. cone-rod dystrophy market captured the largest share within North America in 2024, supported by the country’s advanced healthcare infrastructure and robust clinical research ecosystem. Increasing investments in precision medicine, rising genetic testing rates, and strong government initiatives for rare disease management have enhanced early diagnosis and therapeutic development. In addition, major pharmaceutical and biotech players are pursuing partnerships to advance CRD gene therapy and stem cell treatment pipelines, further strengthening the country’s leadership position in this domain.

Europe Cone-Rod Dystrophy Market Insight

The Europe cone-rod dystrophy market is expected to grow at a notable CAGR during the forecast period, driven by the region’s strong commitment to ophthalmic research and innovation in rare disease therapeutics. Government-backed programs for genetic screening and early detection are enhancing disease awareness, particularly in countries such as Germany, France, and the U.K. The European Medicines Agency (EMA) is also streamlining approvals for advanced therapy medicinal products (ATMPs), creating favorable conditions for CRD gene therapy advancements.

U.K. Cone-Rod Dystrophy Market Insight

The U.K. cone-rod dystrophy market is witnessing steady expansion, supported by national genetic testing initiatives and the country’s growing focus on rare disease treatment. The integration of genomic medicine into routine healthcare through the National Health Service (NHS) is improving diagnostic accuracy and facilitating early intervention. Collaborations between universities and biotech startups are further strengthening the pipeline of novel CRD therapies in the region.

Germany Cone-Rod Dystrophy Market Insight

The Germany cone-rod dystrophy market is projected to expand at a significant CAGR over the forecast period, fueled by technological advancements in ophthalmic imaging and precision diagnostics. Germany’s established life sciences sector and its emphasis on sustainable healthcare innovation are fostering the development of next-generation gene and cell-based therapies. The country’s strong regulatory and research environment supports the testing and adoption of cutting-edge retinal treatment options.

Asia-Pacific Cone-Rod Dystrophy Market Insight

The Asia-Pacific cone-rod dystrophy market is projected to register the fastest CAGR of 8.9% during 2025–2032, driven by expanding genetic testing infrastructure, increased healthcare spending, and the growing participation of regional biotechnology firms in ophthalmic research. Countries such as Japan, China, and South Korea are emerging as key contributors to global retinal disease innovation, with numerous research collaborations focusing on regenerative and gene-based therapies. Rapid improvements in healthcare accessibility and the establishment of specialized retinal centers are further propelling regional market growth.

Japan Cone-Rod Dystrophy Market Insight

The Japan cone-rod dystrophy market is gaining momentum owing to the country’s strong technological foundation, aging population, and commitment to regenerative medicine. Japanese research institutions are actively engaged in stem cell therapy development for retinal diseases, supported by government funding and university–industry collaborations. The integration of AI-assisted ophthalmic diagnostics and next-generation sequencing technologies is enhancing early disease detection and personalized treatment strategies.

China Cone-Rod Dystrophy Market Insight

The China cone-rod dystrophy market accounted for a major share in the Asia-Pacific region in 2024, driven by rapid advancements in gene therapy research, local biopharma innovation, and government-led healthcare modernization programs. China’s increasing focus on rare disease management, coupled with growing availability of genetic testing and CRISPR-based therapeutic research, is accelerating the market’s expansion. Moreover, domestic biotechnology firms are actively collaborating with global research entities to co-develop and commercialize advanced retinal treatments.

Cone- Rod Dystrophy Market Share

The Cone- Rod Dystrophy industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- GenSight Biologics (France)

- Novartis AG (Switzerland)

- Biogen Inc. (U.S.)

- Roche Holding AG (Switzerland)

- AGTC (Applied Genetic Technologies Corporation) (U.S.)

- Nanoscope Therapeutics (U.S.)

- MeiraGTx Holdings plc (U.K.)

- Ocugen Inc. (U.S.)

- ProQR Therapeutics (Netherlands)

- Ionis Pharmaceuticals (U.S.)

- 4D Molecular Therapeutics (U.S.)

- Astellas Pharma Inc. (Japan)

- Adverum Biotechnologies (U.S.)

- Regenxbio Inc. (U.S.)

- Oxurion NV (Belgium)

- Retinagenix Therapeutics (U.S.)

- Applied Genetic Technologies Corporation (U.S.)

- GeneCure Biopharma (U.S.)

Latest Developments in Global Cone- Rod Dystrophy Market

- In January 2025, SparingVision announced that following a favourable Data Safety Monitoring Board (DSMB) review of Step 1 of the PRODYGY trial, its gene-agnostic investigational therapy SPVN06 for rod-cone and cone-rod dystrophies is advancing to Phase II

- In April 2024, SparingVision presented 12-month safety data for the SPVN06 gene therapy in the PRODYGY trial, showing a favourable safety profile in patients with intermediate rod-cone dystrophy, marking a key translational milestone

- In June 2023, Beacon Therapeutics was launched with the objective of developing a next-generation gene therapy targeting the CDHR1 gene for cone-rod dystrophy, representing a significant new entrant focused on CRD

- In May 2025, a report highlighted that the global cone-rod dystrophy market is anticipated to grow significantly, underpinned by advances in gene therapy, stem cell therapy, and retinal implant technologies—pointing to a market value of approximately USD 131 million in 2024, with growth projected through 2030

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.