Global Confectionery Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

119.15 Billion

USD

191.34 Billion

2025

2033

USD

119.15 Billion

USD

191.34 Billion

2025

2033

| 2026 –2033 | |

| USD 119.15 Billion | |

| USD 191.34 Billion | |

|

|

|

|

Confectionery Ingredients Market Size

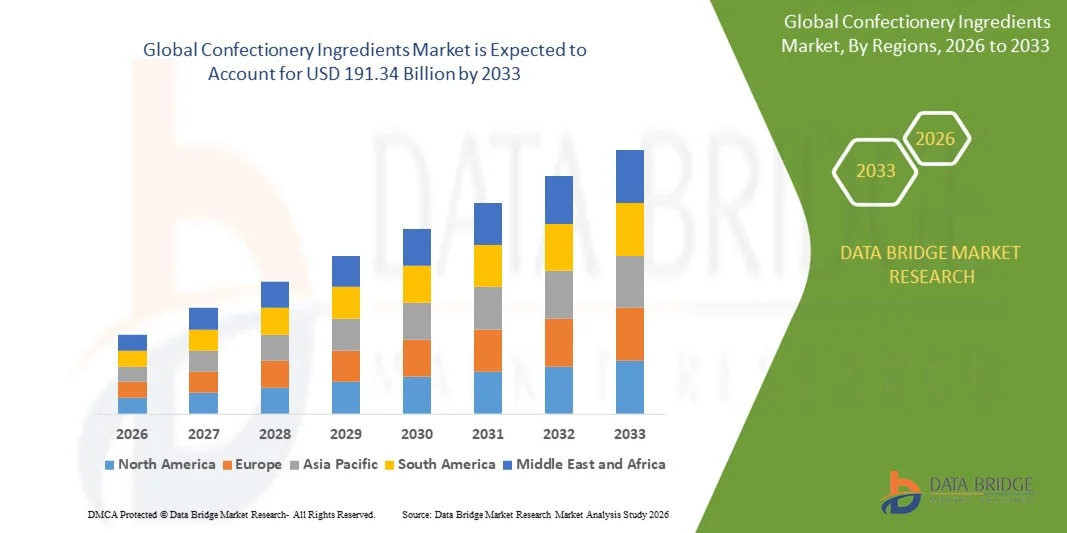

- The global confectionery ingredients market size was valued at USD 119.15 billion in 2025 and is expected to reach USD 191.34 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the rising demand for premium chocolates, sugar-free confectionery, and innovative flavor profiles

- The expanding adoption of clean-label, natural, and functional ingredients is also contributing significantly to overall market expansion

Confectionery Ingredients Market Analysis

- The global confectionery ingredients market is experiencing steady growth due to evolving consumer preferences toward healthier, high-quality, and experiential confectionery products

- Increasing urbanization, changing snacking habits, and rising disposable incomes are further driving ingredient demand across chocolate, bakery confections, and sugar-based treats

- North America dominated the confectionery ingredients market with the largest revenue share in 2025, driven by strong demand for premium, natural, and functional confectionery products across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global confectionery ingredients market, driven by rapid economic development, rising disposable incomes, and strong growth in processed food and confectionery consumption

- The cocoa and chocolate segment held the largest market revenue share in 2025 driven by its widespread use across chocolates, fillings, coatings, and premium confectionery products. High consumer demand for indulgent and artisanal chocolate-based offerings continues to strengthen the dominance of this segment

Report Scope and Confectionery Ingredients Market Segmentation

|

Attributes |

Confectionery Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Kerry Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Confectionery Ingredients Market Trends

Rise of Clean-Label and Natural Ingredient Adoption

- The growing preference for clean-label confectionery is reshaping the ingredients landscape as manufacturers increasingly replace artificial additives with natural sweeteners, flavors, and colors. Consumers are prioritizing ingredient transparency, pushing brands toward simpler formulations that support healthy indulgence. This shift is especially prominent across developed markets where clean-label expectations continue to rise

- The rising demand for plant-based and allergen-free confectionery products is accelerating the use of natural cocoa replacers, fruit-based sweeteners, and functional plant extracts. These ingredients help manufacturers address dietary restrictions while expanding product diversity across vegan and lactose-intolerant demographics. As a result, plant-derived formulations are becoming mainstream in premium and mass-market confectionery

- Consumers are increasingly valuing products that combine indulgence with functional benefits, prompting manufacturers to incorporate antioxidants, fibers, and protein blends. This supports the dual demand for enjoyable yet health-oriented confectionery options. The trend is contributing to product premiumization and greater differentiation across global markets

- For instance, in 2023, several European confectionery manufacturers introduced natural colorant lines derived from berries and spirulina, enabling clean-label launches across gummies, chocolates, and coated candies. These innovations helped brands meet stringent regulatory expectations while appealing to health-conscious buyers. The move also encouraged broader adoption of botanical extracts within the ingredient supply chain

- While clean-label innovations are gaining strong traction, long-term success depends on sustained R&D investments and stable natural ingredient sourcing. Manufacturers must ensure cost-efficient processing technologies to maintain product quality while scaling natural formulations. The adoption of advanced extraction and stabilization methods will further support clean-label expansion

Confectionery Ingredients Market Dynamics

Driver

Increasing Demand for Premium and Functional Confectionery Products

- The rising consumption of premium confectionery such as artisanal chocolates and specialty candies is driving demand for high-quality ingredients including fine cocoa, natural flavors, and specialty sweeteners. Consumers are increasingly willing to pay more for superior taste and authenticity. This trend is opening new opportunities for suppliers offering value-added, sustainably sourced inputs

- Growing interest in functional confectionery such as vitamin-infused candies, protein chocolates, and fiber-rich gummies is stimulating ingredient innovation. Manufacturers are developing multifunctional formulations that appeal to both indulgence-seekers and health-focused buyers. This supports the evolution of confectionery into a hybrid category combining wellness with enjoyment

- The premiumization trend is further enabled by expanding retail channels and rising disposable incomes, especially in emerging markets. Consumers are exploring high-value confectionery options that emphasize ingredient quality and clean-label formulations. This encourages brands to differentiate through superior ingredient sourcing and advanced processing techniques

- For instance, in 2023, multiple North American brands launched antioxidant-rich dark chocolate infused with superfruit extracts to attract health-conscious consumers. These launches helped elevate product positioning while demonstrating the potential of functional ingredient combinations. The strategy also strengthened brand competitiveness within the premium chocolate market

- While demand for premium and functional confectionery continues to grow, manufacturers must maintain cost efficiency in sourcing and production. Ensuring steady ingredient availability and keeping pace with clean-label expectations are key to long-term scalability. Strategic supplier partnerships will play a central role in mitigating risks and sustaining market expansion

Restraint/Challenge

Fluctuating Prices of Key Raw Materials

- Price volatility in critical raw materials such as sugar, cocoa, and dairy ingredients continues to challenge manufacturers. Frequent cost fluctuations disrupt production economics and impact retail pricing strategies. These dynamics can force companies to reformulate products or pass cost increases onto consumers

- Climate-related disruptions and geopolitical tensions often influence global supply chains for cocoa and sugar, creating inconsistent ingredient availability. Manufacturers may face reduced inventories or delays, leading to operational uncertainty and increased reliance on alternative sources. Such instability complicates long-term planning and volume commitments

- Small and mid-sized confectionery producers are particularly affected by raw material volatility due to limited financial capacity to absorb cost surges. Their inability to secure long-term contracts or diversify sourcing weakens production flexibility. This can reduce market competitiveness and slow product innovation

- For instance, in 2023, global cocoa prices surged sharply due to adverse weather conditions in major producing regions, forcing manufacturers to raise product prices and alter formulations. Several brands reduced pack sizes to maintain affordability while balancing profit margins. These adjustments revealed significant market sensitivity to ingredient inflation

- While raw material volatility remains a major restraint, strategic sourcing and diversification are essential to reducing risk exposure. Manufacturers are increasingly investing in sustainable and alternative ingredients to stabilize costs and ensure supply continuity. Strengthening supplier networks and improving forecasting capabilities will be critical to long-term resilience

Confectionery Ingredients Market Scope

The market is segmented on the basis of type, source, form, and application

- By Type

On the basis of type, the confectionery ingredients market is segmented into cocoa and chocolate, citrates, dairy ingredients, emulsifiers, malts, oils and shortenings, starch and derivatives, sweeteners, flavors, hydrocolloids, and others. The cocoa and chocolate segment held the largest market revenue share in 2025 driven by its widespread use across chocolates, fillings, coatings, and premium confectionery products. High consumer demand for indulgent and artisanal chocolate-based offerings continues to strengthen the dominance of this segment.

The sweeteners segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for low-calorie and clean-label sweetening solutions across multiple confectionery formats. Manufacturers are increasingly adopting alternative sweeteners such as stevia, fruit concentrates, and specialty syrups to meet evolving health and transparency preferences.

- By Source

On the basis of source, the market is segmented into natural and synthetic. The natural segment held the largest market revenue share in 2025 due to growing consumer preference for plant-based, minimally processed, and clean-label ingredient options across confectionery applications. Increasing adoption of natural colors, flavors, and sweeteners is further supporting segment growth.

The synthetic segment is expected to witness steady growth from 2026 to 2033, driven by its cost-effectiveness, wide availability, and functional benefits in large-scale confectionery manufacturing. Synthetic ingredients continue to play a crucial role in ensuring product consistency, stability, and affordability for mass-market confectionery products.

- By Form

On the basis of form, the market is segmented into dry form and liquid form. The dry form segment held the largest market revenue share in 2025 owing to its longer shelf life, ease of storage, and suitability for powdered mixes, bakery blends, and confectionery processing lines. Its compatibility with bulk manufacturing makes it a preferred choice for large-scale producers.

The liquid form segment is expected to witness significant growth from 2026 to 2033, driven by its increasing use in fillings, coatings, syrups, and flavor solutions that require smooth consistency and ease of blending. Liquid ingredients enable enhanced texture development and efficient mixing in premium confectionery formulations.

- By Application

On the basis of application, the market is segmented into chocolate, hard candies, coating, fillings, caramels and chewies, aerated confectionery, sugar confectionery, gum, and others. The chocolate segment held the largest market revenue share in 2025 due to strong global consumption of chocolate products and continuous innovation in premium, functional, and artisanal chocolates. High demand across both retail and gifting channels supports segment dominance.

The sugar confectionery segment is expected to witness the fastest growth from 2026 to 2033, driven by rising production of gummies, jellies, and flavored candies across emerging markets. Increasing product diversification and growth in impulse-buying confectionery categories are accelerating ingredient adoption within this segment.

Confectionery Ingredients Market Regional Analysis

- North America dominated the confectionery ingredients market with the largest revenue share in 2025, driven by strong demand for premium, natural, and functional confectionery products across the region

- Consumers in North America increasingly prefer clean-label, organic, and high-quality confectionery offerings as they prioritize ingredient transparency and health-oriented indulgence

- The region’s growth is further supported by a well-established food processing industry, high disposable incomes, and continuous product innovation, strengthening its leadership in the global confectionery ingredients market

U.S. Confectionery Ingredients Market Insight

The U.S. confectionery ingredients market captured the largest revenue share in North America in 2025, driven by rising demand for premium chocolates, functional confectionery, and clean-label ingredients. Manufacturers are increasingly adopting natural sweeteners, plant-based additives, and specialty flavors to meet evolving consumer expectations. The popularity of innovative confectionery formats, such as protein-infused chocolates and low-sugar gummies, is further enhancing market growth. In addition, the strong presence of major confectionery brands and ongoing R&D investments continue to support the expansion of the U.S. market.

Europe Confectionery Ingredients Market Insight

The Europe confectionery ingredients market is expected to witness strong growth from 2026 to 2033, supported by stringent quality standards, rising consumer preference for natural ingredients, and growing demand for artisanal confectionery products. European consumers prioritize clean-label chocolates, organic sweeteners, and premium cocoa-based products. The region also benefits from a mature confectionery manufacturing ecosystem, enabling continuous innovation in flavors, plant-based formulations, and healthier ingredient alternatives.

U.K. Confectionery Ingredients Market Insight

The U.K. confectionery ingredients market is expected to witness significant growth from 2026 to 2033, driven by increasing adoption of reduced-sugar and plant-based confectionery options. Growing health awareness and regulatory emphasis on sugar reduction are shaping ingredient choices across the country. Manufacturers are actively reformulating products to incorporate natural flavors, specialty sweeteners, and functional additives, supporting market expansion across both mainstream and premium confectionery categories.

Germany Confectionery Ingredients Market Insight

The Germany confectionery ingredients market is expected to witness steady growth from 2026 to 2033, fueled by rising demand for high-quality chocolates, organic confectionery, and natural ingredient formulations. Germany’s advanced manufacturing capabilities and strong focus on sustainability are enabling rapid adoption of eco-friendly and clean-label ingredients. The growing popularity of premium and artisanal confectionery products is further influencing ingredient sourcing and product development activities in the market.

Asia-Pacific Confectionery Ingredients Market Insight

The Asia-Pacific confectionery ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, expanding urban populations, and increasing interest in Western-style confectionery products. The region is seeing a surge in demand for flavored candies, chocolates, and functional confectionery, supported by rapid growth in food processing industries. Government initiatives promoting food innovation and the presence of cost-efficient manufacturing hubs are further accelerating market adoption.

Japan Confectionery Ingredients Market Insight

The Japan confectionery ingredients market is expected to witness strong growth from 2026 to 2033 due to rising demand for premium, low-sugar, and functional confectionery products. Japanese consumers place high value on product quality, natural ingredients, and unique flavor profiles. The country’s advanced food technology landscape supports continuous innovation in ingredients such as plant-based sweeteners, natural colorants, and specialty cocoa derivatives, boosting growth across multiple confectionery segments.

China Confectionery Ingredients Market Insight

The China confectionery ingredients market accounted for the largest revenue share in Asia Pacific in 2025, supported by a rapidly expanding middle-class population and increasing demand for affordable yet innovative confectionery products. China’s strong manufacturing ecosystem and growing interest in natural, functional, and premium confectionery options are accelerating ingredient consumption. The rise of e-commerce platforms and widespread adoption of Western-style confectionery are further propelling market growth across the country.

Confectionery Ingredients Market Share

The Confectionery Ingredients industry is primarily led by well-established companies, including:

• Kerry Inc. (U.S.)

• Corbion (Netherlands)

• NATUREX (France)

• Cargill, Incorporated (U.S.)

• DuPont (U.S.)

• ADM (U.S.)

• Arla Foods Ingredients Group P/S (Denmark)

• WENDA INGREDIENTS (U.S.)

• Olam International (Singapore)

• Tate & Lyle (U.K.)

• DSM (Netherlands)

• Avada (U.S.)

• Döhler GmbH (Germany)

• LACTALIS Ingredients (France)

• AAK AB (Sweden)

• Barry Callebaut (Switzerland)

• Chr. Hansen Holding A/S (Denmark)

• Ingredion Incorporated (U.S.)

• Firmenich SA (Switzerland)

• FAT Brands Inc. (U.S.)

Latest Developments in Global Confectionery Ingredients Market

- In April 2025, Altinmarka collaborated with Swiss-Ghana Koa to introduce its new Cacaonly chocolate range. The development focuses on using upcycled cocoa fruit pulp as a natural sweetener, removing the need for refined sugars. This innovation enhances sustainability by reducing waste and offering a cleaner-label alternative. The product aligns with rising consumer demand for natural, minimally processed confectionery solutions. This partnership is expected to influence the confectionery ingredients market by promoting eco-friendly sweetening options and supporting circular manufacturing practices

- In January 2025, FlavorSum expanded its product portfolio with the launch of flavors featuring modulating properties (FMPs). This development aims to address taste challenges in confectionery and beverage applications, including bitterness masking and mouthfeel enhancement. The new systems also help reduce off-notes, improving overall product quality and consumer acceptance. As brands seek more sophisticated flavor solutions, this expansion supports innovation across multiple formulations. The move strengthens FlavorSum’s position in the ingredients market and boosts adoption of advanced flavor modulation technologies

- In December 2024, Tate & Lyle PLC formed a strategic partnership with BioHarvest Sciences to transform the sweeteners category. The collaboration leverages BioHarvest’s botanical synthesis technology to develop plant-based sweeteners with improved taste and sustainability profiles. The initiative aims to provide manufacturers with cleaner, more efficient alternatives to traditional sweeteners. This development supports the growing shift toward natural, responsibly sourced ingredients in confectionery. The partnership is expected to accelerate innovation and expand the availability of high-performance sweetening solutions in the global market

- In February 2024, Brookside Flavors and Ingredients completed the acquisition of Sterling Food Flavorings. This acquisition enhances Brookside’s flavor systems portfolio and widens its offerings across the food and beverage industry. The move strengthens the company’s ability to serve both existing and new customers with comprehensive ingredient solutions. It also supports long-term expansion by improving access to specialized flavor technologies. The acquisition is poised to intensify competition and broaden product innovation within the confectionery ingredients market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Confectionery Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Confectionery Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Confectionery Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.