Global Connected Motorcycle Market

Market Size in USD Million

CAGR :

%

USD

437.94 Million

USD

12,077.16 Million

2024

2032

USD

437.94 Million

USD

12,077.16 Million

2024

2032

| 2025 –2032 | |

| USD 437.94 Million | |

| USD 12,077.16 Million | |

|

|

|

|

Connected Motorcycle Market Size

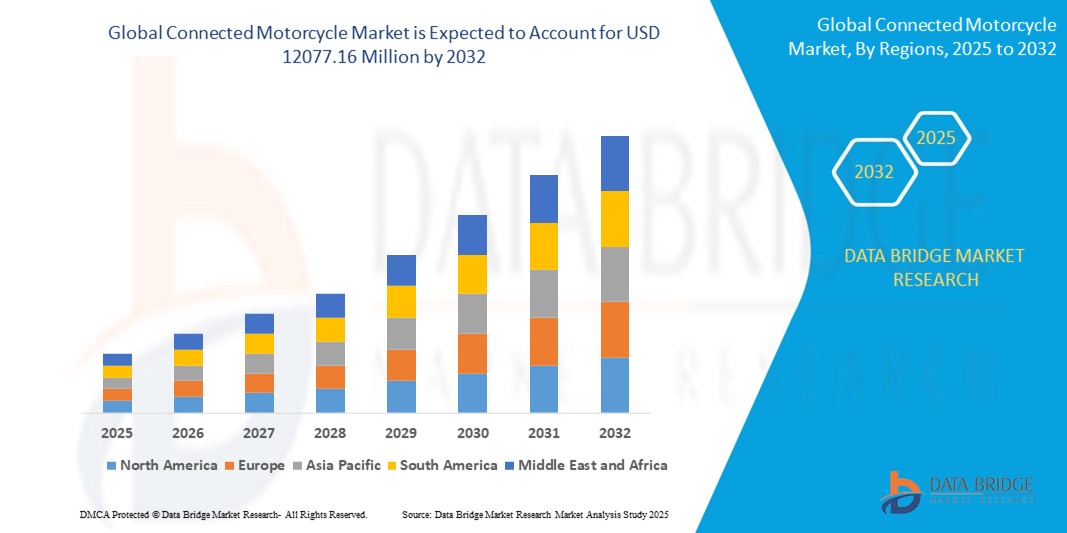

- The global connected motorcycle market size was valued at USD 437.94 million in 2024 and is expected to reach USD 12077.16 million by 2032, at a CAGR of 51.38% during the forecast period

- The market growth is largely fueled by the rising emphasis on rider safety, accident prevention, and real-time vehicle monitoring, driving the demand for connected motorcycles equipped with advanced communication and safety technologies

- Furthermore, increasing consumer preference for seamless connectivity, navigation assistance, and integration with mobile applications is establishing connected motorcycles as a vital component of modern mobility solutions. These factors collectively accelerate market adoption, significantly boosting the growth of the connected motorcycle industry

Connected Motorcycle Market Analysis

- Connected motorcycles, integrating advanced communication systems, real-time monitoring, and rider assistance features, are becoming increasingly essential to modern mobility, offering enhanced safety, connectivity, and operational efficiency for both private users and commercial fleets

- The accelerating demand for connected motorcycles is primarily driven by the growing emphasis on road safety, the rising integration of V2X technologies, and increasing consumer preference for intelligent, data-driven riding experiences

- North America dominated the connected motorcycle market with a share of 37.8% in 2024, due to rising demand for advanced rider safety features, vehicle diagnostics, and integrated connectivity

- Asia-Pacific is expected to be the fastest growing region in the connected motorcycle market during the forecast period due to rapid urbanization, rising middle-class incomes, and growing technological adoption in countries such as China, India, and Japan

- V2I segment dominated the market with a market share of 59.4% in 2024, due to expanding smart road infrastructure and government investments in intelligent transportation systems. V2I communication allows motorcycles to interact with traffic signals, road signs, and cloud platforms, enhancing situational awareness and improving route efficiency, especially in congested urban environments

Report Scope and Connected Motorcycle Market Segmentation

|

Attributes |

Connected Motorcycle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Connected Motorcycle Market Trends

“Growing Demand of Electric 2-Wheelers”

- A significant and rapidly expanding trend in the connected motorcycle market is the growing demand for electric two-wheelers, which is driving the integration of advanced connectivity features. As consumers seek sustainable mobility solutions, manufacturers are combining electric motorcycles with smart technologies to enhance performance, efficiency, and rider experience

- For instance, in October 2021, Kawasaki introduced a hybrid-electric motorcycle equipped with AI-powered assist features and connected mobility through its Rideology app, enabling real-time data access, smart diagnostics, and advanced rider assistance

- The synergy between electric mobility and connected features allows manufacturers to offer benefits such as remote battery monitoring, predictive maintenance alerts, and optimized route planning based on battery range and traffic conditions

- As governments worldwide push for lower emissions and promote e-mobility, the demand for connected electric motorcycles is rising across urban areas where efficiency, safety, and digital integration are highly valued

- This trend is reshaping consumer expectations by combining sustainability with intelligent mobility, prompting key players such as Zero Motorcycles and Energica to focus on next-generation electric motorcycles with enhanced connectivity for performance tracking, remote management, and improved rider safety

- The growing preference for electric motorcycles with integrated connected systems is rapidly gaining traction among both private consumers and fleet operators, accelerating the evolution of smart, sustainable two-wheeler transportation

Connected Motorcycle Market Dynamics

Driver

“Rising Concerns About Rider Safety”

- The growing awareness regarding road safety, combined with increasing motorcycle accident rates, is a major driver for the connected motorcycle market as riders and regulators alike seek enhanced protective measures

- For instance, Continental AG partnered with Sennheiser to develop an AI-powered collision warning system specifically designed for motorcycles, providing real-time audio alerts to prevent accidents. This innovation addresses key safety concerns and contributes to market growth

- Connected motorcycles equipped with V2X communication, real-time hazard notifications, emergency call systems, and advanced rider assistance are increasingly viewed as essential for minimizing accident risks and improving situational awareness

- The ability to access vehicle diagnostics, monitor riding behavior, and receive safety alerts through mobile applications adds another layer of protection, appealing to both private users and fleet operators

- Governments and organizations are also supporting the adoption of connected motorcycles through initiatives aimed at reducing fatalities, making rider safety a central factor in the market's expansion

Restraint/Challenge

“High Upfront Cost”

- The high upfront cost associated with connected motorcycles, driven by the integration of advanced technologies such as V2X communication, real-time tracking, AI-based safety systems, and mobile connectivity platforms, remains a significant challenge limiting market penetration. Unlike traditional motorcycles, connected models incorporate sophisticated hardware and software that substantially increase manufacturing costs, leading to higher retail prices

- For instance, premium connected motorcycles offering features such as predictive maintenance alerts, intelligent collision avoidance, integrated infotainment, and app-based remote control often come with elevated price tags, making them less accessible to entry-level or cost-sensitive consumers, particularly in emerging economies

- In addition, the integration of cutting-edge technologies such as onboard diagnostics, autonomous emergency call systems (eCall), advanced GPS tracking, and seamless smartphone pairing requires substantial investment from manufacturers, which is reflected in the end-user price

- Fleet operators, delivery service providers, and individual riders often hesitate to adopt connected motorcycles due to concerns over return on investment, especially when the added technological features are not perceived as immediately essential or economically justifiable

- To overcome this challenge, manufacturers need to focus on reducing production costs through technological standardization, greater economies of scale, and partnerships with tech providers to offer affordable connectivity solutions. Introducing entry-level models with basic connected features and providing scalable upgrade options can also help expand adoption across broader consumer segments, ensuring long-term market growth

Connected Motorcycle Market Scope

The market is segmented on the basis of hardware, services, communication type, and end user.

• By Hardware

On the basis of hardware, the connected motorcycle market is segmented into concrete mixer truck, refuse collection truck, street sweeper, winter maintenance vehicle, fuel tankers, ambulances, and others. The ambulance segment accounted for the largest revenue share in 2024, primarily due to the critical demand for real-time tracking, emergency routing, and telematics-enabled communication systems. Ambulances heavily benefit from connectivity features such as remote diagnostics, GPS integration, and V2X communication, ensuring rapid response and optimized emergency care delivery. The ability to transmit patient health data en route to hospitals further strengthens the segment’s dominance.

The street sweeper segment is expected to register the fastest CAGR from 2025 to 2032, driven by increasing municipal investments in smart city infrastructure and environmental maintenance automation. Connected street sweepers allow for efficient fleet scheduling, real-time route optimization, and fuel usage tracking. These benefits are encouraging adoption across urban areas focused on sustainability and operational efficiency.

• By Services

On the basis of services, the market is segmented into entertainment, well-being, vehicle management, mobility management, driver assistance, and safety. The vehicle management segment led the market in 2024 due to the rising emphasis on predictive maintenance, fleet diagnostics, and fuel efficiency. Connected motorcycles equipped with advanced vehicle management systems support real-time performance monitoring and alerts, which are crucial for both individual users and commercial fleet owners aiming to reduce operational downtime.

The safety segment is projected to grow at the highest CAGR from 2025 to 2032, owing to the increasing integration of collision alerts, lane-keeping assistance, and emergency call (eCall) systems. The heightened awareness around rider safety and government regulations mandating certain safety technologies are further propelling growth in this segment.

• By Communication Type

On the basis of communication type, the connected motorcycle market is segmented into V2I (vehicle-to-infrastructure) and V2V (vehicle-to-vehicle) communication. The V2I segment held the largest market share of 59.4% in 2024, driven by expanding smart road infrastructure and government investments in intelligent transportation systems. V2I communication allows motorcycles to interact with traffic signals, road signs, and cloud platforms, enhancing situational awareness and improving route efficiency, especially in congested urban environments.

The V2V segment is anticipated to grow at the fastest rate between 2025 and 2032 due to its role in preventing collisions and enabling cooperative driving. As connected motorcycles gain popularity, V2V communication is emerging as a critical technology for group riding coordination, blind spot alerts, and distance monitoring between vehicles, thereby significantly boosting rider safety.

• By End User

On the basis of end user, the market is segmented into commercial and private. The commercial segment dominated the market in 2024, led by growing demand from delivery services, ride-hailing platforms, and logistics providers leveraging connected motorcycles for operational transparency and route optimization. Commercial fleets increasingly rely on IoT-enabled platforms for tracking, driver behavior monitoring, and remote diagnostics, which enhances cost-effectiveness and service quality.

The private segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer adoption of premium motorcycles embedded with smart features. Tech-savvy riders are prioritizing motorcycles that offer navigation, security alerts, infotainment, and mobile app integration. Increasing urbanization and the trend of solo commuting are further stimulating demand among private users for connected and intelligent two-wheelers.

Connected Motorcycle Market Regional Analysis

- North America dominated the connected motorcycle market with the largest revenue share of 37.8% in 2024, driven by rising demand for advanced rider safety features, vehicle diagnostics, and integrated connectivity

- The growing popularity of motorcycles for leisure and urban commuting, combined with the region's strong inclination toward vehicle technology innovation, is accelerating market growth

- High consumer awareness, favorable regulatory support for V2X communication, and the presence of major connectivity solution providers are further boosting adoption across the region

U.S. Connected Motorcycle Market Insight

The U.S. connected motorcycle market captured the largest revenue share in 2024 within North America, propelled by increasing investments in smart transportation infrastructure and strong demand for rider safety and infotainment systems. Motorcycle users in the U.S. are increasingly opting for connected solutions that provide real-time navigation, remote diagnostics, and vehicle-to-vehicle communication. The market is also supported by a tech-savvy consumer base, robust smartphone integration, and favorable regulatory initiatives promoting V2X technologies to reduce traffic accidents and enhance road safety.

Europe Connected Motorcycle Market Insight

The Europe connected motorcycle market is expected to expand at a substantial CAGR during the forecast period, driven by stringent road safety regulations, environmental sustainability efforts, and growing consumer demand for vehicle connectivity. Rising adoption of electric motorcycles, coupled with integrated telematics and safety systems, is fueling market growth across residential and commercial segments. The region's commitment to smart mobility, combined with increasing demand for real-time vehicle management and rider assistance features, is creating favorable growth opportunities.

U.K. Connected Motorcycle Market Insight

The U.K. connected motorcycle market is projected to witness notable growth during the forecast period, supported by rising awareness regarding rider safety and an expanding smart mobility ecosystem. Increasing preference for advanced navigation, theft prevention, and connectivity features among both individual and fleet motorcycle users is driving demand. Furthermore, the U.K.'s initiatives for reducing road fatalities, combined with the rising popularity of app-based vehicle monitoring and control, are contributing to market expansion.

Germany Connected Motorcycle Market Insight

The Germany connected motorcycle market is anticipated to grow at a considerable CAGR during the forecast period, fueled by the country’s emphasis on vehicle safety innovation, precision engineering, and environmental consciousness. With Germany being a hub for premium motorcycle manufacturers and automotive technology providers, there is rising integration of advanced telematics, rider assistance, and V2X communication systems. The focus on connected mobility and increasing use of smart infrastructure further support market growth.

Asia-Pacific Connected Motorcycle Market Insight

The Asia-Pacific connected motorcycle market is forecasted to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising middle-class incomes, and growing technological adoption in countries such as China, India, and Japan. The region’s booming two-wheeler market, coupled with increased focus on road safety and smart transportation, is fueling demand for connected motorcycles. Government initiatives supporting smart city development, combined with the region's role as a manufacturing hub for connected vehicle components, are accelerating market expansion.

Japan Connected Motorcycle Market Insight

The Japan connected motorcycle market is gaining momentum, driven by the country’s advanced technological landscape, urban mobility challenges, and emphasis on rider safety. Japan’s aging population and compact urban environments are spurring demand for smart motorcycles equipped with rider assistance, navigation, and safety alerts. Integration with IoT ecosystems, including smart helmets and vehicle diagnostics, is becoming increasingly prevalent, strengthening the market outlook.

China Connected Motorcycle Market Insight

China accounted for the largest revenue share in the Asia-Pacific connected motorcycle market in 2024, supported by rapid urbanization, expanding smart city initiatives, and the dominance of domestic motorcycle and technology manufacturers. Rising consumer demand for affordable connected two-wheelers, combined with government efforts to improve road safety and promote intelligent transportation, is propelling market growth. The availability of cost-effective telematics solutions and smartphone integration features is enhancing the appeal of connected motorcycles among a broad consumer base.

Connected Motorcycle Market Share

The connected motorcycle industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Vodafone Limited (Italy)

- Panasonic Holdings Corporation (Japan)

- Starcom Systems Inc. (Jersy)

- TE Connectivity (Switzerland)

- KPIT Technologies Limited (India)

- Aeris. (U.S.)

- NovAtel Inc. (Canada)

- Autotalks (Israel)

Latest Developments in Global Connected Motorcycle Market

- In October 2023, BMW Motorrad launched the new R 1250 RT connected motorcycle with an upgraded infotainment system featuring a larger display, enhanced connectivity features, and improved navigation capabilities

- In October 2023, Harley-Davidson unveiled the Harley-Davidson Pan America Special with an optional Advanced Rider Assistance Systems (ADAS) package, including features such as blind spot detection and adaptive cruise control

- In November 2021, Ituran collaborated with MD-Go to advance fleet connectivity solutions, aiming to enhance real-time vehicle tracking, navigation control, and telematics for fleet operators. This partnership strengthens the connected motorcycle market by promoting the integration of safety, monitoring, and navigation systems, especially for commercial fleet management applications

- In October 2021, Continental AG partnered with Sennheiser to introduce an AI-driven collision warning system for motorcycles, enhancing rider safety through advanced audio alerts and situational awareness. This development significantly contributes to the connected motorcycle market by addressing critical safety challenges and increasing the adoption of intelligent rider assistance technologies. The recognition with the CLEPA Innovation Award further validates the system's technological relevance and market potential

- In October 2021, Kawasaki unveiled a hybrid-electric motorcycle equipped with AI-based assist features and connected mobility solutions, integrated through the company’s Rideology app. This initiative accelerates the growth of the connected motorcycle market by combining sustainable transportation with next-generation connectivity, offering enhanced rider experience, real-time diagnostics, and advanced safety capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CONNECTED MOTORCYCLE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CONNECTED MOTORCYCLE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CONNECTED MOTORCYCLE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

6. GLOBAL CONNECTED MOTORCYCLE MARKET, BY MOTORCYCLE TYPE

6.1 OVERVIEW

6.2 STANDARD

6.3 CRUISER

6.4 SPORTS

6.5 TOURING

6.6 ADVENTURE

7. GLOBAL CONNECTED MOTORCYCLE MARKET, BY VEHICLE CLASS

7.1 OVERVIEW

7.2 ECONOMY CLASS

7.3 LUXURY/PREMIUM CLASS

8. GLOBAL CONNECTED MOTORCYCLE MARKET, BY RIDING TYPE

8.1 OVERVIEW

8.2 OFF-ROAD RIDING

8.3 ON-ROAD RIDING

9. GLOBAL CONNECTED MOTORCYCLE MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 HARDWARE

9.2.1 EMBEDDED SENSORS

9.2.2 PROCESSORS

9.2.3 CONNECTIVITY MODULES

9.2.4 TELEMATICS UNITS

9.2.5 OTHERS

9.3 SOFTWARE

9.3.1 BY PLATFORM

9.3.1.1. APP-BASED

9.3.1.1.1. ANDROID

9.3.1.1.2. IOS

9.3.1.2. WEB-BASED

9.4 SERVICES

9.4.1 DRIVER ASSISTANCE

9.4.2 INFOTAINMENT

9.4.3 SAFETY

9.4.4 VEHICLE MANAGEMENT & TELEMATICS

10. GLOBAL CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE

10.1 OVERVIEW

10.2 INTERNAL COMBUSTION ENGINE (ICE)

10.3 ELECTRIC ENGINE

11. GLOBAL CONNECTED MOTORCYCLE MARKET, BY CONNECTIVITY TYPE

11.1 OVERVIEW

11.2 CELLULAR

11.3 WI-FI

12. GLOBAL CONNECTED MOTORCYCLE MARKET, BY COMMUNICATION TYPE

12.1 OVERVIEW

12.2 V2V

12.3 V2I

13. GLOBAL CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE

13.1 OVERVIEW

13.2 C-V2X

13.3 DSRC

14. GLOBAL CONNECTED MOTORCYCLE MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COLLISION WARNING

14.3 EMERGENCY BRAKE LIGHT

14.4 TRAFFIC WARNING

14.5 WEATHER ADVISORY

14.6 OPTIMAL SIGNAL SPEED ADVISORY

14.7 LANE CHANGE WARNING

14.8 ROAD REPAIR WARNING

14.9 STOLEN VEHICLE TRACKING

14.10 ANTI-THEFT SYSTEMS

14.11 NAVIGATION

14.12 OTHERS

15. GLOBAL CONNECTED MOTORCYCLE MARKET, BY END USER

15.1 OVERVIEW

15.2 PRIVATE

15.3 COMMERCIAL

16. GLOBAL CONNECTED MOTORCYCLE MARKET, BY GEOGRAPHY

16.1 GLOBAL CONNECTED MOTORCYCLE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1.1 NORTH AMERICA

16.1.1.1. U.S.

16.1.1.2. CANADA

16.1.1.3. MEXICO

16.1.2 EUROPE

16.1.2.1. GERMANY

16.1.2.2. FRANCE

16.1.2.3. U.K.

16.1.2.4. ITALY

16.1.2.5. SPAIN

16.1.2.6. RUSSIA

16.1.2.7. TURKEY

16.1.2.8. BELGIUM

16.1.2.9. NETHERLANDS

16.1.2.10. NORWAY

16.1.2.11. FINLAND

16.1.2.12. SWITZERLAND

16.1.2.13. DENMARK

16.1.2.14. SWEDEN

16.1.2.15. POLAND

16.1.2.16. REST OF EUROPE

16.1.3 ASIA PACIFIC

16.1.3.1. JAPAN

16.1.3.2. CHINA

16.1.3.3. SOUTH KOREA

16.1.3.4. INDIA

16.1.3.5. AUSTRALIA

16.1.3.6. NEW ZEALAND

16.1.3.7. SINGAPORE

16.1.3.8. THAILAND

16.1.3.9. MALAYSIA

16.1.3.10. INDONESIA

16.1.3.11. PHILIPPINES

16.1.3.12. TAIWAN

16.1.3.13. VIETNAM

16.1.3.14. REST OF ASIA PACIFIC

16.1.4 SOUTH AMERICA

16.1.4.1. BRAZIL

16.1.4.2. ARGENTINA

16.1.4.3. REST OF SOUTH AMERICA

16.1.5 MIDDLE EAST AND AFRICA

16.1.5.1. SOUTH AFRICA

16.1.5.2. EGYPT

16.1.5.3. SAUDI ARABIA

16.1.5.4. U.A.E

16.1.5.5. OMAN

16.1.5.6. BAHRAIN

16.1.5.7. ISRAEL

16.1.5.8. KUWAIT

16.1.5.9. QATAR

16.1.5.10. REST OF MIDDLE EAST AND AFRICA

16.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17. GLOBAL CONNECTED MOTORCYCLE MARKET,COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18. GLOBAL CONNECTED MOTORCYCLE MARKET, SWOT & DBMR ANALYSIS

19. GLOBAL CONNECTED MOTORCYCLE MARKET, COMPANY PROFILE

19.1 YAMAHA MOTOR CO., LTD.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHIC PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 ROBERT BOSCH GMBH

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHIC PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 BAYERISCHE MOTOREN WERKE AG

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHIC PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 CONTINENTAL AG

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHIC PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENT

19.5 SIEMENS

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHIC PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 AUTOTALKS (ACQUIRED BY QUALCOMM)

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHIC PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENT

19.7 PANASONIC CORPORATION (PARTNER WITH HARLEY-DAVIDSON)

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHIC PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENT

19.8 KAWASAKI MOTORS, LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHIC PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENT

19.9 TE CONNECTIVITY

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHIC PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENT

19.10 KPIT

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHIC PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENT

19.11 AERIS

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHIC PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENT

19.12 ITURAN

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHIC PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENT

19.13 TVS MOTOR COMPANY

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHIC PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

19.14 HONDA MOTOR CO

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHIC PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENT

19.15 HERO MOTOR CORP

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHIC PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENT

19.16 LUXOFT (A PART OF DXC TECHNOLOGY)

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHIC PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENT

19.17 TRIUMPH MOTORCYCLES ( A PART OF BLOOR HOLDINGS LIMITED)

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHIC PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20. CONCLUSION

21. QUESTIONNAIRE

22. RELATED REPORTS

23. ABOUT DATA BRIDGE MARKET RESEARCH

Global Connected Motorcycle Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Connected Motorcycle Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Connected Motorcycle Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.