Global Construction Sealants Market

Market Size in USD Billion

CAGR :

%

USD

7.61 Billion

USD

13.19 Billion

2024

2032

USD

7.61 Billion

USD

13.19 Billion

2024

2032

| 2025 –2032 | |

| USD 7.61 Billion | |

| USD 13.19 Billion | |

|

|

|

|

Construction Sealants Market Size

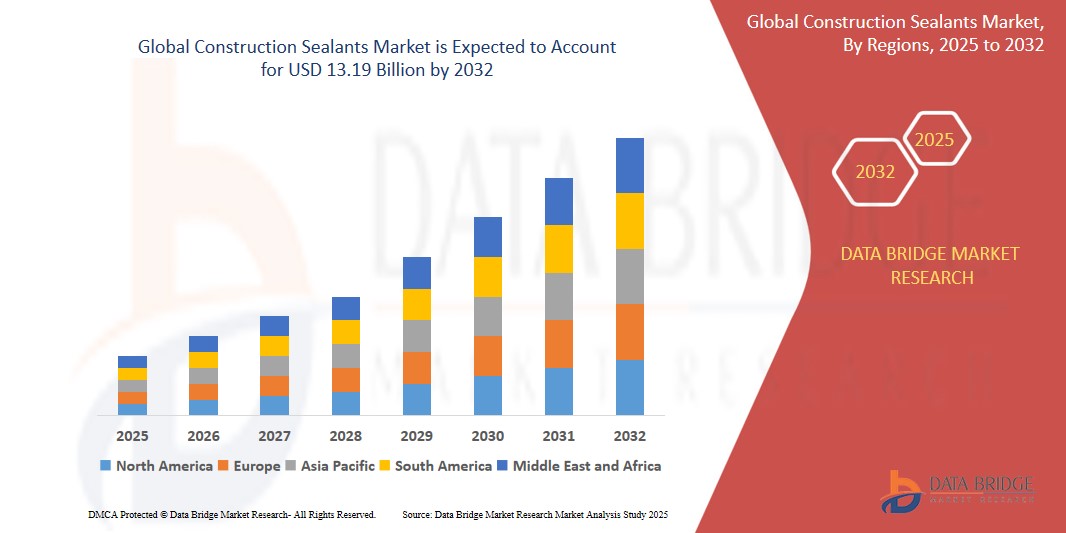

- The Global Construction Sealants Market was valued at USD 7.61 Billion in 2024 and is expected to reach USD 13.19 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.2%, primarily driven by rise in demand for Construction Sealants by the chemical and petrochemical industry in developed and developing economies

- This growth is driven by factors such as growing usage of the Construction Sealants in the commercial and housing applications and surging demand for Sealants in renovation of old buildings and architectural design

Construction Sealants Market Analysis

- Construction Sealants are high-performance bonding agents used in construction to hold materials together, offering strong adhesion, flexibility, and resistance to environmental conditions.

- The market demand is significantly driven by their extensive application across industries, particularly in building and construction, automotive, and furniture, where Sealants play a key role in replacing mechanical fasteners and improving overall structural integrity.

- The Asia-Pacific region leads the market, propelled by rapid urbanization, infrastructure investments, and rising adoption of sustainable and energy-efficient building solutions. Countries like China, India, and Indonesia are major contributors to this growth.

- For instance, in October 2023, the Indian government announced enhanced incentives for green construction materials under its “Housing for All” initiative, accelerating the adoption of Construction Sealants in residential projects.

Report Scope and Construction Sealants Market Segmentation

|

Attributes |

Construction Sealants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Construction Sealants Market Trends

“Rising Demand for Durable, Weather-Resistant, and Sustainable Sealant Solutions”

- Increasing infrastructure and building construction activities globally are driving the need for high-performance, weather-resistant construction sealants, particularly in areas prone to temperature and moisture fluctuations

- There is growing adoption of low-VOC, environmentally friendly sealants to meet green building standards and reduce indoor air pollution

- Manufacturers are introducing hybrid polymer-based sealants that offer superior adhesion, flexibility, and durability, even under extreme conditions

- For instance, in November 2023, Sika AG launched a new line of low-emission, solvent-free hybrid sealants specifically designed for high-humidity environments and sustainable construction practices

- This trend reflects a broader industry shift toward sustainable and long-lasting building materials, driven by both regulatory pressure and consumer demand for healthier living environments

Construction Sealants Market Dynamics

Driver

“Infrastructure Development and Increased Usage in High-Rise and Modular Construction”

- Rapid urbanization and infrastructure expansion in emerging economies, especially in Asia-Pacific and the Middle East, are significantly driving demand for advanced construction sealants

- The rise of modular and prefabricated construction techniques requires reliable and efficient sealing solutions to ensure structural integrity and weather resistance

- Increased usage in high-rise buildings for joint sealing, curtain wall systems, and façade applications is also contributing to growth

- For instance, according to the World Bank, global infrastructure investment is expected to exceed USD 94 trillion by 2040, supporting increased demand for durable sealing technologies

- These factors are collectively supporting the robust growth of the global construction sealants market

Opportunity

“Innovation in Green Sealants and Smart Building Integration”

- Technological advancements are enabling the development of smart sealants that can self-heal or change properties in response to environmental changes, aligning with intelligent building systems

- The growing focus on eco-label certified and LEED-compliant products creates significant opportunities for companies to introduce green, recyclable, and bio-based sealants

- Government support for sustainable urban development and increased retrofit and refurbishment projects in aging buildings are driving demand for high-performance sealants

For instance,

- In March 2024, BASF launched a new line of bio-based polyurethane Construction Sealants made from renewable feedstock, aligning with sustainability trends and appealing to eco-conscious build February 2024, Henkel introduced a bio-based silicone sealant line targeting the European green building market, offering improved sustainability without compromising adhesion strength

The shift toward sustainable innovation and digital integration opens up new growth avenues in the sealants market

Restraint/Challenge

“Stringent Environmental Regulations and Application Complexity”

- Volatile Organic Compounds (VOCs) present in many traditional sealants are subject to strict regulatory scrutiny, particularly in the U.S., Europe, and Japan, impacting product usage

- High-performance sealants often require precise application techniques and specialized tools, increasing labor costs and limiting adoption in small-scale projects

- Raw material cost fluctuations, especially for silicone, polyurethane, and silyl-modified polymers, can impact profit margins and price competitiveness

For instance,

- According to the European Chemicals Agency (ECHA), increasing restrictions on VOC emissions under REACH regulations have led to reformulation costs for several leading sealant manufacturers

These challenges highlight the need for continuous R&D investment and cost-optimization strategies to maintain competitiveness in the market

Construction Sealants Market Scope

The market is segmented on the basis of product type, application, distribution channel, material, end users and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Resin Type |

|

|

By Technology |

|

|

By Function |

|

|

By End-Use Sector |

|

|

By Application |

|

Construction Sealants Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Construction Sealants Market”

-

Asia-Pacific dominates the Construction Sealants market, driven by robust growth in the construction, automotive, and consumer goods sectors, particularly in China, India, Japan, and Southeast Asia

- China holds a significant market share, supported by a well-established construction ecosystem, extensive infrastructure projects, and ongoing technological innovation in Sealants formulations

- The region’s emphasis on energy-efficient buildings, backed by government mandates and green certification programs, is driving demand for high-performance Construction Sealants

- Additionally, the availability of cost-effective raw materials, a large manufacturing base, and the presence of key global and regional players further strengthen Asia-Pacific’s market dominance

“North America is Projected to Register the Highest Growth Rate”

-

North America is expected to witness the highest CAGR during the forecast period, fueled by a resurgence in residential and commercial construction, especially in the U.S. and Canada

- Rising demand for lightweight, durable, and energy-efficient Sealants across sectors like infrastructure, modular housing, and automotive manufacturing is a major growth driver

- Stringent environmental regulations and incentives for adopting low-VOC and sustainable building materials are accelerating the shift toward advanced Sealants technologies

- Innovations in hybrid Sealants and the increasing emphasis on renovation, retrofitting, and sustainable urban development are contributing to market expansion across the region

Construction Sealants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Henkel (Germany)

- 3M (United States)

- Bostik (France)

- Sika AG (Switzerland)

- H.B. Fuller (United States)

- BASF SE (Germany)

- Dow (United States)

- DAP Products (United States)

- Illinois Tool Works Inc (United States)

- AVERY DENNISON CORPORATION (United States)

- Polymeric Systems, Inc. (United States)

- Kenneth Crosby (United States)

- Acoustical Surfaces, Inc. (United States)

- McCoy Soudal (India)

- American Chemical (United States)

- Benson Polymers Limited (India)

- Master Bond Inc. (United States)

- Huntsman Corporation (United States)

- Hexcel (United States)

- Gorilla Glue Inc. (United States)

Latest Developments in Global Construction Sealants Market

- In March 2024, BASF SE unveiled a new series of bio-based Construction Sealants formulated with renewable feedstocks and compliant with EU Green Deal objectives, aiming to support sustainable construction practices in Europe and Asia-Pacific

- In February 2024, Sika AG completed the acquisition of a specialty Sealants manufacturer in the United States to expand its Construction Sealants portfolio and strengthen its position in the North American market, particularly in residential and commercial construction segments

- In January 2024, Henkel AG & Co. KGaA announced the launch of a new range of high-performance, solvent-free Construction Sealants under its Loctite brand, designed specifically for sustainable building applications. The Sealants offer enhanced bonding strength, reduced curing time, and meet stringent low-VOC standards, supporting green building certifications such as LEED and BREEAM

- In June 2023, 3M Company introduced a next-generation line of spray Sealants optimized for large-scale construction projects, offering faster application, superior adhesion, and reduced environmental impact through low-emission formulas

- In October 2023, H.B. Fuller opened a new Sealants innovation center in India to accelerate R&D in eco-friendly Construction Sealants and better serve emerging markets in the Asia-Pacific region, responding to rising demand for smart, durable bonding solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Construction Sealants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Construction Sealants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Construction Sealants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.