Global Consumer Appliances Market

Market Size in USD Billion

CAGR :

%

USD

398.33 Billion

USD

549.35 Billion

2024

2032

USD

398.33 Billion

USD

549.35 Billion

2024

2032

| 2025 –2032 | |

| USD 398.33 Billion | |

| USD 549.35 Billion | |

|

|

|

|

Consumer Appliances Market Size

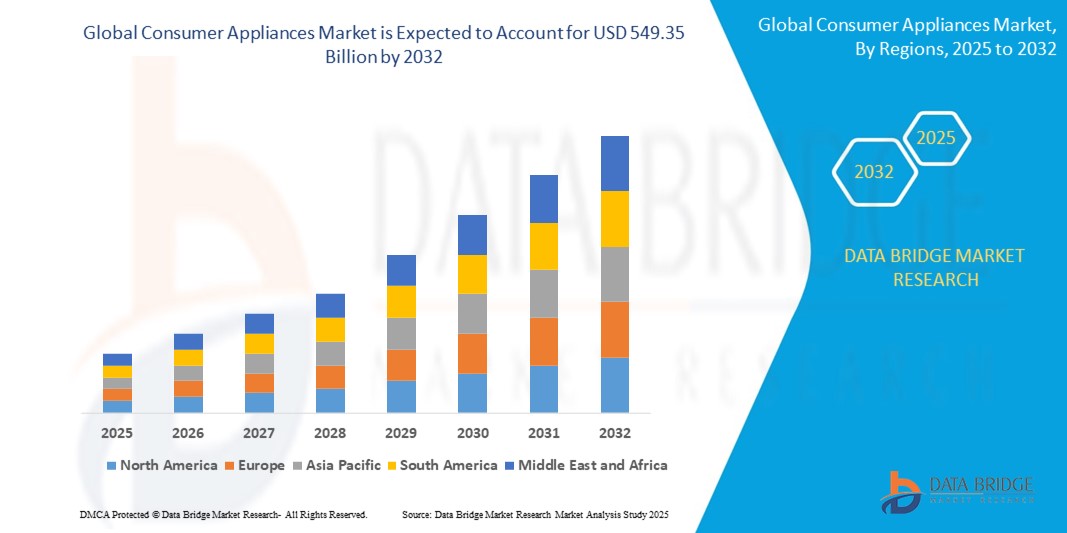

- The global consumer appliances market size was valued at USD 398.33 billion in 2024 and is expected to reach USD 549.35 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is driven by increasing consumer demand for smart and energy-efficient appliances, rapid urbanization, and technological advancements in connected devices

- Rising disposable incomes and a growing preference for convenience-driven, sustainable, and IoT-integrated appliances are accelerating market expansion, particularly in residential settings

Consumer Appliances Market Analysis

- Consumer appliances, encompassing a wide range of products for personal and domestic use, are integral to modern lifestyles, offering enhanced convenience, energy efficiency, and integration with smart home ecosystems

- The surge in demand is fueled by the adoption of smart home technologies, growing consumer awareness of sustainability, and the convenience of connected appliances with remote control and automation features

- Asia-Pacific dominated the consumer appliances market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, a burgeoning middle class, and strong manufacturing hubs in countries such as China, Japan, and South Korea

- North America is expected to be the fastest-growing region during the forecast period, propelled by high consumer spending, early adoption of smart appliances, and innovations from key industry players

- The kitchen appliances segment dominated a significant market revenue share of 39.6% in 2024, driven by increasing urbanization, rising disposable incomes, and the growing demand for convenient and efficient cooking solutions

Report Scope and Consumer Appliances Market Segmentation

|

Attributes |

Consumer Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Consumer Appliances Market Trends

“Increasing Integration of Smart Technology and IoT”

- The global consumer appliances market is experiencing a significant trend toward integrating smart technology and Internet of Things (IoT) capabilities

- These technologies enable advanced connectivity, automation, and data analysis, providing deeper insights into appliance usage, energy efficiency, and predictive maintenance needs

- Smart appliances, such as refrigerators with automated meal planning or washing machines with remote control via smartphones, allow for proactive management, identifying potential issues before they lead to costly repairs or appliance downtime

- For instance, companies such as Samsung and LG are developing IoT-driven platforms that analyze usage patterns to optimize energy consumption or offer personalized user experiences, such as smart kitchen appliances that suggest recipes based on available ingredients

- This trend enhances the value proposition of consumer appliances, making them more appealing to tech-savvy consumers and businesses seeking efficient, connected solutions

- AI and IoT algorithms can analyze a wide range of usage data, including energy consumption, appliance performance, and user preferences, to deliver customized functionalities and improve convenience

Consumer Appliances Market Dynamics

Driver

“Rising Demand for Smart Homes and Energy-Efficient Appliances”

- Increasing consumer demand for smart home ecosystems, including connected appliances offering real-time control, remote diagnostics, and seamless integration with other devices, is a major driver for the global consumer appliances market

- Appliances with advanced features, such as energy-efficient refrigerators, air purifiers with real-time air quality monitoring, and smart washing machines, enhance convenience, sustainability, and user experience

- Government regulations, particularly in regions such as Europe and North America, promoting energy efficiency are contributing to the widespread adoption of eco-friendly appliances

- The proliferation of 5G technology and IoT advancements is enabling faster data transmission and lower latency, supporting more sophisticated functionalities in appliances such as entertainment systems and kitchen devices

- Manufacturers are increasingly offering factory-fitted smart features in appliances across product types, such as air solutions, laundry and cleanliness, and kitchen appliances, to meet consumer expectations and enhance product value

- The Asia-Pacific region, dominating the market with a significant share, is seeing rapid adoption due to urbanization, rising disposable incomes, and growing demand for innovative appliances in countries such as China and India

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The substantial initial investment required for smart appliances, including hardware, software, and IoT integration, can be a significant barrier to adoption, particularly in cost-sensitive emerging markets

- Retrofitting existing appliances with smart technology or integrating advanced systems into new designs can be complex and costly

- Data security and privacy concerns pose a major challenge, as smart appliances collect and transmit vast amounts of sensitive user data, raising risks of breaches, misuse, or non-compliance with regulations such as GDPR in Europe or CCPA in North America

- The fragmented regulatory landscape across regions, particularly regarding data collection, storage, and usage, complicates operations for manufacturers and service providers operating globally

- These factors can deter potential buyers, especially in regions with high awareness of data privacy or where cost sensitivity is a key factor, potentially limiting market growth

- Despite these challenges, North America is the fastest-growing region due to strong demand for premium, connected appliances and significant investments in smart home technologies

Consumer Appliances market Scope

The market is segmented on the basis of product type, usage, and distribution channel.

- By Product Type

On the basis of product type, the global consumer appliances market is segmented into air solutions, entertainment, laundry and cleanliness, connectivity, water solutions, kitchen appliances, grooming accessories, wearables, and other consumer appliances. The kitchen appliances segment dominated a significant market revenue share of 39.6% in 2024, driven by increasing urbanization, rising disposable incomes, and the growing demand for convenient and efficient cooking solutions. This includes refrigerators, microwaves, mixers, juicers, and other essential kitchen gadgets.

The entertainment segment (including televisions, speakers, smart speakers, gaming consoles, and digital cameras) is expected to witness robust growth from 2025 to 2032. This growth is fueled by advancements in smart home ecosystems, increasing consumer demand for integrated and immersive entertainment experiences, and the continuous innovation in display technologies and audio solutions.

- By Usage

On the basis of usage, the global consumer appliances market is segmented into personal care/individual and domestic use. The domestic use segment is expected to hold the largest market revenue share, primarily driven by the fundamental need for appliances in households for everyday tasks such as cooking, cleaning, and climate control. The growing number of households globally and the increasing focus on convenience and comfort in daily life further contribute to this dominance.

The personal care/individual segment is expected to witness significant growth from 2025 to 2032. This is driven by rising consumer awareness regarding personal grooming, increasing disposable incomes, and the proliferation of innovative and portable personal care devices, including trimmers, hair dryers, and electric brushes.

- By Distribution Channel

On the basis of distribution channel, the global consumer appliances market is segmented into online and offline. The offline retail segment (including supermarkets, hypermarkets, and specialty stores) is expected to hold the largest market revenue share. This is attributed to consumers' preference for in-store experience, allowing them to physically inspect products, receive expert advice, and benefit from immediate purchase and after-sales services, particularly for larger and more complex appliances.

The online segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is propelled by increasing internet penetration, the convenience of online shopping, wider product selection, competitive pricing, and the rise of e-commerce platforms offering home delivery and easy comparison of products. The shift in consumer behavior towards digital channels for research and purchase is a key driver.

Consumer Appliances Market Regional Analysis

- Asia-Pacific dominated the consumer appliances market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, a burgeoning middle class, and strong manufacturing hubs in countries such as China, Japan, and South Korea

- Consumers prioritize appliances that enhance convenience, energy efficiency, and smart connectivity, particularly in regions with growing middle-class populations and diverse lifestyle needs

- Growth is supported by advancements in appliance technology, including IoT-enabled devices, energy-efficient systems, and eco-friendly designs, alongside rising adoption in both OEM and aftermarket segments

Japan Consumer Appliances Market Insight

Japan’s consumer appliances market is expected to witness significant growth due to strong consumer preference for high-quality, technologically advanced appliances that enhance convenience and sustainability. The presence of major manufacturers and the integration of smart appliances in OEM products accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Consumer Appliances Market Insight

China holds the largest share of the Asia-Pacific consumer appliances market, propelled by rapid urbanization, rising household ownership, and increasing demand for energy-efficient and connected solutions. The country’s growing middle class and focus on smart home technologies support the adoption of advanced appliances. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Consumer Appliances Market Insight

North America is expected to witness the fastest growth rate in the global consumer appliances market, driven by increasing adoption of smart home technologies and consumer preference for energy-efficient and connected devices. The U.S. leads this growth, supported by strong demand for air solutions, kitchen appliances, and wearables. Rising awareness of sustainability and government incentives for eco-friendly appliances further fuel market expansion.

U.S. Consumer Appliances Market Insight

The U.S. consumer appliances market is expected to witness significant growth, fueled by strong demand for smart and energy-efficient appliances and growing consumer awareness of sustainability and convenience benefits. The trend towards home automation and premium product offerings further boosts market expansion. Manufacturers’ integration of connected appliances in new homes complements aftermarket sales, creating a robust product ecosystem.

Europe Consumer Appliances Market Insight

The Europe consumer appliances market is expected to witness significant growth, supported by regulatory emphasis on energy efficiency and sustainability. Consumers seek appliances that offer smart connectivity, reduced energy consumption, and enhanced functionality. The growth is prominent in both new installations and replacement projects, with countries such as Germany and France showing significant uptake due to environmental concerns and urban living trends.

U.K. Consumer Appliances Market Insight

The U.K. market for consumer appliances is expected to witness rapid growth, driven by demand for energy-efficient and smart appliances in urban and suburban settings. Increased interest in home aesthetics and rising awareness of sustainability benefits encourage adoption. Evolving regulations promoting eco-friendly appliances influence consumer choices, balancing functionality with compliance.

Germany Consumer Appliances Market Insight

Germany is expected to witness strong growth in the consumer appliances market, attributed to its advanced manufacturing sector and high consumer focus on energy efficiency and smart technology. German consumers prefer technologically advanced appliances that reduce energy consumption and enhance convenience. The integration of these appliances in premium households and aftermarket options supports sustained market growth.

Consumer Appliances Market Share

The consumer appliances industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Procter & Gamble (U.S.)

- Panasonic Corporation (Japan)

- Xiaomi (China)

- Wahl Clipper Corporation (U.S.)

- Spectrum Brands, Inc. (U.S.)

- Conair Corporation (U.S.)

- ANDIS COMPANY (U.S.)

- VEGA (India)

- Sunbeam Products, Inc. (U.S.)

- Havells India Ltd. (India)

- Flyco Global (China)

- ZED LIFESTYLE PVT. LTD. (India)

- Happily Unmarried (India)

- General Electric Company (U.S.)

- Syska (India)

- BRIO PRODUCT GROUP (U.S.)

What are the Recent Developments in Global Consumer Appliances Market?

- In July 2025, Pudu Robotics unveiled the PUDU T600 Series, a cutting-edge lineup of industrial delivery robots designed for high-payload, autonomous logistics in complex environments. With a 600kg capacity, advanced navigation, and dual-form design—including a low-profile underride model—the T600 Series streamlines warehouse and manufacturing operations. It supports on-premises deployment, IoT integration, and multi-layer safety systems, reflecting major strides in robotics innovation. While tailored for industrial use, these technologies may eventually shape automated consumer appliances, signaling a broader evolution in smart automation

- In January 2025, Comfee—Germany’s leading air conditioner brand—made its official debut in Malaysia and Indonesia with the launch of its Gusto Aircon series, targeting the young generation. Built around the concept of “cooling smart with style,” the Gusto lineup combines sleek design, smart connectivity, and energy-saving features such as AI-powered ECO+ technology and Active Clean+ self-cleaning. This expansion marks a strategic move into emerging Southeast Asian markets, aligning with the growing demand for smart home integration and lifestyle-driven appliances. Comfee’s vibrant summer campaigns and influencer collaborations further emphasize its youth-focused brand identity

- In March 2025, Midea Group entered into a strategic partnership with the Confédération Africaine de Football (CAF), becoming an Official Sponsor of the TotalEnergies CAF Africa Cup of Nations (AFCON) 2025. This collaboration reflects Midea’s commitment to expanding its brand presence across Africa, a region with growing demand for smart home appliances. By aligning with one of the continent’s most celebrated sporting events, Midea aims to enhance its visibility, engage with passionate football audiences, and reinforce its market position. The sponsorship also marks a milestone in Midea’s global sports marketing strategy

- In April 2024, Whirlpool Corporation finalized a transformative merger with Arçelik A.Ş., combining their European operations to form Beko Europe B.V., a new appliance powerhouse. Whirlpool now holds a 25% stake, while Arçelik owns 75%. This strategic move integrates Whirlpool’s major domestic appliance business with Arçelik’s portfolio—including consumer electronics, air conditioning, and small appliances—creating a company with approximately €5.5 billion in annual revenue and a production capacity of 24 million units. The merger significantly reshapes the competitive landscape in Europe, positioning Beko Europe to drive innovation, sustainability, and consumer value

- In September 2023, BSH Home Appliances Pvt. Ltd unveiled its latest lineup of fully automatic All Round Care front load washing machines, reinforcing its reputation for innovation in essential home appliances. This new range prioritizes advanced functionality, energy efficiency, and user-centric features such as AI-powered wash programs, hygiene steam options, and optimized water usage. Designed to meet the evolving needs of modern households, the launch highlights BSH’s commitment to convenience, sustainability, and premium performance in everyday living

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Consumer Appliances Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Consumer Appliances Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Consumer Appliances Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.