Global Consumer Network Attached Storage Market

Market Size in USD Billion

CAGR :

%

USD

6.63 Billion

USD

23.29 Billion

2024

2032

USD

6.63 Billion

USD

23.29 Billion

2024

2032

| 2025 –2032 | |

| USD 6.63 Billion | |

| USD 23.29 Billion | |

|

|

|

|

Consumer Network Attached Storage Market Size

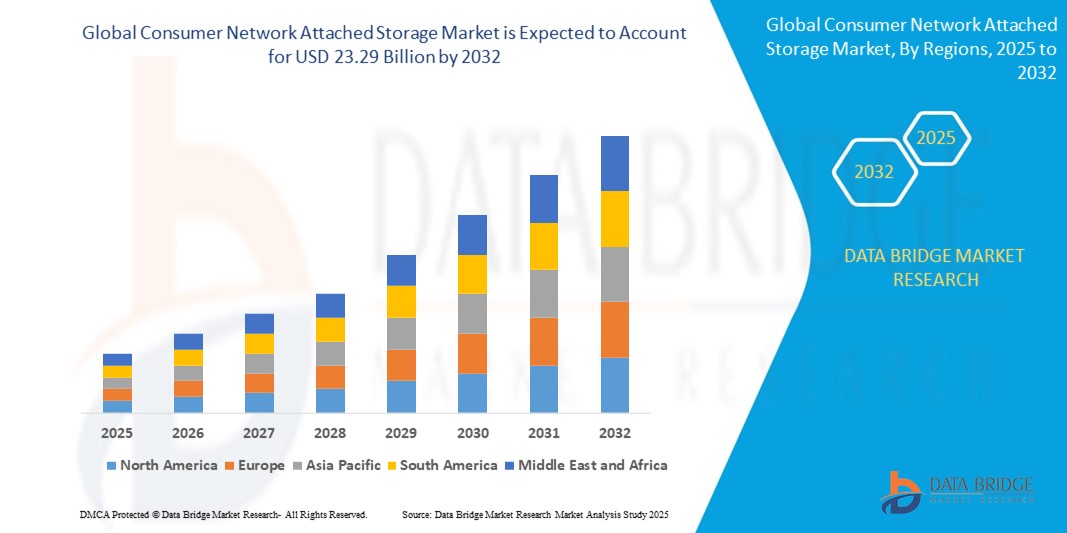

- The global consumer network attached storage market size was valued at USD 6.63 billion in 2024 and is expected to reach USD 23.29 billion by 2032, at a CAGR of 17.00% during the forecast period

- The market growth is driven by increasing demand for centralized data storage, rising adoption of cloud-integrated NAS solutions, and growing needs for data backup and file sharing among residential and enterprise users

- Rising awareness of data security, remote access capabilities, and the proliferation of smart home devices are further propelling the demand for consumer NAS solutions across residential and business applications.

Consumer Network Attached Storage Market Analysis

- The consumer NAS market is experiencing robust growth due to the rising need for scalable, secure, and accessible storage solutions for personal and business data

- The growing trend of digitalization, coupled with increasing data generation from IoT devices, media streaming, and remote work environments, is encouraging manufacturers to innovate with high-capacity, user-friendly, and energy-efficient NAS systems

- North America dominates the largest revenue share of 35.2% in 2024, driven by a mature IT infrastructure, high adoption of advanced storage technologies, and increasing demand for data backup and cloud integration in the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid digital transformation, growing SME sectors, and increasing consumer awareness of data storage solutions in countries such as China, India, Japan, and South Korea

- The 2-Bays segment dominates the market with a revenue share of 28% in 2024, supported by its affordability, compact design, and suitability for small-scale residential and SME applications. The growing demand for RAID-configured NAS for data redundancy is also driving this segment’s growth.

Report Scope and Consumer Network Attached Storage Market Segmentation

|

Attributes |

Consumer Network Attached Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Consumer Network Attached Storage Market Trends

“Rising Preference for Multi-Bay NAS Configurations”

- The 4-bay segment held the largest market share in 2024, accounting for approximately 26.6% to 29.2% of the market, driven by its balance of storage capacity, scalability, and affordability. These systems are ideal for home users and small businesses needing robust data storage for media streaming, backups, and personal cloud solutions

- The 2-bay segment is projected to grow at the fastest CAGR from 2025 to 2032 due to its cost-effectiveness, compact design, and support for RAID configurations, appealing to home users and freelancers seeking reliable local storage over cloud alternatives

- Above 6-bay NAS systems are gaining traction among large enterprises due to their ability to handle data-intensive applications, such as video surveillance and large-scale backups, offering enhanced performance and redundancy

- Standalone NAS devices dominated with a 63.6% market share in 2024, favored for their plug-and-play functionality, making them ideal for residential users and small businesses. They are expected to maintain the fastest CAGR through 2032

- Increasing adoption of smart home ecosystems and IoT devices is driving demand for NAS systems with multimedia streaming capabilities, such as Plex and DLNA support, enhancing their role as centralized media hubs

- Modern NAS devices are incorporating AI-driven file organization and cloud sync features, improving user experience and efficiency for both residential and business applications.

Consumer Network Attached Storage Market Dynamics

Driver

“Rising Demand for Centralized Data Storage and Accessibility”

- The surge in digital content, including 4K/8K videos, high-resolution images, and gaming data, is fueling the need for high-capacity NAS solutions to store and manage large datasets efficiently

- The shift toward remote and hybrid work environments has increased demand for NAS devices that enable secure, centralized data storage and seamless file sharing across multiple devices, boosting productivity for SMEs and large enterprises

- Growing concerns about public cloud data privacy are driving consumers and businesses toward NAS systems for private, on-premises storage with The rise of smart homes and IoT devices requires optimized data management, with NAS systems providing cost-effective, high-performance solutions for multimedia streaming and backups

- Small and medium enterprises are increasingly adopting NAS for cost-effective, scalable storage solutions, supporting video surveillance, file sharing, and data backup needs with lower ownership costs

- NAS vendors such as QNAP and Synology are partnering with tech providers to offer advanced features, such as AI-powered photo management and high-capacity storage, catering to both residential and business users

Restraint/Challenge

“Regulatory and Performance Limitations”

- Premium NAS systems, such as Synology DS920+ or QNAP TS-453D, range from USD 500 to USD 800, excluding installation and maintenance costs, deterring budget-conscious consumers and small businesses

- storage offers flexibility, scalability, and lower initial costs, posing a threat to NAS adoption, particularly for medium enterprises opting for services with free trials and configurable options

- Regular firmware updates, RAID configuration, and backup tasks can be perceived as cumbersome, discouraging users who prefer low-maintenance storage solution

- Data privacy and cybersecurity regulations, such as GDPR in Europe, impose strict requirements on data storage, complicating compliance for NAS manufacturers and limiting market expansion in certain regions

- Despite advancements in CPU and RAM, slower hard drive response times in some NAS systems can impact performance, particularly for data-intensive applications, affecting user satisfaction

Consumer Network Attached Storage Market Scope

The market is segmented on the basis of design and end user.

- By Design

On the basis of design, the consumer network attached storage market is segmented into rack mount, standalone, 1-bay, 2-bays, 4-bays, 5-bays, 6-bays, and above 6-bays. The 2-Bays segment dominates the market with a revenue share of 28% in 2024, supported by its affordability, compact design, and suitability for small-scale residential and SME applications. The user-friendly interfaces and enhanced data management features of 4-bay network attached storage systems further drive their popularity across diverse consumer segments.

The 2-bays segment is anticipated to witness the fastest CAGR of 13.6% from 2025 to 2032, driven by its cost-effectiveness and compact design, making it an attractive option for home users, freelancers, and small businesses seeking reliable local storage solutions. The 2-bay network attached storage systems offer sufficient storage capacity, support for RAID configurations for data redundancy, and seamless integration with smart home ecosystems, contributing to their growing adoption.

- By End User

On the basis of end user, the consumer network attached storage market is segmented into residential, small and medium enterprises (SMEs), and large enterprises. The large enterprises, held the largest market revenue share of 57.3% in 2024, driven by the increasing need for secure, scalable, and high-capacity storage solutions. The ability to integrate network attached storage with business applications and cloud services further enhances its appeal in this segment.

The residential segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising consumption of digital content, growing concerns about data privacy, and the increasing adoption of smart home and IoT applications. The convenience of centralized storage and seamless media streaming to devices such as smart TVs and gaming consoles further drives adoption in residential settings.

Consumer Network Attached Storage Market Regional Analysis

- North America dominates the largest revenue share of 35.2% in 2024, driven by a mature IT infrastructure, high adoption of advanced storage technologies, and increasing demand for data backup and cloud integration in the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid digital transformation, growing SME sectors, and increasing consumer awareness of data storage solutions in countries such as China, India, Japan, and South Korea

U.S. Consumer Network Attached Storage Market Insight

The U.S. consumer network attached storage market captured the largest revenue share of 35.2% within North America in 2025, fueled by the high adoption rate of connected devices, advanced digital infrastructure, and a strong awareness among consumers regarding data backup and security. The U.S. leads the market in this region, fueled by the increasing demand for data storage from digital transformation across various industries and a growing preference for personal cloud storage solutions.

Europe Consumer Network Attached Storage Market Insight

The European consumer network attached storage market is projected to expand at a substantial CAGR, primarily driven by stringent data privacy regulations and the escalating need for enhanced data security in homes and offices. The region, with countries such as Germany and the UK being major contributors, is concentrated on technological advancements and consumer awareness about data privacy. The increasing urbanization and demand for connected devices also foster the adoption of NAS, as European consumers are drawn to the convenience, control, and efficiency these devices offer.

U.K. Consumer Network Attached Storage Market Insight

The U.K. consumer network attached storage market is anticipated to grow at a noteworthy CAGR, driven by the escalating trend of home automation, a desire for heightened data security, and the convenience of centralized storage. Concerns regarding data loss and cyber threats are encouraging both homeowners and businesses to choose network attached storage solutions for reliable backup and data management. The UK's embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth.

Germany Consumer Network Attached Storage Market Insight

The German consumer network attached storage market is expected to expand at a considerable CAGR, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious data management solutions. Germany's well-developed infrastructure, combined with its emphasis on innovation and data privacy, promotes the adoption of NAS, particularly in residential and small business settings. The integration of network attached storage with smart home systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations.

Asia-Pacific Consumer Network Attached Storage Market Insight

The Asia-Pacific consumer NAS market is poised to grow at the fastest CAGR, with projections exceeding 24% in 2025 and a CAGR of 10.0% through 2034. This rapid expansion is driven by increasing urbanization, rising disposable incomes, and rapid technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of consumer network attached storage. Furthermore, as APAC emerges as a manufacturing hub for NAS components and systems, the affordability and accessibility of these devices are expanding to a wider consumer base.

Japan Consumer Network Attached Storage Market Insight

The Japan consumer NAS market is gaining momentum due to the country's high-tech culture, rapid urbanization, and strong demand for convenience and efficient data management. The Japanese market places a significant emphasis on data security and reliability, and the adoption of network attached storage is driven by the increasing number of smart homes and connected buildings. The integration of network attached storage with other IoT devices, such as home security cameras and smart appliances, is fueling growth. Moreover, Japan's aging population is also likely to spur demand for easier-to-use, secure data storage solutions in both residential and commercial sectors.

China Consumer Network Attached Storage Market Insight

The China consumer network attached storage market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and consumer NAS solutions are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable NAS options, alongside strong domestic manufacturers, are key factors propelling the market in China

Consumer Network Attached Storage Market Share

The consumer network attached storage industry is primarily led by well-established companies, including:

- Western Digital Corporation (U.S.)

- NETGEAR (U.S.)

- Synology Inc. (Taiwan)

- QNAP Systems, Inc. (Taiwan)

- ASUSTOR Inc. (Taiwan)

- Dell (U.S.)

- Nasuni (U.S.)

- Hitachi Vantara Corporation (U.S.)

- D-Link Limited (Taiwan)

- NEC Corporation (Japan)

- Seagate Technology Holdings plc (U.S.)

- Zyxel (Taiwan)

- Hewlett Packard Enterprise Development LP (U.S.)

- IBM (U.S.)

- NetApp, Inc. (U.S.)

Latest Developments in Global Consumer Network Attached Storage Market

- In January 2024, Ugreen partnered with Intel to launch the NASync series, a lineup of AI-powered network attached storage (NAS) devices. These solutions feature automated decision-making and enhanced storage efficiency, catering to individuals and small businesses. The collaboration integrates Intel’s advanced processing capabilities, ensuring high-performance NAS solutions that optimize data management and accessibility. The NASync series was unveiled at CES 2024, marking Ugreen’s expansion into consumer NAS technology

- In September 2023, QNAP Systems, Inc. introduced the TS-AI642, an AI-powered NAS solution tailored for small and medium-sized businesses. Featuring a Neural Processing Unit (NPU), it accelerates AI applications such as video surveillance and image storage, ensuring high-speed data management. With a storage capacity of up to 110 TB, the TS-AI642 enhances backup solutions while optimizing processing efficiency. This launch strengthens QNAP’s consumer NAS portfolio, addressing the rising demand for advanced data management

- In September 2023, Huawei introduced the OceanStor Pacific 9920, an entry-level NAS array designed for data center storage. With a 2U rack space and up to 92TB raw capacity, it functions as a standalone NAS or integrates into OceanStor clusters, offering scalability and flexibility. The system features all-flash storage, AI Fabric network acceleration, and erasure coding redundancy, ensuring high-speed performance for virtualization, cloud computing, and AI applications. This launch strengthens Huawei’s presence in consumer and enterprise NAS markets

- In August 2023, Buffalo announced the transition from its TeraStation 6000 and 5010 Series to the new TeraStation 5020 Series, enhancing performance and scalability for consumer and small business users. The TS5020 Series integrates updated CPU and RAM, ensuring smoother operations and reduced backup times in high-load environments. It features robust security, including two-factor authentication (2FA) and snapshot backup capabilities, reinforcing data protection. The transition maintains Buffalo’s reputation for reliable NAS solutions, supporting virtualization and cloud integration

- In June 2023, Synology Inc. launched the DiskStation DS223j, a 2-bay NAS solution designed for small businesses and home offices. This energy-efficient device supports data backup, file syncing, sharing, and video surveillance applications, ensuring secure and scalable storage. Powered by Synology’s DiskStation Manager (DSM), the DS223j offers intuitive file management, cross-device access, and cloud integration. With up to 36 TB of raw storage, it enhances workflow efficiency for remote teams

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Consumer Network Attached Storage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Consumer Network Attached Storage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Consumer Network Attached Storage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.