Global Contactless Biometrics Market

Market Size in USD Billion

CAGR :

%

USD

19.20 Billion

USD

60.26 Billion

2024

2032

USD

19.20 Billion

USD

60.26 Billion

2024

2032

| 2025 –2032 | |

| USD 19.20 Billion | |

| USD 60.26 Billion | |

|

|

|

|

Contactless Biometrics Market Size

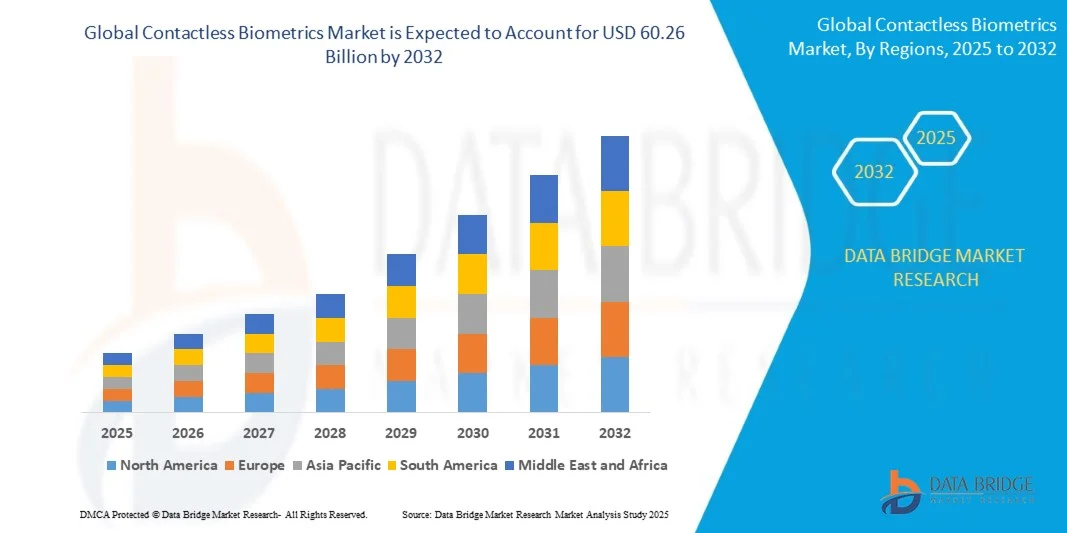

- The global contactless biometrics market size was valued at USD 19.2 billion in 2024 and is expected to reach USD 60.26 billion by 2032, at a CAGR of 15.37% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced biometric technologies across sectors such as government, banking, and healthcare, driven by the global shift toward secure, contact-free identity verification. The demand for hygiene-friendly, efficient, and accurate authentication systems has surged, particularly after the pandemic, propelling the deployment of contactless solutions such as facial and iris recognition

- Furthermore, growing emphasis on fraud prevention, regulatory compliance, and seamless digital onboarding is strengthening market expansion. Enterprises are increasingly integrating AI-driven biometric systems to enhance accuracy, speed, and scalability, positioning contactless biometrics as a critical component of next-generation security infrastructures. These combined factors are accelerating global adoption, significantly boosting the market’s growth

Contactless Biometrics Market Analysis

- Contactless biometrics, encompassing technologies such as facial, iris, and palm-vein recognition, are transforming identity verification by offering faster, safer, and touch-free authentication across public and private sectors. Their growing application in border control, financial services, and healthcare underscores their importance in improving operational security and user convenience

- The rapid proliferation of AI-powered recognition systems, mobile-based biometric solutions, and digital identity programs is driving the market’s evolution. Increasing investments by governments and enterprises in contactless identification systems are fueling global demand, making contactless biometrics a key enabler of secure digital transformation and trusted access management

- North America dominated the contactless biometrics market with a share of 36.6% in 2024, due to rapid adoption of advanced identification technologies across government, banking, and healthcare sectors

- Asia-Pacific is expected to be the fastest growing region in the contactless biometrics market during the forecast period due to large-scale digitalization, growing population, and rising security needs across emerging economies

- Software segment dominated the market with a market share of 45% in 2024, due to the increasing integration of AI and machine learning for enhanced recognition accuracy and real-time data analytics. The growing shift toward cloud-based biometric platforms for remote authentication and secure database management further boosts software demand. Continuous upgrades for algorithm optimization and seamless system interoperability are also contributing to the accelerating adoption of biometric software solutions across enterprises

Report Scope and Contactless Biometrics Market Segmentation

|

Attributes |

Contactless Biometrics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Contactless Biometrics Market Trends

“Integration of AI and Machine Learning in Biometric Authentication”

- The contactless biometrics market is witnessing accelerated transformation driven by the integration of artificial intelligence (AI) and machine learning (ML) in biometric authentication systems. These technologies are enabling faster processing, improved accuracy, and adaptive learning capabilities across facial, iris, and palm recognition platforms, enhancing both security and user convenience

- For instance, NEC Corporation has integrated advanced AI algorithms into its facial recognition systems to improve liveness detection and identification accuracy, even under low-light or partially obscured conditions. This application of AI and ML helps reduce errors due to environmental variations and strengthens authentication reliability in real-time scenarios

- Machine learning models are being used to analyze massive datasets of biometric patterns, allowing systems to refine recognition processes and adapt over time to new user inputs. This significantly enhances the scalability and predictive performance of biometric authentication platforms used in airports, healthcare facilities, and government applications

- The integration of AI into contactless biometrics enables multi-modal verification systems that combine facial, voice, and gait recognition to ensure higher security precision. These hybrid models improve resilience against spoofing, enabling organizations to implement robust identity management systems across multiple access points

- Manufacturers are expanding their research into deep learning to enhance recognition algorithms that can detect micro-movements or subtle behavioral traits for more authentic identification. For instance, Aware Inc. and Idemia are developing ML-based models capable of adapting dynamically to diverse demographics while maintaining compliance with data protection regulations

- The continuous advancement of AI and ML in contactless biometrics is redefining the landscape of identity authentication by improving speed, reliability, and safety without requiring physical interaction. As digital transformation accelerates globally, AI-driven biometric systems will become central to the enhancement of seamless, touch-free verification processes across industries

Contactless Biometrics Market Dynamics

Driver

“Rising Demand for Contactless Identity Verification Across Sectors”

- The growing global emphasis on security, hygiene, and operational efficiency is fueling the demand for contactless identity verification technologies across multiple sectors. Contactless biometrics minimize physical contact while providing reliable and speedy authentication, meeting the rising need for safe and efficient verification methods in public and private domains

- For instance, airports such as Dubai International and Singapore Changi have implemented facial and iris recognition systems developed by Thales Group to facilitate seamless passenger processing and eliminate the need for manual identity checks. Such implementations showcase the increasing reliance on non-intrusive biometric verification technologies for large-scale operations

- The surge in digital transformation across sectors such as finance, healthcare, and government is intensifying the adoption of contactless biometric systems for authentication and access control. Financial institutions are leveraging facial recognition for secure banking transactions and remote account verification to improve customer experience while ensuring compliance with Know Your Customer (KYC) standards

- The COVID-19 pandemic significantly accelerated the shift toward touchless identification systems as organizations sought hygienic alternatives to traditional fingerprint or palm-scanning technologies. This shift has positioned contactless biometrics as a vital component of modern security infrastructure

- With the expansion of smart cities, intelligent transportation, and connected workforce ecosystems, the deployment of AI-enabled contactless biometric systems is increasing rapidly. As industries continue to prioritize secure and frictionless identity verification, the market is expected to progress toward widespread adoption across both developed and emerging economies

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- High implementation costs associated with advanced contactless biometric solutions remain a significant challenge for market growth. The integration of AI-driven recognition technologies requires sophisticated hardware such as high-resolution cameras, sensors, and processors, leading to elevated project expenses for large-scale deployments

- For instance, government projects adopting nation-wide biometric identity systems such as Aadhaar in India and the national ID program in Saudi Arabia have faced substantial infrastructure and operational costs. The need for widespread calibration, maintenance, and software upgrades further adds to the total cost of ownership for implementing such technologies

- Data privacy and security concerns surrounding the collection and storage of biometric information also pose critical challenges. Unauthorized data access, system breaches, or misuse of digital identities can undermine public trust and invite stringent regulatory scrutiny from authorities overseeing data protection frameworks

- Compliance with regional privacy regulations such as the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) demands rigorous data encryption, anonymization, and user consent protocols. Maintaining this compliance increases both complexity and cost, especially for multi-jurisdictional organizations

- To address these concerns, companies are focusing on developing privacy-preserving biometric frameworks featuring on-device processing, decentralized data storage, and end-to-end encryption. Overcoming high cost barriers and privacy risks through technological innovation and transparent data practices will be essential to ensure sustainable adoption of contactless biometric systems globally

Contactless Biometrics Market Scope

The market is segmented on the basis of component, technology, mobility, application, and end-user.

- By Component

On the basis of component, the contactless biometrics market is segmented into hardware, software, and services. The software segment dominated the market with the largest revenue share of 45% in 2024, driven by the increasing integration of AI and machine learning for enhanced recognition accuracy and real-time data analytics. The growing shift toward cloud-based biometric platforms for remote authentication and secure database management further boosts software demand. Continuous upgrades for algorithm optimization and seamless system interoperability are also contributing to the accelerating adoption of biometric software solutions across enterprises.

The hardware segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to the extensive deployment of biometric scanners, cameras, and sensors across government, healthcare, and banking sectors. The demand is primarily supported by the rising need for fast and accurate identity verification systems in public security and border control. In addition, the development of advanced 3D facial cameras and infrared-based sensors has strengthened the adoption of robust biometric infrastructure for large-scale installations.

- By Technology

On the basis of technology, the contactless biometrics market is segmented into facial recognition, iris recognition, and more. The facial recognition segment held the largest market revenue share in 2024, primarily due to its wide adoption in surveillance, smartphone authentication, and public safety applications. Its ability to enable rapid and contactless identification in crowded environments has made it a preferred choice for governments and airports. The integration of AI-based facial analytics with high-resolution imaging further strengthens its performance in detecting individuals with precision and speed.

The iris recognition segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its exceptional accuracy and low false acceptance rate in identity verification. Its growing use in high-security environments such as defense, banking, and immigration is propelling adoption. Moreover, the increasing development of contactless iris scanners compatible with mobile and wearable devices is enhancing user convenience and expanding market penetration.

- By Mobility

On the basis of mobility, the market is segmented into fixed/on-premise systems and mobile/embedded devices. The fixed/on-premise systems segment dominated the market in 2024 with the largest revenue share, attributed to their extensive use in airports, government offices, and corporate facilities requiring secure access control. These systems provide reliable, high-throughput verification and are integrated with centralized databases for continuous monitoring and management. The long-term deployment of stationary biometric units ensures stability, scalability, and compliance with institutional security protocols.

The mobile/embedded devices segment is expected to record the fastest growth from 2025 to 2032, fueled by the proliferation of smartphones and tablets equipped with biometric capabilities. Increasing demand for portable authentication in field operations, e-commerce, and digital banking drives the segment’s momentum. In addition, embedded biometric modules in IoT and wearable devices enhance convenience, enabling secure identity verification anytime, anywhere.

- By Application

On the basis of application, the contactless biometrics market is segmented into access control, payments and transactions, and more. The access control segment held the largest share in 2024, supported by the rising deployment of biometric security systems in offices, airports, and educational institutions. Contactless biometric access ensures hygiene and efficiency while reducing the risks associated with physical touchpoints. The integration with cloud systems and IoT-enabled devices allows real-time monitoring and centralized management of entry points.

The payments and transactions segment is projected to witness the fastest growth during 2025–2032, owing to the increasing demand for secure and frictionless digital payment solutions. Biometric-based payment authentication using facial or iris recognition reduces fraud risk and enhances user experience. The adoption of biometric-enabled payment cards and mobile wallets across fintech ecosystems is further expanding this segment’s potential.

- By End-User

On the basis of end-user, the contactless biometrics market is segmented into government and public sector and more. The government and public sector segment dominated the market with the largest revenue share in 2024, driven by large-scale national ID projects, border control systems, and law enforcement initiatives. Governments worldwide are investing in biometric-based citizen identification to improve security and streamline public service access. The use of contactless systems minimizes hygiene concerns and accelerates verification processes in crowded public environments.

The healthcare segment is anticipated to grow at the fastest rate from 2025 to 2032, propelled by the increasing need for secure patient identification and contact-free verification during medical procedures. Hospitals and clinics are adopting facial and iris recognition for managing patient records, preventing identity fraud, and ensuring access control to restricted zones. The ongoing digital transformation in healthcare infrastructure continues to strengthen biometric integration for safe and efficient operations.

Contactless Biometrics Market Regional Analysis

- North America dominated the contactless biometrics market with the largest revenue share of 36.6% in 2024, driven by rapid adoption of advanced identification technologies across government, banking, and healthcare sectors

- The region’s focus on security modernization, coupled with strong investments in AI-based facial and iris recognition systems, has strengthened market expansion

- Widespread integration of biometric systems in airports, law enforcement, and access control solutions continues to boost demand. The growing emphasis on digital identity verification and fraud prevention across industries reinforces the region’s leadership in the global market

U.S. Contactless Biometrics Market Insight

The U.S. contactless biometrics market captured the largest revenue share within North America in 2024, supported by high technology adoption and extensive use of biometric authentication in public and private sectors. Increasing demand for secure, touch-free verification methods in banking, border control, and healthcare has accelerated deployment. The presence of leading technology providers and government-led identity programs continues to drive innovation. Furthermore, the expansion of mobile-based facial and iris recognition applications in payments and enterprise access systems enhances the country’s market growth trajectory.

Europe Contactless Biometrics Market Insight

The Europe contactless biometrics market is projected to grow at a significant CAGR during the forecast period, fueled by strict data protection laws and growing security concerns. The region’s increasing investments in biometric-enabled e-passports, border management, and corporate access control systems are propelling demand. European countries are prioritizing privacy-focused, GDPR-compliant biometric solutions for safer digital identification. Rising adoption across BFSI and healthcare sectors for fraud reduction and patient verification also strengthens market presence.

U.K. Contactless Biometrics Market Insight

The U.K. contactless biometrics market is expected to grow steadily throughout the forecast period, driven by the country’s strong focus on digital transformation and public safety. The implementation of biometric systems in government identity programs and transportation hubs enhances security efficiency. In addition, the growing trend of contactless authentication for financial transactions and retail applications supports market growth. Increasing collaborations between technology vendors and government agencies are further strengthening the adoption landscape in the U.K.

Germany Contactless Biometrics Market Insight

The Germany contactless biometrics market is anticipated to witness considerable growth during the forecast period, attributed to its robust industrial infrastructure and emphasis on secure access control solutions. The integration of advanced biometric technologies in manufacturing facilities, airports, and corporate offices is accelerating. Germany’s commitment to data privacy and innovation is encouraging adoption of AI-powered, contactless recognition systems. The country’s initiatives toward smart city development and efficient border control systems are also enhancing market expansion.

Asia-Pacific Contactless Biometrics Market Insight

The Asia-Pacific contactless biometrics market is poised to register the fastest CAGR during 2025–2032, driven by large-scale digitalization, growing population, and rising security needs across emerging economies. Rapid adoption of mobile-based biometric authentication and increasing government initiatives for national identification systems are key contributors. Expanding use in sectors such as BFSI, travel, and e-commerce is strengthening the region’s market position. The surge in investments by local tech manufacturers and cost-effective solutions further accelerates widespread adoption.

China Contactless Biometrics Market Insight

The China contactless biometrics market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization and strong government initiatives in surveillance and digital identity programs. The growing use of facial recognition in public security, mobile payments, and smart city projects drives substantial demand. Domestic technology giants are actively developing AI-based biometric systems, enhancing accessibility across industries. The country’s extensive digital infrastructure and increasing preference for contact-free transactions are propelling continuous market growth.

India Contactless Biometrics Market Insight

The India contactless biometrics market is expected to experience the fastest growth rate in Asia-Pacific, fueled by expanding digital identity initiatives such as Aadhaar and rising adoption in financial and healthcare sectors. The government’s push for secure and paperless verification systems supports rapid market penetration. Increasing smartphone usage and advancements in cloud-based biometric authentication enhance scalability and accessibility. In addition, growing demand for secure digital onboarding in banking, telecom, and e-governance applications continues to accelerate adoption across the country.

Contactless Biometrics Market Share

The contactless biometrics industry is primarily led by well-established companies, including:

- Aware (U.S.)

- Fingerprint Cards AB (Sweden)

- Fujitsu (Japan)

- HID Global (U.S.)

- IDEMIA (France)

- M2SYS Technology (China)

- NEC Corporation (Japan)

- nVIAsoft (U.S.)

- Touchless Biometric Systems (Switzerland)

- Thales (France)

- Veridium (U.K.)

- BioConnect (Canada)

- Innovatrics (Slovakia)

- Cognitec Systems (Germany)

- DERMALOG Identification Systems (Germany)

- SecuGen (U.S.)

- Neurotechnology (Lithuania)

- Shufti Pro (U.K.)

- Fidentity (Switzerland)

- Daon (U.S.)

- NVISO (Switzerland)

- Noldus (The Netherlands)

- Blue Biometrics (Australia)

- True Face (U.S.)

- Veridos (Germany)

- ID R&D (U.S.)

Latest Developments in Global Contactless Biometrics Market

- In May 2025, NEC Corporation introduced its next-generation multimodal biometric authentication platform that integrates facial, iris, and palm-vein recognition powered by edge-AI optimization. This launch enhances real-time accuracy and speed for large-scale verification systems, reinforcing NEC’s role in advancing secure, contactless identity solutions across government and enterprise sectors while strengthening its position in the expanding global contactless biometrics market

- In March 2025, Onsemi unveiled its Hyperlux ID iToF sensors, capable of extending accurate depth capture up to 30 meters to enable longer-range passive liveness detection. This technological advancement enhances facial recognition precision and anti-spoofing performance, supporting the growing demand for smart access and surveillance systems in the contactless biometrics market and positioning Onsemi as a key innovator in imaging-based authentication

- In March 2025, South Korea completed its nationwide rollout of mobile-ID systems integrated with blockchain security and biometric verification. This achievement marks a significant step in secure digital identity transformation, enabling banks to reduce KYC costs and accelerate user onboarding while setting a benchmark for other nations adopting large-scale biometric identity frameworks

- In February 2025, Mastercard initiated a phased migration from traditional 16-digit card numbers to biometric-token-based checkout solutions. This strategic transition aims to enhance fraud resilience, improve transaction security, and elevate consumer trust, firmly establishing Mastercard’s leadership in the global digital payment ecosystem increasingly driven by biometric authentication

- In January 2025, ASSA ABLOY acquired 3millID and Third Millennium to strengthen HID’s biometric reader and middleware portfolio. This acquisition demonstrates the company’s commitment to providing end-to-end access control solutions, supporting its horizontal expansion strategy, and reinforcing ASSA ABLOY’s leadership in the evolving global contactless biometrics market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Contactless Biometrics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Contactless Biometrics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Contactless Biometrics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.