Global Container Fleet Market

Market Size in USD Billion

CAGR :

%

USD

13.80 Billion

USD

22.33 Billion

2024

2032

USD

13.80 Billion

USD

22.33 Billion

2024

2032

| 2025 –2032 | |

| USD 13.80 Billion | |

| USD 22.33 Billion | |

|

|

|

|

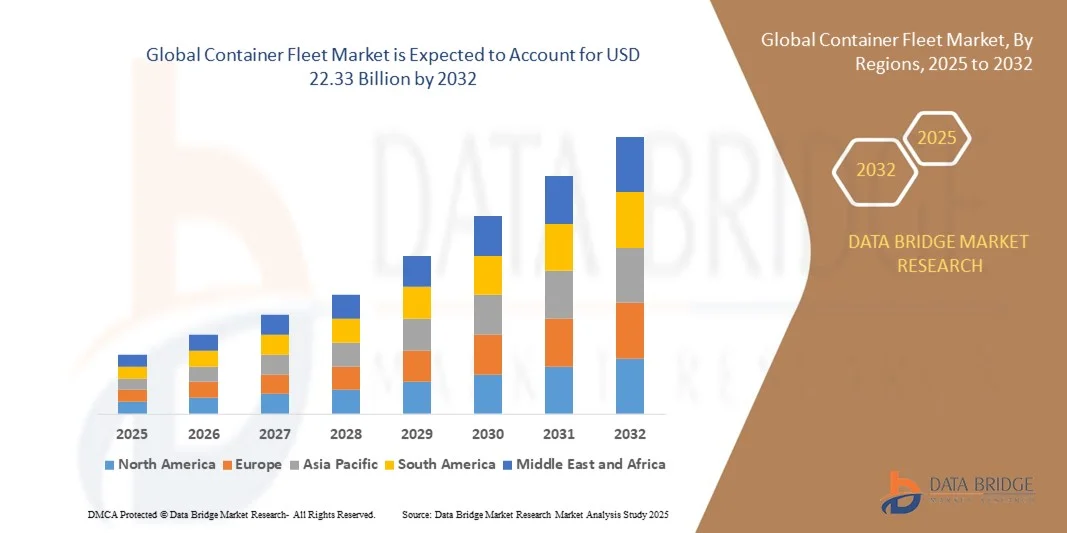

What is the Global Container Fleet Market Size and Growth Rate?

- The global container fleet market size was valued at USD 13.80 billion in 2024 and is expected to reach USD 22.33 billion by 2032, at a CAGR of 6.20% during the forecast period

- The container fleet market is rising in demand owing to growing use of high capacity vessels or ships, which reduces the cost of containers as they can stock up a greater number of containers at a time. Also, the intermodal transportation is in high demand in the container fleet due to the goods are not required to unload or restock from the containers in an international transportation process which is also highly impacting the growth of the container fleet

- The rising urbanization, increase in disposable income, along with the increasing intermodal freight transportation and demand from refrigerated sea transportation

What are the Major Takeaways of Container Fleet Market?

- The rapid increase in use of high capacity vessels or ships reduces the cost of containers as they can stockpile a greater number of containers at a time. This is associated with the rapid increase in use of fleet management systems which expected to push the growth of container fleet market in the above mentioned forecast period

- The major factor which actively drives the demand of container fleet market is the increasing demand from the sea transport. Likewise, the refrigerated cargo containers assist the container fleet market to transport fresh vegetables, fruits, medicines and meat, at the same time maintaining their temperature consequently reducing the risk of damage

- The Asia-Pacific region dominated the container fleet market with the largest revenue share of 42.5% in 2024, driven by the rapid expansion of international trade, strong economic growth, and a surge in containerized transportation demand across major economies such as China, Japan, and India

- The North American container fleet market is projected to grow at the fastest CAGR of 7.6% from 2025 to 2032, propelled by increasing cross-border trade, e-commerce growth, and modernization of logistics infrastructure

- The Dry Container segment dominated the market with the largest revenue share of 58.7% in 2024, owing to its extensive use in transporting a wide range of general cargo, including manufactured goods, textiles, and electronics

Report Scope and Container Fleet Market Segmentation

|

Attributes |

Container Fleet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Container Fleet Market?

Technological Advancements and Fleet Digitalization

- A major and accelerating trend in the global container fleet market is the adoption of digital technologies such as IoT, AI, blockchain, and automation to improve efficiency, visibility, and operational control in global maritime logistics. Fleet digitalization is revolutionizing how containers are tracked, maintained, and managed throughout the supply chain

- For instance, Maersk has implemented blockchain-based systems for real-time cargo tracking and document verification, while Hapag-Lloyd uses AI-driven predictive analytics to optimize fleet operations and fuel consumption. These innovations enhance decision-making, reduce operational costs, and improve reliability in shipping logistics

- AI-powered predictive maintenance is another emerging aspect of digital transformation in container shipping. It enables early detection of machinery wear and potential failures, minimizing downtime and enhancing fleet safety. Companies such as CMA CGM and MSC are investing heavily in AI-based route optimization systems that reduce fuel usage and improve environmental performance

- The use of IoT-enabled sensors allows continuous monitoring of container conditions, including temperature, humidity, and location, which is particularly critical for perishable and high-value goods. Integration with cloud-based platforms facilitates real-time analytics, providing shipping operators and customers with transparency across the logistics chain

- This ongoing digital transformation is significantly enhancing the operational efficiency of container fleets while supporting sustainability goals by reducing carbon emissions. As the demand for smarter, greener, and more transparent logistics grows, the integration of AI and IoT technologies will remain central to market evolution

What are the Key Drivers of Container Fleet Market?

- The surge in global trade activities and the expansion of e-commerce and manufacturing sectors are major factors driving the growth of the container fleet market. Increasing global demand for goods and raw materials has led to a substantial rise in container shipping volumes

- For instance, in July 2024, CMA CGM Group launched a new fleet of LNG-powered container vessels to meet growing trade demands while aligning with environmental standards. This move reflects the broader market shift toward sustainable and efficient container transport solutions

- Rising demand for intermodal transport — combining sea, rail, and road — is another growth driver, as it improves supply chain flexibility and reduces transit time. Container fleets are essential in ensuring seamless cargo movement across transportation modes, enhancing efficiency and scalability

- In addition, government initiatives promoting green shipping and carbon reduction have spurred investment in energy-efficient fleets and eco-friendly containers. Fleet modernization through automation and hybrid fuel adoption is further driving market expansion

- The adoption of smart container technologies, enabling real-time tracking, predictive maintenance, and automated route optimization, is significantly improving cargo visibility and reliability. This technological progress, coupled with growing global logistics demands, is expected to fuel long-term market growth

Which Factor is Challenging the Growth of the Container Fleet Market?

- One of the primary challenges restraining the growth of the container fleet market is the volatile cost of fuel and high operational expenses associated with fleet maintenance and modernization. Fluctuations in crude oil prices have a direct impact on shipping costs, influencing profitability for fleet operators

- For instance, in 2024, a rise in bunker fuel prices led major carriers such as Hapag-Lloyd and Evergreen Marine Corporation to introduce fuel surcharges, which increased freight costs and affected global shipping margins

- Another significant challenge is the imbalance between container availability and demand across different trade routes. The global supply chain disruptions during 2023–2024 exposed vulnerabilities in fleet distribution and repositioning, leading to container shortages in some regions and surpluses in others

- Moreover, the transition toward decarbonization and environmental compliance poses cost and regulatory pressures on operators. Adopting green fuel alternatives and retrofitting vessels to meet IMO (International Maritime Organization) emissions standards require substantial capital investment

- Addressing these challenges through fuel-efficient technologies, data-driven fleet management, and strategic partnerships is essential to ensuring market stability. Companies investing in digitalization and sustainable logistics practices are better positioned to mitigate cost pressures and maintain competitiveness in the evolving global container fleet landscape

How is the Container Fleet Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the container fleet market is segmented into Dry Container, Reefer Container, Tank Container, and Special Container. The Dry Container segment dominated the market with the largest revenue share of 58.7% in 2024, owing to its extensive use in transporting a wide range of general cargo, including manufactured goods, textiles, and electronics. Its cost-effectiveness, easy handling, and availability across major global trade routes make it the most preferred container type. Dry containers also offer standardized dimensions, ensuring compatibility with all shipping modes, which enhances logistics efficiency and supply chain flexibility.

The Reefer Container segment is projected to witness the fastest CAGR of 22.4% from 2025 to 2032, driven by rising global demand for temperature-controlled logistics in food, pharmaceuticals, and chemicals. With the growth of e-commerce and perishable goods exports, reefer containers are gaining prominence as key enablers of safe, high-quality cold chain transportation across international routes.

- By Application

On the basis of application, the container fleet market is segmented into Automotive, Oil and Gas, Food, Mining and Minerals, Agriculture, and Others. The Food segment held the largest revenue share of 41.5% in 2024, primarily driven by the increasing global trade of processed and perishable food products requiring reliable, temperature-controlled transport. Growing urbanization, changing dietary patterns, and the expansion of international food supply chains further support this segment’s dominance. Reefer containers play a crucial role in ensuring freshness and compliance with safety standards during long-distance shipments.

The Automotive segment is expected to register the fastest CAGR of 20.9% from 2025 to 2032, fueled by the surge in global vehicle production and the expansion of automotive part exports. Automakers increasingly rely on containerized transport for cost-efficient movement of high-value components and assemblies. The demand for specialized and customized container solutions for bulky automotive shipments is also expected to accelerate market growth in the coming years.

Which Region Holds the Largest Share of the Container Fleet Market?

- The Asia-Pacific region dominated the container fleet market with the largest revenue share of 42.5% in 2024, driven by the rapid expansion of international trade, strong economic growth, and a surge in containerized transportation demand across major economies such as China, Japan, and India

- The region’s dominance is supported by its extensive port infrastructure, growing manufacturing base, and large-scale exports in industries such as electronics, automotive, and consumer goods. The increasing adoption of smart fleet management systems and digital tracking technologies also strengthens operational efficiency across shipping routes

- In addition, the rise in government investments toward port modernization, logistics automation, and cross-border trade agreements continues to fuel the container fleet expansion, positioning Asia-Pacific as the global hub for maritime transportation and logistics services

China Container Fleet Market Insight

The China container fleet market captured the largest revenue share of 65% in 2024 within Asia-Pacific, attributed to its robust export-oriented economy, vast manufacturing ecosystem, and investments in port infrastructure. China’s Belt and Road Initiative and expansion of major ports such as Shanghai and Ningbo-Zhoushan have enhanced its global trade connectivity. The country's focus on adopting digitalized fleet management, real-time tracking, and AI-based route optimization has further strengthened its leadership position. Moreover, domestic shipping giants are expanding their fleets and investing in eco-friendly containers to comply with global sustainability standards, reinforcing China’s pivotal role in global container shipping.

Japan Container Fleet Market Insight

The Japan container fleet market is projected to grow steadily throughout the forecast period, driven by the country’s advanced logistics infrastructure and focus on sustainable shipping practices. Japan’s key ports, such as Yokohama and Tokyo, are integrating digital monitoring systems and IoT-based tracking solutions to enhance supply chain transparency. In addition, Japanese companies are increasingly adopting energy-efficient container designs and autonomous shipping technologies. The rising demand for refrigerated containers for food, pharmaceuticals, and chemicals is also supporting fleet expansion. The nation’s commitment to carbon-neutral logistics is expected to stimulate steady market growth in the years ahead.

India Container Fleet Market Insight

The India container fleet market is experiencing rapid expansion, fueled by growing export-import volumes, government-backed infrastructure projects, and private investments in port and shipping modernization. Initiatives such as Sagarmala and PM Gati Shakti are improving maritime logistics and enhancing fleet efficiency across major ports including Mumbai, Chennai, and Mundra. In addition, the rising adoption of smart tracking, container leasing, and intermodal transportation is promoting market growth. India’s increasing focus on manufacturing exports, coupled with strategic trade partnerships, is expected to further strengthen its container fleet capacity over the forecast period.

Which Region is the Fastest Growing Region in the Container Fleet Market?

The North American container fleet market is projected to grow at the fastest CAGR of 7.6% from 2025 to 2032, propelled by increasing cross-border trade, e-commerce growth, and modernization of logistics infrastructure. The region’s ports in the U.S., Canada, and Mexico are undergoing significant digital transformation to improve fleet utilization and reduce turnaround times. Moreover, the integration of AI, IoT, and predictive analytics in fleet operations is driving enhanced visibility and efficiency in container management. Growing emphasis on sustainability is also leading to the adoption of hybrid and fuel-efficient vessels in fleet expansion programs, further accelerating market growth across North America.

U.S. Container Fleet Market Insight

The U.S. container fleet market accounted for 79% of North America’s total share in 2024, driven by the rapid growth of domestic and international freight transportation. The country’s major ports, such as Los Angeles, Long Beach, and New York/New Jersey, are witnessing a surge in containerized cargo volumes. U.S.-based shipping companies are investing heavily in digital fleet tracking, automated port operations, and smart logistics networks to meet increasing trade demands. In addition, favorable government policies supporting infrastructure upgrades and green shipping initiatives are contributing to sustained market expansion.

Canada Container Fleet Market Insight

The Canada container fleet market is expanding steadily, supported by trade with Asia and Europe through major ports such as Vancouver and Halifax. The growing adoption of intermodal transportation—combining rail, road, and sea logistics—is optimizing container flow and improving cost efficiency. Investments in port digitization, cold chain logistics, and fleet electrification are further strengthening Canada’s position as a key logistics gateway in North America.

Mexico Container Fleet Market Insight

The Mexico container fleet market is projected to register strong growth, driven by nearshoring trends and the expansion of automotive and manufacturing exports to the U.S. and Latin America. Strategic port developments in Veracruz and Lázaro Cárdenas are enhancing the nation’s container handling capacity. The growing participation of global shipping lines and public-private investments in port modernization are expected to sustain robust fleet growth across the forecast period.

Which are the Top Companies in Container Fleet Market?

The container fleet industry is primarily led by well-established companies, including:

- Evergreen Marine Corporation (Taiwan)

- Hapag-Lloyd AG (Germany)

- HMM Co. Ltd. (South Korea)

- Kawasaki Kisen Kaisha Ltd. (Japan)

- Mitsui O.S.K. Lines (Japan)

- NYK Line (Japan)

- Orient Overseas Container Line Limited (Hong Kong)

- YANG MING (Taiwan)

- ZIM Integrated Shipping Services Ltd. (Israel)

- Pacific International Lines Pte Ltd (Singapore)

- NileDutch (Netherlands)

- Westfal-Larsen (Norway)

- Ocean Network Express Pte. Ltd. (Singapore)

- WAN HAI LINES LTD. (Taiwan)

- Unifeeder A/S (Denmark)

- MATSON (U.S.)

- Arkas Container Transport S.A. (Turkey)

- China Ocean Shipping Company Limited (China)

- Mediterranean Shipping Corporation S.A. (Switzerland)

- CMA CGM Group (France)

What are the Recent Developments in Global Container Fleet Market?

- In May 2024, Thenamaris, a Greek shipping company, confirmed the implementation of the Starlink connectivity service onboard its vessels in partnership with Navarino, its satellite communications provider. The company operates a fleet of 47 tankers, 25 bulk carriers, 8 LNG carriers, and 7 LPG carriers, and plans to deploy the LEO service across most of these ships alongside existing satellite systems. This initiative highlights Thenamaris’ commitment to enhancing operational efficiency and connectivity across its fleet

- In January 2024, SITC and Xiamen Port Holdings Group signed a framework agreement to strengthen logistics operations in Asia. The partnership focuses on route network design, international transit, end-to-end logistics services, cross-border e-commerce, hinterland cargo development, port intelligence, and digital transformation. This collaboration marks a strategic move to improve logistics efficiency and digital integration in the region

- In September 2023, MSC Mediterranean Shipping Company S.A. entered into a strategic partnership with Hamburger Hafen und Logistik Aktiengesellschaft (HHLA), aiming to acquire all free-floating A-shares of HHLA through a voluntary public takeover offer. This alliance underscores MSC’s expansion strategy and strengthens its position in global port and logistics operations

- In April 2023, Ocean Network Express Pte. Ltd. (ONE) introduced the ONE Eco Calculator, a tool designed to measure CO₂ emissions generated by ONE’s operational vessels. The launch represents ONE’s ongoing commitment to sustainability and environmental responsibility within the maritime transport sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Container Fleet Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Container Fleet Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Container Fleet Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.