Global Contraband Detector Market

Market Size in USD Billion

CAGR :

%

USD

4.71 Billion

USD

8.80 Billion

2024

2032

USD

4.71 Billion

USD

8.80 Billion

2024

2032

| 2025 –2032 | |

| USD 4.71 Billion | |

| USD 8.80 Billion | |

|

|

|

|

Contraband Detector Market Size

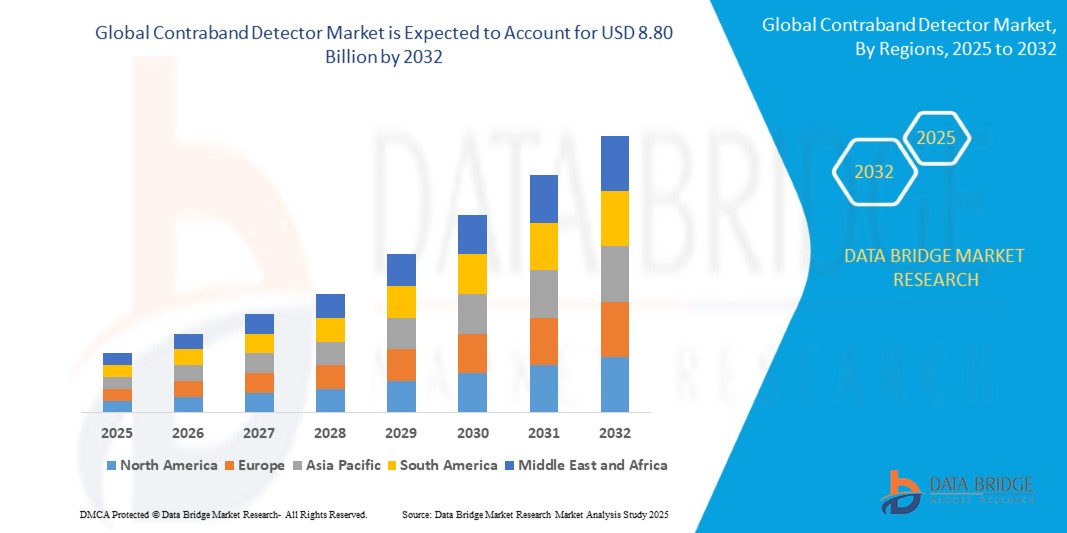

- The global contraband detector market size was valued at USD 4.71 billion in 2024 and is expected to reach USD 8.80 billion by 2032, at a CAGR of 8.14% during the forecast period

- The market growth is largely fueled by increasing security concerns across airports, seaports, railway stations, and other high-traffic public and commercial areas, driving the adoption of advanced contraband detection technologies

- Furthermore, rising government regulations and stringent safety standards are encouraging organizations to deploy sophisticated screening solutions, enhancing the demand for X-ray imaging, metal detection, and spectroscopy-based systems. These converging factors are accelerating the uptake of contraband detectors, thereby significantly boosting the industry’s growth

Contraband Detector Market Analysis

- Contraband detectors are advanced security systems designed to identify prohibited items, including narcotics, explosives, and weapons, across human, baggage, cargo, and automotive screenings. These devices leverage technologies such as X-ray imaging, metal detection, AI-assisted scanning, and portable or fixed deployment setups to improve accuracy and operational efficiency

- The escalating demand for contraband detectors is primarily fueled by rising global security concerns, increasing passenger and cargo traffic, and the need for rapid, accurate, and automated screening in both government and commercial sectors

- North America dominated the contraband detector market with a share of 33.70% in 2024, due to growing security concerns across transportation hubs, government facilities, and commercial establishments

- Asia-Pacific is expected to be the fastest growing region in the contraband detector market during the forecast period due to rapid urbanization, increasing government initiatives on public safety, and rising disposable incomes

- X-ray imaging segment dominated the market with a market share of 54.62% in 2024, due to its ability to provide detailed visualization of scanned items and accurately identify contraband materials. X-ray systems are widely deployed across airports, border checkpoints, and high-security facilities due to their reliability and high throughput. Their capacity to screen both human baggage and cargo efficiently makes them essential for maintaining security in high-traffic environments. The demand for X-ray imaging is further boosted by technological advancements such as automated threat recognition and high-resolution imaging, which enhance operational efficiency

Report Scope and Contraband Detector Market Segmentation

|

Attributes |

Contraband Detector Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Contraband Detector Market Trends

Growing Adoption of AI and Automation in Contraband Detection Systems

- The contraband detector market is evolving as AI and automation enhance detection accuracy. Advanced algorithms improve scanning precision, reduce human error, and allow faster screening even in high-traffic environments such as airports and transit hubs

- For instance, Smiths Detection has introduced AI-powered baggage scanners capable of automatically identifying dangerous items and contraband materials. These innovations reduce operator dependency, strengthen consistency, and improve throughput during large-scale security operations worldwide

- The rising demand for non-intrusive inspection is strengthening adoption. Automated contraband detectors provide discreet and efficient screening that maintains compliance while minimizing passenger inconvenience across airports, government facilities, and large public event venues

- In addition, contraband detection systems are increasingly integrated with networked platforms. Centralized monitoring and real-time alerts improve response capabilities, ensuring that security agencies can coordinate faster interventions in case of suspected threats or illegal smuggling

- The shift toward portable and handheld detectors is gaining traction. Compact AI-powered systems enable on-the-go screening for law enforcement and border control, enhancing operational agility without compromising detection accuracy across challenging environments

- Continuous R&D is producing detectors with multi-sensor capabilities. Combining X-ray, trace detection, and millimeter-wave scanning with AI supports faster identification of explosives, narcotics, and weapons, enabling comprehensive security solutions for critical infrastructure protection

Contraband Detector Market Dynamics

Driver

Rising Security Concerns in Transportation Hubs and Public Spaces

- Global security concerns in airports, seaports, and public spaces are driving adoption of advanced contraband detectors. Rising risks from terrorism, smuggling, and organized crime are pushing governments to strengthen border and transit security infrastructure

- For instance, Rapiscan Systems has deployed contraband detection scanners at several major international airports. These installations highlight growing public authority investments in advanced inspection systems to ensure passenger safety and prevent smuggling or trafficking incidents

- The increasing volume of air and maritime cargo traffic creates demand for rapid yet reliable inspections. Contraband detectors play a critical role in safeguarding logistics supply chains by preventing illegal items from entering trade networks

- In addition, government mandates are reinforcing mandatory deployment of security systems across critical facilities. Defense, customs, and homeland security agencies are steadily accelerating procurement to strengthen preventative measures at high-risk entry points

- Growing public pressure for safety in large events and mass gatherings further supports market expansion. Contraband detectors are being used in stadiums, concert venues, and rail stations to ensure proactive risk prevention globally

Restraint/Challenge

High Installation and Maintenance Costs

- Cost barriers remain a major restriction for the contraband detector market. Large-scale installations require significant upfront capital for infrastructure integration, operator training, and testing, making affordability difficult for smaller airports and public authorities

- For instance, Morpho Detection highlighted cost concerns among municipal governments deploying advanced X-ray and chemical trace detectors. The combination of acquisition and service contracts limited adoption in several budget-constrained transit hubs and public venue projects

- Maintenance and calibration requirements further add to expenses. Sensitive detectors require routine servicing to maintain accuracy, creating recurring operational costs that remain difficult to justify without strong government or institutional funding support

- In addition, integration with legacy infrastructure complicates deployment. Retrofitting systems into older transit facilities increases both installation time and costs, further delaying adoption in regions with outdated security frameworks and limited modernization budgets

- Without cost optimization and scalable deployment models, adoption will remain restricted. Vendors are under continuous pressure to deliver modular, energy-efficient, and low-maintenance systems to make contraband detection feasible across resource-limited geographies globally

Contraband Detector Market Scope

The market is segmented on the basis of technology, screening type, deployment type, and end use.

• By Technology

On the basis of technology, the contraband detector market is segmented into X-ray imaging, metal detection, spectroscopy/spectrometry, and others. The X-ray imaging segment dominated the largest market revenue share of 54.62% in 2024, driven by its ability to provide detailed visualization of scanned items and accurately identify contraband materials. X-ray systems are widely deployed across airports, border checkpoints, and high-security facilities due to their reliability and high throughput. Their capacity to screen both human baggage and cargo efficiently makes them essential for maintaining security in high-traffic environments. The demand for X-ray imaging is further boosted by technological advancements such as automated threat recognition and high-resolution imaging, which enhance operational efficiency.

The metal detection segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness, ease of installation, and adaptability for human screening at diverse locations. Metal detectors are particularly favored in entry points of commercial buildings, transportation hubs, and events due to their capability to detect metallic threats rapidly. Their low maintenance requirements and portability make them suitable for temporary setups and high-volume screening. As security concerns continue to rise globally, the adoption of metal detectors is expected to expand steadily.

• By Screening Type

On the basis of screening type, the contraband detector market is segmented into human screening, baggage and cargo screening, and automotive screening. The baggage and cargo screening segment held the largest market revenue share in 2024, driven by the increasing volume of global air and freight traffic, which requires thorough inspection for contraband materials. Advanced scanning systems in this segment offer high accuracy, fast processing, and minimal disruption to cargo and passenger movement. Airports and logistics hubs increasingly rely on automated and integrated solutions to enhance operational efficiency while ensuring compliance with safety regulations.

The human screening segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising security concerns in public spaces, government buildings, and mass gatherings. Human screening technologies, including walk-through metal detectors and handheld devices, offer effective deterrence against prohibited items. Integration with AI-based monitoring and portable screening tools is enhancing detection accuracy and reducing screening times. The segment is also gaining traction in commercial and hospitality sectors where visitor safety is a priority.

• By Deployment Type

On the basis of deployment type, the contraband detector market is segmented into fixed and portable. The fixed segment dominated the largest market revenue share in 2024, driven by its installation in airports, government facilities, critical infrastructure, and permanent security checkpoints. Fixed systems provide consistent and continuous surveillance, allowing integration with broader security frameworks and centralized monitoring solutions. Their robust design supports high-throughput operations and can handle large volumes of baggage and human traffic efficiently.

The portable segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for flexible security solutions at temporary checkpoints, events, and remote locations. Portable detectors are lightweight, easy to deploy, and can be used for on-the-go inspections without extensive infrastructure. Their adaptability makes them suitable for emergency situations, mass gatherings, or areas with limited space for permanent installations. The rising need for rapid response security measures is expected to further drive the adoption of portable devices.

• By End Use

On the basis of end use, the contraband detector market is segmented into government, transportation, retail, hospitality, events & sports, commercial, and others. The government segment held the largest market revenue share in 2024, driven by extensive deployment across law enforcement agencies, defense installations, and public safety departments. Government institutions prioritize contraband detection to ensure national security, prevent illegal trade, and safeguard citizens. Investments in advanced technologies, training, and infrastructure further strengthen the demand in this segment.

The transportation segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing passenger traffic, cargo operations, and stringent security regulations at airports, seaports, railway stations, and highways. Security systems in this sector are focused on minimizing threats while ensuring smooth operations and minimal delays. Growing adoption of automated scanning solutions and AI-assisted detection tools in transportation hubs is enhancing operational efficiency and safety standards. Rising travel and trade activities worldwide are expected to sustain strong demand in this segment.

Contraband Detector Market Regional Analysis

- North America dominated the contraband detector market with the largest revenue share of 33.70% in 2024, driven by growing security concerns across transportation hubs, government facilities, and commercial establishments

- Consumers and institutions in the region highly prioritize advanced screening technologies for enhanced safety and efficiency

- This widespread adoption is further supported by high security budgets, well-established infrastructure, and technological expertise, establishing contraband detectors as a critical solution for threat prevention in both public and private sectors

U.S. Contraband Detector Market Insight

The U.S. contraband detector market captured the largest revenue share in 2024 within North America, fueled by stringent security regulations and increasing adoption of advanced screening systems in airports, seaports, and mass transit. The demand is further accelerated by technological integration, such as automated scanning and AI-assisted detection, improving both accuracy and throughput. In addition, rising public awareness of safety measures and investments in smart security infrastructure continue to drive market growth in both government and commercial applications.

Europe Contraband Detector Market Insight

The Europe contraband detector market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict security mandates and rising concerns over public safety. The adoption of contraband detectors is supported by increasing urbanization, robust transportation networks, and demand for advanced inspection technologies. European organizations are increasingly implementing sophisticated screening solutions across airports, railway stations, and large public venues.

U.K. Contraband Detector Market Insight

The U.K. contraband detector market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of security and rising public safety concerns. Government and private institutions are actively deploying advanced screening systems for human, baggage, and automotive inspections. The country’s developed technological infrastructure and e-commerce-driven logistics sector further support adoption.

Germany Contraband Detector Market Insight

The Germany contraband detector market is expected to expand at a considerable CAGR, fueled by the demand for technologically advanced, reliable, and eco-conscious screening solutions. Germany’s focus on innovation, strong regulatory frameworks, and well-developed transportation networks promotes the integration of contraband detectors across commercial and government facilities. Continuous modernization of security infrastructure and rising investments in smart monitoring technologies are further driving market growth.

Asia-Pacific Contraband Detector Market Insight

The Asia-Pacific contraband detector market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing government initiatives on public safety, and rising disposable incomes. Countries such as China, Japan, and India are witnessing growing adoption of advanced screening solutions across airports, railway stations, seaports, and public venues. The region’s increasing focus on smart cities, along with local manufacturing of detection systems, is enhancing affordability and accessibility, thereby accelerating market penetration.

Japan Contraband Detector Market Insight

The Japan contraband detector market is gaining momentum due to the country’s high-tech culture, strong public safety emphasis, and increasing integration of AI and IoT-enabled detection systems. Airports, commercial complexes, and mass gatherings are adopting portable and fixed screening solutions to enhance operational efficiency. Japan’s aging population is also driving demand for easy-to-use, reliable detection systems across both residential and commercial applications.

China Contraband Detector Market Insight

The China contraband detector market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, high technological adoption, and extensive government investment in public safety. Airports, railway stations, and logistics hubs are major adopters of advanced contraband detection systems. The growth is further propelled by smart city initiatives, availability of affordable detection devices, and strong local manufacturing capabilities meeting the rising demand in both commercial and government sectors.

Contraband Detector Market Share

The contraband detector industry is primarily led by well-established companies, including:

- Berkeley Varitronics Systems, Inc. (U.S.)

- Decision Sciences (U.S.)

- Leidos (U.S.)

- Metrasens (U.K.)

- Nuctech Company Limited (China)

- OSI Systems, Inc. (U.S.)

- PKI Electronic Intelligence (U.K.)

- Smiths Detection Group Ltd (U.K.)

- Vidisco Ltd. (Israel)

- Walaris (U.S.)

Latest Developments in Global Contraband Detector Market

- In April 2024, Smiths Detection Group Ltd., a UK-based manufacturer of sensors and detection technologies, launched the SDX 10060 XDi, an X-ray Diffraction (XRD) scanner designed to enhance automated detection of narcotics and contraband at international airports, customs control points, and express forwarding facilities. This AI-powered scanner significantly improves accuracy and efficiency, reducing reliance on manual inspection. The introduction of the SDX 10060 XDi is expected to strengthen Smiths Detection’s market position by offering advanced screening solutions that meet the growing demand for faster and more reliable contraband detection in high-traffic transport hubs

- In September 2023, Walaris, a U.S.-based developer of drone detection systems, unveiled the AirScout UAV detection system to prevent drone-based contraband smuggling in prisons. Using advanced AI and multispectral cameras, the system is effective under various environmental conditions and has already been deployed in over 20 prisons across the U.S. and Europe. This development addresses a niche but critical security challenge, positioning Walaris as a key player in the emerging market for anti-drone contraband detection technologies

- In May 2023, the U.S. Department of Homeland Security’s Science and Technology Directorate partnered with the Department of Energy’s Pacific Northwest National Laboratory to enhance portable drug detectors’ ability to identify narcotics, including fentanyl. By providing reference data to OEMs in exchange for updated detection libraries, the initiative improves first responders’ detection systems through rigorous testing and evaluation. This collaboration is expected to accelerate the adoption of portable, high-accuracy detection devices, driving market growth in mobile and field-deployable contraband screening solutions

- In March 2023, Smiths Detection partnered with GRASP Innovations under the Ada Initiative to integrate GRASP’s sensor technology into security checkpoints. This collaboration aims to enhance passenger flow data and operational efficiency while maintaining high safety standards. The integration of advanced sensors supports smarter, more streamlined security operations, reinforcing Smiths Detection’s competitive edge in providing innovative, technology-driven contraband detection solutions for airports and other high-traffic facilities

- In January 2023, Rapiscan Systems, a U.S.-based manufacturer of security screening equipment, introduced the 920CT Cargo and Vehicle Scanner, which combines advanced computed tomography (CT) imaging with AI algorithms to detect explosives and contraband in cargo and vehicles. This system reduces inspection time and increases detection accuracy, catering to growing demand from ports, logistics hubs, and border control agencies. The launch strengthens the adoption of high-tech cargo screening solutions, expanding Rapiscan’s market presence in both commercial and government security sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Contraband Detector Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Contraband Detector Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Contraband Detector Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.