Global Contract Furniture And Furnishing Market

Market Size in USD Billion

CAGR :

%

USD

4.40 Billion

USD

8.89 Billion

2024

2032

USD

4.40 Billion

USD

8.89 Billion

2024

2032

| 2025 –2032 | |

| USD 4.40 Billion | |

| USD 8.89 Billion | |

|

|

|

|

Global Contract Furniture and Furnishing Market Analysis

The global contract furniture and furnishing market is experiencing significant growth, driven by factors such as increasing urbanization, expanding commercial activities, and rising investments in infrastructure and real estate. As cities develop and businesses expand, the demand for modern, functional, and aesthetically pleasing furniture solutions has surged. Companies are increasingly seeking versatile and high-quality furniture to create ergonomic and productive work environments. The integration of technology into furniture, such as smart features and connectivity options, is reshaping the market and enhancing user experience. Additionally, the emphasis on sustainability and eco-friendly practices is gaining traction, with consumers and businesses prioritizing furniture made from recycled materials and non-toxic finishes. The market is also witnessing growth due to the rising number of co-working spaces and the presence of multinational corporations, which require adaptable and innovative furniture solutions. As a result, the contract furniture market is poised for continued expansion, with key regions such as North America and Asia Pacific leading the charge. This trend highlights the importance of staying abreast of evolving consumer preferences and technological advancements to remain competitive in the dynamic landscape of the contract furniture industry.

Global Contract Furniture and Furnishing Market Size

The contract furniture and furnishing market size was valued at USD 4.40 billion in 2024 and is projected to reach USD 8.89 billion by 2032, with a CAGR of 7.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

Global Contract Furniture and Furnishing Market Trends

“Transforming Spaces with Intelligent Comfort”

In today's rapidly evolving workspace, technology integration has become a key trend in the contract furniture market. Smart furniture is designed to enhance user experience by incorporating advanced features such as adjustable heights, which allow users to customize their seating and desk positions for optimal comfort and productivity. Built-in charging ports ensure that devices remain powered throughout the day, reducing clutter and improving efficiency. Connectivity options enable seamless integration with other smart devices, creating a more interactive and connected work environment. This trend is not just about adding gadgets but about rethinking how furniture can adapt to the needs of modern users, making their daily interactions more intuitive and enjoyable

Report Scope and Global Contract Furniture and Furnishing Market Segmentation

|

Attributes |

Contract Furniture and Furnishing Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Haworth Inc. (U.S.), Carlick Contract Furniture (Canada), Herman Miller, Inc. (U.S.), Kinnarps AB (Sweden), Sitraben Contract Furniture Ltd. (U.K.), Knoll, Inc. (U.S.), Pioneer Contract Furniture Ltd. (U.K.), Steelcase Inc. (U.S.), Forest Contract (U.K.), 9to5 Seating LLC. (U.S.), AFC SYSTEM (Italy), BERCO DESIGNS (U.S.), Hussey Seating Company (U.S.), Creative Wood (U.S.), Global Furniture Group (Canada), Godrej Interio (India), Kimball (U.S.), KOKUYO CO.,LTD. (Japan), OKAMURA CORPORATION (Japan), Architonic AG (Switzerland). |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Contract Furniture And Furnishing Market Definition

Contract furniture and furnishing refer to the design, manufacture, and supply of furniture and fixtures intended for commercial, institutional, and public spaces. Unlike residential furniture, contract furniture is engineered to meet stringent standards for durability, safety, and functionality, as it is subjected to heavier use and higher traffic. This category includes items like office desks, chairs, conference tables, hotel room furnishings, restaurant seating, and public seating solutions. Contract furniture is often customizable to fit the specific needs of the client, ensuring that the design aligns with the brand identity and functional requirements of the space.

Global Contract Furniture And Furnishing Market Dynamics

Drivers

- Rising Demand for Ergonomic furniture

As health consciousness rises, there's an increasing awareness of the need for maintaining proper posture and minimizing strain during prolonged periods of sitting or working. Ergonomic furniture, crafted to support the body's natural curves and enhance comfort, is gaining popularity in both office and home environments. These pieces of furniture often feature adjustable heights, lumbar support, and customizable settings, enabling users to create a personalized and comfortable workspace. Such adjustments help prevent common health issues associated with poor posture and extended sitting, such as back pain and muscle strain. By promoting better posture and reducing discomfort, ergonomic furniture contributes to overall well-being and productivity. This growing trend underscores the importance of investing in furniture that not only meets aesthetic and functional requirements but also supports a healthier lifestyle. Whether for professional or personal use, ergonomic furniture is becoming an essential element in creating spaces that prioritize comfort and health.

- Urban Migration and Global Trade

The rapid urban migration is driving the establishment of new offices and commercial spaces, as cities expand and become hubs for economic activities. This urban growth increases the demand for modern, functional, and aesthetically pleasing furniture. Global trade plays a crucial role in this trend, as businesses aim to establish a presence in different regions to leverage global markets. This creates a need for versatile, high-quality commercial furniture that caters to diverse needs and preferences. Consequently, the contract furniture market is experiencing significant growth. The emphasis on innovative and adaptable furniture solutions is essential to support the evolving urban landscape and commercial environments. This trend highlights the importance of creating spaces that are both functional and visually appealing, ensuring that they meet the demands of an increasingly urbanized world. As a result, companies in the contract furniture industry are focusing on developing products that align with the changing needs of urban populations and businesses, driving the market forward.

Opportunities

- Transforming Workspaces with Smart Furniture

In the rapidly evolving workspace, integrating technology into furniture is revolutionizing the market. Smart furniture enhances user experience with advanced features like adjustable heights, allowing users to customize seating and desk positions for optimal comfort and productivity. Built-in charging ports keep devices powered throughout the day, reducing clutter and improving efficiency. Connectivity options enable seamless integration with other smart devices, creating a more interactive and connected work environment. This trend goes beyond adding gadgets; it's about reimagining how furniture can adapt to modern users' needs, making daily interactions more intuitive and enjoyable. By focusing on ergonomic design and technological advancements, smart furniture transforms how people work and live, promoting better posture, reducing strain, and enhancing overall well-being. This shift reflects a broader movement towards creating adaptable, user-friendly environments that support the dynamic nature of contemporary lifestyles. As a result, smart furniture is becoming an essential component in both office and home settings, driving innovation in the furniture industry and contributing to more efficient and comfortable workspaces.

- Embracing Eco-Friendly Choices

As environmental concerns intensify, consumers and businesses are increasingly focusing on sustainability in their purchasing decisions. This shift has driven a significant increase in demand for furniture made from recycled materials, non-toxic finishes, and designs that promote longevity and minimize waste. Companies are now adopting eco-friendly manufacturing processes and sourcing sustainable materials to align with the global trend towards environmental responsibility. By providing green alternatives, furniture manufacturers are not only meeting the rising consumer demand but also playing a crucial role in fostering a healthier planet. This emphasis on sustainability reflects a broader movement towards more responsible consumption and production practices, aiming to reduce the environmental impact of the furniture industry. As a result, the market for sustainable furniture is growing, and companies that prioritize eco-friendly practices are gaining a competitive edge by appealing to environmentally conscious customers. This trend underscores the importance of integrating sustainability into all aspects of the furniture production process, from material selection to manufacturing and distribution.

Restraints/Challenges

- High Cost Barrier in the Contract Furniture

This factor significantly restrains the market, as the use of high-quality materials, advanced manufacturing processes, and the costs associated with shipping and logistics drive up the overall expense of contract furniture. These high costs can present a substantial barrier, particularly for small and medium-sized businesses with limited budgets for outfitting their spaces with premium, ergonomic, and technologically integrated furniture. The challenge lies in balancing the demand for superior quality and advanced features with the affordability concerns of budget-conscious businesses. Consequently, these cost-related constraints can slow the adoption of high-end contract furniture among smaller enterprises, impacting market growth. To overcome this, manufacturers must innovate and find cost-effective solutions to provide high-quality products at more accessible prices, ensuring broader market reach and addressing the needs of businesses of all sizes.

- Overcoming Labor Shortages in the Contract Furniture Market

Labor shortages present a significant challenge in the contract furniture and furnishing market. These shortages can lead to production slowdowns, increased lead times, and higher operational costs. With fewer workers available to manage manufacturing and logistics, companies may find it difficult to meet demand efficiently, impacting their bottom line and overall market growth. This issue is particularly acute in regions where skilled labor is scarce or where there are high turnover rates in the workforce. As a result, companies may struggle to maintain productivity and meet customer expectations. Addressing these labor shortages requires innovative solutions, such as investing in automation and workforce development, to ensure that the industry can continue to thrive despite these challenges.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Contract Furniture and Furnishing Market Scope

The market is segmented on the basis of type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Desks and Tables

- Chairs and Stools

- Storage Cabinets

- Sofas

- Cafeteria Tables and Chairs

- Others

End User

- Corporate Offices

- Hospitals

- Hospitality and Food Services

- Others

Distribution Channel

- Online

- Offline

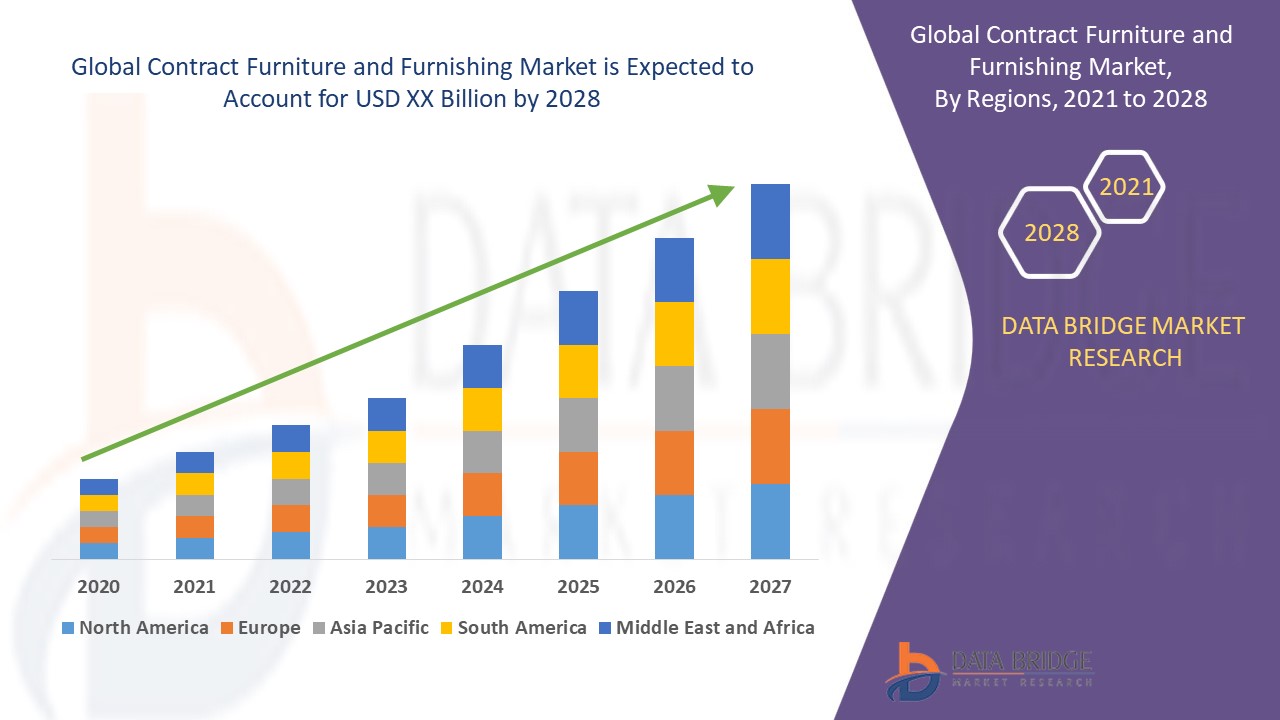

Global Contract Furniture and Furnishing Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, end user, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the global contract furniture and furnishing market. North America is expected to dominate the global contract furniture and furnishing market. This dominance is attributed to the high demand for office furniture in the U.S. and Canada, driven by the presence of numerous multinational corporations and a strong focus on creating modern, ergonomic workspaces. As businesses prioritize employee well-being and productivity, there is a growing need for high-quality, functional, and aesthetically pleasing office furniture.

Asia Pacific is expected to be the fastest-growing market for contract furniture and furnishings. This surge is fueled by rapid urbanization, escalating commercial activities, and substantial investments in infrastructure and real estate. Countries such as China and India are at the forefront of this expansion, owing to their vast populations and burgeoning economies. The region's dynamic growth creates a burgeoning demand for modern, functional, and aesthetically pleasing furniture solutions that cater to diverse commercial needs. As urban centers develop and businesses expand, the need for high-quality contract furniture increases, driving market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Contract Furniture and Furnishing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Contract Furniture and Furnishing Market Leaders Operating in the Market Are:

- Haworth Inc. (U.S.)

- Carlick Contract Furniture (Canada)

- Herman Miller, Inc. (U.S.)

- Kinnarps AB (Sweden)

- Sitraben Contract Furniture Ltd. (U.K.)

- Knoll, Inc. (U.S.)

- Pioneer Contract Furniture Ltd. (U.K.)

- Steelcase Inc. (U.S.)

- Forest Contract (U.K.)

- 9to5 Seating LLC. (U.S.)

- AFC SYSTEM (Italy)

- BERCO DESIGNS (U.S.)

- Hussey Seating Company (U.S.)

- Creative Wood (U.S.)

- Global Furniture Group (Canada)

- Godrej Interio (India)

- Kimball (U.S.)

- KOKUYO CO.,LTD. (Japan)

- OKAMURA CORPORATION (Japan)

- Architonic AG (Switzerland)

Latest Developments in Global Contract Furniture And Furnishing Market

- In July 2022, HNI Corporation announced the completion of its sale of the Lamex office furniture company to Kokuyo Co., Ltd. for USD 75 million. The transaction included Lamex's operations in China and Hong Kong. This strategic move allowed HNI Corporation to streamline its focus on core businesses and optimize its portfolio. Kokuyo Co., Ltd., a prominent office furniture manufacturer, acquired Lamex to expand its market presence in the Asia-Pacific region, leveraging Lamex's established operations and customer base to strengthen its position in the global office furniture market

- In July 2021, the merger of Herman Miller and Knoll created a dominant leader in contemporary design, impacting both home and workplace environments. This strategic alliance combined two iconic brands known for their innovative and stylish furniture, resulting in a powerhouse in the design industry. The merger aimed to leverage their complementary strengths, expand their product offerings, and enhance their market presence. As a result, customers can expect a broader range of high-quality, aesthetically pleasing furniture solutions that cater to modern living and working spaces, driving forward the evolution of design in both sectors

- In July 2022, Kokuyo Co., Ltd. acquired HNI Corporation's Lamex Office Furniture business for USD 75 million. This transaction, completed in July 2022, included Lamex's operations in China and Hong Kong. The acquisition allows Kokuyo to strengthen its presence in the Asia-Pacific region, leveraging Lamex's established market and customer base. This strategic move aligns with Kokuyo's goal to expand its global footprint and enhance its product offerings. The deal also enables HNI Corporation to focus on its core businesses and optimize its portfolio, while Kokuyo benefits from Lamex's expertise in the office furniture industry

- In April 2022, Fursys Inc. and Sidiz Inc. agreed to sell FURSYS VN Ltd. to Fursys Inc. for KRW 50 billion. The transaction board resolution was made on April 22, 2022, and the deal was scheduled to close on May 6, 2022. This acquisition strengthens Fursys Inc.'s position in the market, allowing them to consolidate their operations and expand their influence in the industry. By integrating FURSYS VN Ltd. into their portfolio, Fursys Inc. aims to enhance their production capabilities and market reach, ultimately driving growth and innovation within their business

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.