Global Contract Logistics Market

Market Size in USD Million

CAGR :

%

USD

347.38 Million

USD

624.18 Million

2025

2033

USD

347.38 Million

USD

624.18 Million

2025

2033

| 2026 –2033 | |

| USD 347.38 Million | |

| USD 624.18 Million | |

|

|

|

|

What is the Global Contract Logistics Market Size and Growth Rate?

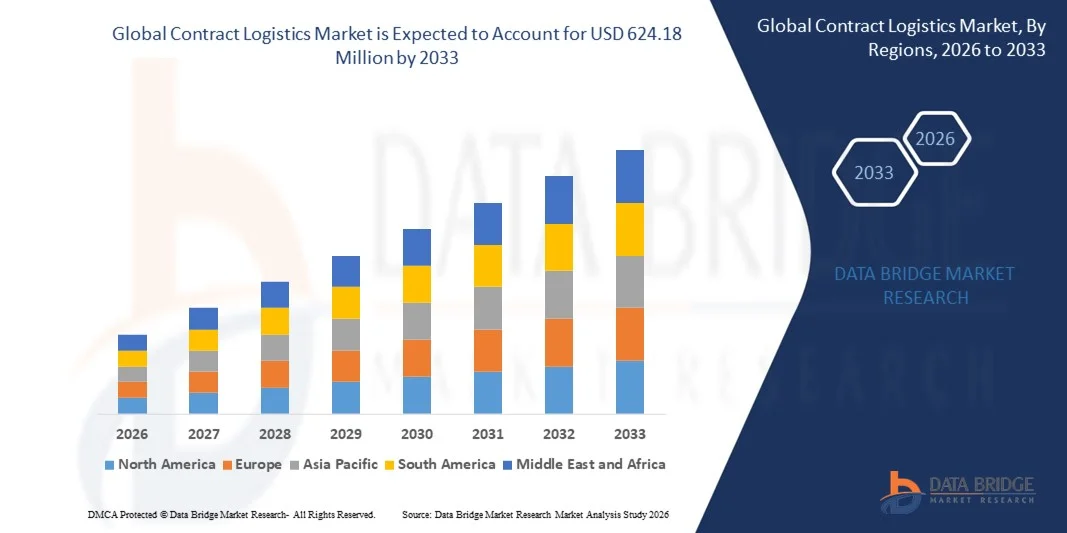

- The global contract logistics market size was valued at USD 347.38 million in 2025 and is expected to reach USD 624.18 million by 2033, at a CAGR of7.60% during the forecast period

- Rising demand for outsourced logistics services, increasing complexity of supply chains, rapid growth of e-commerce and omnichannel retailing, expansion of global trade, growing focus on cost optimization, and increasing adoption of technology-enabled warehousing and transportation solutions are some of the major factors expected to drive the growth of the contract logistics market

What are the Major Takeaways of Contract Logistics Market?

- Strong growth in e-commerce, retail, automotive, healthcare, and industrial sectors, along with increasing investments in smart warehouses, automation, and digital supply chain solutions, is creating significant growth opportunities for the contract logistics market

- High operational costs, dependency on skilled workforce, infrastructure limitations in emerging economies, and challenges related to system integration and coordination across multi-client logistics networks may act as key restraints on market growth

- Asia-Pacific dominated the contract logistics market with a 42.8% revenue share in 2025, driven by rapid expansion of e-commerce, industrial production, and retail supply chains across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 10.7% from 2026 to 2033, fueled by rising e-commerce penetration, advanced technology adoption, and demand for integrated supply chain solutions across the U.S. and Canada

- The Transportation segment dominated the market with a 41.2% share in 2025, driven by increasing demand for timely, reliable, and cost-efficient movement of goods across domestic and international supply chains

Report Scope and Contract Logistics Market Segmentation

|

Attributes |

Contract Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Contract Logistics Market?

Increasing Shift Toward Digitized, Integrated, and Technology-Driven Contract Logistics Solutions

- The contract logistics market is witnessing strong adoption of digital warehouse management systems (WMS), transportation management systems (TMS), automation, and data-driven logistics platforms to enhance operational efficiency and visibility

- Logistics providers are increasingly deploying AI, IoT, robotics, and cloud-based solutions to optimize inventory management, order fulfillment, and last-mile delivery operations

- Growing demand for cost-efficient, scalable, and flexible logistics services is accelerating the shift toward outsourced contract logistics across retail, e-commerce, manufacturing, and healthcare sectors

- For instance, companies such as DHL Supply Chain, GXO Logistics, DB Schenker, CEVA Logistics, and Kuehne + Nagel are investing in automated warehouses, smart distribution centers, and digital supply chain platforms

- Rising need for real-time tracking, faster delivery cycles, and integrated end-to-end logistics solutions is driving adoption of technology-enabled contract logistics models

- As global supply chains become more complex, contract logistics providers will remain critical for improving efficiency, resilience, and scalability across industries

What are the Key Drivers of Contract Logistics Market?

- Rising demand for outsourced logistics services to reduce operational costs, improve service levels, and focus on core business activities

- For instance, in 2024–2025, leading logistics players expanded automated warehousing, omnichannel fulfillment, and cold-chain capabilities to support growing customer demand

- Rapid growth of e-commerce, retail, pharmaceuticals, and manufacturing industries is significantly boosting demand for contract logistics services across the U.S., Europe, and Asia-Pacific

- Advancements in warehouse automation, robotics, AI-based demand forecasting, and digital supply chain platforms are enhancing service efficiency and accuracy

- Increasing adoption of just-in-time inventory models, cross-border trade, and last-mile delivery solutions is driving demand for integrated contract logistics

- Supported by sustained investments in supply chain infrastructure, digital transformation, and logistics innovation, the Contract Logistics market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Contract Logistics Market?

- High initial investment costs associated with warehouse automation, digital infrastructure, and advanced logistics technologies limit adoption among smaller service providers

- For instance, during 2024–2025, rising fuel prices, labor shortages, and infrastructure costs increased operational expenses for several global logistics companies

- Complexity in managing multi-modal transportation, cross-border regulations, and fluctuating demand patterns increases operational risk

- Limited logistics infrastructure and low technology adoption in emerging markets can restrain market expansion

- Intense competition among global and regional logistics providers creates pricing pressure and margin constraints

- To overcome these challenges, companies are focusing on automation, strategic partnerships, digital optimization, and sustainable logistics solutions to expand global adoption of contract logistics services

How is the Contract Logistics Market Segmented?

The market is segmented on the basis of service, type, transportation mode, and industry vertical.

- By Service

On the basis of service, the contract logistics market is segmented into Transportation, Warehousing, Distribution, Aftermarket Logistics, and Other Services. The Transportation segment dominated the market with a 41.2% share in 2025, driven by increasing demand for timely, reliable, and cost-efficient movement of goods across domestic and international supply chains. Efficient transport services are essential for e-commerce, retail, automotive, and industrial sectors, where speed and accuracy are critical.

The Aftermarket Logistics segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of reverse logistics, spare parts distribution, and warranty management services across automotive, electronics, and industrial equipment industries. Increasing focus on sustainability, product lifecycle management, and customer satisfaction is further accelerating growth in aftermarket logistics solutions. Providers are investing in automated tracking systems, AI-powered route optimization, and real-time shipment visibility tools to enhance service quality and operational efficiency.

- By Type

On the basis of type, the market is segmented into Outsourcing and Insourcing. The Outsourcing segment dominated the market with a 62.5% share in 2025, as companies increasingly rely on third-party logistics providers to reduce operational costs, streamline supply chain operations, and focus on core competencies. Outsourcing allows access to advanced infrastructure, technology-enabled services, and expert workforce, particularly in warehousing, transportation, and distribution.

The Insourcing segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by enterprises seeking greater control over sensitive supply chains, custom logistics solutions, and integration with proprietary systems. Rising demand for hybrid models combining in-house capabilities with outsourced expertise, along with investments in digital supply chain platforms, is further fueling growth in insourced logistics. Continuous focus on efficiency, cost reduction, and enhanced customer experience is shaping adoption trends in this segment.

- By Transportation Mode

On the basis of transportation mode, the market is segmented into Roadways, Railways, Airways, and Waterways. The Roadways segment dominated the market with a 48.6% share in 2025, owing to its flexibility, extensive reach, and ability to provide door-to-door delivery for short and medium distances. Road transport is particularly critical for e-commerce, retail, and FMCG industries, where fast delivery and last-mile connectivity are essential.

The Airways segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for express shipments, high-value cargo, and international trade. Growth in e-commerce, perishable goods transportation, and time-sensitive deliveries is accelerating adoption of air freight services. Integration of tracking systems, real-time monitoring, and cloud-enabled logistics platforms is further enhancing efficiency and reliability across all transportation modes.

- By Industry Vertical

On the basis of industry vertical, the market is segmented into Retail & E-Commerce, Automotive, Pharma & Healthcare, Industrial & Manufacturing, Aerospace & Defense, High-Tech & Electronics, and Other Industry Verticals. The Retail & E-Commerce segment dominated the market with a 44.3% share in 2025, fueled by rapid growth in online shopping, omnichannel fulfillment, and demand for quick delivery services.

The Pharma & Healthcare segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for temperature-controlled logistics, medical device distribution, and cold-chain solutions. Rising regulatory compliance, technological adoption in supply chains, and focus on patient safety are further driving growth in this vertical. Advanced warehouse management systems, AI-enabled demand forecasting, and automated order fulfillment are increasingly adopted across all verticals to enhance service efficiency and supply chain resilience.

Which Region Holds the Largest Share of the Contract Logistics Market?

- Asia-Pacific dominated the contract logistics market with a 42.8% revenue share in 2025, driven by rapid expansion of e-commerce, industrial production, and retail supply chains across China, Japan, India, South Korea, and Southeast Asia. High adoption of digitalized logistics, automated warehouses, and advanced supply chain management solutions continues to support growth in the region

- Leading providers are investing in AI-driven route optimization, IoT-enabled tracking systems, and cloud-based logistics platforms to enhance operational efficiency. Strong government support, expanding manufacturing hubs, and rising cross-border trade further reinforce market dominance

- Increasing demand for temperature-controlled logistics, express delivery, and high-value goods distribution across automotive, pharma, and electronics verticals ensures sustained adoption of contract logistics services

China Contract Logistics Market Insight

China is the largest contributor in Asia-Pacific, supported by world-leading e-commerce volumes, industrial manufacturing, and retail distribution networks. Rapid adoption of digital logistics platforms, automated warehouses, and smart transport solutions drives market growth. High demand for express delivery, temperature-controlled logistics, and high-value goods distribution across automotive, pharmaceutical, and electronics sectors further strengthens market adoption. Government initiatives to modernize supply chains and improve infrastructure continue to bolster regional dominance.

Japan Contract Logistics Market Insight

Japan shows steady growth, underpinned by advanced industrial supply chains, precision manufacturing logistics, and strong focus on quality and reliability. Investments in robotics, automated warehouses, and real-time tracking solutions drive adoption of contract logistics services. Rising e-commerce demand and modernization of automotive, industrial, and electronics sectors reinforce market expansion.

India Contract Logistics Market Insight

India is emerging as a high-growth hub, driven by rapid e-commerce penetration, increasing industrial output, and government initiatives supporting Make in India and digital logistics infrastructure. Rising demand for automotive, electronics, and pharmaceutical logistics, combined with adoption of AI-enabled warehouse and delivery management solutions, fuels market growth.

South Korea Contract Logistics Market Insight

South Korea contributes significantly due to advanced manufacturing, high-value electronics production, and robust e-commerce logistics. Adoption of automated warehouses, predictive analytics, and high-speed transport services drives market growth. Increasing investments in AI-based supply chain optimization, industrial automation, and cross-border logistics infrastructure support sustained expansion in the country.

North America Contract Logistics Market

North America is projected to register the fastest CAGR of 10.7% from 2026 to 2033, fueled by rising e-commerce penetration, advanced technology adoption, and demand for integrated supply chain solutions across the U.S. and Canada. The U.S. leads regional growth, driven by robust industrial and retail logistics, sophisticated transportation infrastructure, and high adoption of automated and data-driven supply chain management systems. Canada contributes through expanding warehousing capabilities, government-backed digital logistics initiatives, and growing demand for temperature-sensitive and high-value product handling. North American companies are leveraging cloud-enabled platforms, AI-based analytics, and predictive demand forecasting to optimize delivery performance, reduce operational costs, and enhance supply chain resilience. Rising demand for sustainable logistics solutions and omni-channel fulfillment further accelerates market expansion.

Which are the Top Companies in Contract Logistics Market?

The contract logistics industry is primarily led by well-established companies, including:

- DHL Supply Chain (Germany)

- GXO Logistics, Inc. (U.S.)

- United Parcel Service, Inc. (UPS) (U.S.)

- DB Schenker (Germany)

- Kuehne + Nagel International AG (Switzerland)

- DSV A/S (Denmark)

- Nippon Express Co., Ltd. (Japan)

- CEVA Logistics (France)

- GEODIS SA (France)

- Ryder System, Inc. (U.S.)

What are the Recent Developments in Global Contract Logistics Market?

- In October 2024, DB Schenker launched an 18,000-square-meter contract logistics warehouse near Amsterdam to cater to the semiconductor industry, enhancing regional supply chain capabilities and supporting high-tech manufacturing growth

- In May 2024, C.H. Robinson expanded its contract logistics services to Australia and New Zealand, focusing on customized warehousing, inventory management, and distribution solutions to meet rising regional demand, strengthening its footprint in Oceania

- In October 2023, Ryder System acquired Impact Fulfillment Services (IFS), adding 15 U.S. locations and boosting its contract packaging, manufacturing, and warehousing capabilities, thereby improving service coverage for key consumer sectors

- In March 2023, Kuehne+Nagel inaugurated its third Transport Operation Centre in Gurugram, India, to centralize pan-India distribution management, optimize routes, provide real-time monitoring, and enhance logistics efficiency while supporting sustainability goals

- In September 2022, Rhenus Logistics launched a new business unit, Supply Chain Solutions, in India to offer integrated contract logistics, warehousing, and tech-enabled supply chain visibility services, with a focus on sustainable solutions such as electric vehicles and carbon-neutral operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.