Global Contract Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

23.17 Billion

USD

37.49 Billion

2024

2032

USD

23.17 Billion

USD

37.49 Billion

2024

2032

| 2025 –2032 | |

| USD 23.17 Billion | |

| USD 37.49 Billion | |

|

|

|

|

Contract Manufacturing Market Size

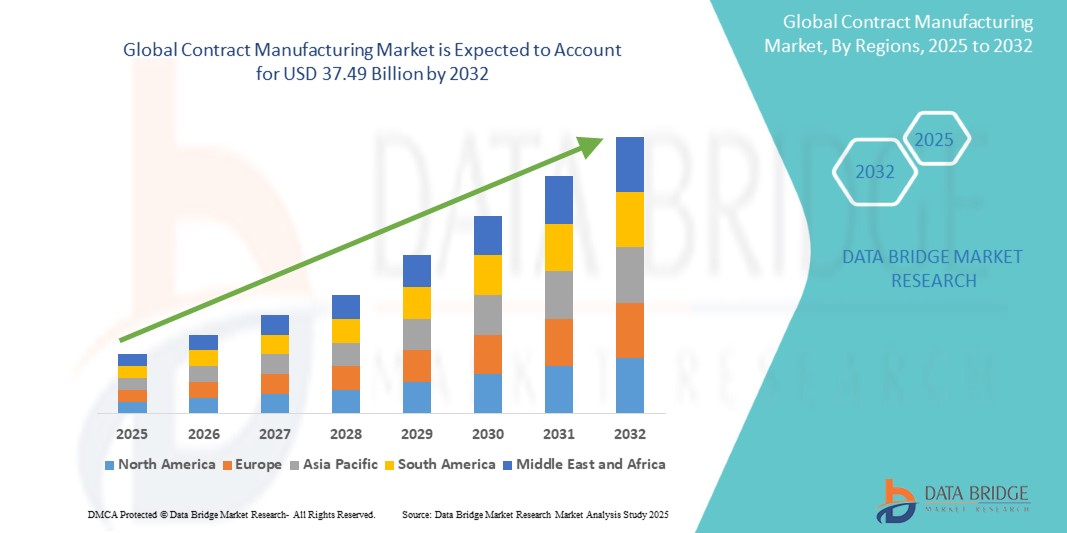

- The global contract manufacturing market size was valued at USD 23.17 billion in 2024 and is expected to reach USD 37.49 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of outsourcing and technological advancements in manufacturing processes, leading to higher efficiency and cost optimization across various industries

- Furthermore, rising demand from companies for flexible, scalable, and specialized production solutions is driving the uptake of contract manufacturing services, thereby significantly boosting the industry's growth

Contract Manufacturing Market Analysis

- Contract manufacturing, offering outsourced production and specialized services, is increasingly vital for companies in pharmaceuticals, medical devices, and other industries due to cost efficiency, access to expertise, and faster time-to-market

- The escalating demand for contract manufacturing is primarily fueled by rising outsourcing trends, the need for scalable production capabilities, and growing emphasis on quality and regulatory compliance

- Asia-Pacific dominated the contract manufacturing market with a 45.67% revenue share in 2024, driven by rapid industrialization, growing healthcare and pharmaceutical sectors, and increasing investments in manufacturing infrastructure

- North America is expected to register the fastest-growing CAGR in the contract manufacturing market, driven by increasing demand for advanced manufacturing technologies, outsourcing solutions, and high-quality production in the pharmaceutical, medical device, and industrial sectors. The region’s strong R&D capabilities, technological expertise, and established regulatory framework support rapid adoption of Contract Manufacturing services

- The Pharmaceutical Products Manufacturing segment dominated the market with a revenue share of 46.5% in 2024, primarily due to the increasing trend of outsourcing drug production to specialized contract manufacturers

Report Scope and Contract Manufacturing Market Segmentation

|

Attributes |

Contract Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Contract Manufacturing Market Trends

Enhanced Efficiency and Strategic Partnerships in Contract Manufacturing

- A significant and accelerating trend in the global contract manufacturing market is the increasing focus on operational efficiency and strategic collaborations with industry leaders. Companies are streamlining their production processes, optimizing supply chains, and expanding capabilities to meet growing client demands

- For instance, leading contract manufacturers are enhancing their multi-site production networks, enabling faster turnaround times and greater flexibility to handle varying order volumes. Similarly, specialized firms are investing in precision manufacturing equipment and quality management systems to ensure consistent product standards

- Integration of end-to-end manufacturing services, from prototyping and production to packaging and logistics, allows clients to consolidate their supply chain, reduce operational costs, and improve time-to-market for new products

- Strategic partnerships with raw material suppliers, technology providers, and distribution channels are helping contract manufacturers expand their service offerings, increase scalability, and adapt to dynamic market requirements

- This trend towards more efficient, flexible, and client-focused manufacturing operations is reshaping expectations in the Contract Manufacturing industry. Consequently, companies are developing comprehensive solutions to support customized production, regulatory compliance, and rapid delivery across diverse sectors

- The demand for reliable, high-quality, and scalable contract manufacturing services is growing rapidly across industries such as pharmaceuticals, electronics, consumer goods, and automotive, as companies increasingly seek to focus on core competencies while leveraging external manufacturing expertise

Contract Manufacturing Market Dynamics

Driver

Growing Demand Driven by Outsourcing and Operational Efficiency

- The global Contract Manufacturing market is experiencing robust growth as companies increasingly outsource production to specialized manufacturers to enhance efficiency, reduce costs, and focus on core business functions

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) expanded its contract manufacturing capabilities to include precision component production for advanced storage systems. Such strategic initiatives by major players are expected to significantly contribute to market growth during the forecast period

- As businesses aim to accelerate time-to-market and maintain consistent product quality, contract manufacturers are providing comprehensive services that include design support, prototyping, large-scale production, assembly, and packaging

- In addition, industries such as pharmaceuticals, electronics, automotive, and consumer goods are increasingly leveraging contract manufacturing to meet fluctuating demand, access specialized technologies, and scale operations efficiently

- The ability to utilize advanced machinery, skilled labor, and multi-site production networks enables manufacturers to deliver high-quality products while optimizing production costs, making contract manufacturing a preferred solution for global enterprises

Restraint/Challenge

Challenges Related to High Initial Investment and Quality Compliance

- The Contract Manufacturing market faces significant challenges due to the substantial initial investments required for establishing advanced production facilities, acquiring state-of-the-art machinery, and maintaining robust quality control systems. These costs can be particularly burdensome for small- and medium-sized manufacturers, limiting market entry and expansion opportunities

- Companies offering specialized contract manufacturing services must also comply with strict regulatory standards and obtain necessary certifications, which adds layers of operational complexity and ongoing costs. Ensuring consistent product quality across multiple production sites further increases the management and monitoring burden on contract manufacturers

- In addition, in price-sensitive markets, some enterprises perceive outsourcing production as more expensive compared to in-house manufacturing, which can slow adoption and limit growth. Balancing cost efficiency with high-quality outputs remains a critical challenge

- The dynamic nature of client demands, including variations in order volumes, product specifications, and delivery timelines, requires contract manufacturers to maintain flexibility without compromising quality, creating further operational pressure

- Overcoming these challenges through scalable infrastructure investments, streamlined production processes, adherence to global quality standards, and competitive pricing strategies will be essential for sustained growth and long-term success in the Contract Manufacturing market

Contract Manufacturing Market Scope

The global contract manufacturing market is segmented on the basis of product, end user, and distribution channel.

• By Product

On the basis of product, the market is segmented into pharmaceutical products manufacturing and medical device manufacturing. The pharmaceutical products manufacturing segment dominated the market with a revenue share of 46.5% in 2024, primarily due to the increasing trend of outsourcing drug production to specialized contract manufacturers. This is driven by the need for operational efficiency, cost optimization, and compliance with stringent regulatory standards. Contract manufacturers provide advanced capabilities including large-scale formulation, quality assurance, regulatory documentation, and packaging solutions, making them a preferred partner for pharmaceutical companies aiming to accelerate product launches and maintain high quality standards.

The medical device manufacturing segment is anticipated to witness the fastest growth at a CAGR of 22.3% from 2025 to 2032, fueled by rising demand for technologically advanced medical devices, such as wearable health monitors, implantable devices, and minimally invasive surgical tools. Strategic collaborations with contract manufacturers enable medical device companies to scale production rapidly, integrate innovative technologies, and meet global quality compliance requirements efficiently.

• By End User

On the basis of end user, the market is segmented into pharmaceutical companies, biotechnology companies, biopharma companies, medical device companies, original equipment manufacturers (OEMs), and research institutes. The pharmaceutical companies segment held the largest market share of 42.7% in 2024, driven by the high demand for outsourced drug production, enabling companies to focus on research and development, optimize manufacturing costs, and ensure timely delivery of products while complying with strict regulatory standards. Contract manufacturing allows pharmaceutical companies to scale production efficiently, leverage specialized expertise, and meet growing global healthcare demands.

The Biopharma Companies segment is expected to witness the fastest CAGR of 23.1% over the forecast period, propelled by the increasing production of biologics, personalized medicines, and advanced therapies. Collaboration with specialized contract manufacturers allows biopharma firms to integrate cutting-edge technologies, maintain high-quality standards, and rapidly respond to evolving healthcare needs.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into retail sales, direct tender, and others. The direct tender segment accounted for the largest revenue share of 48.3% in 2024, primarily due to long-term agreements between contract manufacturers and major pharmaceutical, biotechnology, and medical device companies. These agreements ensure continuity of supply, optimize production planning, and reduce operational risks, making direct tender a preferred distribution approach for high-volume and critical healthcare products.

The retail sales segment is expected to witness the fastest growth at a CAGR of 20.8% from 2025 to 2032, fueled by the expanding availability of over-the-counter pharmaceutical products, growth in online and brick-and-mortar pharmacy networks, and increasing consumer access to medical and healthcare products. Rising health awareness, increasing disposable incomes, and the trend of self-care and home healthcare solutions are further contributing to the rapid adoption of retail-based distribution channels.

Contract Manufacturing Market Regional Analysis

- Asia-Pacific dominated the contract manufacturing market with a 45.67% revenue share in 2024, driven by rapid industrialization, the expansion of healthcare and pharmaceutical sectors, and significant investments in manufacturing infrastructure

- The region benefits from a large, skilled workforce, advanced technological adoption, and supportive government policies that encourage local production and innovation. Countries such as China, Japan, and India are emerging as major hubs for Contract Manufacturing, offering cost-effective production solutions, high-quality output, and the ability to meet both domestic and international demand efficiently

- Rising urbanization, increasing disposable incomes, and the focus on smart manufacturing and digitalization further accelerate market growth across Asia-Pacific

China Contract Manufacturing Market Insight

The China contract manufacturing market captured the largest share in Asia-Pacific in 2024, fueled by rapid industrial growth, an expanding middle class, and widespread adoption of advanced technologies. Strong domestic manufacturing capabilities, coupled with government support and continuous investments in healthcare, pharmaceutical, and high-tech industries, are driving market expansion. China also functions as a key export hub, providing competitive, scalable, and high-quality Contract Manufacturing solutions to meet international standards.

Japan Contract Manufacturing Market Insight

The Japan contract manufacturing market is witnessing steady growth due to its high-tech manufacturing expertise, robust healthcare sector, and focus on precision and quality. Increasing automation, urbanization, and demand for efficient production solutions are key drivers. The adoption of cutting-edge technologies, eco-friendly practices, and innovation-oriented processes strengthens Japan’s position as a leading Contract Manufacturing hub in the region, catering to both domestic requirements and global supply chains.

North America Contract Manufacturing Market Insight

The North America contract manufacturing market held a 38.47% revenue share in 2024, supported by a strong presence of pharmaceutical and medical device companies, advanced manufacturing technologies, and widespread adoption of outsourcing solutions. North America is expected to register the fastest-growing CAGR in the contract manufacturing market, driven by increasing demand for advanced manufacturing technologies, outsourcing solutions, and high-quality production in the pharmaceutical, medical device, and industrial sectors. The region’s strong R&D capabilities, technological expertise, and established regulatory framework support rapid adoption of Contract Manufacturing services The region’s well-established infrastructure, highly skilled workforce, and strict regulatory compliance provide a favorable environment for Contract Manufacturing. Both residential and commercial sectors leverage outsourcing to improve operational efficiency, reduce costs, and gain access to specialized expertise. The increasing demand for precision-engineered products, scalable manufacturing solutions, and rapid time-to-market strategies further propel market growth in North America.

U.S. Contract Manufacturing Market Insight

The U.S. contract manufacturing market captured the largest revenue share within North America in 2024, driven by strong demand for pharmaceuticals, medical devices, and industrial components. Adoption of advanced technologies, automation, and precision engineering is widespread. Contract Manufacturing allows companies to efficiently scale production, optimize costs, and accelerate product launches, making the U.S. a prominent hub for high-quality outsourced manufacturing solutions.

Canada Contract Manufacturing Market Insight

The Canada contract manufacturing market is steadily expanding, supported by growth in healthcare, biotechnology, and life sciences sectors. Emphasis on innovation, high-quality manufacturing standards, and government incentives encourages outsourcing partnerships. Canadian firms increasingly rely on Contract Manufacturing to address both domestic and international demand, particularly for medical devices, high-tech components, and specialized production, enhancing the country’s strategic importance in North America’s manufacturing ecosystem.

Europe Contract Manufacturing Market Insight

The Europe contract manufacturing market is witnessing substantial growth in the Contract Manufacturing market, driven by stringent regulatory requirements, increasing demand for high-quality manufacturing services in the healthcare and pharmaceutical sectors, and rising industrial automation. The region’s well-established infrastructure, skilled workforce, and emphasis on precision engineering are key enablers. Contract Manufacturing adoption is increasing across pharmaceuticals, medical devices, and consumer goods, with both new product development and large-scale production benefiting from outsourcing solutions.

Germany Contract Manufacturing Market Insight

The Germany contract manufacturing market is expanding at a significant pace due to strong industrialization, technological advancements, and high regulatory standards. Germany’s focus on innovation, sustainability, and quality assurance attracts both domestic and international companies to partner with local Contract Manufacturers. The country’s robust infrastructure and expertise in pharmaceuticals, medical devices, and high-tech manufacturing support efficient, large-scale production, making it a leading hub within Europe.

U.K. Contract Manufacturing Market Insight

The U.K. contract manufacturing market is projected to grow at a noteworthy CAGR, fueled by increasing demand for outsourcing solutions in pharmaceuticals, biotechnology, and medical device manufacturing. The region benefits from a strong research and development ecosystem, skilled labor force, and a well-established regulatory framework. Rising healthcare requirements, combined with the trend of cost optimization and operational efficiency, are encouraging both domestic and international companies to leverage U.K.-based Contract Manufacturing services. Furthermore, the U.K.’s e-commerce and logistics infrastructure facilitates smooth supply chain operations, reinforcing market expansion.

Contract Manufacturing Market Share

The Contract Manufacturing industry is primarily led by well-established companies, including:

- Aenova Group (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Evonik Industries AG (Germany)

- Lonza Group AG (Switzerland)

- Boehringer Ingelheim Biopharmaceuticals GmbH (Germany)

- Catalent, Inc. (U.S.)

- Recipharm AB (Sweden)

- Wuxi AppTec (China)

- Samsung Biologics (South Korea)

- Pfizer CentreOne (U.S.)

- CMIC Group (Japan)

- Patheon (U.S.)

Latest Developments in Global Contract Manufacturing Market

- In December 2024, the Society of Chemical Manufacturers & Affiliates (SOCMA) released its 2025 Contract Manufacturing Outlook Report, highlighting how specialty chemical manufacturers are adapting and strengthening their operations while navigating economic pressures and market challenges. The report emphasizes the industry's strategic resilience amid economic and market pressures, showcasing the sector's ability to innovate and maintain operations despite external challenges

- In August 2025, BCC Research reported that the global contract manufacturing market is on track to reach USD 968.7 billion by 2030. The report offers a detailed look at the contract manufacturing market, analyzing it by contract type, distribution channel, and end-use industry. It explores technological developments, regulatory factors, and competitive dynamics, along with economic trends influencing the market

- In August 2025, T1 Energy and Corning signed an agreement to create a fully domestic solar supply chain in the United States, encompassing the production of polysilicon, wafers, solar cells, and panels. This initiative aligns with the "One Big Beautiful Bill Act" under President Donald Trump, which mandates that solar projects contain minimal materials from foreign entities of concern, such as China, to qualify for federal clean energy tax credits. Corning will begin supplying solar wafers from its Michigan factory in the latter half of 2026, supporting T1's cell production in Austin, Texas, and panel assembly near Dallas. The deal is set to boost U.S. energy security, reduce dependence on Chinese supply chains, and create approximately 6,000 jobs across Michigan and Texas

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.