Global Controlled Substance Api C Ii To C

Market Size in USD Million

CAGR :

%

USD

396.00 Million

USD

792.10 Million

2025

2033

USD

396.00 Million

USD

792.10 Million

2025

2033

| 2026 –2033 | |

| USD 396.00 Million | |

| USD 792.10 Million | |

|

|

|

|

Controlled Substance API (C-II to C-V) Market Size

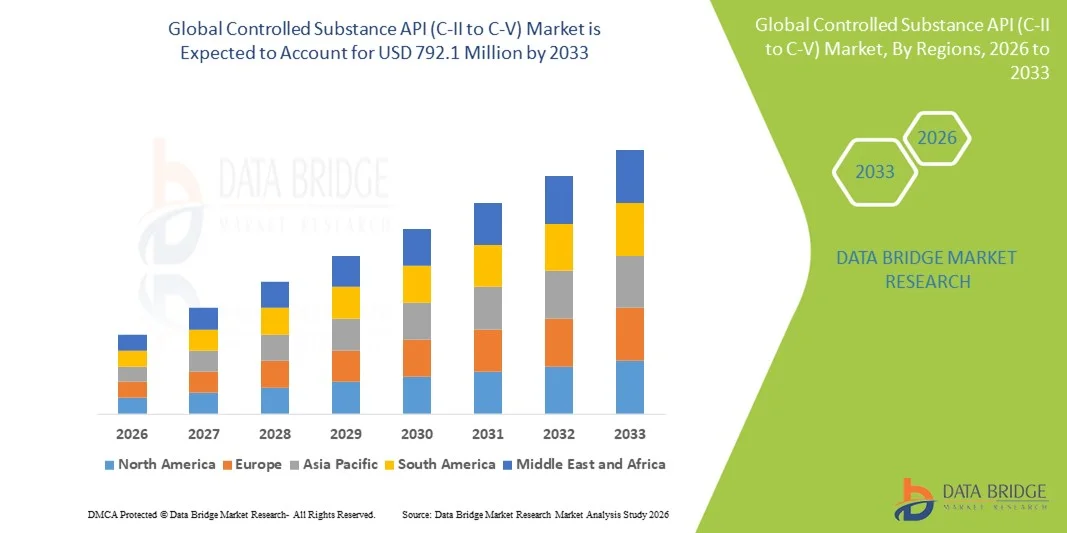

- The global Controlled Substance API (C-II to C-V) market size was valued at USD 396 Million in 2025 and is expected to reach USD 792.1 Million by 2033, at a CAGR of 9.10% during the forecast period

- The market growth is largely fueled by the growing demand for regulated and high-quality active pharmaceutical ingredients (APIs) in the manufacture of controlled substances (C-II to C-V), coupled with increasing adoption of advanced manufacturing technologies and stringent quality standards across pharmaceutical production facilities

- Furthermore, rising regulatory compliance requirements, growing prevalence of chronic diseases, and increasing need for secure, reliable, and standardized APIs are establishing Controlled Substance APIs (C-II to C-V) as critical components in pharmaceutical manufacturing. These converging factors are accelerating the uptake of Controlled Substance API (C-II to C-V) solutions, thereby significantly boosting the industry's growth

Controlled Substance API (C-II to C-V) Market Analysis

- Ultrasound stimulators, offering non‑invasive therapeutic solutions for pain management, rehabilitation, and physiotherapy, are increasingly vital components of modern healthcare and homecare settings due to their enhanced convenience, ease of use, portability, and effectiveness in improving patient outcomes. *(Note: this line appears to be a leftover from your prior instructions and should be replaced — see the next two bullets for Controlled Substance API framing below)

- The escalating demand for controlled substance APIs (C‑II to C‑V) is primarily fueled by rising prevalence of chronic pain, neurological disorders, and other conditions requiring specialized medications, coupled with increasing focus on secure, high‑quality API production and compliance with stringent regulatory standards that ensure safety and efficacy

- North America dominated the controlled substance API (C‑II to C‑V) market with the largest revenue share of approximately 38.5% in 2025, driven by advanced pharmaceutical infrastructure, robust regulatory frameworks, high demand for pain management and specialty therapies, and significant presence of key pharmaceutical manufacturers

- Asia‑Pacific is expected to be the fastest‑growing region in the controlled substance API (C‑II to C‑V) market during the forecast period due to increasing healthcare investments, expanding API manufacturing capabilities in China and India, supportive government policies, and growing demand for controlled therapeutic drugs

- The Prescription Medications segment held the largest revenue share of 53.6% in 2025, driven by increasing chronic disease prevalence, post-operative pain management, and growing pharmaceutical production globally

Report Scope and Controlled Substance API (C-II to C-V) Market Segmentation

|

Attributes |

Controlled Substance API (C-II to C-V) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

|

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Controlled Substance API (C-II to C-V) Market Trends

Increasing Focus on Safe Handling, Compliance, and Digital Supply Chain Integration

- A significant and accelerating trend in the global controlled substance API (C-II to C-V) market is the growing adoption of digitally integrated supply chains and compliance monitoring tools, which improve tracking, reduce diversion risk, and support regulatory adherence across manufacturers, distributors, and healthcare facilities

- For instance, in May 2023, Mallinckrodt Pharmaceuticals implemented a blockchain-enabled tracking system for select controlled substance APIs, providing real-time visibility across production, distribution, and hospital administration. This enhanced compliance and reduced risk of misuse

- The integration of digital quality control platforms and serialization systems is enabling manufacturers to monitor batch integrity, reduce counterfeiting, and ensure traceability from raw material sourcing to finished pharmaceutical products

- Healthcare providers and distributors are increasingly using centralized inventory management systems that link with regulatory reporting platforms, allowing real-time tracking of API utilization and automated compliance notifications

- Cloud-based systems and AI-assisted analytics are slowly being adopted to predict demand trends, optimize inventory, and reduce shortages or overproduction in controlled substance APIs

- This trend is fundamentally reshaping industry expectations for transparency, safety, and operational efficiency, making digitally monitored and fully traceable API supply chains a standard expectation in the market

Controlled Substance API (C-II to C-V) Market Dynamics

Driver

Rising Demand Due to Increasing Prevalence of Chronic Pain and Opioid Therapy Needs

- The global Controlled Substance API market is being driven by the increasing prevalence of chronic pain, cancer, and other conditions that require regulated opioid or non-opioid therapy. Rising incidence of these diseases is prompting healthcare providers to expand their use of controlled substance APIs in formulations and treatment plans

- For instance, in February 2024, Purdue Pharma expanded its Oxycodone API production capacity in response to rising prescriptions for pain management in North America, highlighting how manufacturers are scaling output to meet growing therapeutic needs

- Hospitals and clinics are increasingly stocking formulations derived from C-II to C-V APIs to manage postoperative pain, palliative care, and severe chronic pain, increasing the overall market demand

- Pharmaceutical companies are focusing on new formulations, controlled-release tablets, and combination therapies to improve patient compliance and reduce misuse, which further boosts demand for APIs

- The rising awareness among clinicians about the efficacy of controlled substances in targeted therapies is driving more regulated use, especially in emerging economies with expanding healthcare access

- The combination of higher patient population, expanding healthcare infrastructure, and evolving therapeutic guidelines is supporting sustained growth in the production and distribution of C-II to C-V APIs globally

Restraint/Challenge

Strict Regulatory Oversight and High Compliance Costs

- A significant restraint on market growth is the highly regulated environment surrounding controlled substance APIs, including DEA scheduling, quotas, and strict licensing requirements, which create operational and administrative challenges for manufacturers

- For instance, in September 2022, a mid-sized U.S. API manufacturer temporarily halted production after failing to meet updated DEA reporting requirements for Schedule II APIs, demonstrating how regulatory challenges can directly disrupt supply chains and business operations

- Compliance costs, including software, audits, and specialized personnel, increase production overhead and can limit entry for smaller companies or startups

- Frequent inspections and documentation requirements by multiple regulatory agencies demand continuous investment in quality management systems and staff training

- Variability in regulations across countries complicates export and international supply, requiring additional compliance measures and approvals for each market

- Addressing these regulatory and operational challenges is essential for sustainable growth, and manufacturers are investing in automated reporting, compliance training, and digital monitoring to streamline adherence and reduce risk

Controlled Substance API (C-II to C-V) Market Scope

The market is segmented on the basis of drug type and application.

- By Drug Type

On the basis of drug type, the Controlled Substance API (C-II to C-V) market is segmented into Opioids, Stimulants, Sedatives & Hypnotics, and Others. The Opioids segment dominated the market with a revenue share of 42.5% in 2025, driven by the rising prevalence of chronic pain, surgical procedures, and palliative care requirements across North America and Europe. Hospitals, clinics, and pharmaceutical manufacturers increasingly rely on high-quality opioid APIs for formulation of prescription medications and patient-centric therapies. Government approvals and regulatory guidelines for opioid production ensure safe, consistent supply, fostering market stability. Strong demand is supported by the growth of the pain management sector, coupled with increasing investments in drug development programs. Expansion of healthcare infrastructure in emerging markets has boosted access to opioid-based therapies. Research & development initiatives targeting improved formulations and controlled-release products further drive demand. Prescription medication applications dominate opioid usage, particularly in chronic and post-operative care. Hospitals favor opioids for patient safety, efficacy, and compliance with clinical standards. Clinical trials and pharmaceutical research contribute to recurring consumption. Integration with emerging smart delivery systems, such as personalized dosing, strengthens adoption. The high therapeutic efficacy and essential role in healthcare maintain the segment’s leading position.

The Stimulants segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, fueled by increasing use in attention-deficit hyperactivity disorder (ADHD) treatments, narcolepsy management, and neurological research. Pharmaceutical companies are investing heavily in stimulant APIs to meet the growing prescription demand in North America, Europe, and Asia-Pacific. Rising awareness among healthcare professionals and patients regarding therapeutic benefits supports adoption. Research institutions are using stimulants in clinical trials for neurological and cognitive disorder therapies. Expansion of mental health programs and government-backed healthcare initiatives enhances market penetration. Stimulant APIs are also increasingly used in hospital and clinical settings for specialized treatments. Technological innovations in controlled-release and formulation precision improve safety and efficacy. Emerging markets, especially in Asia-Pacific, are witnessing accelerated uptake due to increased healthcare access and awareness. Academic research and pharmaceutical R&D pipelines drive recurring consumption. The segment benefits from regulatory approvals for safe production and distribution. Growing prevalence of ADHD and related disorders globally ensures sustained market demand. Enhanced monitoring, dosage management, and compliance systems reinforce the segment’s rapid growth.

- By Application

On the basis of application, the Controlled Substance API (C-II to C-V) market is segmented into Prescription Medications, Research & Development, and Hospital and Clinical Use. The Prescription Medications segment held the largest revenue share of 53.6% in 2025, driven by increasing chronic disease prevalence, post-operative pain management, and growing pharmaceutical production globally. Pharmaceutical manufacturers prioritize high-quality Controlled Substance APIs to ensure safety, efficacy, and compliance with regulatory standards. Rising demand for opioids, sedatives, and stimulants in prescription drugs fuels market growth. Expansion of healthcare infrastructure in emerging regions increases accessibility to prescription medications. Government initiatives for safe controlled substance management and patient safety programs further support adoption. Hospitals, clinics, and specialty pharmacies are significant end-users, emphasizing quality and consistency. Research & development programs in the pharmaceutical industry reinforce recurring API consumption. Increasing awareness about controlled medications, alongside rising geriatric populations, drives higher demand. Innovative formulations, such as extended-release and combination therapies, enhance market appeal. Digital prescription tracking and smart dispensing systems improve compliance. The recurring requirement for prescription medications ensures the dominance of this segment.

The Research & Development segment is projected to witness the fastest CAGR of 19.5% from 2026 to 2033, propelled by rising investment in clinical trials, novel drug formulations, and biopharmaceutical innovations. Pharmaceutical companies and research institutions are increasingly focusing on developing improved therapies for pain, neurological disorders, and sedation, boosting API demand. Growth is supported by government and private funding for innovative drug discovery. Academic institutions are also driving adoption through experimental studies on controlled substances. Expansion in emerging markets provides affordable access to raw APIs for R&D applications. Pharmaceutical R&D pipelines require consistent, high-quality APIs to ensure reproducibility and compliance. Technological advancements in synthetic APIs and formulation research enhance efficiency. Regulatory approvals for safe R&D usage encourage industry participation. Collaborations between biotech firms and universities further accelerate growth. Increased focus on personalized medicine and targeted therapies increases demand for experimental APIs. The segment’s recurring need for laboratory and preclinical testing strengthens its fastest-growing status.

Controlled Substance API (C-II to C-V) Market Regional Analysis

- North America dominated the controlled substance API (C-II to C-V) market with the largest revenue share of approximately 38.5% in 2025

- Driven by advanced pharmaceutical infrastructure, robust regulatory frameworks, high demand for pain management and specialty therapies

- Significant presence of key pharmaceutical manufacturers

U.S. Controlled Substance API (C-II to C-V) Market Insight

The U.S. controlled substance API (C-II to C-V) market captured the largest share within North America, fueled by rising prevalence of chronic diseases, increasing healthcare spending, and strong adoption of controlled therapeutic drugs. The emphasis on high-quality, secure, and compliant APIs, combined with significant R&D investments by pharmaceutical companies, is driving the expansion of controlled substance API production and utilization across hospitals, specialty clinics, and manufacturing facilities.

Europe Controlled Substance API (C-II to C-V) Market Insight

The Europe controlled substance API (C-II to C-V) market is projected to expand at a substantial CAGR, supported by stringent regulatory oversight, growing prevalence of chronic diseases, and demand for high-quality APIs. Countries such as the U.K. and Germany are witnessing increased adoption of controlled therapeutic drugs, with healthcare providers and pharmaceutical manufacturers emphasizing safety, compliance, and efficacy in API sourcing and utilization.

U.K. Controlled Substance API (C-II to C-V) Market Insight

The U.K. controlled substance API (C-II to C-V) market is expected to grow steadily during the forecast period due to increasing demand for specialty therapies, strict regulatory compliance, and rising awareness about pain management and neurological disorder treatments. Pharmaceutical manufacturers are focusing on secure, high-quality APIs to meet both domestic demand and export opportunities.

Germany Controlled Substance API (C-II to C-V) Market Insight

Germany controlled substance API (C-II to C-V) market is anticipated to expand at a considerable CAGR, driven by high regulatory standards, adoption of controlled therapeutic drugs, and the presence of established pharmaceutical manufacturers. The country’s focus on innovation, patient safety, and quality compliance continues to support market growth.

Asia-Pacific Controlled Substance API (C-II to C-V) Market Insight

Asia-Pacific controlled substance API (C-II to C-V) market is expected to be the fastest-growing region during the forecast period, propelled by increasing healthcare investments, expanding API manufacturing capabilities in China and India, supportive government policies, and growing demand for controlled therapeutic drugs. Rising chronic disease prevalence, expanding middle-class populations, and improving healthcare infrastructure are accelerating adoption across hospitals, clinics, and pharmaceutical manufacturers.

Japan Controlled Substance API (C-II to C-V) Market Insight

Japan controlled substance API (C-II to C-V) market is gaining momentum due to rising demand for specialty therapies, advanced healthcare infrastructure, and strong regulatory oversight. Focus on quality and safety in pharmaceutical manufacturing is driving the adoption of high-quality APIs for controlled substances in hospitals, clinics, and research facilities.

China Controlled Substance API (C-II to C-V) Market Insight

China controlled substance API (C-II to C-V) market accounted for the largest revenue share in Asia-Pacific in 2025, driven by expanding healthcare infrastructure, growing demand for specialty drugs, and increasing domestic API manufacturing capabilities. Government support, regulatory reforms, and rising prevalence of chronic diseases are further accelerating adoption of Controlled Substance APIs (C-II to C-V) across hospitals, clinics, and pharmaceutical production units.

Controlled Substance API (C-II to C-V) Market Share

The Controlled Substance API (C-II to C-V) industry is primarily led by well-established companies, including:

• Mallinckrodt Pharmaceuticals (U.S.)

• Teva Pharmaceutical Industries (Israel)

• Pfizer (U.S.)

• Johnson & Johnson (U.S.)

• Hikma Pharmaceuticals (U.K.)

• Catalent (U.S.)

• Cambrex Corporation (U.S.)

• Patheon (U.S.)

• Recipharm (Sweden)

• Aurobindo Pharma (India)

• Jubilant Life Sciences (India)

• Sandoz (Switzerland)

• Hetero Drugs (India)

• Cipla (India)

• Lannett Company (U.S.)

• Amneal Pharmaceuticals (U.S.)

• WuXi AppTec (China)

• Fagron (Netherlands)

• Alcami Corporation (U.S.)

Latest Developments in Global Controlled Substance API (C-II to C-V) Market

- In February 2023, Piramal Pharma Solutions initiated production at its new API facility in Riverview, Michigan, marking completion of “Project PRIME Phase 1” with a US$38 million investment, significantly enhancing API manufacturing capacity in the United States, including APIs used in controlled drug supply chains

- In April 2023, Aurobindo Pharma approved the transfer of two API units (Unit V and Unit XVII) to its fully owned subsidiary Apitoria Pharma Pvt. Ltd., consolidating API operations to streamline production and regulatory compliance for future API supply — including controlled APIs — across markets

- In October 2023, Egis Pharmaceuticals expanded operations in Hungary with an investment of 100 billion HUF, boosting its drug substance contract development and manufacturing services, including capacity that supports active pharmaceutical ingredients for regulated therapeutic categories

- In November 2024, the API Innovation Center (APIIC) announced a National Fragility Index project aimed at identifying critical vulnerabilities in U.S. generic drug and API supply, including controlled substance APIs, signaling stronger strategic focus on supply chain resilience

- In April, 2025, the U.S. Drug Enforcement Administration (DEA) delayed the effective date of two final rules expanding telemedicine access for buprenorphine treatment and continuity of care for Veterans Affairs patients — policies that influence prescribing and distribution of certain controlled substance medications and the APIs that support them — extending current flexibilities through December 31, 2025

- In May 2025, **Dr. Reddy’s Laboratories’ active pharmaceutical ingredient (API) manufacturing facility in Middleburgh, New York received two US FDA Form 483 observations, indicating regulatory issues that require corrective action — a noteworthy development in API quality oversight including APIs for controlled substances

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.