Global Converged Cable Access Platform Ccap Market

Market Size in USD Billion

CAGR :

%

USD

7.32 Billion

USD

14.69 Billion

2024

2032

USD

7.32 Billion

USD

14.69 Billion

2024

2032

| 2025 –2032 | |

| USD 7.32 Billion | |

| USD 14.69 Billion | |

|

|

|

|

Converged Cable Access Platform (CCAP) Market Size

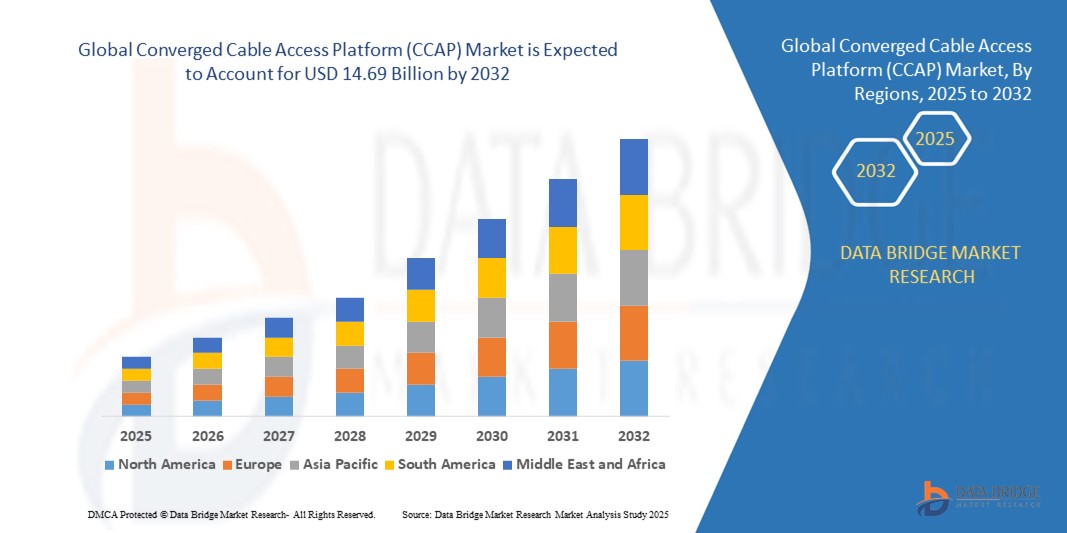

- The global converged cable access platform (CCAP) market size was valued at USD 7.32 billion in 2024 and is expected to reach USD 14.69 billion by 2032, at a CAGR of 9.10% during the forecast period

- The market growth is largely fuelled by the rising demand for high-speed broadband, increasing deployment of hybrid fiber-coaxial (HFC) networks, and the need for scalable, flexible, and cost-efficient network infrastructure to support growing digital content consumption

- Continuous advancements in DOCSIS (Data Over Cable Service Interface Specification) technologies, increasing adoption of video-on-demand services, and growing investments by cable operators in network modernization further propel market expansion

Converged Cable Access Platform (CCAP) Market Analysis

- The CCAP market is witnessing a significant shift toward virtualized and modular architectures, allowing cable operators to streamline network management, reduce operational costs, and improve service agility

- Growing consumer demand for high-definition video streaming, online gaming, and smart home services is driving cable operators to upgrade existing infrastructure with CCAP solutions capable of delivering higher bandwidth and enhanced quality of service

- North America dominated the CCAP market with the largest revenue share of 38.5% in 2024, driven by the rising demand for high-speed broadband, digital TV services, and advanced cable infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global converged cable access platform (CCAP) market, driven by expanding internet user base, rising demand for high-definition and 4K content, and ongoing investments in modern cable infrastructure across countries such as India, China, and Japan

- The CCAP segment held the largest market revenue share in 2024, driven by the increasing adoption of integrated solutions that combine CMTS and Edge QAM functionalities. CCAP platforms offer enhanced network efficiency, lower operational complexity, and faster data delivery, making them highly preferred by cable operators seeking to upgrade their broadband infrastructure

Report Scope and Converged Cable Access Platform (CCAP) Market Segmentation

|

Attributes |

Converged Cable Access Platform (CCAP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Demand For High-Speed Broadband And Advanced Cable Services |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Converged Cable Access Platform (CCAP) Market Trends

Increasing Adoption of Virtualized and Modular CCAP Architectures

• The rapid shift toward virtualized CCAP (vCCAP) and modular architectures is transforming the cable access landscape by enabling operators to manage network traffic more efficiently and deploy services with lower operational complexity. These platforms allow real-time monitoring and bandwidth allocation, improving service reliability and reducing latency across broadband networks

• Rising demand for high-speed data and broadband connectivity in residential, commercial, and enterprise sectors is accelerating the adoption of advanced CCAP solutions. Operators are increasingly deploying modular CCAP platforms to scale network capacity flexibly while supporting a variety of video, voice, and data service

• The cost efficiency, interoperability, and energy-saving features of modern CCAP systems are making them attractive for network operators seeking to optimize infrastructure investments. Operators benefit from reduced maintenance costs, simplified network upgrades, and enhanced service delivery

• For instance, in 2023, several North American cable service providers upgraded their legacy CCAP systems to virtualized architectures, enabling faster rollouts of high-speed internet packages and improved customer satisfaction through reduced downtime

• While CCAP adoption is growing, continuous innovation in software-defined capabilities, integration with cloud-based management systems, and security enhancements will be crucial to fully capitalize on the market potential

Converged Cable Access Platform (CCAP) Market Dynamics

Driver

Rising Demand For High-Speed Broadband And Advanced Cable Services

• The global surge in broadband traffic due to OTT video streaming, cloud computing, and remote working is pushing cable operators to adopt high-performance CCAP solutions. These platforms enable faster data delivery and better quality of service across large subscriber bases. In addition, rising consumer expectations for uninterrupted streaming and gaming experiences are compelling operators to upgrade their network infrastructure to meet demand efficiently

• Increasing deployment of digital services, including IPTV, VoIP, and interactive applications, is fueling the demand for flexible and scalable CCAP architectures. Operators can meet growing customer expectations while maintaining network efficiency and reducing operational complexity. Furthermore, the need for seamless multi-device connectivity in smart homes and businesses is driving investments in modular and cloud-enabled CCAP systems

• Government and regulatory support for next-generation broadband infrastructure in developed and developing regions is accelerating the adoption of modern CCAP platforms. Funding and policy initiatives for enhanced digital connectivity drive investments in high-capacity network upgrades. Such initiatives also encourage public-private partnerships for nationwide broadband expansion, boosting the adoption of advanced CCAP technologies

• For instance, in 2022, major European operators launched modular CCAP deployments to accommodate increasing HD and 4K content streaming demands, improving subscriber retention and enabling future-ready networks. This upgrade also allowed operators to efficiently manage network congestion and prepare for the rollout of 8K streaming and interactive media services in the future

• While network demand continues to rise, operators must focus on security, interoperability, and backward compatibility with legacy systems to ensure smooth deployment and sustained adoption. In addition, they must invest in monitoring tools and predictive analytics to optimize network performance and proactively address potential service disruptions

Restraint/Challenge

High Initial Investment And Integration Complexity

• The significant capital expenditure required for advanced CCAP systems, including hardware, software, and integration costs, poses challenges for small- and mid-sized cable operators. High initial investments can delay adoption despite long-term operational benefits. Moreover, fluctuating component costs and supply chain constraints can further impact project budgets and timelines

• Integration with legacy networks and heterogeneous infrastructure remains a critical challenge, as operators must maintain service continuity while upgrading to next-generation CCAP platforms. This can result in increased deployment time and operational risks. The complexity is compounded when integrating with multi-vendor systems, requiring extensive testing and validation to avoid service outages

• Limited availability of skilled personnel for configuring, maintaining, and managing CCAP systems in some regions further restricts adoption. Training and technical support are essential to ensure smooth network operations and reduce downtime. Operators also face challenges in retaining qualified engineers amid increasing demand for network modernization across the telecom sector

• For instance, in 2023, several cable operators in Asia-Pacific faced delays in virtualized CCAP rollouts due to compatibility issues with existing HFC (hybrid fiber-coaxial) networks, highlighting the need for careful planning and phased implementation. These delays also impacted service expansion plans for high-speed broadband packages in key urban and suburban markets

• While CCAP technology continues to evolve, addressing cost, integration, and technical expertise challenges is vital. Vendors and operators must focus on modular designs, cloud-based management, and partner ecosystems to bridge adoption gaps and maximize market potential. In addition, developing standardized frameworks and interoperability protocols can help accelerate adoption and reduce operational complexities

Converged Cable Access Platform (CCAP) Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the CCAP market is segmented into CMTS and CCAP. The CCAP segment held the largest market revenue share in 2024, driven by the increasing adoption of integrated solutions that combine CMTS and Edge QAM functionalities. CCAP platforms offer enhanced network efficiency, lower operational complexity, and faster data delivery, making them highly preferred by cable operators seeking to upgrade their broadband infrastructure.

The CMTS segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing demand for modular CMTS solutions that provide flexibility for incremental network upgrades. CMTS systems are particularly popular for their ability to support high-density subscriber environments and deliver scalable broadband services, serving as a key component in hybrid fiber-coaxial networks.

- By Application

On the basis of application, the CCAP market is segmented into Internet TV and Video on Demand (VoD). The Internet TV segment held the largest market revenue share in 2024, driven by increasing consumer consumption of high-definition and ultra-high-definition content over broadband networks. Internet TV adoption is further accelerated by the proliferation of connected devices and smart TVs, which demand high-performance CCAP platforms to ensure seamless streaming.

The Video on Demand (VoD) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the surging popularity of on-demand video services and subscription-based OTT platforms. CCAP solutions supporting VoD offer better bandwidth management, low latency, and enhanced quality of experience, making them crucial for operators seeking to meet growing content delivery requirements.

Converged Cable Access Platform (CCAP) Market Regional Analysis

- North America dominated the CCAP market with the largest revenue share of 38.5% in 2024, driven by the rising demand for high-speed broadband, digital TV services, and advanced cable infrastructure

- Cable operators in the region are increasingly investing in scalable and modular CCAP solutions to improve network efficiency and support growing subscriber bases

- This adoption is further bolstered by government initiatives promoting next-generation broadband and robust urban infrastructure, establishing CCAP as a key technology for modern cable networks

U.S. Converged Cable Access Platform (CCAP) Market Insight

The U.S. CCAP market captured the largest revenue share in North America in 2024, fueled by the rapid expansion of high-definition and 4K content delivery, IPTV, and video-on-demand services. Operators are focusing on upgrading legacy CMTS networks to CCAP to meet increasing bandwidth requirements and improve service reliability. Moreover, the growing trend of OTT streaming and cloud-based applications is encouraging cable operators to adopt virtualized and software-defined CCAP architectures to enhance scalability, reduce latency, and optimize operational costs.

Europe Converged Cable Access Platform (CCAP) Market Insight

The Europe CCAP market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent regulatory requirements for broadband connectivity and increasing digital content consumption. Rising deployment of fiber-to-the-home (FTTH) networks, coupled with the demand for interactive TV, IPTV, and VoD services, is fostering the adoption of CCAP solutions. European operators are also investing in cloud-based and modular architectures to optimize network performance, reduce maintenance costs, and ensure seamless delivery of next-generation digital services.

U.K. Converged Cable Access Platform (CCAP) Market Insight

The U.K. CCAP market is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for high-speed broadband and the rising adoption of Internet TV and on-demand video services. Cable operators are increasingly replacing traditional CMTS infrastructure with CCAP systems to support higher data throughput and enhanced quality of service. In addition, government initiatives to improve digital infrastructure and investments in smart city projects are further promoting the deployment of advanced CCAP platforms across residential and commercial networks.

Germany Converged Cable Access Platform (CCAP) Market Insight

The Germany CCAP market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing broadband penetration, digital content consumption, and modernization of legacy cable networks. German operators are focusing on deploying high-capacity CCAP systems to support IPTV, VoD, and interactive services while ensuring network reliability and reduced operational complexity. The market is further supported by strong government backing for next-generation network upgrades and the integration of virtualized CCAP solutions to enhance flexibility and reduce CAPEX.

Asia-Pacific Converged Cable Access Platform (CCAP) Market Insight

The Asia-Pacific CCAP market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing broadband adoption, and increasing digital content consumption in countries such as China, Japan, and India. The rising number of Internet TV and VoD subscribers is encouraging operators to upgrade to CCAP systems for scalable, high-performance network delivery. Furthermore, as APAC emerges as a hub for cable equipment manufacturing and technological innovation, affordable and advanced CCAP solutions are becoming widely accessible, promoting adoption across both urban and semi-urban regions.

Japan Converged Cable Access Platform (CCAP) Market Insight

The Japan CCAP market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high demand for advanced digital services, including IPTV and video-on-demand platforms. Operators are increasingly deploying modular CCAP solutions to ensure seamless service delivery, high network reliability, and efficient bandwidth management. In addition, Japan’s aging population and growing preference for home entertainment services are further accelerating the adoption of CCAP systems in residential networks.

China Converged Cable Access Platform (CCAP) Market Insight

The China CCAP market accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to rapid urbanization, expanding broadband infrastructure, and rising digital content consumption. Chinese cable operators are upgrading legacy CMTS networks to CCAP to support high-speed Internet, IPTV, and VoD services for an increasing subscriber base. The government’s push for next-generation broadband, coupled with strong domestic manufacturers providing cost-effective CCAP solutions, is driving widespread adoption across residential, commercial, and enterprise networks.

Converged Cable Access Platform (CCAP) Market Share

The Converged Cable Access Platform (CCAP) industry is primarily led by well-established companies, including:

- Arris (U.S.)

- Cisco (U.S.)

- Casa Systems (U.S.)

- Harmonic (U.S.)

- Nokia (Finland)

- Huawei (China)

- Broadcom (U.S.)

- Juniper (U.S.)

- Chongqing Jinghong (China)

- Blonder Tongue Laboratories (U.S.)

Latest Developments in Global Converged Cable Access Platform (CCAP) Market

- In January 2023, Cisco announced its collaboration with OTEGLOBE. This collaboration aided in increasing the capacity and performance of its network to deliver faster and more efficient connections to its customers with a full-scale, 800G-ready infrastructure. OTEGLOBE deployed new Cisco 8800 series routers powered by Cisco Silicon One to connect more people and businesses across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.