Global Converted Roll Stock Packaging Market

Market Size in USD Billion

CAGR :

%

USD

27.30 Billion

USD

37.94 Billion

2025

2033

USD

27.30 Billion

USD

37.94 Billion

2025

2033

| 2026 –2033 | |

| USD 27.30 Billion | |

| USD 37.94 Billion | |

|

|

|

|

Converted Roll Stock Packaging Market Size

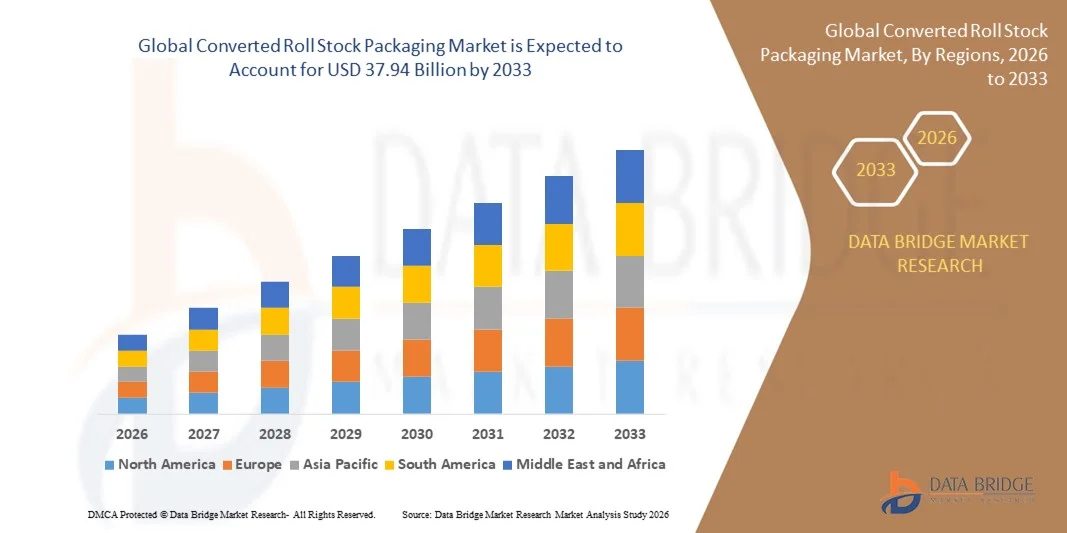

- The global converted roll stock packaging market size was valued at USD 27.30 billion in 2025 and is expected to reach USD 37.94 billion by 2033, at a CAGR of 4.20% during the forecast period

- The market growth is largely fuelled by the rising adoption of flexible packaging formats across FMCG, pharmaceuticals, and food industries due to their efficiency and cost-effectiveness

- Growing demand for high-barrier packaging solutions that enhance product shelf life across perishables and sensitive products is further driving market expansion

Converted Roll Stock Packaging Market Analysis

- The market is witnessing steady growth due to the shift from rigid to flexible packaging across various end-use industries, driven by convenience, reduced material usage, and lower transportation costs

- Advancements in printing technologies such as digital and flexographic printing are enhancing customization, branding capabilities, and visual appeal, supporting widespread adoption

- North America dominated the converted roll stock packaging market with the largest revenue share in 2025, driven by strong demand for flexible packaging solutions across food, beverage, personal care, and pharmaceutical industries. The region’s mature packaging ecosystem, coupled with advanced manufacturing capabilities and early adoption of innovative materials, continues to support market expansion

- Asia-Pacific region is expected to witness the highest growth rate in the global converted roll stock packaging market, driven by booming e-commerce activity, rising disposable incomes, and accelerated adoption of flexible packaging across food, pharma, and personal care sectors

- The plastic segment held the largest market revenue share in 2025, driven by its versatility, cost-effectiveness, and suitability for high-speed packaging operations across major industries. Plastic films offer strong barrier properties, lightweight structure, and excellent printability, making them the preferred choice for flexible packaging manufacturers

Report Scope and Converted Roll Stock Packaging Market Segmentation

|

Attributes |

Converted Roll Stock Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Berry Global Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Converted Roll Stock Packaging Market Trends

Shift Toward Sustainable And Eco-Friendly Packaging Materials

- The increasing shift toward environmentally responsible packaging solutions is reshaping the converted roll stock packaging market, driven by rising regulatory pressure and consumer preference for recyclable, biodegradable, and low-carbon materials. Brands across FMCG and food sectors are moving toward compostable and bio-based films to reduce environmental impact while maintaining product integrity. This transition is further supported by growing awareness of waste reduction goals and corporate sustainability commitments

- Growing adoption of recyclable mono-material roll stock formats is supporting circular economy initiatives. Manufacturers are focusing on developing high-barrier yet sustainable alternatives to multi-layer plastics, enabling easier recycling and improved compatibility with existing waste-management systems. Increased investments in recycling infrastructure and material innovation are helping accelerate the commercialization of these eco-friendly formats

- The cost-efficiency and versatility of eco-friendly roll stock materials are making them increasingly viable for mass-market applications, encouraging wider integration across personal care, household products, and pharmaceuticals. Their compatibility with high-speed packaging machinery and reduced environmental footprint are attracting long-term interest from major brands. These materials also support lightweighting strategies, which help reduce shipping emissions and operational costs

- For instance, in 2024, several global food brands transitioned to recyclable polyethylene-based roll stock films for snack and confectionery packaging, reducing material waste and enhancing brand sustainability positioning. These innovations contributed to lower carbon footprints and optimized packaging performance. The move also encouraged suppliers to expand their portfolios of recyclable films to meet rising commercial demand

- While sustainability-driven innovations are strengthening market demand, long-term growth relies on continued advancements in recyclable materials, improved barrier properties, and broader manufacturing adoption to ensure cost competitiveness and large-scale feasibility. Collaboration between material scientists, converters, and brand owners will be essential for overcoming technical and cost-related challenges. Regulatory support and consumer-driven market pressure will further shape innovation priorities

Converted Roll Stock Packaging Market Dynamics

Driver

Growing Demand For Flexible Packaging Across Consumer Goods Industries

- The rising preference for flexible packaging across food, beverage, pharmaceutical, and personal care sectors is significantly boosting demand for converted roll stock formats. Their lightweight structure, superior printability, and reduced material consumption make them an attractive alternative to rigid packaging. Growing e-commerce activity is also increasing demand for durable, lightweight packaging materials that improve logistics efficiency

- Manufacturers are increasingly adopting roll stock solutions to enhance operational efficiency, reduce transportation costs, and support high-speed packaging lines. The shift is driven by the need for cost-effective packaging solutions that offer durability, convenience, and enhanced product presentation. This transition enables companies to achieve higher output rates while maintaining consistent quality

- Industry initiatives promoting sustainable, space-saving, and customizable packaging are further accelerating adoption. Continuous technological advancements in barrier coatings and film processing are enabling improved shelf-life performance and better protection for perishable products. Enhanced printing technologies such as digital and flexographic systems are also giving brands greater flexibility in creating impactful, high-quality designs

- For instance, in 2023, major snack manufacturers in Europe and Asia enhanced production throughput by switching to high-performance roll stock materials optimized for automated packaging systems, resulting in reduced downtime and improved product consistency. These materials also supported better heat-sealing efficiency, contributing to lower operational costs. The shift encouraged other manufacturers to upgrade their machinery and materials to stay competitive

- Although rising demand is driving market expansion, manufacturers must continue innovating in barrier technology, sustainability, and cost optimization to meet evolving end-user expectations and regulatory requirements. Increased pressure to minimize plastic waste is pushing producers to develop recyclable and compostable alternatives. Investment in advanced material research will play a critical role in addressing future market challenges

Restraint/Challenge

Volatility In Raw Material Prices And Dependence On Petrochemical-Based Films

- Frequent fluctuations in prices of raw materials such as polyethylene, polypropylene, and other petrochemical-derived resins pose a significant challenge for manufacturers, directly impacting production costs and profit margins. These fluctuations are often influenced by geopolitical tensions, crude oil supply disruptions, and global economic uncertainties. As a result, companies face difficulties in maintaining stable pricing for customers

- Heavy reliance on petroleum-based substrates limits price stability and complicates long-term procurement strategies. Manufacturers face uncertainty in material availability, particularly during periods of global supply chain disruptions or energy market instability. This dependence also exposes producers to sudden market shocks that can disrupt production schedules and increase operational risks

- Small and mid-sized converters are especially affected, as rapid changes in resin prices can hinder production planning and reduce competitiveness in cost-sensitive markets. These companies often lack the financial buffer to absorb sharp cost increases, forcing them to scale back production or seek alternative suppliers. Such challenges can negatively impact product consistency and customer relationships

- For instance, in 2023, several packaging producers in North America reported operational disruptions and increased unit costs due to sudden spikes in resin prices triggered by feedstock shortages and refinery outages. These disruptions affected supply availability and extended lead times across multiple product categories. The instability also influenced long-term contract negotiations between suppliers and converters

- While alternative materials and recycling initiatives are gaining traction, achieving stable material supply and minimizing cost volatility remain essential challenges for sustained market growth. Industry stakeholders are increasingly exploring bio-based films and recycled resins to reduce petrochemical dependence. Strengthening material diversification strategies will be crucial for improving market resilience in the years ahead

Converted Roll Stock Packaging Market Scope

The market is segmented on the basis of material, technology, and application

- By Material

On the basis of material, the converted roll stock packaging market is segmented into plastic, aluminum foil, and others. The plastic segment held the largest market revenue share in 2025, driven by its versatility, cost-effectiveness, and suitability for high-speed packaging operations across major industries. Plastic films offer strong barrier properties, lightweight structure, and excellent printability, making them the preferred choice for flexible packaging manufacturers.

The aluminum foil segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising demand for high-barrier packaging that protects products against moisture, oxygen, and light. Aluminum foil roll stock is increasingly adopted for premium food, pharmaceutical, and nutraceutical applications due to its extended shelf-life benefits and superior product safety performance.

- By Technology

On the basis of technology, the converted roll stock packaging market is segmented into flexography, rotogravure, digital printing, and others. The flexography segment held the largest market revenue share in 2025 owing to its efficiency in large-volume printing, adaptability to various substrates, and cost-effective production for high-speed packaging lines. Flexographic printing continues to be favored for its consistency, durability, and suitability for mass-market packaging applications.

The digital printing segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for customization, short-run production, and quick turnaround times. Digital printing enables high-resolution graphics, variable data printing, and rapid design changes, making it ideal for promotional packaging and brand differentiation strategies.

- By Application

On the basis of application, the converted roll stock packaging market is segmented into food, beverage, pharma & health care, personal care & cosmetics, and others. The food segment held the largest market revenue share in 2025 due to rising consumption of packaged and ready-to-eat products that require efficient, lightweight, and high-barrier packaging formats. Roll stock materials are widely used for snacks, bakery, confectionery, and frozen foods, supporting large-scale commercial adoption.

The pharma & health care segment is expected to witness the fastest growth rate from 2026 to 2033, supported by growing demand for safe, contamination-resistant, and regulatory-compliant packaging solutions. Increasing production of medicines, supplements, and medical supplies is boosting the use of high-barrier roll stock films that offer durability, product integrity, and extended shelf stability.

Converted Roll Stock Packaging Market Regional Analysis

- North America dominated the converted roll stock packaging market with the largest revenue share in 2025, driven by strong demand for flexible packaging solutions across food, beverage, personal care, and pharmaceutical industries. The region’s mature packaging ecosystem, coupled with advanced manufacturing capabilities and early adoption of innovative materials, continues to support market expansion.

- Consumers and brands in North America increasingly prefer lightweight, cost-efficient, and sustainable packaging formats, boosting the use of recyclable and high-barrier roll stock materials.

- The region’s focus on reducing packaging waste, improving shelf-life performance, and enhancing supply-chain efficiency has further encouraged manufacturers to invest in advanced roll stock technologies, reinforcing North America’s leading position in the global market

U.S. Converted Roll Stock Packaging Market Insight

The U.S. converted roll stock packaging market captured the largest revenue share in 2025 within North America, fuelled by the widespread use of flexible packaging across major industries and the rapid shift toward sustainable materials. Strong consumer demand for convenient, portable, and longer-lasting packaged products is encouraging brands to adopt high-quality roll stock films. Moreover, advancements in digital printing, recyclable mono-material structures, and high-barrier laminates are significantly contributing to market growth. The increasing integration of automation across packaging lines and rising e-commerce activities further strengthen the adoption of roll stock formats across the U.S.

Europe Converted Roll Stock Packaging Market Insight

The Europe converted roll stock packaging market is expected to witness the fastest growth rate from 2026 to 2033, supported by stringent environmental regulations and a strong regional commitment to sustainable packaging. Growing demand for recyclable, compostable, and low-carbon materials is driving manufacturers to innovate in eco-friendly roll stock solutions. The region’s rising adoption of flexible packaging across food, healthcare, and household products is strengthening market expansion. In addition, ongoing investments in advanced printing and converting technologies are enhancing product quality, efficiency, and customization across European markets.

U.K. Converted Roll Stock Packaging Market Insight

The U.K. converted roll stock packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing sustainability mandates, growing consumer preference for recyclable packaging, and rapid expansion in food and personal care sectors. Rising concerns related to plastic waste, along with national recycling targets, are encouraging companies to transition toward mono-material films and eco-friendly structures. The U.K.’s strong retail infrastructure and focus on modern packaging trends further support the adoption of high-performance roll stock formats.

Germany Converted Roll Stock Packaging Market Insight

The Germany converted roll stock packaging market is expected to witness the fastest growth rate from 2026 to 2033, propelled by the country’s advanced manufacturing base, strong sustainability focus, and rising adoption of high-barrier flexible packaging. Germany’s emphasis on innovation, energy efficiency, and eco-friendly materials is encouraging widespread use of recyclable and bio-based roll stock options. The integration of smart manufacturing technologies and the expanding demand for premium packaged goods are also accelerating market growth.

Asia-Pacific Converted Roll Stock Packaging Market Insight

The Asia-Pacific converted roll stock packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, increasing disposable incomes, and growing consumption of packaged foods and personal care products. Countries such as China, India, and Japan are experiencing strong demand for flexible packaging solutions due to expanding retail sectors and a rising preference for convenient, lightweight packaging. Government initiatives supporting manufacturing modernization and sustainability are further amplifying market growth across the region.

Japan Converted Roll Stock Packaging Market Insight

The Japan converted roll stock packaging market is expected to witness the fastest growth rate from 2026 to 2033 owing to the country’s strong technological orientation, rising demand for compact packaging, and growing interest in eco-friendly materials. High adoption of automation, coupled with Japan’s preference for high-quality, precision-engineered packaging, is driving the use of advanced roll stock films. In addition, demographic shifts and increased packaged food consumption are contributing to heightened demand for safe, hygienic, and sustainable flexible packaging solutions.

China Converted Roll Stock Packaging Market Insight

The China converted roll stock packaging market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid urbanization, strong manufacturing capabilities, and increasing consumer preference for packaged and branded products. China’s large-scale production environment, combined with its leadership in flexible packaging manufacturing, positions it as a major contributor to regional and global market growth. The expansion of e-commerce, rising demand for convenience foods, and government-driven sustainability initiatives are further propelling the adoption of converted roll stock materials across the country.

Converted Roll Stock Packaging Market Share

The Converted Roll Stock Packaging industry is primarily led by well-established companies, including:

• Berry Global Inc. (U.S.)

• Amcor plc (Switzerland)

• Mondi plc (U.K.)

• Constantia Flexibles (Austria)

• Sonoco Products Company (U.S.)

• Sealed Air (U.S.)

• Huhtamaki Oyj (Finland)

• Coveris (Austria)

• CLONDALKIN GROUP (Netherlands)

• Transcontinental Inc. (Canada)

• Novolex (U.S.)

• Bischof + Klein SE & Co. KG (Germany)

• UFlex Limited (India)

• ProAmpac (U.S.)

• Aluflexpack AG (Austria)

• PPC Flexible Packaging LLC (U.S.)

• C-P Flexible Packaging (U.S.)

• Swiss Pack (India)

• Printpack (U.S.)

• Wihuri (Finland)

• Sigma Plastics Group (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Converted Roll Stock Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Converted Roll Stock Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Converted Roll Stock Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.